Between all this talk of GST hikes and wealth taxes, it seems like many Singaporeans have a lot of growing costs to be concerned about. But the most pertinent cost for property owners might just be interest rate hikes, which will affect anyone with a bank mortgage.

If you’re currently servicing a bank home loan, you might need to refinance soon. Let us walk you through how to prepare for it.

The US interest rate hike, in brief

The US Federal Reserve, a.k.a. “the Fed”, is looking to raise interest rates in 2022. But why!? To understand this, we’ll need to revise some recent history.

Recall, if you can, life before Covid-19. Interest rates generally started from 1.5% back then. It wasn’t unusual to earn as much as 2% on our savings accounts, and bank loans were at times almost on par with the HDB loan (which has remained at 2.6% throughout).

When Covid-19 struck in early 2020, it threatened to bring the US economy to its knees. So the US Federal Reserve slashed interest rates drastically, to almost 0%. Near-zero interest rates made it cheap to borrow money — to fund property purchases, for instance — thus encouraging consumer spending. This kept the economy afloat.

But a resilient economy has an unpleasant side effect: inflation. So in 2022, the US Federal Reserve will raise interest rates again to pre-pandemic levels to combat inflation. By the end of the year, the Fed’s interest rate is expected to be as high as 1% – up from the current 0.25%.

What does it mean for homeowners in Singapore?

But how do the Fed’s actions affect us halfway across the world? Well, the US is a global trendsetter for interest rates. Whatever it does, other economies in the developed world follow.

When the Fed slashed interest rates during Covid, our local banks’ mortgage rates plummeted. These super-cheap home loans of the past two years were one reason why Singapore’s property market boomed throughout the pandemic.

But our days of cheap mortgages are numbered. So if your current mortgage interest lock-in period is expiring soon, you may want to gird your loins for higher interest rates and more expensive monthly repayments.

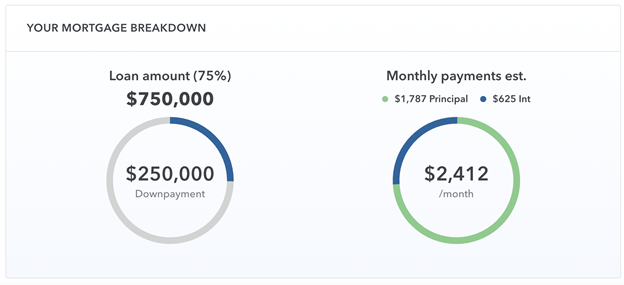

Let’s say you have a $1m condo and your current mortgage interest rate is 1%. Here’s how much your monthly repayment is according to our mortgage calculator:

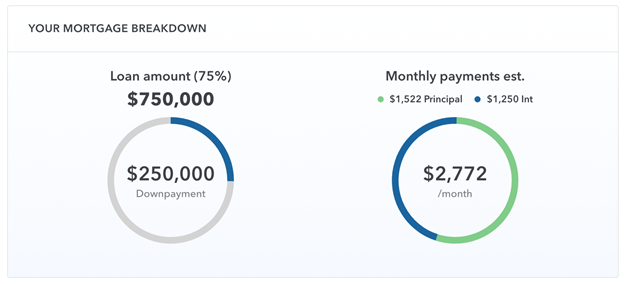

What happens with an interest rate hike to 2%?

With a 1% increase in interest, you’ll be paying S$360 more every month. That’s an extra S$4,320 a year, practically enough to fund a leisure trip on the VTL of your choice. Note that your interest payments would also double from S$625 per month to $1,250.

Yikes! What should homeowners do?

First of all, remain calm. A 1% increase in interest rates is big and will not happen overnight. The US Federal Reserve is only expected to start increasing interest rates in March 2022, but it’ll be in three stages.

Of course, if your mortgage is still in the lock-in stage, there’s nothing you can do until this period expires. After that, the bank will notify you of your new mortgage interest rates and instalments.

Now there are three things you can do:

- Nothing. You might look around mortgage websites and find that the new rate offered by your bank is competitive. In this case, there is no action needed.

- Reprice your home loan. If your bank offers a cheaper loan package, you can ask to reprice your mortgage to that one. As there is no change in provider, the bank can generally do this with minimal hassle, and you only need to pay a small admin fee.

- Refinance your home loan. If you want to take advantage of a much more attractive offer from another bank, you can opt to refinance, i.e. jump ship. Refinancing generally incurs more fees, but some banks offer waivers to attract new customers, leading to greater savings in the long run.

From the bank’s perspective, refinancing customers is no different from customers applying for a new home loan. As much as the new bank wants your business, it also minimises risk with such large sums involved. Therefore, you’ll be subject to a slew of rigorous checks, including getting your property value appraised by a professional.

In addition, any information around your income, credit history, and repayment behaviour — including your credit score — will be placed under the microscope. Fail this credit assessment component and your refinancing application might be rejected.

How to check your credit score

Anyone looking to refinance their home loan should get their credit score to present a clean bill of financial health to the prospective new bank. Your credit score is a four-digit number that tells the bank how likely you will default on your repayments.

| Credit score | Risk grade | Probability of default |

| 1911 to 2000 | AA | ≤0.27% |

| 1844 to 1910 | BB | 0.27% to 0.67% |

| 1825 to 1843 | CC | 0.67% to 0.88% |

| 1813 to 1824 | DD | 0.88% to 1.03% |

| 1782 to 1812 | EE | 1.03% to 1.58% |

| 1755 to 1781 | FF | 1.58% to 2.28% |

| 1724 to 1754 | GG | 2.28% to 3.48% |

| 1000 to 1723 | HH | 3.48% |

Don’t recall ever signing up for this credit score thingy? You didn’t. It’s automatically administered by the Credit Bureau Singapore (CBS). Everyone who’s ever taken a loan (including a mortgage) or used a credit card in Singapore has one.

As you go through life borrowing and repaying (or not), these transactions are captured by the CBS and feed into your credit report, of which your credit score is a component. Banks then request this data from CBS when they’re deciding whether to loan you money.

While the final decision is at the bank’s discretion, banks are generally not inclined to accept customers with a CC risk grade or worse, meaning a credit score of 1843 or below.

To find out where you stand, you can check your credit score by buying a credit report from CBS. Alternatively, apply for a new credit card with any CBS member and you can request it when your application gets approved or rejected.

How to improve your credit score

So maybe you haven’t been great with your loan repayments in the past couple of years and it’s showing up in your less-than-stellar credit score. Don’t worry, it’s not the end of the world.

Your credit score is continuously updated with new transaction data. So while you may not be successful at refinancing your home loan right this instant, you can work on improving your credit score so that you can get your application accepted eventually.

For starters, pay all your existing bills and make sure there’s no outstanding debt. Make sure to repay all loans and credit card bills in full and on time from now on. You’ll want to keep at least one credit card active, charging to it and making full payments each month. These “good behaviour” transactions will feed into your credit score and improve it over time.

Meanwhile, avoid applying for too many credit cards or loans at once. This kind of behaviour suggests that you’re “credit hungry” and can worsen your credit score.

After a few months of being on your best financial behaviour, your credit score should start to improve, albeit in a slow and steady fashion. Improving your credit score to at least 1844 (BB risk grade) will open up more financial options for you — including refinancing your home loan to a cheaper one.

–

Will you refinance or ride out the interest rate hikes? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends checking out Now that interest rates are rising, how will it affect housing affordability? and 9 things about SORA for home loan interest rates (before it replaces SOR and SIBOR).

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Refinancing soon? How to prep for interest rate hikes & check your credit score appeared first on 99.co.