When people talk about landed properties in Singapore, whether it’s semi-detached houses or Good Class Bungalows (GCB), they often refer to the freehold ones. Less discussed is the leasehold landed property.

Most of the time when people buy landed property in Singapore, it’s usually to allow different generations of the family to live together. There would also be plans for the house to be passed down to the next generations.

That’s not something one can do with a leasehold landed property, as the tenure usually runs for 99 years. They’ll probably be able to pass it down to their children, but the tenure may not be long enough for their children to pass it down to their offspring.

On top of that, it would be harder to get a loan if it’s a resale property with less than 60 years of remaining lease.

But one major reason why people choose a freehold over a leasehold is capital appreciation.

Leasehold landed properties don’t enjoy as much price appreciation

Just like leasehold condos, prices of leasehold landed properties don’t appreciate as much as their freehold counterparts. Due to lease decay, the property value will eventually decrease over time.

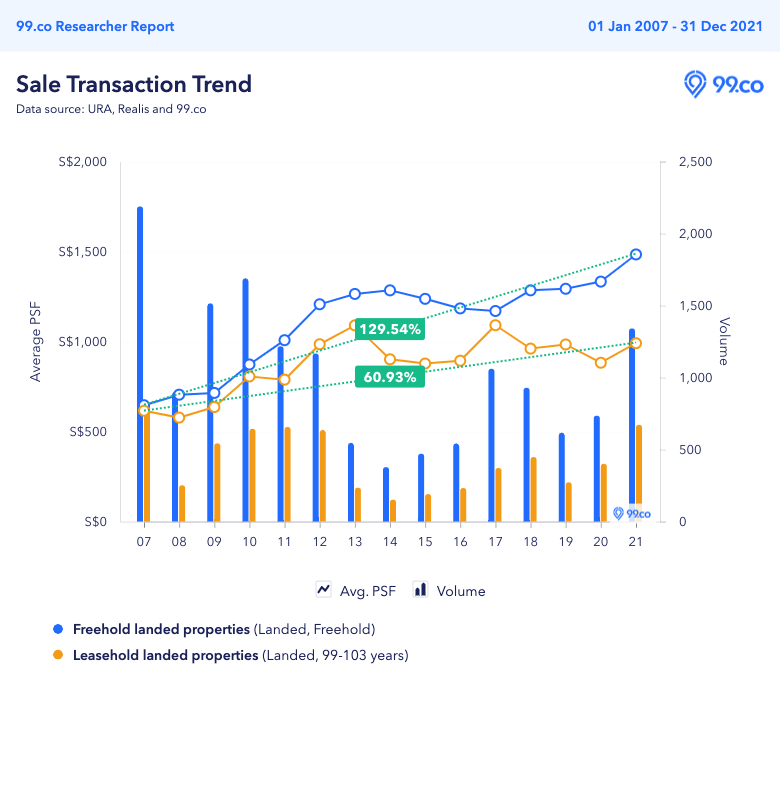

Here’s a look at the average price psf of freehold landed properties versus leasehold landed properties over the last 15 years.

Prices of freehold landed properties have generally increased by a whopping 129.54%. In comparison, prices of leasehold landed homes have increased at half of the rate at 60.93%.

In addition, the price gap between the two property types has gotten wider over the years. In 2007, the average price psf of freehold landed properties was S$647, while the average price psf of leasehold homes was S$616. So there’s not much of a price difference at that time.

However, 15 years later in 2021, prices of freehold landed properties averaged around S$1,484 psf, compared to leasehold landed homes at S$991 psf.

This is one reason why less people buy leasehold landed properties. From the graph, we can also tell that the yearly transaction volume of freehold landed properties is usually twice of the volume for leasehold landed properties.

Despite the lower price appreciation, there’s still a select group of people that buy these leasehold properties.

What’s the appeal of leasehold landed properties?

Enjoy a landed home experience at a lower price

One major appeal of leasehold landed properties is the lower price.

“The demand for leasehold landed homes in recent years is mainly due to affordability. Those in prime areas are much more affordable in terms of quantum as compared to freehold properties,” Ray Teo, Advisory Associate Branch District Director at PropNex tells us.

As mentioned earlier, prices of leasehold landed homes have generally been lower than their freehold counterparts. Last year, the average price of leasehold landed homes was S$991 psf — two-thirds of the average price psf of freehold landed homes.

Nevertheless, as with any property purchase, price is not the only main factor.

Ray shares that lifestyle needs and the need for space are the main driving forces of the demand for leasehold landed homes.

With a lower outlay, owners can still have the landed home living experience, enjoying the bigger space and privacy these homes provide. Those with green thumbs get to have their own garden and backyard to grow their farms. And for those with pets, there is more space to play with them.

So for those who need more space, and high-rise living is not suitable for them, leasehold landed homes can be a viable option. This is especially for homeowners who want to live in the house for the long term, who don’t look into capital gains and are not looking to sell it. And they probably don’t foresee themselves passing down the house to their children.

Sentosa Cove: for the prestige and ease of foreign ownership

When talking about leasehold landed properties, one development that comes to mind is Sentosa Cove. It’s another area in Singapore besides Bukit Timah that’s considered prestigious, given its price, limited supply and exclusivity.

But unlike landed homes in Bukit Timah, the landed homes there come with a 99-year leasehold tenure.

Ray tells us that besides the prestige, Sentosa Cove’s appeal is the ease of foreign ownership, noting that foreigners would need to get approval to buy landed properties.

“These landed homes in Sentosa are definitely the easiest form of landed property that foreigners can buy.”

In Singapore, under the Residential Property Act, any foreign person (including PRs) who plan to buy a landed residential property here need to get approval from the Land Dealings Approval Unit (LDAU) of the Singapore Land Authority (SLA). One of the criteria for approval is to be a PR for at least five years.

An exception to this is Sentosa Cove. Foreigners can apply to the SLA for approval to purchase a property there, as long as its land area doesn’t exceed 1,800 sqm. The property should also be for their own occupation.

“This leads to prolonged interest (in Sentosa Cove), even though they are still subject to lease decay issues in the future,” comments Ray.

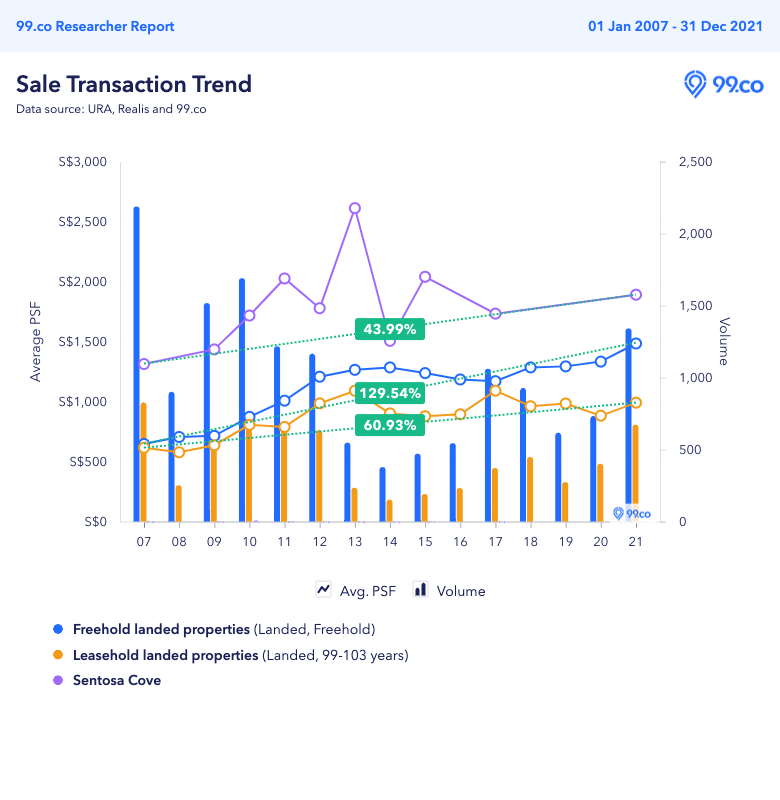

Comparing the transactions of Sentosa Cove homes with freehold and leasehold landed homes over the past 15 years, the price appreciation for these homes is lower at 43.99%.

On the other hand, prices of landed homes in Sentosa Cove have generally been higher than that of freehold and leasehold landed homes. Last year, the average price of Sentosa Cove homes was S$1,891 psf. This is higher than last year’s average price for leasehold landed homes at S$991 psf, and for freehold landed homes at S$1,484 psf.

Leasehold GCBs in the making

It was recently reported that Perennial plans to redevelop Mediacorp’s old site at the former Caldecott Broadcast Centre into 15 leasehold GCB plots. The developer had bought the 752,015 sq ft site for S$280.9 million in December 2020. So these will be the first major 99-year leasehold GCB sites to be launched. (Mediacorp had initially planned to build a condo there, but URA rejected the proposal.)

To many Singaporeans (and this writer), the idea of having leasehold GCBs feels, to put it bluntly, strange.

After all, good class bungalows are the most prestigious form of landed property in Singapore. They’re usually intended to be passed down to the next generations for wealth preservation.

On the other hand, whether it’s landed or not, leasehold properties are considered less premium. They generally carry a lower price tag of around 15% than their freehold counterparts.

In other words, when it comes to private property, leasehold properties are at the lower end of the spectrum.

Given the connotation that these terms carry, leasehold GCBs seem like an oxymoron. As a Redditor pointed out on the news of the redevelopment, it sounds “self-contradicting”.

But just like leasehold landed homes, these leasehold GCBs will probably still appeal to some people, especially given the limited supply and lower price.

“At around S$374 psf land area, it will probably be the most affordable GCB in terms of the cost of land,” Ray shares.

He notes that freehold GCBs in the area, from resale to brand new houses, have been transacting at around a land price psf of S$1,600 to S$4,000.

“Therefore, I believe that potential buyers of these leasehold GCBs will be in for a treat. The developer will definitely make sure these GCBs are given exquisite architecture and luxurious finishes as there is margin to be made. Given that they had employed Singapore’s top award-winning architect DP Architects (whose past projects include Esplanade), we should expect great groundbreaking architecture.”

Would you buy a leasehold landed property? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Can a Singapore PR buy a landed property in Singapore? and Good Class Bungalow (GCB) house-hunting: Confessions from agents.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post What’s the appeal of 99-year leasehold landed properties? appeared first on 99.co.