When you purchase a private property, one of the first things your law firm will do for you after you’ve exercised the Option To Purchase (OTP) is to lodge a caveat.

This is mostly a “behind the scenes” event for most buyers, but it’s more important than you’d think. On top of that, a caveat can sometimes be a good way to check property values.

Here’s what it’s all about:

What is a caveat?

The word caveat literally means “beware“. The purpose of a caveat is to protect a property buyer: Once you’ve lodged a caveat on the property you’re buying, other people will know that you have priority.

For example, if another person was thinking of trying to claim the property (by trying to buy it out from under you, etc.), the caveat will block them from doing so.

A caveat also prevents owners from executing scams whereby they’d sell the property multiple times to unsuspecting buyers, and then disappearing with the deposits.

In any case, you’ll be notified if such an event occurs, so you won’t become a victim. Your lawyer will advise you on the next course of action if another person attempts to lodge a caveat on the same property after you’ve already done so.

Think of caveats as the act of ‘chope-ing‘ your property, the same way Singaporeans chope tables at hawker centres with packets of tissue paper. When you find a table, which is the equivalent of executing your OTP, you place a packet of tissue paper (the equivalent of a caveat) on it to dissuade others from seating at your table while you order and queue for your food (the equivalent of finalising the purchase of your property).

Just as you’ll remove the packet of tissue paper when you’ve returned to the table with your food, the caveat will also cease when the caveator officially takes ownership of the property on the date of completion.

Your conveyancing firm will usually help you to lodge a caveat right after you’ve exercised the Option To Purchase (OTP), or when you’ve completed the Sale & Purchase Agreement. Otherwise, another party – such as the bank extending you the loan, or even the CPF board if your CPF monies are used, can also lodge the caveat (but it’s almost always handled by your lawyer).

Caveats are lodged with the Singapore Land Authority (SLA). You can’t do it yourself, unless you have a lodgement account for some reason.

What you can do, however, is check for existing caveats on a private property.

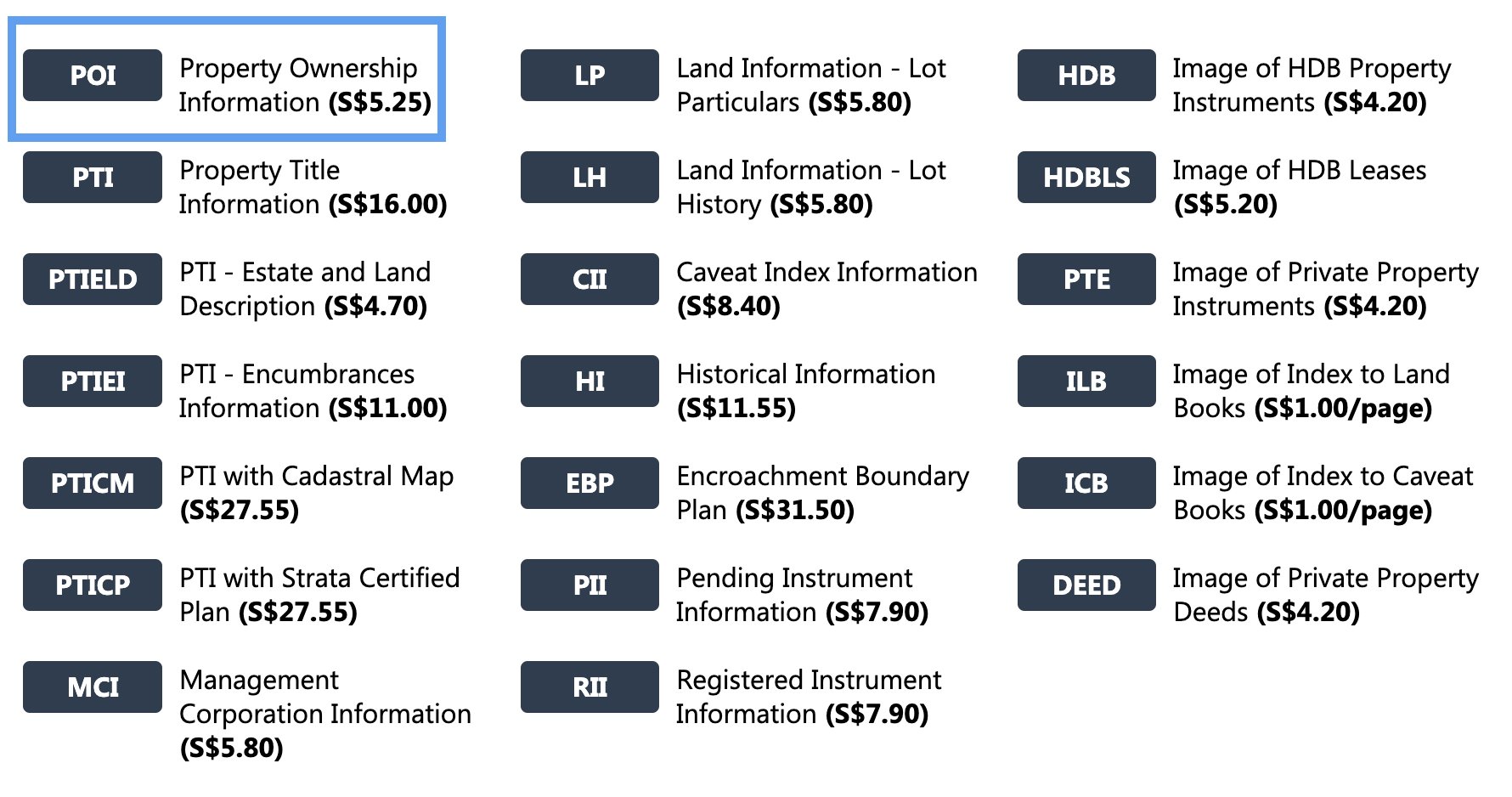

The SLA INLIS portal lets you search for and download caveats for a small fee of S$5.25. Simply click on ‘Property Ownership Information’ under Product Listings and follow the instructions. (Note: click ‘Cancel’ when prompted to purchase the ‘Strata Certified Plan’.)

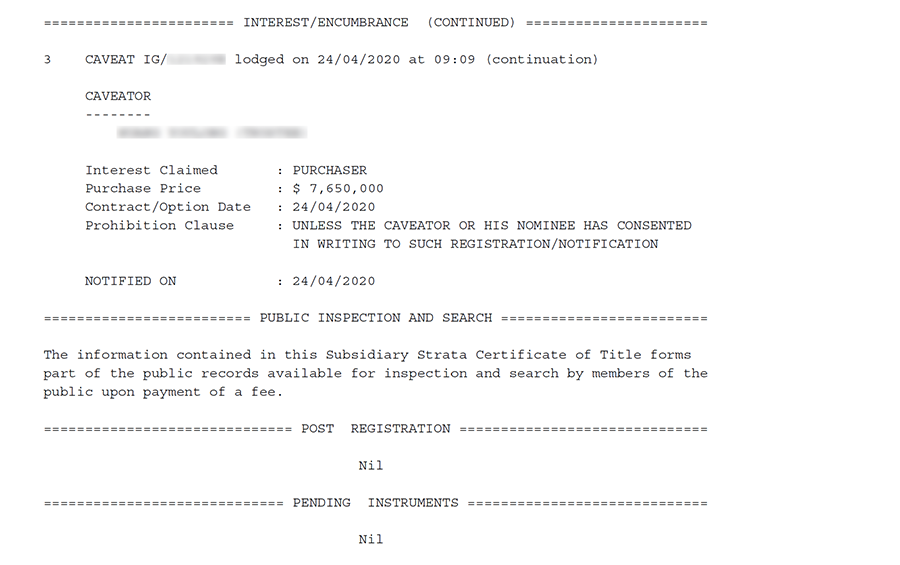

The caveat includes information that’s very useful to property buyers, including

- The name of the rightful owner of the property

- The lot area (i.e. size) of the property

- Tenure of the property

- Details of caveats lodged

- Whether the property is mortgaged

- Any issues with the property (called “encumberances” that could prevent it from being sold)

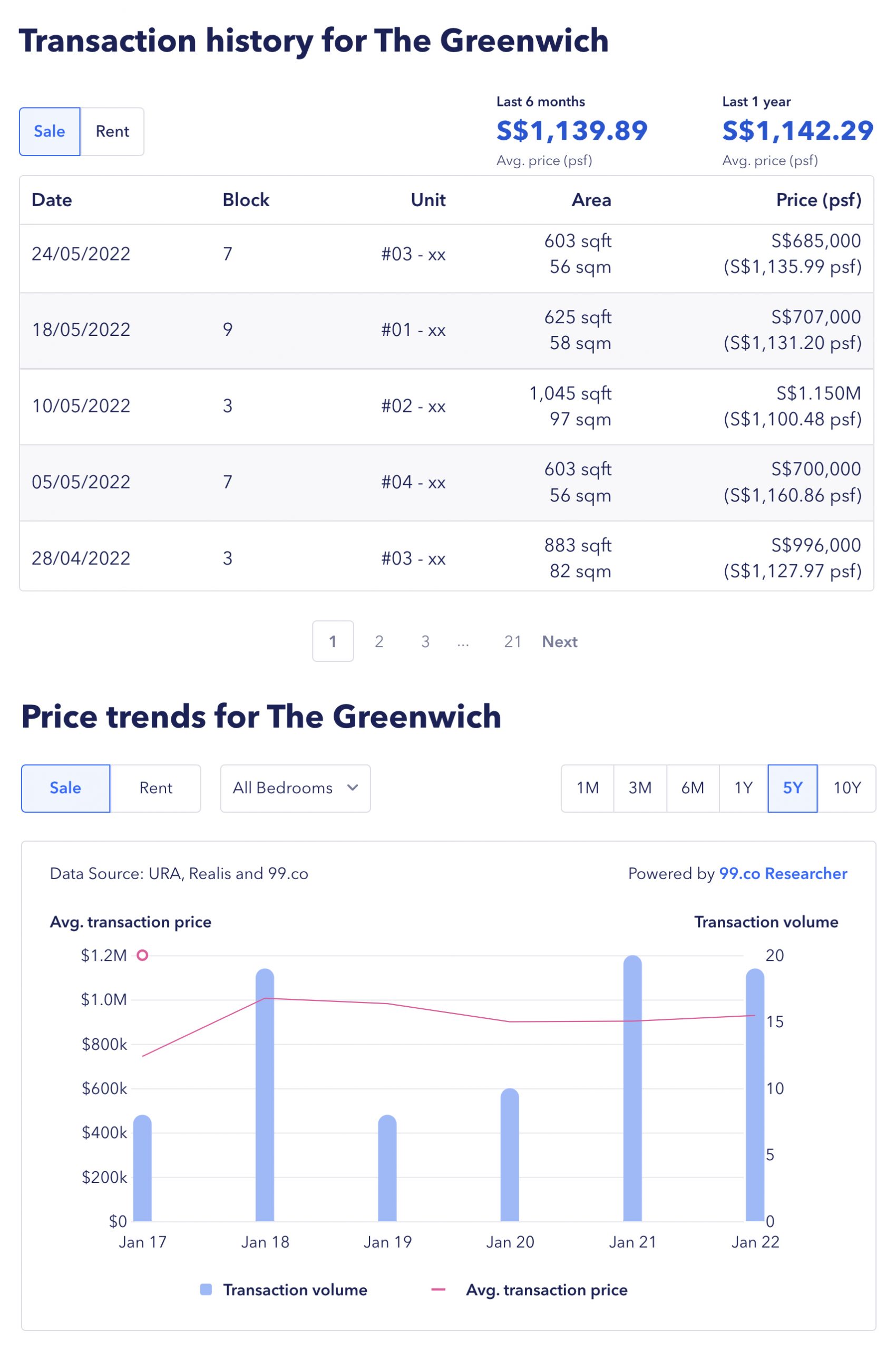

A property search portal like 99.co collates all the caveats lodged and presents them in an easy to understand format under every property listing. This lets you know what’s a fair price to offer for the property based on latest transaction info. You can also see the price trend for the development:

(Note that you might sometimes see bizarrely skewed prices, such as a unit sold far below the norm. These might happen from time to time, such as when parents sell to their own children at below market value.)

Recommended article: Option To Purchase: 5 things you might not know about (but really should)

What’s the process for lodging a caveat?

Uh, we can tell you but you probably can’t do it. The lodgement is done online, via the Singapore Titles Automated Registration System (STARS) website. You won’t be able to log in and do it though, unless for some reason you have a lodgement account. Your law firm will do it for you.

It costs S$64.45, and takes effect on the day it’s lodged.

Once the caveat is lodged, the information is available to the public via the Urban Redevelopment Authority’s (URA) transactions tool, so anyone can easily find out how much you’re selling (or buying) your home for.

The property that I want to buy already has a caveat lodged against it. What now?

Before you try to buy any property, your law firm will check for existing caveats. If someone else has lodged a caveat, they have priority over you. Your purchase will be blocked, and you’re not likely to get the property unless something dramatic happens (e.g. the earlier buyer pulls out even after exercising the OTP, for some reason or other).

There may, however, be cases where your lawyer can argue against the caveat. For example, if it turns out it was lodged by spiteful ex-spouse to interfere with the transaction. There have been cases where conveyancing lawyers managed to get a court order for the caveat to be removed; or even appealed to SLA to cancel the caveat.

Who are caveats for?

Home buyers

Like we discussed above, checking for a caveat will save you time as a potential home buyer by checking if anyone has ‘choped’ the unit already. Just enlist the help of your lawyer to check that there’s no caveat lodged on the property before proceeding to contact the owner for a viewing (or move on to the next unit on your list).

Home sellers

For those selling their homes, using the URA transaction tool gives you a sense of how much you should price your property at by looking at caveats lodged on similar listings. It shows all URA caveats lodged within the last 60 months, so you can get the most up to date information, such as:

- Project name

- Street name

- Type (condominium, landed, etc.)

- Postal district

- Market segment (CCR, RCR, or OCR)

- Tenure (freehold or 99-year leasehold)

- Type of sale (resale, sub-sale or new sale)

- No. of units

- Price and nett price

- Area (sqft)

- Type of area (strata or land area)

- Floor level (non-specific, e.g. 31 to 35

- Unit price (price psf)

- Date of sale

Having a buyer lodge a caveat on your home also shows that they are serious about going through with the sale. This gives you peace of mind to proceed with your next property purchase.

Have more questions on caveats or need personalised help? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends 5 reasons why property buyers forfeit their option fees and 5 ways selling your property can go horribly wrong (and how to fix it)

The post Why does a ‘lodging a caveat’ matter in a property transaction? appeared first on 99.co.