URA has earlier today closed the GLS tender for Pine Grove (Parcel A) and Dunman Road sites. Both sites were closely watched and expected to draw many bidders, as developers’ land banks are dwindling.

Interestingly, while Pine Grove (Parcel A) attracted five bidders, the site at Dunman Road only received two bids.

United Venture Development, an 80:20 joint venture between UOL Group and Singapore Land Group, had submitted the top bid for the Pine Grove site at S$671.5 million. As for the land parcel at Dunman Road, the top bid of S$1.284 billion was submitted by SingHaiyi.

Steven Tan, CEO of OrangeTee & Tie, pointed out the number of bids and prices indicated the developers’ positive outlook on the Singapore property market. At the same time, most were mindful of macroeconomic uncertainties and rising construction costs.

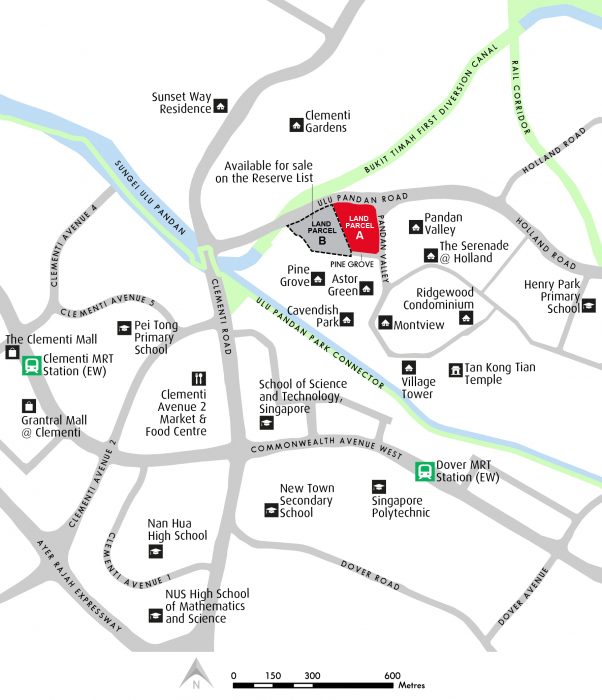

Pine Grove (Parcel A) GLS site

With a site area of 22,534.7 sqm and a gross floor area of 47,323 sqm, the site is expected to yield an estimated 520 units.

In our previous land analysis of the site, we noted that the site is in a quiet residential area suitable for families. Particularly, the site is close to a wide range of schools, such as Henry Park Primary and Pei Tong Primary which fall within a 1km radius.

Jesline Goh, Group Chief Investment and Asset Officer at UOL, pointed out that the site is also near one-north and the upcoming Clementi Nature Trail. Holland Village, The Clementi Mall and The Star Vista can be reached within a 10-minute drive as well.

“Given the site’s strong attributes, we expect to see keen interest from both homebuyers and investors.”

Tan believed that there may be strong pent-up demand in the area, given that there have been no new large projects in the area in the past decade.

This is echoed by Tricia Song, Head of Research, Southeast Asia at CBRE. She further pointed out that the difference between UOL’s top bid and the second-highest bid by Allgreen/Kerry Properties was only S$800 or 0.0001%.

According to Lam Chern Woon, Head of Research and Consulting at Edmund Tie, the difference was the lowest in the public tender history.

At the same time, he commented that the number of bids was lower than expected, given its location near prime District 10 and close proximity to popular schools.

“Notwithstanding the site’s positive attributes, developers are understandably a tad more cautious given the sombre economic outlook and the wave of rising prices and interest rates eating into homebuyers’ affordability. There could also be some concern on competition should the neighbouring site Parcel B on the Reserve List be triggered and awarded.”

Likewise, Tan shared that given the strong demand of Parcel A, Parcel B may be moved to the Confirmed List.

With the top bid translating to S$1,318 psf per plot ratio, he expects the selling price at launch to range between S$2,300 and S$2,400 psf.

Similarly, Lam expects an average selling price of over S$2,300 psf.

On the other hand, Song’s prediction is slightly lower at S$2,200 to S$2,300 psf.

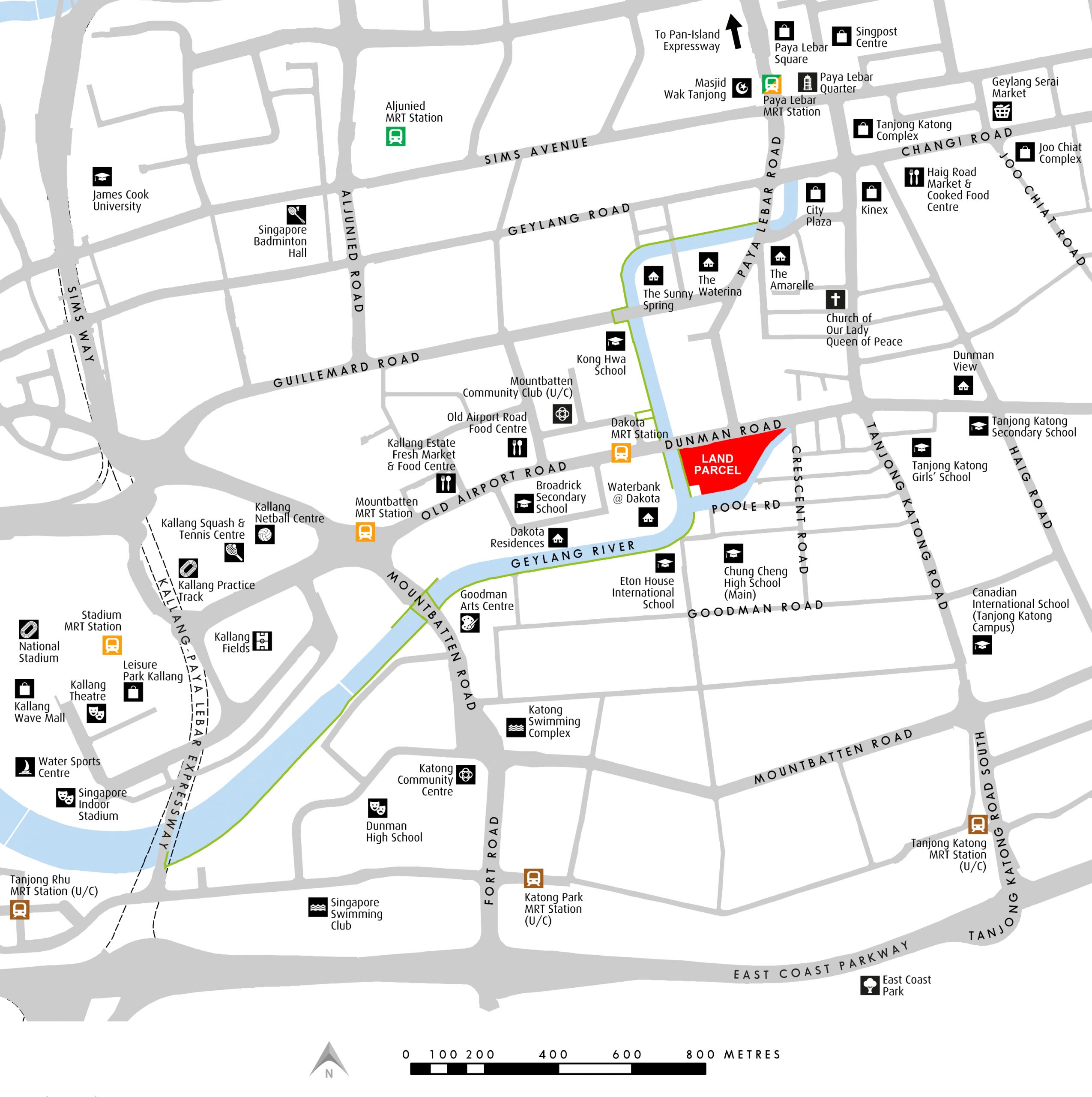

Dunman Road GLS site

The Dunman Road site is slightly bigger at 25,234.3 sqm, with an even higher gross floor area of 88,321 sqm. With that, it is expected to yield an estimated 1,040 units.

Notably, the site is less than 100m from Dakota MRT. It is also close to various schools, with Kong Hwa School and Tanjong Katong Primary within a 1km radius of the site.

According to Song, while the low number of bids at the Dunman Road site was lower than expected, the bid price of S$1,350 psf ppr was in line with expectations. In fact, she highlighted this was higher than the Jalan Tembusu site which was awarded for S$1,302 psf ppr in January 2022.

As noted in our previous land analysis, the site is near two new condo sites. One is the Jalan Tembusu GLS site that drew eight bids, while the other is the freehold plot at Thiam Siew Avenue.

Besides the potential competition coming from other new launches here, the higher developmental risk have led to the low number of bids for this site.

“It is the largest site on the Confirmed List with over 1,000 units and hence carry a heightened development risk – with a 35% Additional Buyer’s Stamp Duty (ABSD) on developers should they not sell everything within five years,” Song elaborated.

“The mounting economic headwinds is another chief factor for the muted response for the site,” Lam added.

Nevertheless, Tan pointed out that there is still demand for mega projects, like what we have seen with Normanton Park. The recent launch of Liv @ MB also indicated a healthy demand for private housing in the area.

“Based on the bid price, we anticipate that the future selling price of this project to be between S$2,300 and S$2,400 psf.”

This is similar to Lam’s prediction of an average price of over S$2,300 psf.

Meanwhile, Song expects a launch price of between S$2,200 to S$2,300.

Bidders are continually looking to build up their pipeline: Analyst

Looking at the developers who submitted the bid, Lam shared that they are continually building up their pipeline given the sustained confidence in the property market. At the same time, they are making good progress in their current projects.

“With the launch of AMO Residence and Watten Estate [en bloc site] expected in the coming months, UOL was likely emboldened by the robust take-up rates at Piccadilly Grand and Liv@MB, and is opting to replenish its landbank. Take-up rates of over 70% have been recorded at its other existing projects. Allgreen is likely keen to expand the reach of their project offerings beyond their Bukit Timah Collection [Juniper Hill, Fourth Avenue Residences and Royalgreen] towards the Ulu Pandan enclave to entice potential buyers.

Meanwhile, CEL is moving on from its Kopar at Newton project with over 70% sold, while preparing for new projects like the Peace Centre and Maxwell House redevelopments. CDL has enjoyed stellar success with its recent Piccadilly Grand launch and will be developing the GLS site at Jalan Tembusu while Sim Liam is also coming in fresh from winning the Dairy Farm Walk tender with Treasure at Tampines fully sold.”

—

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post United Venture Development wins Pine Grove GLS bid by $800 appeared first on 99.co.