A limited supply of integrated developments in the suburbs has made them even more attractive to buyers and tenants, leading to higher prices and rents than other condos in the Outside Central Region (OCR).

According to OrangeTee & Tie Research & Analytics Market Watcher series report, some buyers are willing to pay up to 27% more for such properties.

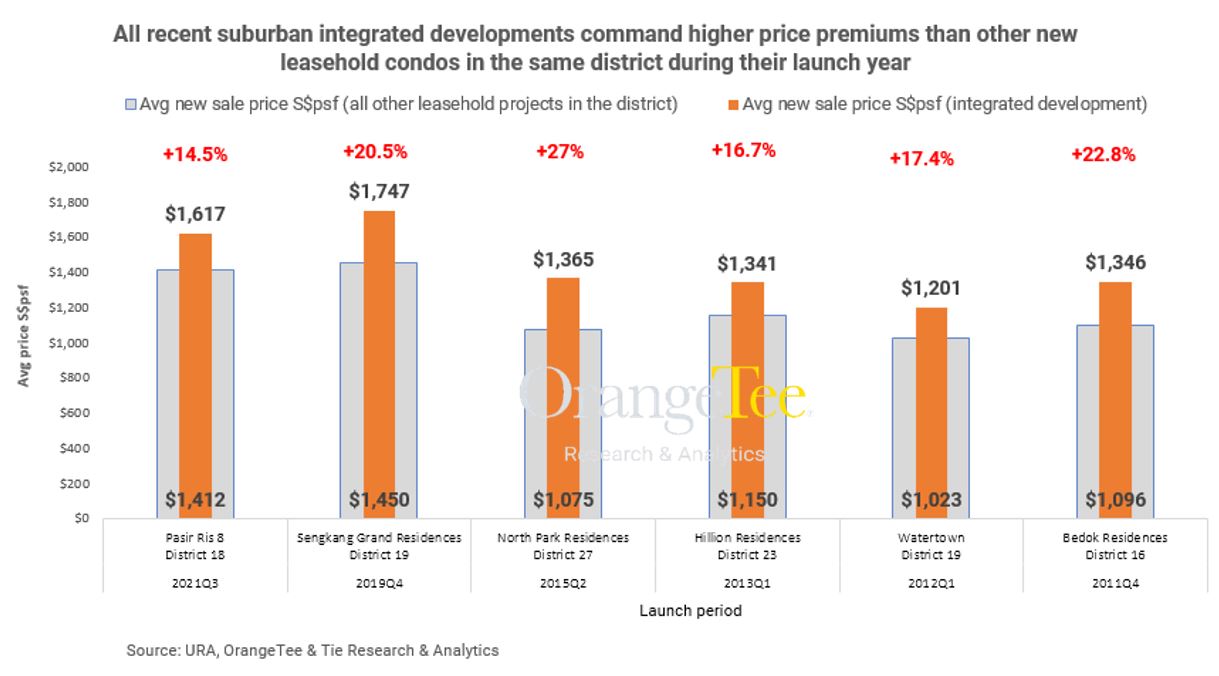

Citing URA data, Christine Sun, Senior Vice President of Research & Analytics at OrangeTee & Tie, elaborated in the report that six OCR integrated developments were launched at higher prices than other new leasehold condos in the same district.

“For instance, the launch price of Pasir Ris 8 (S$1,617 psf) was 14.5% higher than the average price of new leasehold condos (S$1,412 psf) in District 18 in 2021. Similarly, the launch price of North Park Residences (S$1,365 psf) was 27% higher than the average price of other new leasehold condos in District 27 (S$1,075 psf) in 2015.”

To date, 19 integrated developments have been launched in Singapore, with the first being Compass Heights in 2001. Out of these, only eight are located in the suburbs.

As the name suggests, besides residential, integrated developments comprise either a retail mall, office tower and/or a hotel component. Some of these developments may even have a direct link to the MRT and bus interchange, providing residents increased convenience and connectivity to the rest of the island.

Over the past year, new launch condos with a very high take-up rate over the launch weekend tend to be integrated developments. This includes Piccadilly Grand (77%), Canninghill Piers (77%) and Pasir Ris 8 (85%).

Integrated developments command a higher rent

Sun also noted in the report that compared to other resale condos in the area, 11 out of 13 completed integrated developments across the island have commanded higher rents.

Among these mixed-use developments, South Beach Residences has recorded the highest rental premium in median rent for two-bedroom units (123.7%) and three-bedroom units (266.3%).

During the first half of 2022, the median rent of such units in the development was a whopping S$8,500, more than double the median rent of other condos in District 7 (S$3,800).

Likewise, its median rent for three-bedroom units (S$18,500) was more than three times the median rent of other condos in the same district (S$5,050).

The same trend has also been observed in the suburbs. For instance, North Park Residences recorded a median rent of S$3,000 for two-bedroom units over the same period, 11.9% higher than the median rent in District 27 (S$2,680). The rental premium is also higher for three-bedroom units, with the median rent at S$4,075, 31.5% higher than the median rent of other condos in the same district (S$3,100).

(On the other hand, despite the scarcity of integrated developments, they do not necessarily command a higher price appreciation than standalone residential developments.)

Supply of integrated developments is expected to remain low

Following the successful launch of Piccadilly Grand in May, the next integrated developments to be launched this year are Lentor Modern and Sky Eden@Bedok.

Both projects are highly anticipated – not only due to them being mixed-use developments, but also because they will be the first new projects to be launched in their respective areas in a long time.

Lentor Modern is the first new launch condo in the Lentor neighbourhood, while Sky Eden@Bedok marks the first time a new condo is launching in Bedok in over 10 years.

Moving forward, Sun noted in the report that the supply of these mixed-use developments will remain low. She expects the Jalan Anak Bukit site to be launched next year.

Other upcoming mixed-use developments include the Marina View site and the former AXA Tower site, which is slated to take over Guoco Tower’s title as the tallest building in Singapore.

GLS launches for integrated developments in the pipeline include Marina Gardens Lane, Tampines Avenue 11 and Woodlands Avenue 2, which is currently on the Reserve List.

Would you buy a unit at an integrated development in the suburbs? Let us know in the comments section below.

If you found this article helpful, 99.co recommends H2 2022 GLS: First condo in Marina South, second EC in Tengah and more sites at Lentor and Are neighbourhood condos affected when an integrated-MRT condo comes to town?

The post Buyers are willing to pay up to 27% more for OCR integrated developments appeared first on .