19th April to 2nd May 2022

Analysts expect the upcoming 1,600 Build-to-Order (BTO) flats in Farrer Park to receive strong demand, given the new estate’s desirable location and amenities. Meanwhile, the owners of Golden Mile Complex have agreed to a collective sale of the iconic development at $700 million.

1) Analysts see strong demand for Farrer Park flats

Source: HDB

The upcoming 1,600 BTO flats in Farrer Park are expected to receive strong demand, given the new estate’s desirable location and amenities, reported Channel News Asia.

Notably, the Government has unveiled conceptual plans to redevelop a 10ha site in Farrer Park into a new housing estate with about 1,600 new flats.

Set for launch in the next three years, the new flats “will support the strong demand for public housing”, said HDB, Urban Redevelopment Authority (URA), and Sport Singapore (SportSG) in a joint release.

OrangeTee & Tie’s Senior Vice-president of Research and Analytics Christine Sun noted that it is the first BTO project to feature a sports theme in recent years. She added that developments with a specific theme usually have a stronger appeal to buyers.

Lee Sze Teck, Senior Director of Research at Huttons Asia, forecasts a subscription rate of over 10 for the upcoming development, while Sun also projects a subscription rate of more than 10 if the units are launched as Prime Location Public Housing (PLH) flats and over eight if offered as BTO flats.

BTO application rates for BTO projects in mature estates vs that of non-mature estates are typically higher and more competitive. Those who intend to ballot for the Farrer Park BTO project can expect tough competition due to the site’s desirable city fringe location, excellent connectivity to public transport networks, and proximity to various lifestyle amenities and F&B options.

Related article: BTO Application Rates in 2021 Are High: Here’s How to Improve Your HDB BTO Application Ballot Chances

2) Golden Mile Complex gets green light for collective sale at $700mil

Source: ET&Co

The owners of Golden Mile Complex have agreed to a collective sale of the iconic development at $700 million, which is lower than its $800 million reserve price, reported Channel News Asia.

In a letter to owners, Edmund Tie & Company, the development’s marketing agent, shared that more than 80% of the owners – in terms of both share value and strata area – had given their consent for the sale.

“Under the conditional agreement, the collective sale committee has up till 9 May 2022 to exercise the option,” it said.

“Once the conditional agreement has been exercised, we will hold an Owners’ Meeting as soon as is practicable to share with you the indicative sale timeline and the steps forward.”

While the letter did not mention the buyer’s name, it was previously reported that a consortium led by Far East Organization and Perennial Holdings had offered to acquire the development for $700 million.

The iconic building was gazetted as a conserved building in October 2021. To incentivise and make the site more attractive to buyers,measures including allowing the site boundary to be extended, the ability to build a 30-storey high tower block next to the primary building, tax incentives, and the possibility of a lease renewal to a fresh 99-year lease, were offered.

3) North Gaia sells nearly 27% of units at average price of $1,301.93 psf

Source: Sing Holdings

North Gaia, the first executive condominium (EC) project to be launched this year, sold nearly 27% or 164 of its 616 units over its launch weekend, reported The Business Times.

With 62% of the units sold opting for the deferred payment scheme, the development achieved an average sales price of $1,301.93 per sq ft (psf) and a total sales value of $232.528 million, said project developer Sing Holdings.

Of the units sold, 84.1% were three-bedroom units, 10.4% were four-bedders and 5.5% were five-bedders.

Describing the sales performance as respectable, SRI’s Managing Partner Ken Low revealed that second-timers accounted for around 70% of the buyers.

Related article: Executive Condo Singapore (2022): 4 Upcoming ECs We Can Expect

There is strong demand for ECs, as indicated by the unsold housing stock currently being at an all-time low. Prior to the release of North Gaia, there were only 16 new EC units from projects launched in 2021. Aside from North Gaia, we can expect three more EC launches this year: Tengah Garden Residences, the Tampines Street 62 EC and the Bukit Batok West Ave 8 EC.

4) Freehold site at Killiney Road on sale for $76mil

A prime freehold site at 118 Killiney Road has been put up for sale with an asking price of $76 million, revealed sole marketing agent Edmund Tie.

With an area of about 7,688 sq ft, the site is zoned for “Residential with Commercial at First Storey” use under the 2019 Master Plan. It currently houses a six-storey building which features a restaurant on its first storey, 30 residential units on its upper floors as well as a basement carpark.

Edmund Tie noted that investors can redevelop the property for hotel use or retrofit the existing development into serviced apartments, which would allow investors “to be cost-efficient with reduced carbon impact”.

It added that no development charge is payable to convert the property into either hotel or serviced apartment use.

The tender for the site closes on 1 June.

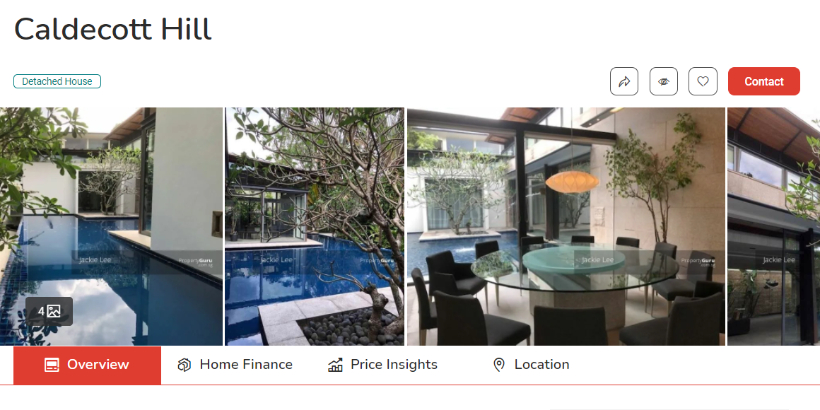

5) Lee Hsien Yang selling Caldecott Hill bungalow to Luxasia Group scion

Luxasia Group Managing Director Alwyn Chong is acquiring the Caldecott Hill bungalow of Lee Hsien Yang and his wife Lee Suet Fern for $13.25 million or $1,336 per sq ft (psf), reported The Straits Times.

Notably, the scion of Luxasia Group lodged a caveat for the property on 8 April.

Located in Caldecott Close, the property was described as a “resort-style modern bungalow” and is being sold with vacant possession. It featured two living rooms, a dining room, six bedrooms, a basement wine cellar and lounge, a koi pond, an infinity pool and a helper’s room.

Lighthouse Property Consultants’ Managing Director Samuel Eyo said the price for the property is reasonable given that it is an older house and located on a smaller plot at 9,920 sq ft.

6) Property magnate Wee Thiam Siew’s family acquires Olive Road GCB for $50.2mil

A Good Class Bungalow (GCB) at Olive Road has been sold to the late property magnate Wee Thiam Siew’s family for $50.2 million, reported The Straits Times.

Documents showed that Wee Hian Nam lodged the caveat for the property on 18 April.

The deal, which was brokered by SRI, works out to around $1,800 per sq ft (psf) based on the freehold property’s area of 27,909 sq ft. It surpassed the previous record set by an Olive Road GCB that was sold for $36 million to Secretlab’s Co-founder and CEO Ian Ang last year.

Lighthouse Property Consultants Managing Director Samuel Eyo said the $1,800 psf price is decent for a freehold GCB site within the Caldecott Hill Estate GCB area.

“This is a good buy given the current market, and the nearby Leedon Park GCB area and Ridout Park GCB areas are commanding $2,500 psf to $3,000 psf,” he said.

2021 was a stellar year for the GCB market, with prices and volumes hitting new highs. The GCB market is likely to remain buoyant in 2022, with prices remaining on the uptick. Despite the sustained interest in GCBs, the limited supply is set to ease sales momentum in the year ahead.

7) Many successful applicants of Rochor BTO flats intend to stay for long time

River Peaks I &II, the Rochor BTO project launched in Nov 2021. Source: HDB

Many of the successful applicants for the Rochor BTO project plan to stay in their new homes for a long time.

In fact, 19 of the 20 successful applicants interviewed by The Straits Times said they intend to live there for the long haul.

However, 11 shared that they may consider selling their unit in the event their life circumstances change, with the possibility of achieving a good price for their flat as their top motivation to cash in.

Related article: Prime Location Public Housing Nov 2021 Rochor BTO Flats: 6 Singaporeans Answer Why They Did or Did Not Apply

Only one applicant, who declined to be named, admitted to acquiring the flat for investment purposes and shared plans to sell the unit upon completion of the Minimum Occupation Period (MOP).

Launched last November, the Rochor BTO project, River Peaks I and II, is the first HDB project under the new PLH model.

This means unit owners will have to deal with stricter buying and selling conditions. Despite this, the project received robust demand with five first-time buyers vying for each four-room flat.

To date, the other project launched under the PLH model is the Feb 2022 Kallang/Whampoa BTO project, King George’s Heights, and was oversubscribed like the November 2021 Rochor BTO project. While not confirmed yet, the upcoming 1,600 Farrer Park and 6,000 Greater Southern Waterfront BTO flats are also probably PLH flats, given their location.

8) Number of foreigners acquiring homes in Singapore down in Q1 2022

The property cooling measures rolled out by the government in December 2021 may have deterred some foreigners from purchasing non-landed homes in Singapore during the first quarter of 2022, reported Singapore Business Review citing OrangeTee & Tie.

Citing URA data, OrangeTee & Tie noted that the number of non-landed homes acquired by foreigners dropped 47.3% to 147 units in Q1 2022 from 279 units in Q4 2021.

Purchases by permanent residents (PRs), on the other hand, dropped at a slower rate of 21.8% to 828 units in Q1 2022 from 1,059 units in Q4 2021.

Related article: Loan-To-Value Ratio (LTV) For Singapore Property in 2022: A Complete Guide

Under the December measures, the government raised the Additional Buyer’s Stamp Duty (ABSD) for foreigners to 30% from 20% previously.

The biggest group of foreigners who acquired non-landed properties in Singapore were from Mainland China, followed by those from Malaysia, India, the US and Indonesia.

Related article: What You Need to Know if You’re Buying Property in Singapore as a Foreigner (2022)

9) HDB resale prices to increase 5% to 8% this year

OrangeTee & Tie expects resale prices of HDB flats to increase by 5% to 8% this year as people become reluctant to pay for resale flats and shift their attention to paying for basic goods, reported Singapore Business Review.

HDB data showed that the growth for HDB resale prices eased in Q1 2022, rising only by 2.4%, down from the previous quarter’s 3.4% increase.

Related article: HDB Resale Flat Price 2022: Singapore Estates Ranked from Most Expensive to Most Affordable

OrangeTee & Tie said the easing was expected given that prices had increased for eight quarters in a row causing some price resistance.

It noted that the worsening inflation may also see buyers choosing more affordable smaller units or flats located in non-mature estates.

According to our Singapore Consumer Sentiment Study H1 2022, the buying preference for larger homes in areas further from the city centre is likely to endure in post-pandemic Singapore. This is fuelled by enduring work from home or hybrid work arrangements.

10) Chinatown shophouses put up for sale for $110mil

A block of seven adjoining three-storey conservation shophouses at 20 Trengganu Street has been put up for sale via an expression of interest (EOI) with an indicative price of $110 million, revealed exclusive marketing agent CBRE.

If sold at such a price, the property will break the record for Singapore’s largest shophouse transaction, currently held by Porcelain Hotel at $90 million.

With a total floor area of about 31,364 sq ft, the shophouses occupy an island plot spanning 10,444 sq ft within the Chinatown Historic District.

The ground floor is currently tenanted to multiple retail outlets such as an antique shop, cosmetic shop and supermarket, while the second and third floors are occupied by a restaurant and boutique hotel, respectively.

The EOI exercise for the shophouses closes on 1 June.

Looking for a property in Singapore? Visit PropertyGuru’s Listings, Project Reviews and Guides.

Cheryl Chiew, Digital Content Specialist at PropertyGuru, edited this story. To contact her about this story, email: cheryl@propertyguru.com.sg.