Table of contents

- 2025 Review

- 2026 Outlook

2025 Review

An eventful world in 2025

In terms of the global economy and geopolitics, 2025 was remarkable. The 47th administration of the United States pursued a dramatic shift in stance, precipitating a change in the global world order and introducing a “new normal” of previously unthinkable policy positions. Markets reacted sharply and then learnt not to, with the term “TACO” entering global financial parlance as the shock of extreme positions gradually moderated over time.

Despite the noise and volatility, share markets delivered positive returns for the year, with the benchmark S&P 500 increasing by nearly 18%, helped by AI tailwinds and the “Magnificent Seven”, while Singapore’s STI increased by more than 22% as investors found good value opportunities locally.

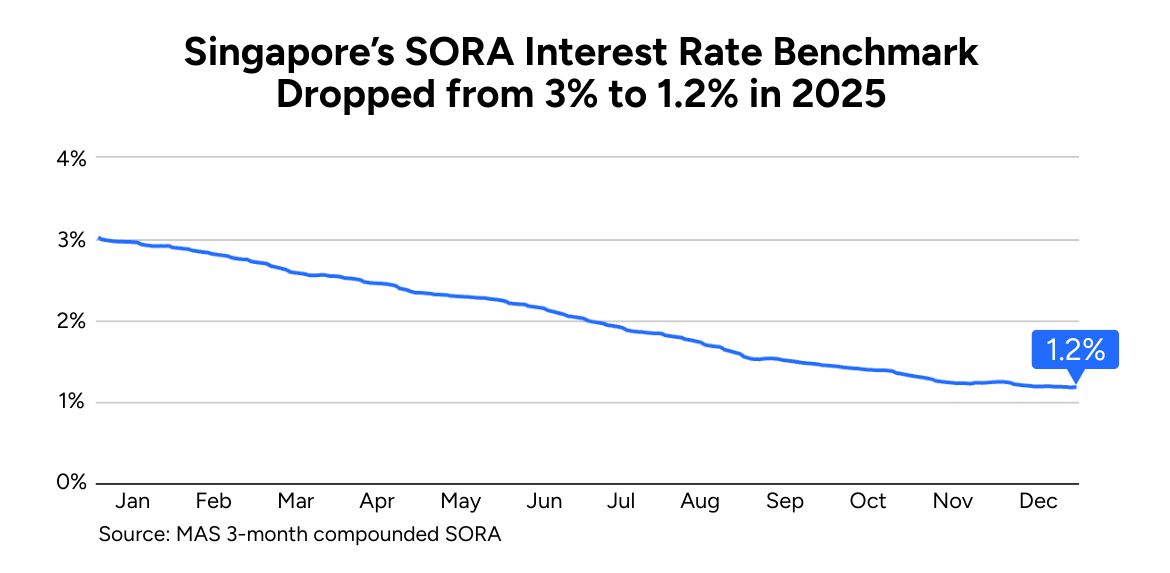

The Singapore economy fared significantly better than expected in 2025, with economic growth of 5%, well above the earlier official forecast of 1-3%. Coupled with strong employment and significantly lower interest rates, the stage was set for a robust, but balanced 2025 in the real estate market.

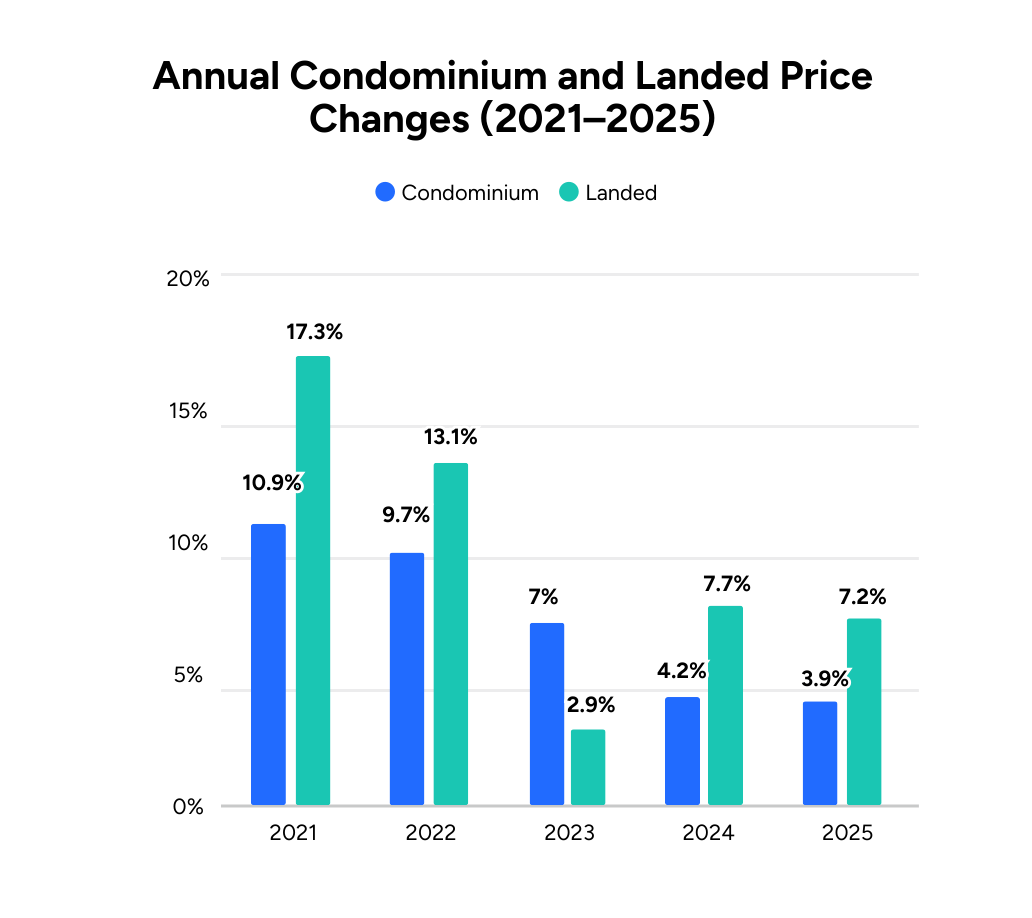

Residential prices in 2025: “A return to equilibrium”

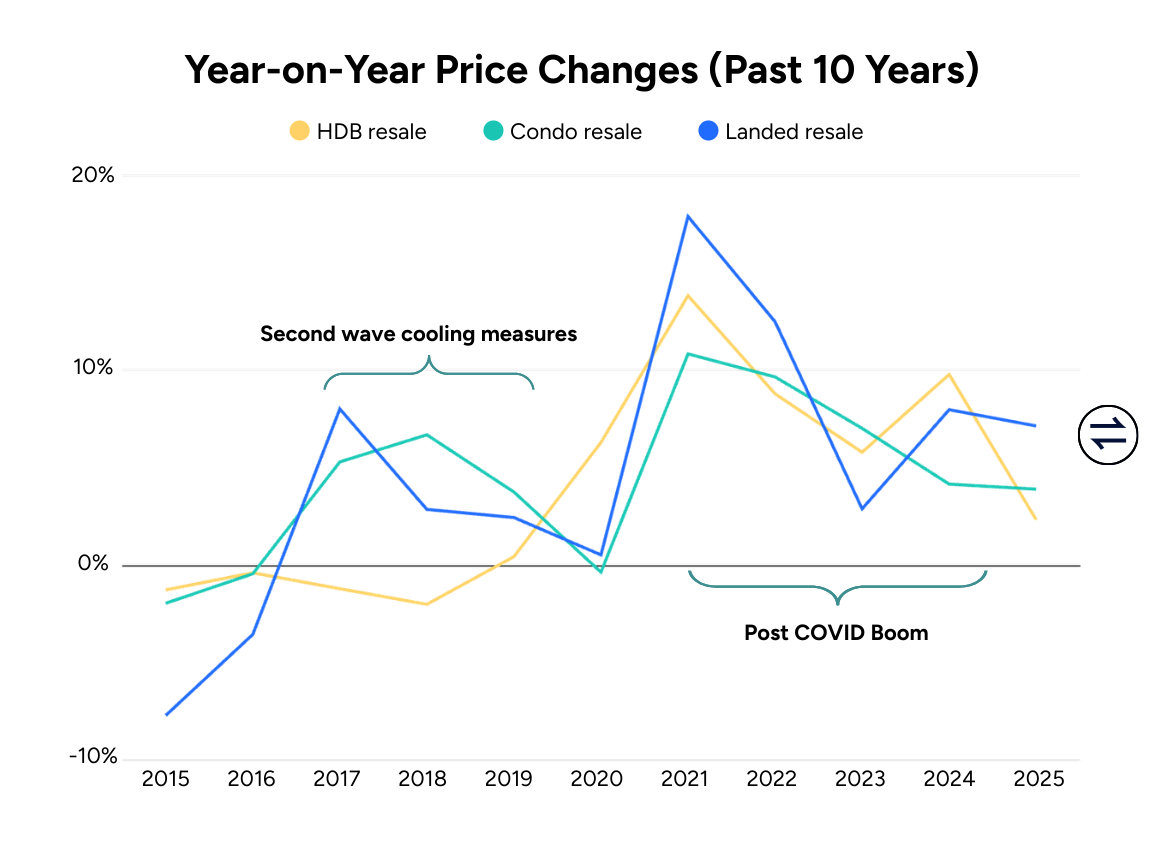

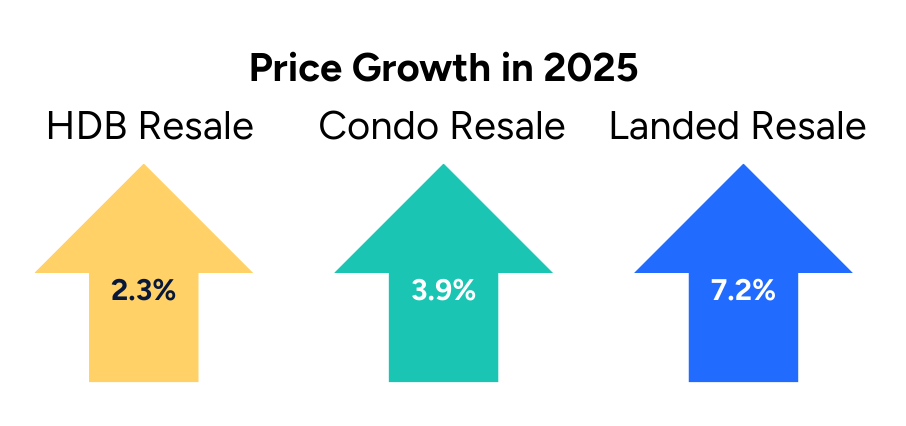

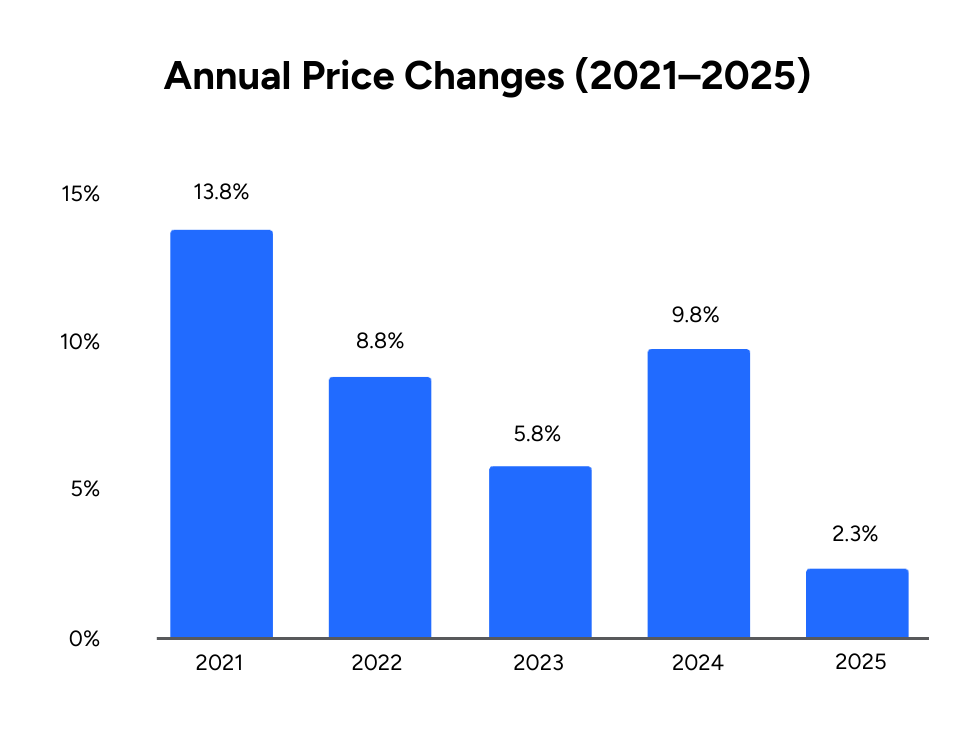

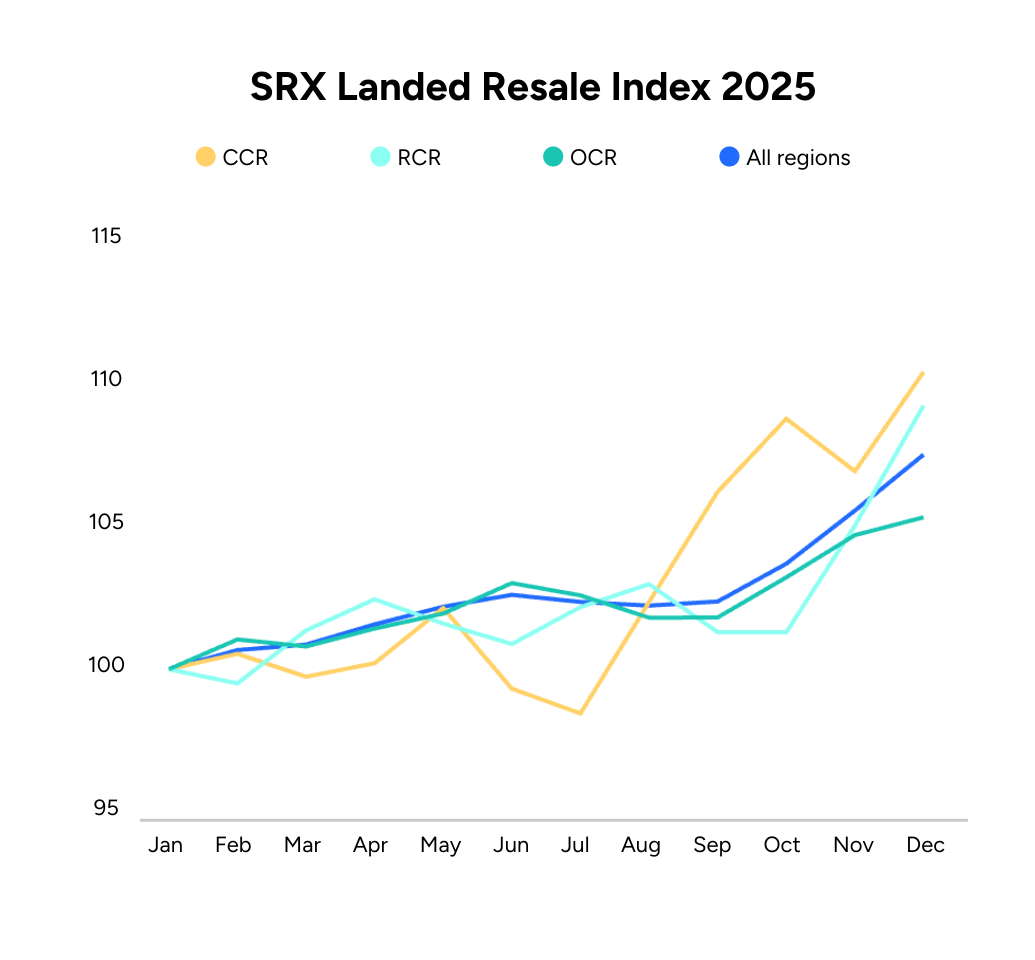

After several years of above-normal price growth following the post-COVID boom in 2021, HDB and Condo resale prices recorded more moderate and sustainable growth in 2025, reflecting demand and supply moving closer to balance.

The landed housing market, supported by scarcity and upgrader demand, continued to see higher growth, although this remained below levels observed in earlier years.

Note: Change in prices refers to the change in the relevant SRX price index over 2025. Condo refers to “Non-Landed Private”

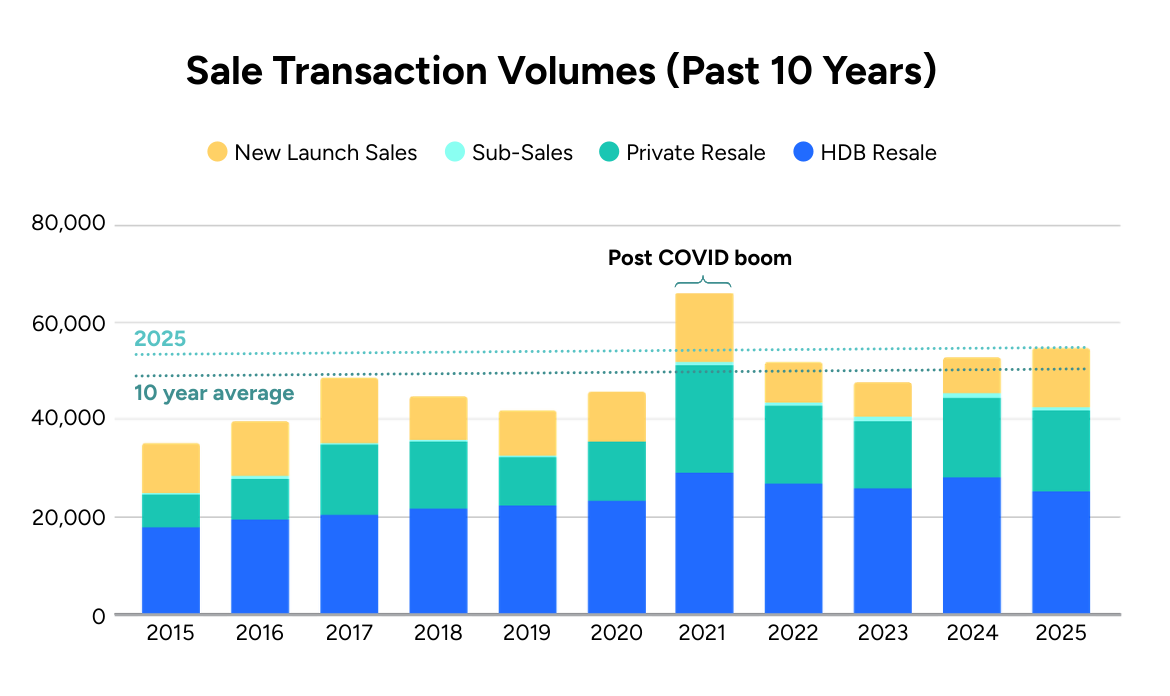

Sale activity second highest in the last decade

2025 was a busy year for residential real estate, with overall sale transaction volume 14% above the 10-year average and above all recent years except for 2021.

This was driven by a surge in new launch activity, with 24 projects and more than 11,000 units brought to market. Sub-sale activity declined from the high levels seen in 2023 and 2024, but was still higher than in any other year in the last 10 years.

Only the HDB resale market saw a notable decline in resale volumes, with approximately 2,800 fewer units transacted compared to the previous year. Even so, resale activity remained above the 10-year average.

Source: Data.gov, HDB, URA REALIS

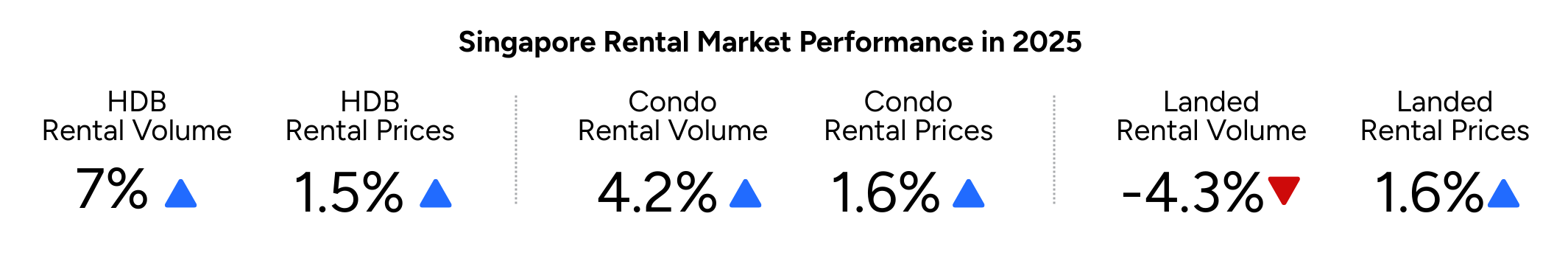

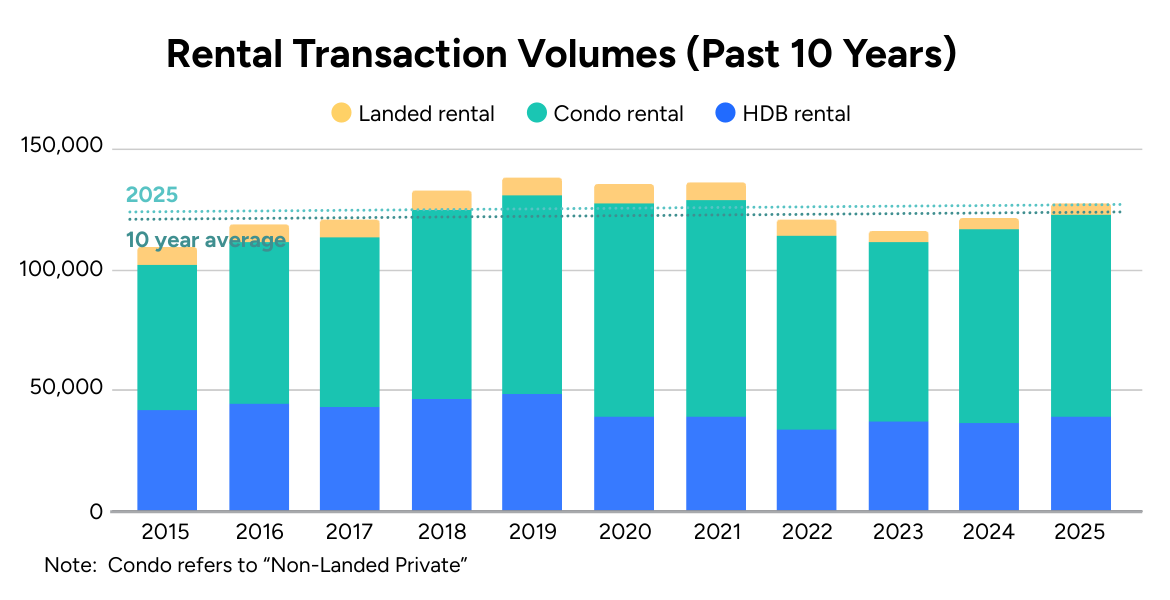

Rental market

After surging approximately 50% over the three years from 2021 to 2023, HDB and Condo rents delivered considerably lower growth in 2025, though growth was still above Singapore’s average headline inflation for the year, which stood at 0.9%.

Rental volumes saw mild growth and, overall, tracked in line with the 10-year average.

Source: Data.gov, HDB, URA REALIS

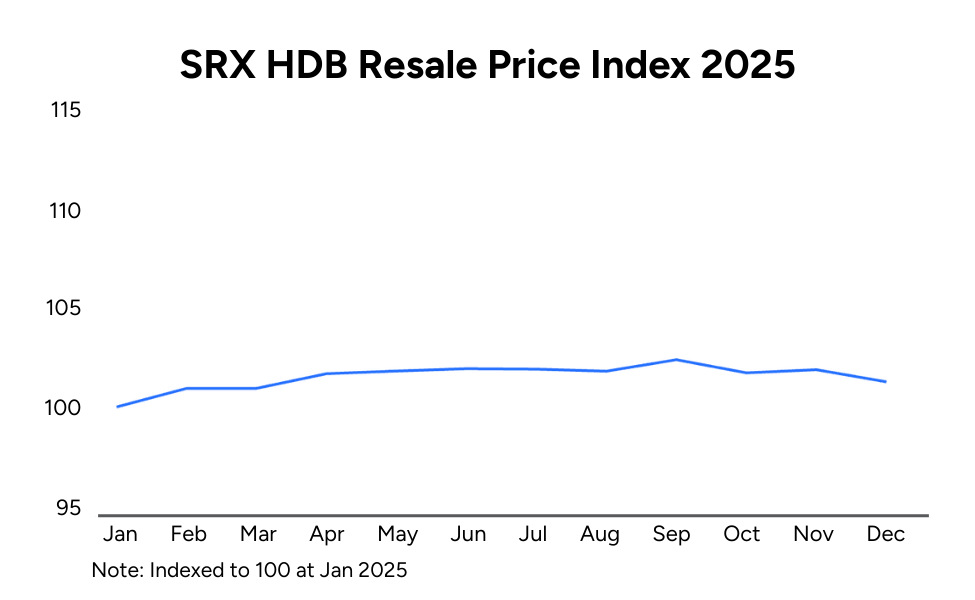

HDB resale market in 2025: Return to sustainable growth

The mild growth of 2.3% in HDB resale prices followed the 44% (9.5% CAGR) surge in prices from 2020 to 2024 and marked a return to more sustainable levels.

Observing the median resale prices for the HDB towns across Singapore shows just how much prices have changed since 2020. Toa Payoh leads the pack, with the overall median unit resale price more than doubling. A further 21 HDB towns saw their median resale price grow by 30% or more over the same period.

Source: HDB, SRX HDB SPI

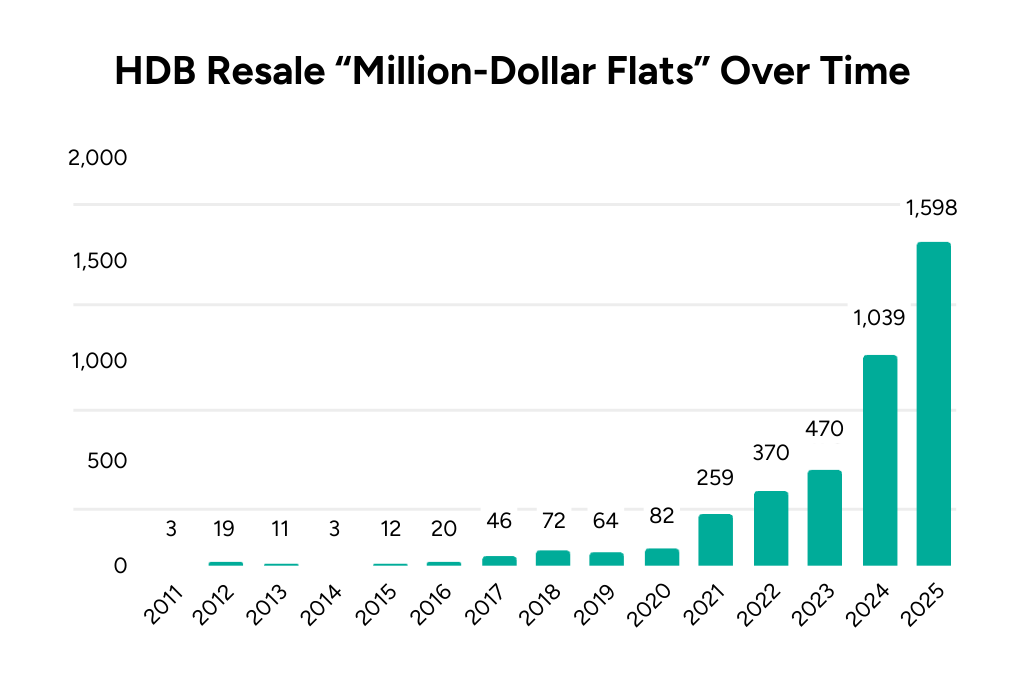

HDB resale market in 2025: Record million-dollar flats

A total of 1,598 million-dollar HDB flats were recorded in 2025 – the highest on record and more than 500 higher than in 2024. Bear in mind, just one year before that, in 2023, there weren’t even 500 million dollar flats.

Since the first million dollar flat sale was recorded more than 14 years ago in 2011, the number of flats crossing this threshold has steadily increased, though at around 6% of total resale volume, it is still a small proportion of overall transactions.

The one to watch now is the S$1.5m flats, of which there were 39 HDB resale transactions in 2025 at prices of S$1.5m or higher, with the Central Area and Toa Payoh each accounting for 10 transactions.

Source: HDB

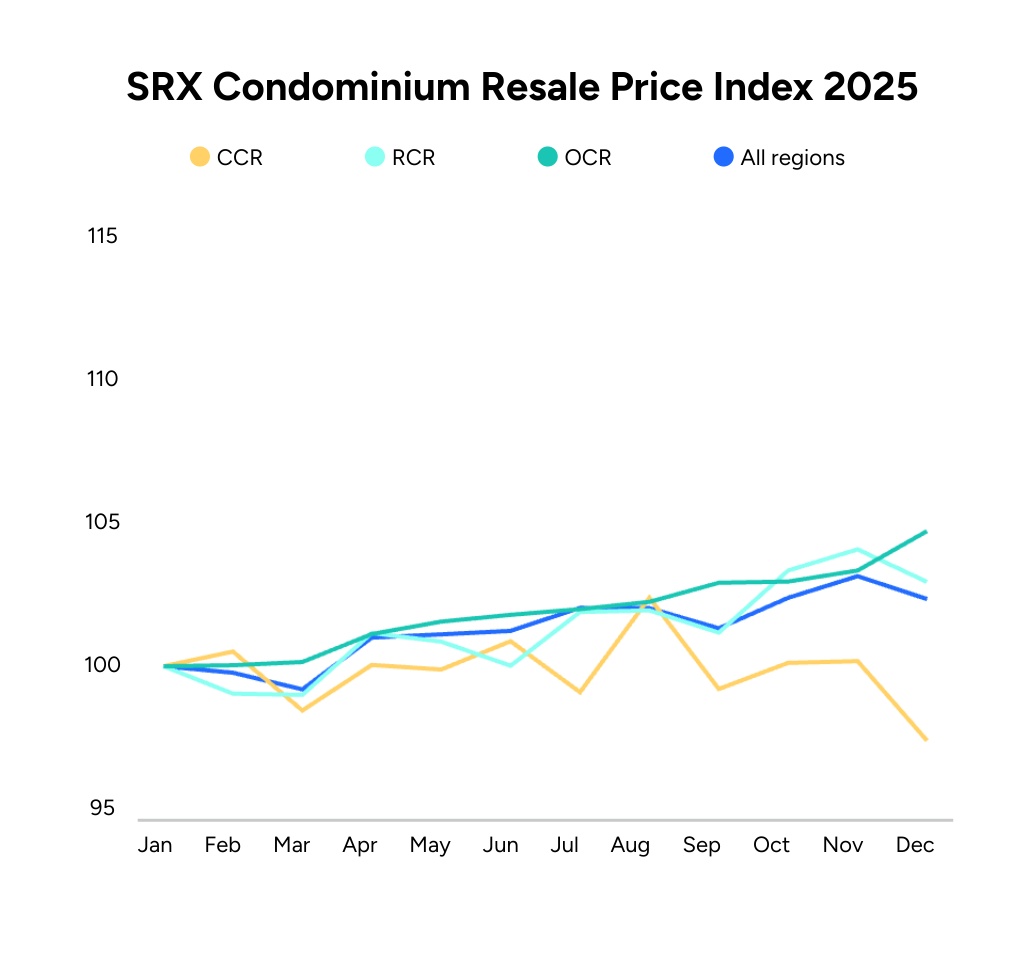

Private resale market in 2025: OCR the Star

While the overall condo resale price index increased by 3.9% in 2025, there was a marked divergence in fortunes between the planning regions. OCR saw the largest price increase in 2025, at 5.6%, followed closely by RCR, which increased by 5.0%. The CCR region, however, saw slightly negative growth of -0.2% for 2025.

Comparing prices in December 2025 to December 2020, the differences between regions are even more stark. While OCR recorded an increase of 47.8% (CAGR of 8.1%) over the period, followed by RCR at 40.0% (7% CAGR), CCR grew at nearly half the rate, with prices increasing by 23.6% (4.3% CAGR).

Source: SRX Sales price index

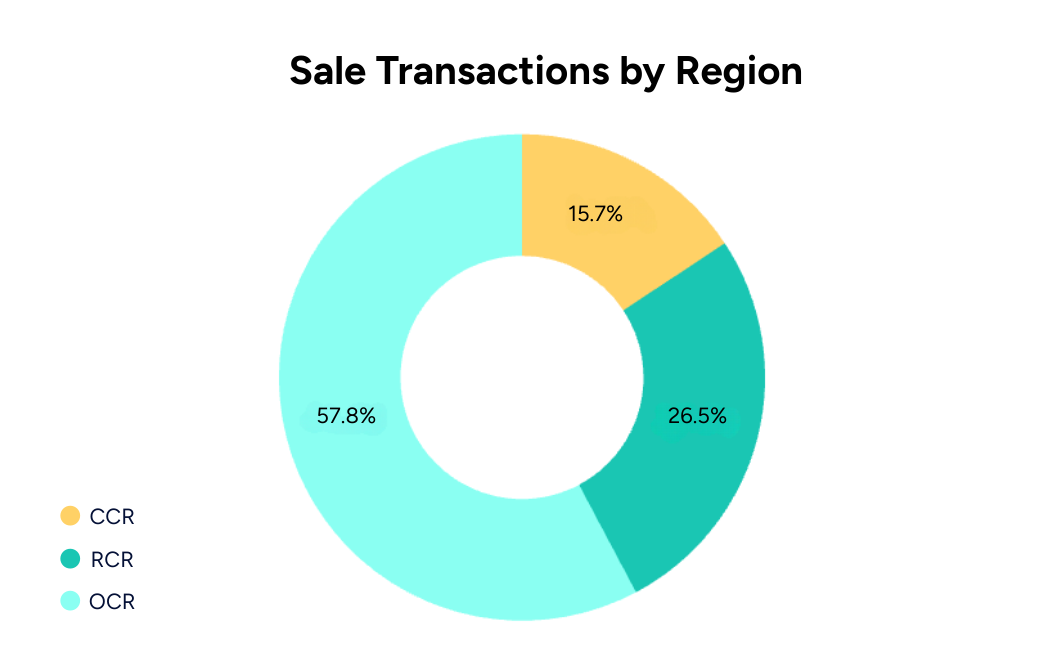

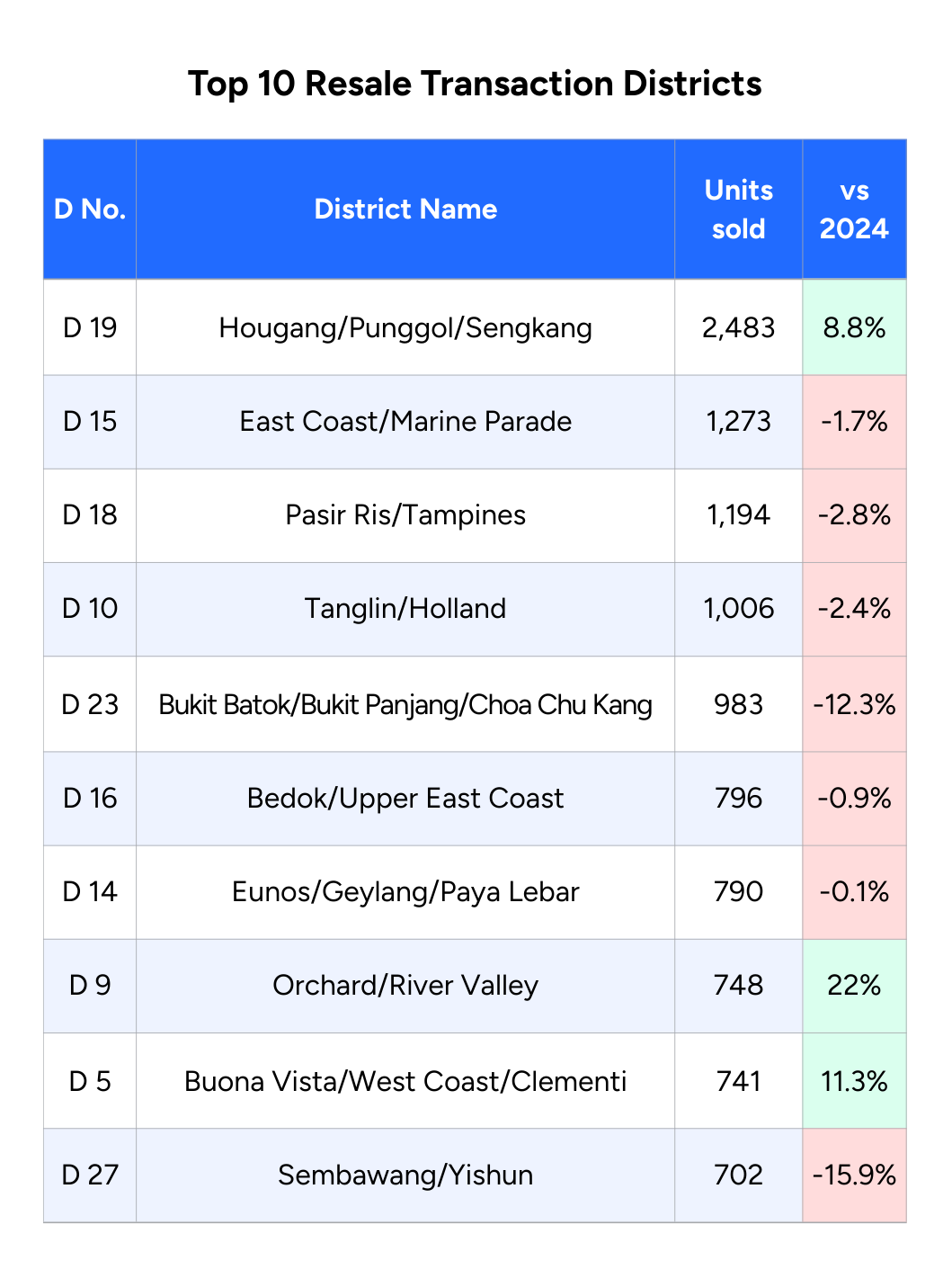

Private resale market in 2025: OCR 58% of transactions

OCR didn’t just deliver the best price performance in 2025, it was also the most active region for resale transactions. More than 9,500 resale transactions were recorded in OCR during the year, exceeding twice the number recorded in RCR and 3.6 times the number in CCR.

District 19 (Hougang, Punggol and Sengkang) was the most active district, with close to 2,500 transactions.

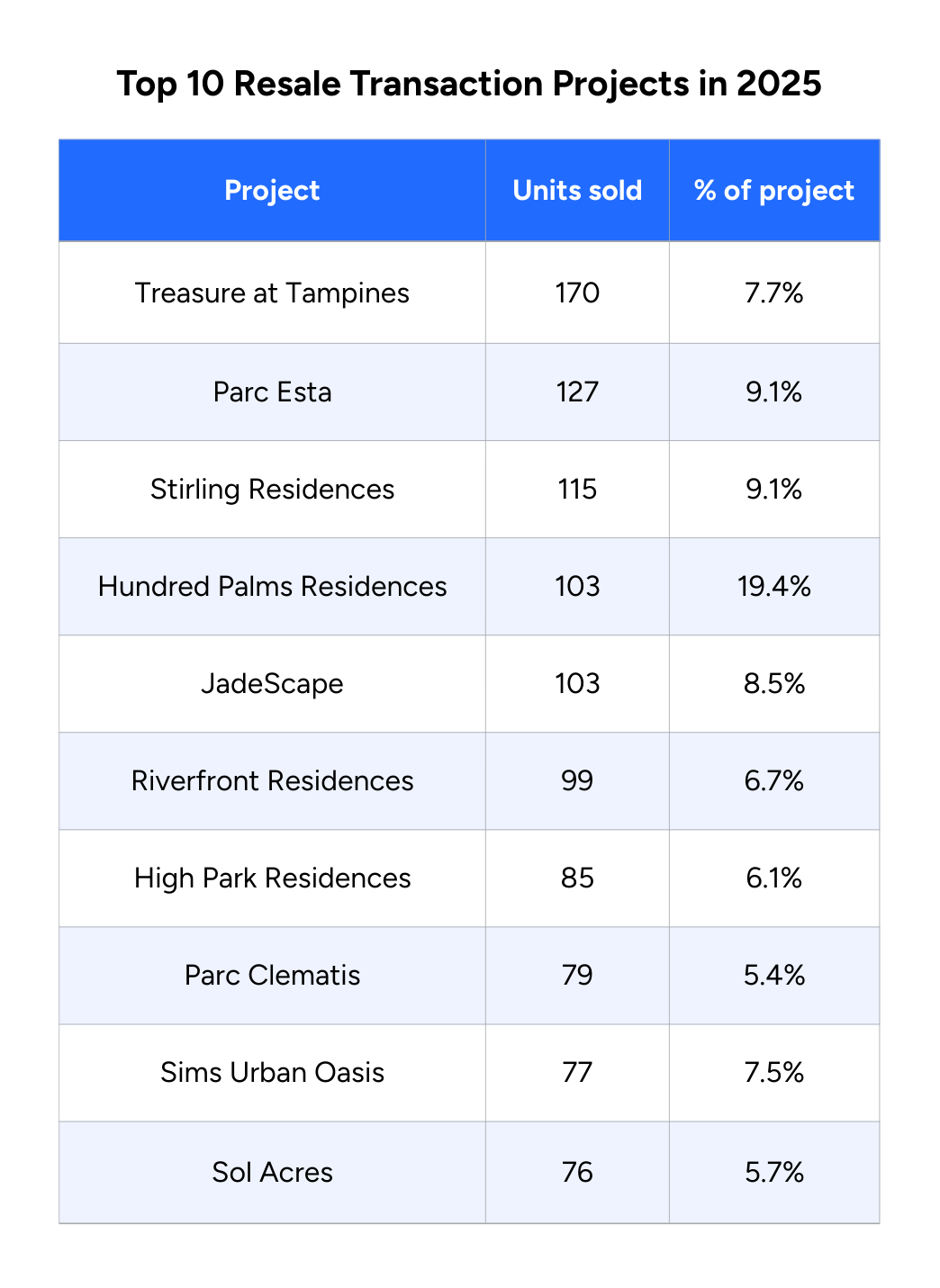

The most transacted project was Treasure at Tampines, with 170 units, while Hundred Palms Residences saw the highest relative turnover, with nearly 20% of its units resold in 2025.

Source: URA REALIS

2026 Outlook

The world in 2026: More of the same

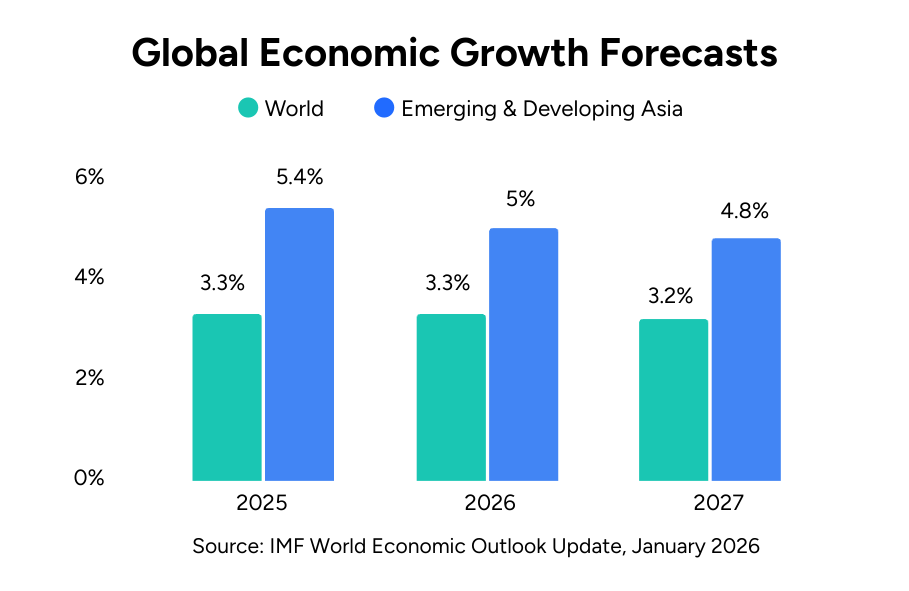

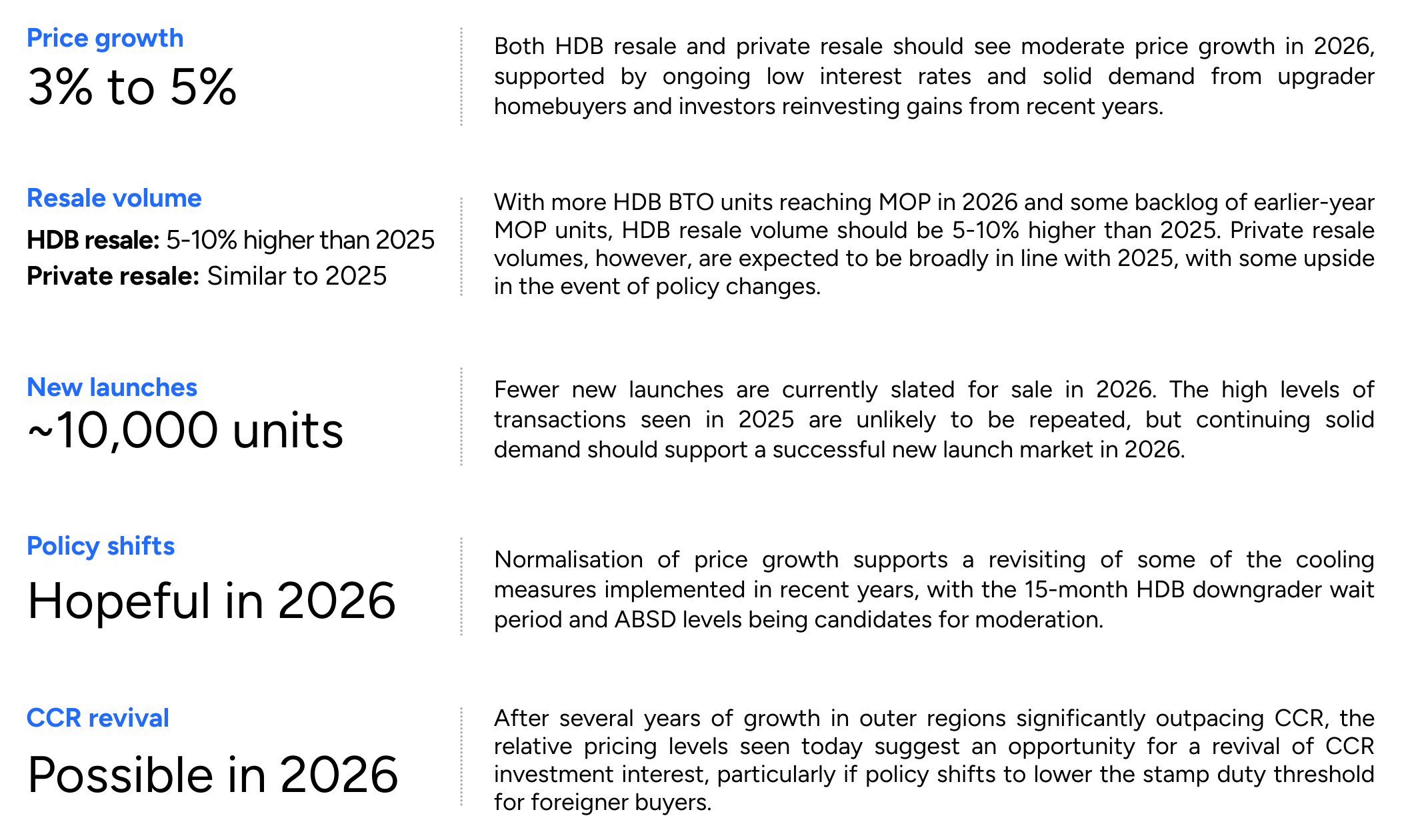

Overall, the world in 2026 should track a similar course to that of 2025, with moderate economic growth of 3.3% expected by the IMF, in line with 2025, and with inflation declining from 4.1% in 2025 to 3.8% in 2026. Continued investment in AI and the realisation of the productivity benefits flowing therefrom are important assumptions underpinning these growth expectations.

Interest rates are expected to remain stable, and the generally accommodative stance should continue through 2026.

The other feature of 2025 that continues into 2026, however, is the material risk of geopolitical and trade shocks arising from the continuing reorganisation of the world order. With financial markets generously pricing risk, there is potential for a significant event to trigger a reassessment of both the impact of the event itself and the pricing of risk in general, which could cause a large enough move in markets to impact confidence and economic activity more broadly.

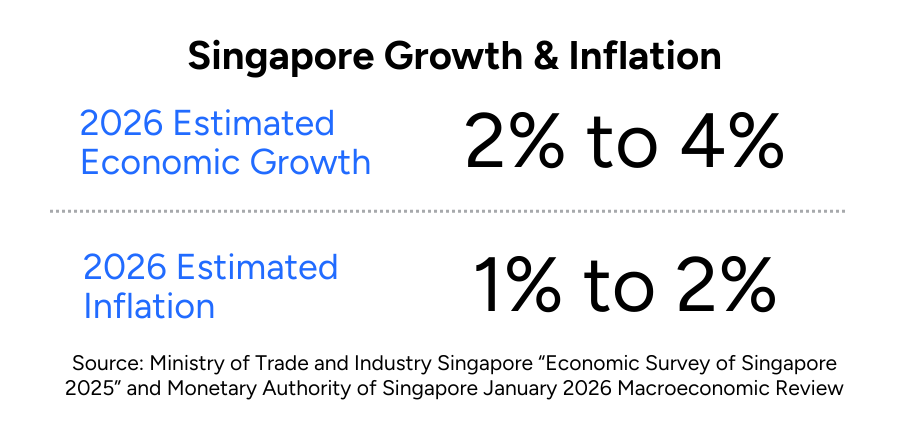

Closer to home, Singapore’s economic growth in 2026 is expected to be lower than in 2025, with MAS projecting growth of 2–4%, and inflation expected in the range of 1–2%. Combined with a relatively stable employment outlook and continuing low interest rates, this lays the foundation for a stable, moderate growth scenario for Singapore’s residential real estate market in 2026.

Singapore residential real estate in 2026

HDB resale: More newly MOP-ed units coming to market

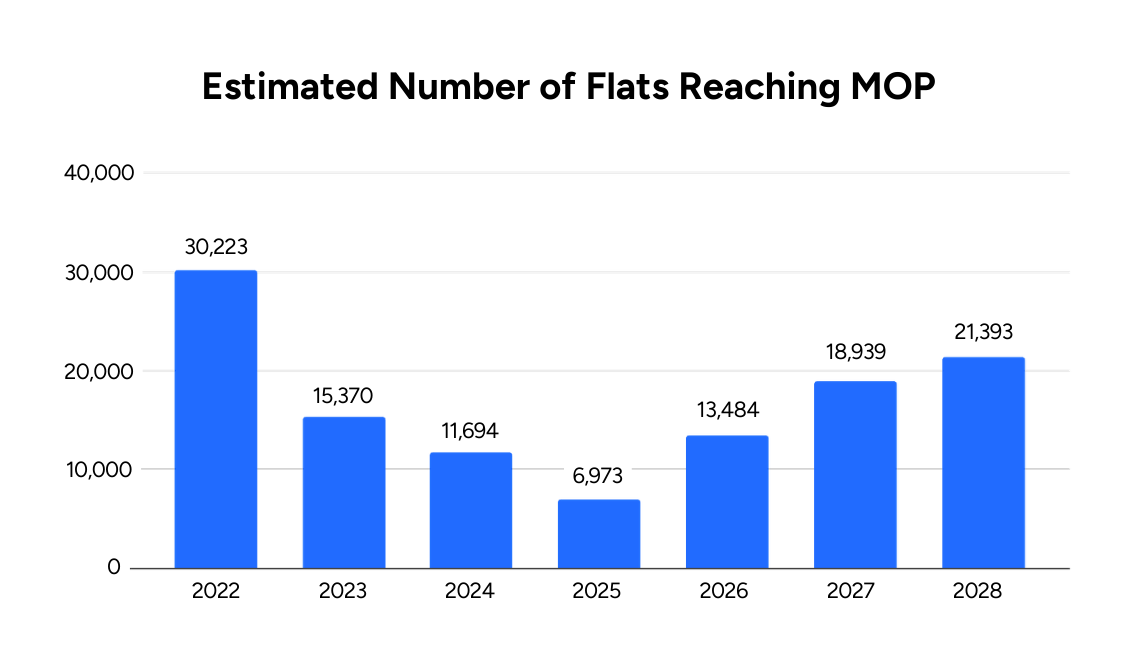

2025 had the smallest number of flats reaching MOP in years. 2026 should see roughly double that number, with even more coming thereafter.

On average, 16% of all BTO units sell within one year of reaching MOP, rising to 30-35% within five years of MOP, suggesting there should be a good range of recently MOP-ed unit choices for HDB resale homebuyers. We estimate that 5,000 to 6,000 recently MOP-ed units will change hands in 2026.

Source: Data.gov

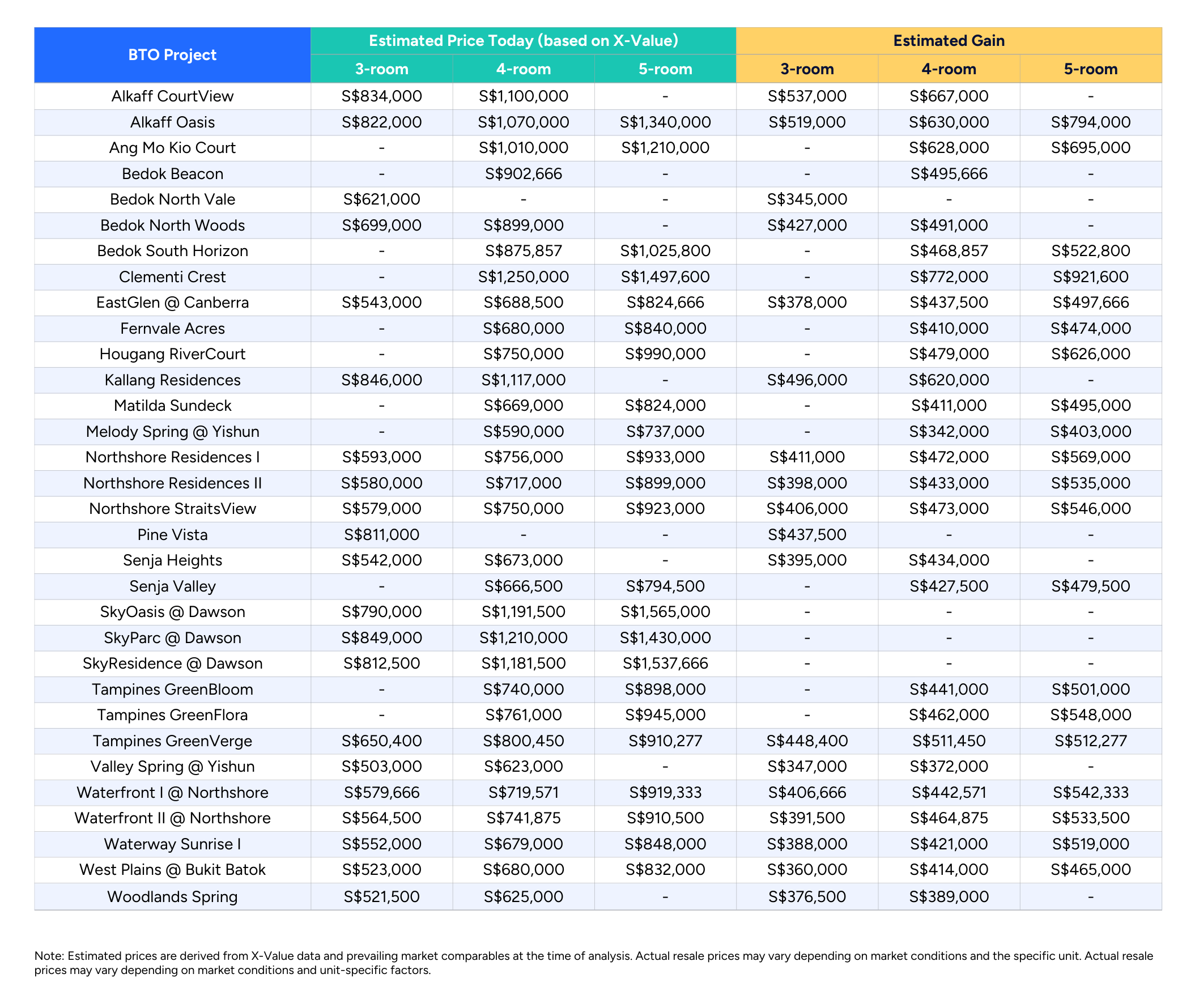

HDB MOP 2026: Attractive gains for BTO homeowners

The increase in home values since 2020 means that BTO homeowners whose flats reached MOP in 2025 stand to make significant gains, creating a broad pool of potential upgraders and investors heading into 2026.

To find out the value of your home and understand your upgrade options, consult a 99.co trusted advisor

Disclaimer: This Singapore’s Housing Market: 2025 Review & 2026 Outlook is provided for general informational purposes only. The views, analysis, and forward-looking statements presented are based on information available at the time of publication and are subject to change without notice. Actual outcomes may differ materially due to risks, uncertainties, and changing market conditions.

This report does not constitute financial, investment, legal, or other professional advice. While reasonable care has been taken in preparing this material, no representations or warranties are made as to its accuracy. Readers are advised to seek independent professional advice before making any property or investment decisions.

The post Singapore’s housing market: 2025 review & 2026 outlook appeared first on .