The private resale market closed December 2025 on a softer note, with overall condo resale prices dipping slightly even as transaction volumes edged up. While the headline numbers point to a short-term pullback, the broader data suggests this shift was more seasonal than structural.

Table of contents

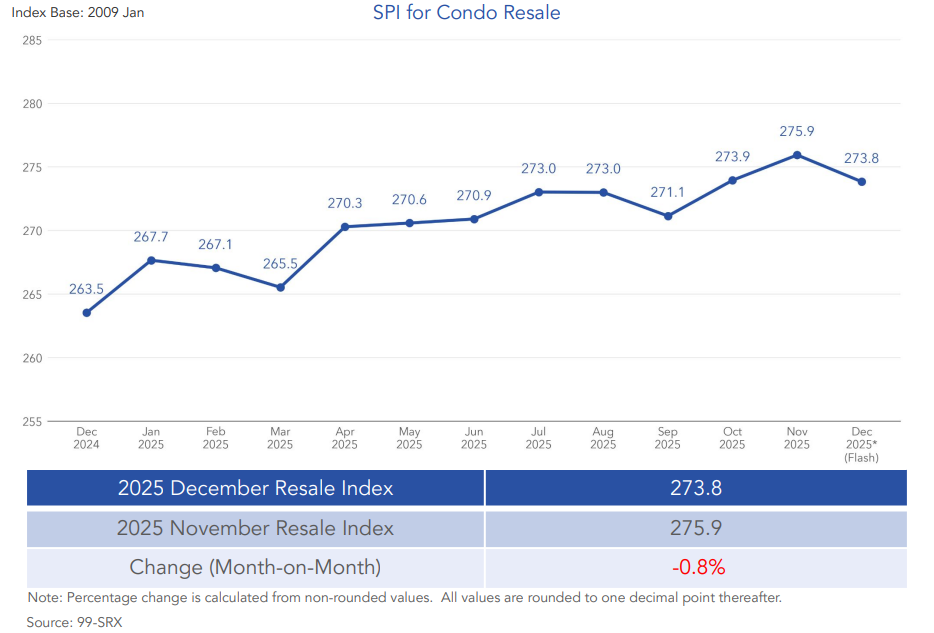

- Overall resale condo prices fell by 0.8% month-on-month in December

- Resale volumes edge up, though activity remains muted

- High-value resale deals surface across regions

- Capital gains ease, with wide variation by district

- Returns remain positive, but uneven

- What December’s numbers suggest

Overall resale condo prices fell by 0.8% month-on-month in December

At the same time, resale activity picked up modestly. According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, this combination does not point to broad-based price weakness. Instead, it aligns closely with typical year-end patterns, when market momentum often cools as buyers and sellers pause during the holiday period and ahead of the new year.

Importantly, the longer-term trend remains intact. Compared to December 2024, overall resale condo prices were still 3.9% higher, indicating that the December dip reflects short-term recalibration rather than the start of a deeper downturn in the resale market.

A closer look at price movements by region shows a clear divergence across market segments. In December, both the Core Central Region (CCR) and Rest of Central Region (RCR) recorded month-on-month price declines, while the Outside Central Region (OCR) continued to see price growth.

Resale prices in the CCR fell by 2.7% over the month, while the RCR posted a smaller decline of 1.1%. In contrast, OCR prices rose by 1.3%, providing support to the overall market.

When viewed on a year-on-year basis, the picture becomes clearer. RCR resale prices were 5% higher than a year ago, while OCR prices climbed by 5.6%. CCR prices, however, were marginally lower, slipping by 0.2% compared to December 2024.

This trend reflects sustained demand in city-fringe and suburban locations, where absolute price levels remain more accessible.

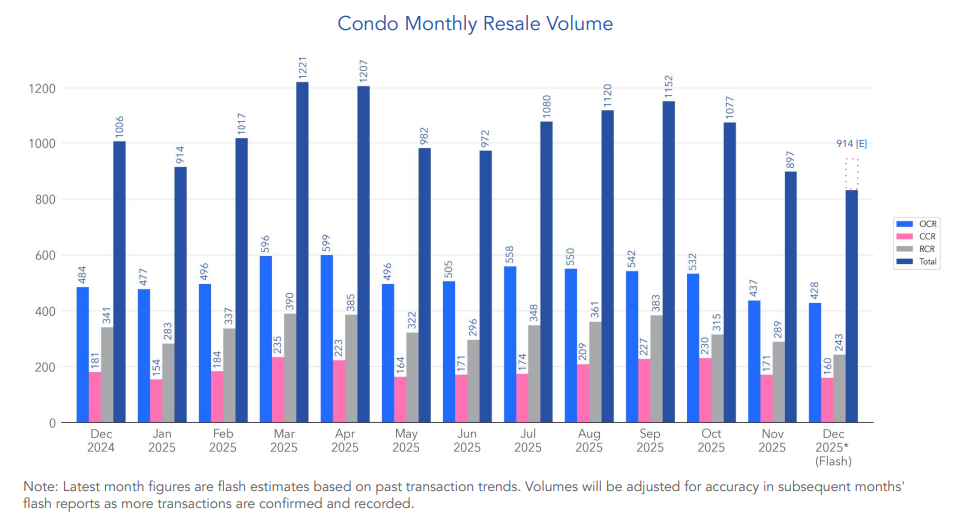

Resale volumes edge up, though activity remains muted

Transaction volumes increased slightly in December, with an estimated 914 resale units changing hands. This marked a 1.9% increase from November’s 897 units. Even so, activity remained below historical norms.

Compared to December last year, resale volumes were 9.1% lower. They were also 8.1% below the five-year average for December, reinforcing the view that year-end months tend to see lighter activity.

In terms of regional distribution, OCR continued to account for the largest share of resale transactions. More than half of all resale deals in December, or 51.5%, took place in the OCR. The RCR made up 29.2% of transactions, while the CCR accounted for the remaining 19.3%.

Sub-sale transactions formed a smaller portion of overall secondary market activity. In December, sub-sales made up 4.7% of total secondary transactions, down from the previous month. These transactions involve units sold before project completion, and the lower share suggests limited speculative activity in the market.

High-value resale deals surface across regions

Despite softer overall prices, several high-value resale transactions still stood out in December. While such deals can be eye-catching, they remain the exception rather than the norm.

Turquoise at S$12 million

The highest resale price recorded during the month was S$12 million, achieved by a unit at Turquoise. Located at Sentosa Cove in District 4, Turquoise is an ultra-luxury waterfront development catering to a very specific buyer profile.

Developed by Ho Bee Cove Pte Ltd, the 99-year leasehold project was completed in 2010 and comprises just 91 units. Homes range from large three- and four-bedroom apartments to expansive penthouses and sky villas, with some units spanning close to 8,000 square feet. The development sits on over 11,000 square metres of land along Cove Drive, offering low-density living within a resort-style setting.

Turquoise is known for its marina-facing layout and private yacht berthing facilities, with selected residences having direct access to dedicated berths. Full condominium facilities support a high-end lifestyle, reflecting the development’s positioning within Sentosa Cove.

In terms of connectivity, the project is located near HarbourFront and provides relatively quick access to Orchard Road and the CBD by car. It is also close to VivoCity, Sentosa’s leisure attractions, and surrounding marinas.

Recent listings indicate prices generally ranging from around S$1,300 to under S$2,000 per square foot, depending on unit type and orientation.

The Caribbean at Keppel Bay at S$5,008,888 in RCR

In the RCR, the highest resale price was recorded at The Caribbean at Keppel Bay, where a unit sold for S$5,008,888. Situated along Keppel Bay Drive in District 4, this 99-year leasehold waterfront development was completed in 2004 by the Keppel Group. It comprises 969 units spread across multiple towers of up to 10 storeys, with homes ranging from two-bedroom apartments to large penthouses.

The development is known for its extensive range of facilities, including an Olympic-sized swimming pool, multiple barbecue pits, tennis courts, a gym, clubhouse, and jogging track. Its marina-facing layout and proximity to HarbourFront MRT, VivoCity, Sentosa, and Mount Faber Park continue to support its appeal.

Recent listings indicate prices ranging from about S$1,246 to S$2,209 per square foot, depending on unit type and orientation.

Ocean Park at S$3,850,000 in OCR

Meanwhile, the highest resale transaction in the OCR took place at Ocean Park, where a unit was resold for S$3.85 million. Ocean Park is a freehold condominium located along East Coast Road in District 15. Completed in 1983 by Primelands Pte Ltd, the development spans roughly 298,000 square feet and comprises 298 units across six low-rise blocks.

Homes at Ocean Park are known for their spacious layouts, with unit types including apartments, maisonettes, and penthouses. Facilities include swimming pools, tennis and squash courts, a gym, landscaped gardens, and 24-hour security.

The project is located near the upcoming Marine Parade MRT station on the Thomson-East Coast Line, as well as major expressways such as the ECP and PIE, allowing for relatively quick access to the CBD. Current listings show a wide price range, reflecting the diversity of unit sizes and configurations.

Recent listings on 99.co indicate prices up to S$ 2,151 psf per square foot, depending on unit type and orientation.

Capital gains ease, with wide variation by district

Beyond headline prices, profitability indicators also softened slightly in December. The median capital gain for resale condos stood at S$365,000, which was about S$23,000 lower than the previous month.

Performance differed significantly across districts. District 10, covering Tanglin, Holland, and Bukit Timah, recorded the highest median capital gain at S$730,000. In contrast, District 1, which includes Boat Quay, Raffles Place, and Marina, posted a median capital loss of S$250,000.

These figures highlight how entry timing and price levels continue to shape resale outcomes, particularly in prime districts where prices are more volatile.

Returns remain positive, but uneven

Overall returns for resale condos remained healthy in December, though outcomes varied widely by location. The median unlevered return across all resale transactions was 29.1%.

District 20, which includes Ang Mo Kio, Bishan, and Thomson, posted the strongest performance, with a median unlevered return of 45.8%. On the other end of the spectrum, District 1 recorded the lowest median unlevered return at -13.1%.

These returns are calculated by comparing each unit’s latest resale price with its previous transaction price. Districts with fewer than 10 matching transactions were excluded to ensure more reliable comparisons.

What December’s numbers suggest

As Mr. Luqman Hakim notes, December is often characterised by softer momentum, as some buyers and sellers step back during the festive period. Even so, the broader trend remains intact. With prices still higher than a year ago and OCR demand continuing to anchor the market, the latest data points to temporary cooling rather than a shift in fundamentals.

For buyers and sellers, December’s figures underscore the importance of looking beyond headline prices and understanding how location, timing, and affordability continue to shape outcomes in Singapore’s condo resale market.

The post Year-end seasonality weighed on condo resale prices in December appeared first on .