Two URA sites at Jalan Tembusu and Lentor Hills Road (Parcel A) were the first to close after the recent cooling measures were rolled out on 16 Dec.

The response showed that developers were still keen on replenishing their land bank, but with a more subdued and cautious approach.

Both sites received only 4 to 8 bids, a stark contrast from the 9 to 15 bids that were usually received for private residential GLS tenders pre-cooling measures.

CDL bids highest for Jalan Tembusu GLS site

Singapore-listed real estate group City Developments Limited (CDL) tops the bidding list for the Jalan Tembusu GLS site at S$768m.

The developer is one of eight bidders for the 99-year leasehold residential site, which was released for sale last year on 30 September.

Bids received for GLS Land Parcel at Jalan Tembusu

| Ranking | Name of Tenderer | Bid price | S$PSF PPR |

| 1 | City Developments Ltd | S$768,000,000 | S$1,302 |

| 2 | Hong Leong Holdings, Hong Realty and TID | S$712,600,000 | S$1,208 |

| 3 | Sim Lian Group | S$708,100,000 | S$1,201 |

| 4 | Far East Organisation, CSC Land Group, Sekisui House and Stamford Land Development | S$678,300,000 | S$1,150 |

| 5 | CEL Development, SingHaiyi Group and KSH Holdings | S$653,833,333 | S$1,109 |

| 6 | United Engineers and Soilbuild Group | S$618,888,118 | S$1,049 |

| 7 | Wing Tai Holdings | S$571,999,999 | S$970 |

| 8 | Allgreen Properties and Kerry Properties | S$460,000,000 | S$780 |

Situated in District 15, the 210,545 sq ft state land site received the top bid for S$768 million, or S$1,302 psf per plot ratio (ppr).

It sits on a gross plot ratio of 2.8 and can yield about 640 residential units, making it a mid-size project for the developer.

CDL’s parent company, Hong Leong Holdings, along with Hong Realty and TID, submitted the second-highest bid of S$712.6 million, which was 7.7% lower than CDL’s bid.

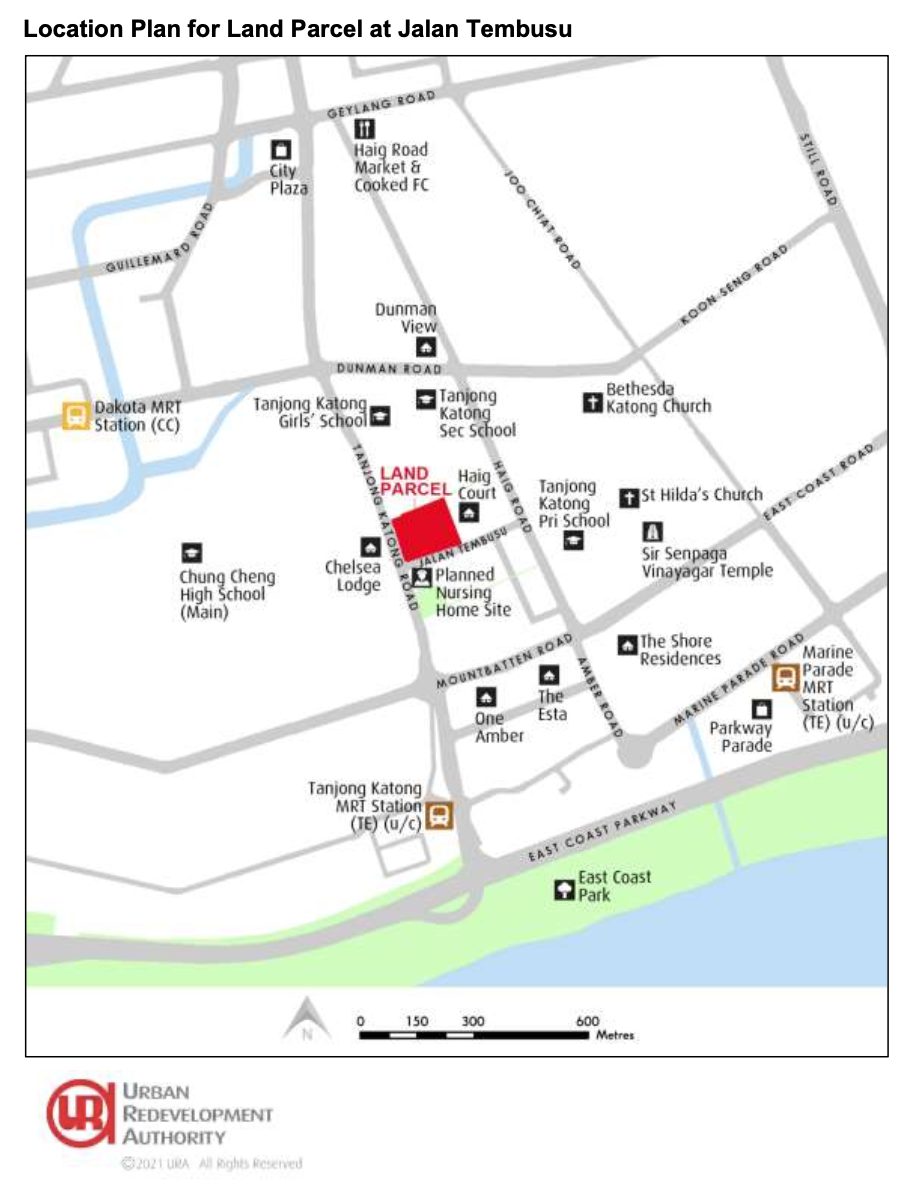

Amenities and schools near Jalan Tembusu site

The site is located in the popular enclave of East Coast just off Tanjong Katong Road near amenities and popular schools such as Chung Cheng High School (Main), Tanjong Katong Primary School and Tanjong Katong Secondary School.

The upcoming Tanjong Katong MRT is conveniently situated 600m away, improving connectivity and linking commuters to the Thomson-East Coast line. It is projected to be completed in 2024.

Estimated PSF launch price of the Jalan Tembusu site

According to CBRE’s Head of Research for Southeast Asia, Tricia Song, CDL has the potential to launch the development from S$2,100 to S$2,200 psf.

This figure is based on nearby ongoing launches, including the freehold Amber Park and Coastline Residences, which are selling at a median price of S$2,519 and S$2,536 psf in 2021, respectively.

Other leasehold projects in the vicinity transacted between S$1,115psf to S$1,532psf in 2021.

| Project | Leasehold | TOP | S$PSF |

| The Shore Residences | 99-year | 2014 | S$1,431 |

| Dunman View | 99-year | 2004 | S$1,115 |

| OLA Residences | Freehold | 2011 | S$1,516 |

| Haig Court | Freehold | 2004 | S$1,532 |

Low number of bids for Lentor Hills Road

In contrast to the record-smashing number of 9 bids for the Lentor Central site in July 2021, the Lentor Hills Road (Parcel A) site received just 4 bids.

The winning bid was submitted by a joint venture between Hong Leong Holdings, GuocoLand and TID at S$586.6 million, or S$1,060 psf ppr.

| Ranking | Name of Tenderer | Bid price | S$PSF PPR |

| 1 | Hong Leong Holdings, GuocoLand and TID | S$586,591,288 | S$1,060 |

| 2 | Sim Lian Group | S$551,800,000 | S$997 |

| 3 | UOL Group, Singapore Land Group and Kheng Leong Co. | S$508,300,000 | S$919 |

| 4 | United Engineers and Soilbuild Group | S$500,888,118 | S$905 |

GuocoLand also won the Lentor Central site bid, showing that the developer has a keen interest in developing the Lentor estate.

The Lentor Hills Road (Parcel A) plot sits on a gross plot ratio of 3.0 and yields 595 residential units.

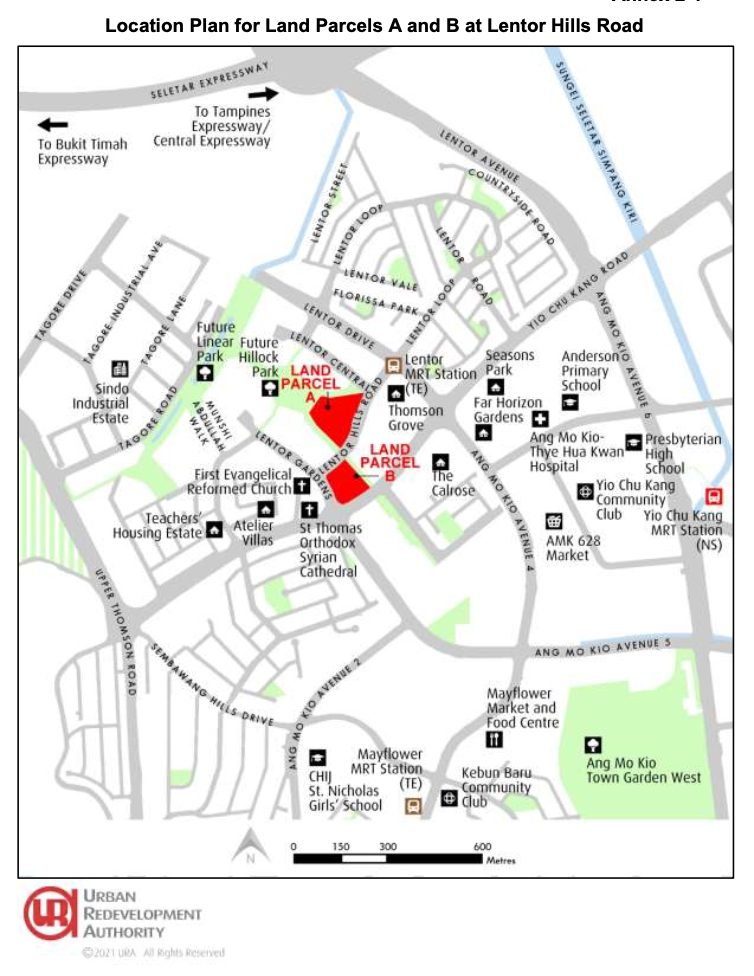

Amenities and schools near Lentor Hills Parcel A site

Although the site attracted few bidders, it still holds attraction due to its 1km proximity to St Nicholas Girls Primary School and Anderson Primary School.

Lentor MRT is also a 6-minute walk away, connecting residents to the Thomson-East Coast Line.

Estimated PSF launch price for Lentor Hills Parcel A site

Looking at surrounding developments, CBRE estimates the launch price to be between S$1,800 to S$1,900 psf.

| Project | Leasehold | TOP | S$PSF |

| The Panorama | 99-year | 2017 | S$1,513 |

| Castle Green | 99-year | 1997 | S$940 |

| Seasons Park | 99-year | 1997 | S$935 |

| The Calrose | Freehold | 2007 | S$1,344 |

The next confirmed sites up for tender in February and March 2022 will be along Pandan Valley and Dunman Road respectively.

Will collective sales or GLS sites be more attractive for developers? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out URA launches three sites under the H2 2021 Government Land Sales (GLS) and 12 affordable properties within 1km of top primary schools.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Jalan Tembusu and Lentor Hills Parcel A sites received highest bids of S$768m and S$586.6m respectively appeared first on 99.co.