2021 is here, and with it a new year of opportunities and developments. It’s a good time to take stock of the past year, and plan for the coming year– especially financially. In terms of property, one of the major financial items in your expenditure will undoubtedly be your mortgage. To plan and set aside what you need for the year ahead, a good practice would be to read your mortgage statement and familiarise yourself with what has been paid and charged.

If you’ve never really paid attention to your monthly statement before, we’re here to help! Here’s a simple reference guide to understanding your mortgage statements, and what they mean.

How to Read Your HDB Mortgage Statement

Retrieving your HDB Statement

If you’re among the thousands of Singaporeans who have taken a HDB loan, retrieving your mortgage statement can be done online via your SingPass. Here are the steps:

- Login to your Statement of Account page in MyHDB portal using your Singpass.

- If you used the link above, upon logging in, you will be presented with your account balance (loan summary).

- Click “View Statement of Account”.

- Set the time period for which you wish to see the statement. You may select a maximum of one year at a time.

HDB Housing Loan Account Balance

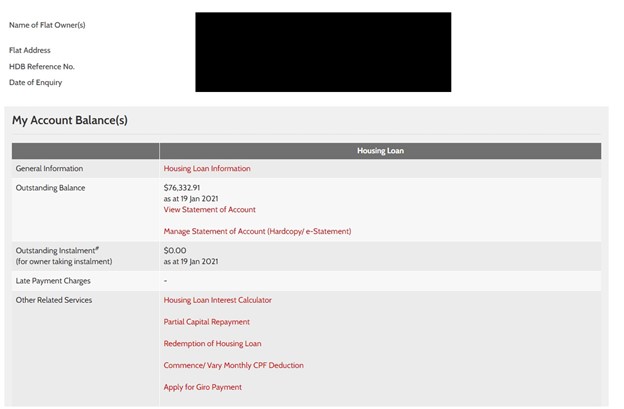

On this page, the main information to take note of is your outstanding balance. This amount is the amount of loan principal left unpaid, and does not include interest. If you have any arrears, they will be displayed in the “Outstanding Instalment” section, as well as any late payment charges that have been incurred from your arrears.

Ideally, this section should be empty! Although a HDB loan is flexible and forgiving, not keeping up with payments can still result in additional and unnecessary penalty costs.

Besides informing you of your balance, this screen also gives you an interest calculator (which is useful for you in anticipating your financial expenditure), as well as the option of pre-paying your loan (Partial Capital Repayment). You can also pay off your loan completely (Redemption of Housing Loan), and adjust your payment methods between Giro and CPF.

HDB Housing Loan Statement

Once you have opened your detailed statement of account, you will be able to see the various charges and transactions that have occurred throughout the time period you are interested in. In this example, you can see the most common transactions that will typically occur with your HDB loan.

Balance Brought Forward (Bal-BF)

This is the balance that you had outstanding at the start of the period for which you requested a statement. Throughout the year, HDB will charge interest on the amount, and deduct payments from your CPF to service the loan.

Interest Charge (IP-2.60)

This item denotes the interest charged on your outstanding balance by HDB. The “IP” code in your statement refers to interest, and the 2.60 refers to the current interest rate of 2.6%. Should the interest rate change (it hasn’t for a long time), the number will also change.

HDB interest is calculated by computing your outstanding balance every month, and charging one-twelfth of the annual interest rate, i.e. approximately 0.22% each month, to that outstanding balance. Hence, as your outstanding balance goes down monthly due to repayments, so the interest charged each month will also steadily decrease.

You can reduce the interest amounts further by prepaying portions of your loan once you have the cash. The prepayment will be reflected as a transaction under different codes depending on the method used to transfer the funds.

Monthly Instalment Payment

After the interest charges, the most common statement item is of course your repayments of the HDB loan. These can be reflected under different codes depending on your method of payment. In this example, the instalments are being deducted from CPF.

Want to save more on your home loan? Compare the best mortgage rates on PropertyGuru Finance, or contact us for more personalised advice and recommendations:

How to Read Your Bank Mortgage Statement

In many respects, the financial elements of a bank mortgage statement should not differ too much from a HDB statement, as they are both mortgages. Regardless of which bank you have borrowed from, and regardless of whether you are still using paper statements or tracking your transactions online, the details in the following samples should cover the vast majority of statements, although the format and arrangement will differ from bank to bank.

Bank Mortgage Annual Statement

This is an example of a paper annual statement which you might receive at the end of a calendar year if you did not opt out.

Total disbursement

The first thing you will tend to see is the total amount outstanding. In this case, it has been listed as “Total disbursement”, which simply denotes the amount disbursed, i.e. the loan principal for the mortgage. Disbursement is the amount the financial institution has disbursed during the year. The format starts with the balance at the beginning of the year, adding on the disbursement during the year.

Total interest charged

This line tells you the total amount of interest that you have paid this year on your outstanding principal. However, depending on bank, it may not contain any details about what the rates were, or how or when they were calculated.

Total monthly repayment

This is the amount you have repaid over the course of the year–the sum of 12 months of repayment.

Total capital repayments

If you have been able to pre-pay your mortgage, the amounts you have paid off will be stated in total here.

Others

If you have incurred other fees and charges during the previous calendar year, they will be reflected here. Examples of such fees may include admin fees, conveyancing fees, late payment fees and prepayment charges.

Online Bank Mortgage Statement

Unlike your paper statement, viewing your bank mortgage statement online may yield much more information that is useful for your 2021 financial planning. For one, your online statement would tend to have a more detailed breakdown of costs and calculations.

As with the HDB statement, your bank online statement would list your monthly instalment repayments, as well as the interest charged on each month’s balance. Unlike the HDB interest rate, which holds steady at 2.6%, your bank’s interest charges will vary depending on the package you signed up for, as well as market fluctuations if your interest rate is floating.

Planning for the Future

Viewing your annual mortgage statements not only allows you to find out how much you are paying in interest each month, it also allows you to calculate or anticipate how much you would be paying subsequently in the year ahead. It also keeps you updated on how much you owe, and allows you to make decisions with this data as to whether your mortgage is manageable, or the best deal you could be having given your financial situation.

Doing your financial housekeeping and viewing your annual statement in detail could lead you to realise you could be getting a better mortgage deal, which could lower your interest costs and help you free up your cashflow. Who knows, it may just be the perfect time to actively manage your mortgage and seek refinancing – switching to another bank with a better mortgage package!

That said, refinancing isn’t always the sure-win answer. It’s important to also take into consideration any changes in current personal circumstances and/or future plans. For example, if you are planning to sell your property within the next year, then it may not make sense to refinance.

Whatever the case, pausing to reflect on the progress of your mortgage is good practice. If, after checking your annual statement, you think you could do with some guidance and recommendations on how to better manage your home loan, simply enlist the help of our Home Finance Advisors here at PropertyGuru Finance.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time.Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs.PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.