When it comes to picking between a leasehold and freehold condo, it all boils down to one thing when all other factors such as location, cost, size, and so forth are neck and neck: the lease term.

In theory, between two condo units that are similar in every respect other than lease, the freehold unit is preferable. However, comparisons are seldom this simplistic, and there are other factors to consider:

Three main things to know about leasehold condos

Having spoken to many of leasehold condo buyers over the past few months, it turns out there their considerations can be condensed into three general guiding principles. If you nod your head at any of these, then go ahead and consider buying a 99-year leasehold over a freehold condo project:

- There’s no substitute for a superior location

- Buy leasehold to win at real-life Monopoly

- A house is not a (permanent) home

1. There’s no substitute for a superior location

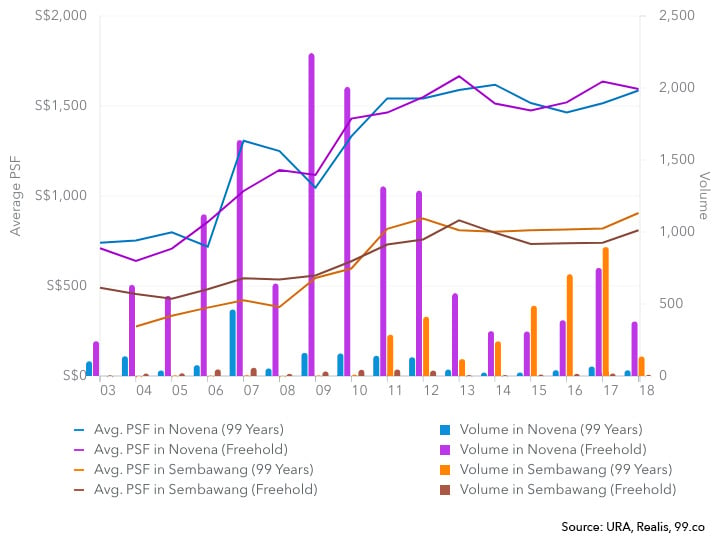

For condo properties, location could well be a bigger determining factor for capital appreciation than tenure. Here’s our comparison between condos in Novena and Sembawang:

Looking at average psf prices in the 15-year chart, the 99-year leasehold condos in the prime district of Novena have had a much bigger upside than freehold condos in far-flung Sembawang. The following two points are also noteworthy:

- The price difference between 99-year-leasehold and freehold condos in Novena is negligible. 99-year leasehold properties had the higher psf price in 4 out of 10 years (2008-2017).

- 99-year leasehold property in Sembawang has seen a greater upside than the freehold condo property there.

We’re not surprised by our key findings. After all, the first rule of property is always location, and a property that’s near to key amenities or the Central Business District (CBD) will have scarcity value. Tenure is of secondary consideration to location.

Whether you’re a homebuyer or a property investor, you should think along the same lines. Bear in mind a freehold property that’s inaccessible won’t attract tenants, or that you may find it a major hassle to live there (and wake up every workday dreading a long commute).

And when you try to sell the property, its value at that time will factor in these inconveniences — unless major redevelopments have taken place in the vicinity. Even then, your area might be trying to play catch up to changes and improvements that have also taken place in other, better locations.

When savvy buyers know that freehold status won’t rescue a property that’s inaccessible, they go for the 99-year leasehold option.

So, it’s typically Novena over Sembawang, or a leasehold unit right next to the MRT over a freehold condo that takes a feeder bus to reach — basically anything to get the best location within a set budget.

2. Buy leasehold to win at real-life Monopoly

Here’s the thing: tenants don’t care whether your property is leasehold or freehold. If your leasehold property can match nearby units in attributes such as comfort and convenience, and is well-maintained, it will probably fetch a similar rental income regardless of the remaining tenure.

So, if you want to be a successful Monopoly landlord kingpin in real life, consider buying an older — read: cheaper — leasehold condo to get a higher rental yield.

Now the formula for gross rental yield is (annual rental income)/(total property cost) x 100.

Let’s say you want to compare between two condos — one freehold and one leasehold — that fetch the same annual rental income of S$40,800 per annum. Both were built in 1998, and the leasehold condo has about 78 years left on its lease*.

A 2-bedroom, 1,000 sq ft unit at the freehold condo costs S$1.2 million, which with the rental income gives you a gross rental yield of 3.4%.

Meanwhile, a 2-bedroom, 1,000 sq ft unit at the 99-year leasehold condo only costs S$950,000, due to the shrinking lease. However, the rental income of S$40,800 is similar to that of the leasehold condo. The gross rental yield is thus 4.3%, significantly higher than its freehold counterpart.

This example assumes the condos are broadly similar except for the lease (e.g. one can’t have more wear and tear or fewer condo facilities than the other). Many time, comparisons are not so clear cut, as factors such as proximity to amenities, condo facilities and the quality of upkeep all affect rental yield.

*We based our example on two real-life projects.

Read this: Calculate rental yield in Singapore: A quick and simple guide

3. A house is not a (permanent) home

We don’t mean this in a bad way. Leasehold buyers buy with a clear exit strategy. This is in contrast to intending to live in the same property till old and then passing the asset to the children, which is a freehold mindset.

To leasehold buyers, home can mean a new unit in a new estate, and potential near- to medium- term benefits outweigh any sentimental value of home being a fixed physical location.

When a leasehold condo can provide flexibility and opportunity for upward mobility, buyers don’t see why they should pay a hefty premium for a freehold condo.

Here’s what we mean when we talk about near- to medium-term benefits. For instance, a newly-married couple may want a house near a reputable primary school, and is prepared to move near a reputable secondary school when their kids grow up, and so forth.

Or they might plan to take advantage of the next property boom to sell and upgrade before the lease runs down too much.

Or they might be aiming to buy a second property five years down the road. (For the last example, the last thing they want is to be locked in to a freehold property with higher mortgage and lower rental yields.)

As long as the house isn’t seen as a permanent home, the permutations are endless, and so are the reasons for buying 99-year leasehold condos.

Read this: 12 affordable properties within 1km of top primary schools in Singapore

A blueprint for choosing a 99-year leasehold vs freehold condo

It’s important to know that all of the three guiding principles are interlinked. You can’t sell to upgrade if your location is bad; you can’t maximise rental yield if you bought a leasehold condo at too high a price; and you could lack resources to invest in a second property if you bought a freehold property first.

If you’re uncertain about buying a 99-year leasehold condo or a freehold condo, we’d recommend you consult a financial advisor or wealth manager to work out which one fits your long-term plans better.

Ultimately, we don’t know what type of buyer you are, but we know there’ll be a fair few readers who will see leasehold condos — and the people who buy them — in a whole new light after reading this!

Buying a leasehold or freehold condo? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Everything to know about private condo payment schedule and Eight-step guide to buying a new launch condo in Singapore

The post Should you buy a 99-year leasehold over a freehold condo? appeared first on 99.co.