Orchard Towers is on the en bloc chopping block for S$1.6 billion. Yes, you read that right. That’s a billion, with a capital B. It will be Singapore’s most expensive collective sale if it goes through, surpassing Farrer Court’s, which sold for S$1.34b in 2007 (and is now the d’Leedon site).

Its unit owners will hold an Extraordinary General Meeting (EGM) for this extraordinary sale on 18 February at 2 pm. EGMs refer to a company meeting that convenes in the event any matter requiring the approval of shareholders arises. During the meeting, a vote will be called to green-light the proposed reserve price, amongst other things.

The collective sale committee (CSC) of Orchard Towers appointed real estate consulting firm Edmund Tie as the sole marketing agent to tender the sale. For the en bloc tender to be launched, at least 80% of the owners need to give their consent.

Previous record-breaking collective sale attempt

Last year, International Plaza went for a similar collective sale effort with an impressive reserve price of S$2.7 billion, with Edmund Tie being its marketing agent as well. The tender closed on 30 November 2021, but its outcome remains unknown.

Orchard Towers

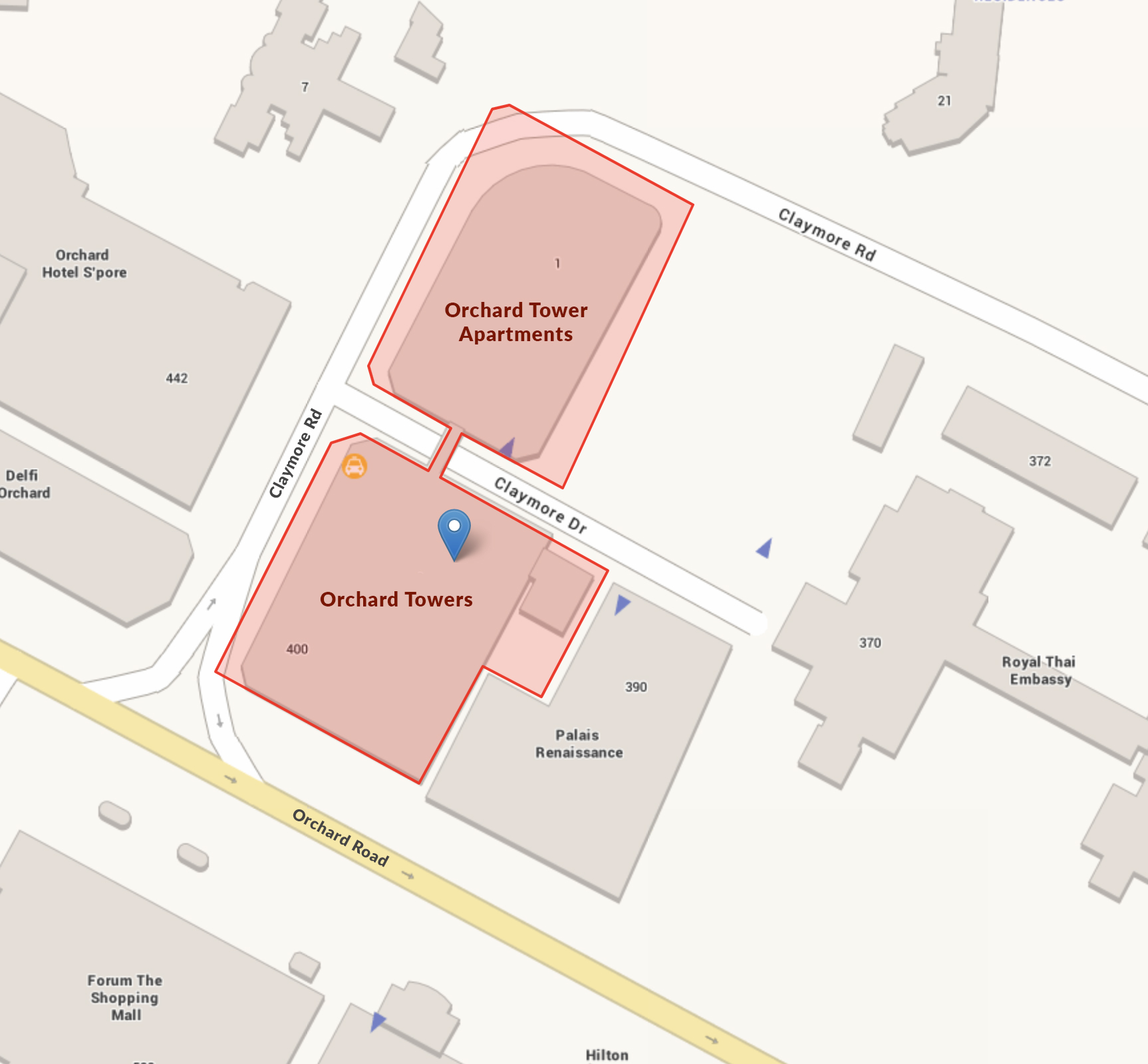

Completed in 1975 and located at the corner of Claymore Road and Orchard Road, the freehold site sits in the prime shopping strip of District 9.

Orchard Tower is a mixed-use development comprising of two buildings. The front building houses five floors of retail and office space, with commercial and 58 freehold residential units in the rear complex.

The units in the back tower are currently transacting at an average of S$1,320 per square foot. It has a maximum gross plot ratio (GPR) of 4.9 and sits on a site area of about 6,130 square metres (65,983 square feet).

Deal or no deal?

In a memo to its shareholders, property developer Hiap Hoe noted that there is no certainty that the intended collective sale will proceed. The company’s subsidiary, Golden Bay Realty Ptd Ltd, currently owns 59 strata lots, of which 21 are shops and 38 are offices.

Rare development opportunity

However, Orchard Towers is no doubt a hot site for development. Within a convenient 500-metre vicinity are popular malls such as Forum The Shopping Mall, Far East Shopping Centre, Wheelock Place and ION Orchard, as well as Orchard MRT station.

Another huge appeal is the commercial zoning status of Orchard Tower’s street-front plot. This means that property developers can build a mixed-use development without constraints stemming from Additional Buyer’s Stamp Duty (ABSD).

Previously, the ABSD rate was 25%, with a non-remissible component of 5%. It has since moved up 10 points in accordance with the new cooling measures to 35%, with the non-remissible percentage of 5% remaining unchanged.

More risks for developers

A higher ABSD percentage poses a greater risk to property investors as they are required to complete and sell all units within a 5-year deadline. As a result, developers may hesitate to execute new projects, especially those that come with a large price tag.

An example would be Shun Tak Holdings pulling out of its S$556.7 million tender for High Point and forfeiting its S$1 million deposit following the launch of the cooling measures.

Other risks include a pandemic-induced lower labour force, leading to higher construction costs and supply chain issues.

Questionable reputation

Orchard Towers’ reputation precedes itself as being notoriously known as the “Four Floors of Whores” or simply the “Four Floors”. Bars, sex shops and beauty parlours occupied many units in the entertainment complex, most of which have since shuttered due to the pandemic.

It also has a sordid history of murders, with the first being a double murder in 2002. A British expat slaughtered his friend and friend’s fiancée at his apartment before dumping their bodies in a car. He later abandoned it on the sixth storey carpark of Orchard Towers.

The second was a recent occurrence, where a fight broke out in one of the nightclubs on July 2019. A group of seven youths then ganged up to murder a 31-year-old male, who was pronounced dead an hour later after being taken to a hospital.

If the collective sale goes through, it will rewrite Orchard Towers’ sordid past and hopefully bring a fresh face to Orchard Road’s facade.

Do you think the Orchard Towers collective sale will go through? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Collective sales in Singapore: What does this mean for home prices? and What factors are necessary for a possible en bloc or collective sale?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Why the most expensive en bloc sale may not go through appeared first on 99.co.