99.co’s Consumer Sentiments Study polled 790 respondents across various demographics to find out how people feel about the local property scene and what they think is worth the money and consideration when deciding to purchase a home.

Key observation #1: Homebuyers have an average budget of S$1.2-2m for new launch condos, or S$1.5m-3m for resale condos

- 54.1% of our respondents live in HDB flats, with 38.5% in a condo and 7% in landed properties. 0.4% live in an integrated mixed-use development.

- While 29.5% aren’t looking at a property purchase at the moment, 24.3% of respondents are interested in purchasing their first property, with 20.4% already owning their first property and looking to upgrade to their second.

- 10.4% want to buy another property to rent out, and 11.8% of people want to invest in Singapore property.

- More than one-third (43.3%) of respondents are looking to purchase condos for their own stay, while 31.5% eye them as an investment asset.

- Respondents shared that they have an average budget of S$1.2m-2m for new launch condos or S$1.5m-3m for resale condos. When it comes to how much they’re willing to pay, it’s clear that people are willing to dig deeper into their pockets and shell out up to 50% more if the intention is to make it their home.

- Following that, investors have capped their average budget of S$1m-2.5m for new launches and S$1m-S$2m for resale condos.

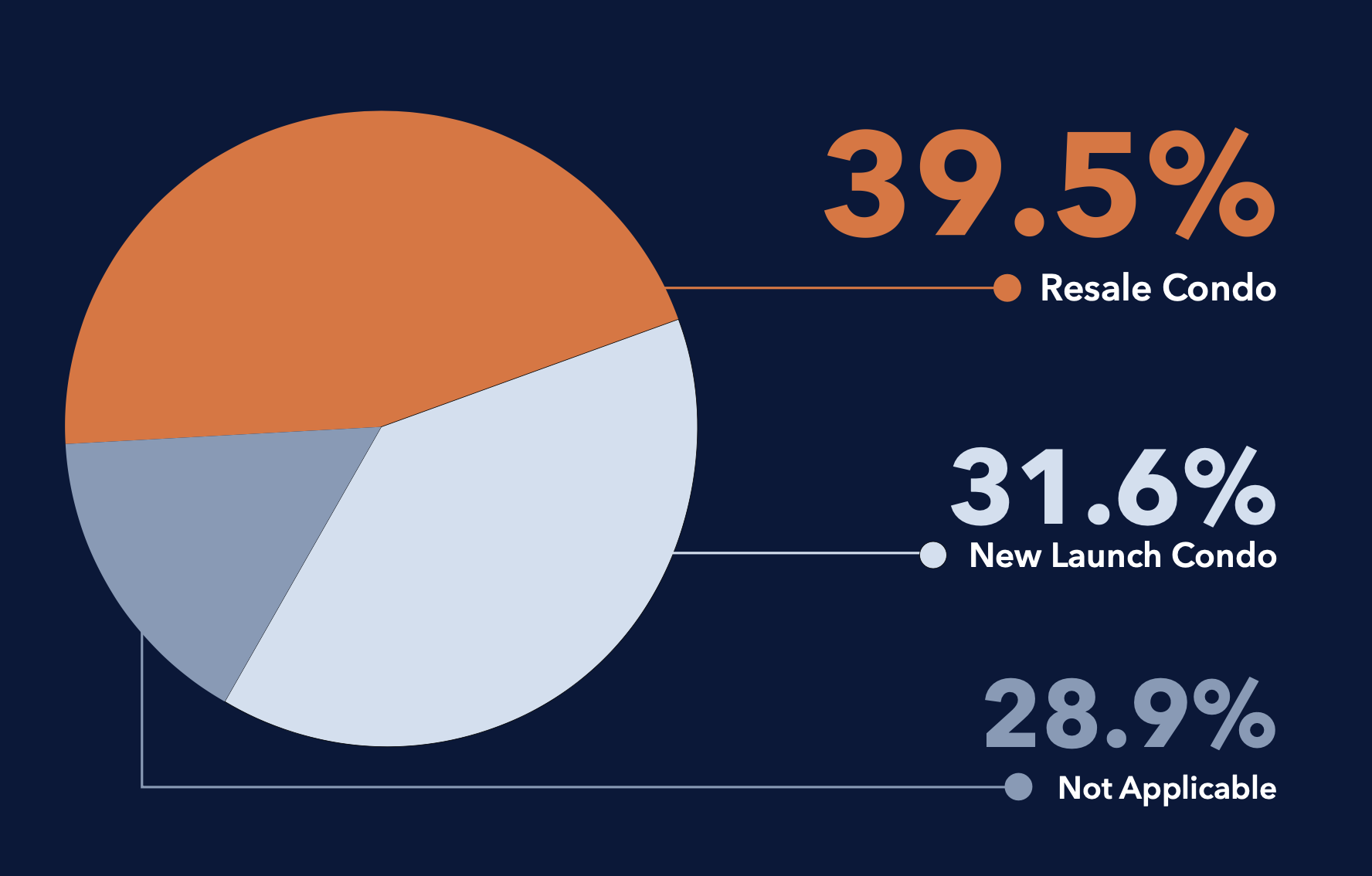

- 39.5% prefer buying a resale condo over a new launch condo (31.6%), a sentiment that is reflected in the percentage of resale condo sales, which made up 62% of the total condo sale volume in 2022 so far. This is the highest level recorded since 1995.

Pow Ying Khuan, Head of Research at 99 Group, noted that in Q2 2022, 60.4% of resale condo transactions were registered, less than the 64.1% in Q1 2022. This can be compared to pre-pandemic levels, which registered 51.9% for resale condos sold between 2018 to 2019. It’s largely attributed to the knock-on effect the pandemic has had on the property market, with manpower and construction supplies being in shortage combined with the lack of new launches forcing homebuyers to turn to the secondary market.

Furthermore, with more workplaces embracing hybrid arrangements of working from home, more people such as young couples or working professionals felt the urgency to move into their own space and sought to cut short their property wait by going the resale route.

Q2 2022’s overall median transacted prices fall within the respondent’s budgets, with new condos going for S$1.888 million and resale condos going for S$1.35 million. Regardless of whether respondents are buying a condo as a live-in option or as an investment piece, both new and resale condos in the Core Central Region (CCR) and new condos in the Rest of Central Region (RCR) have either surpassed or are a stretch to most of their budgets in the last few quarters.

More affordable options are RCR resale as well as Outside of Central Region (OCR) new and resale condos, especially with the rapid rise of interest rates, risks of recession and geopolitical tensions.

Key observation #2: 65.1% prefer freehold over leasehold, but 67.8% of transactions were leasehold projects in Q2 2022

- 65.1% of condo-buyers would rather pick a freehold over a leasehold (34.9%), with almost 41.9% viewing it as a higher-value property asset to pass down to future generations due to the absence of lease decay. 33.2% have a common belief that freehold properties have better en-bloc opportunities and fetch higher prices if they choose to sell them.

- However, most buyers (especially investors) usually favour leaseholds due to better affordability, with 67.8% of transactions stemming from leasehold projects in Q2 2022.

- When it comes to renting or selling the unit within a short period, there’s the common sentiment that leaseholds provide a better rental yield as tenants renting out a unit have no preference regarding whether the property is leasehold or freehold. Those who prefer leasehold condos are primarily investors, with 44.8% citing affordability, better rental yield, and ease of sale as their reasons for picking leasehold over freehold.

“Interestingly, pre-pandemic transactions saw a higher uptake in leasehold condos, with 71.6% from 2018 to 2019 and 74.2% from 2015 to 2018. It shows that more freehold condo units are being sold in recent years despite being 28.4% higher than their leasehold counterpart, based on caveats lodged in the first half of 2022,” Pow notes.

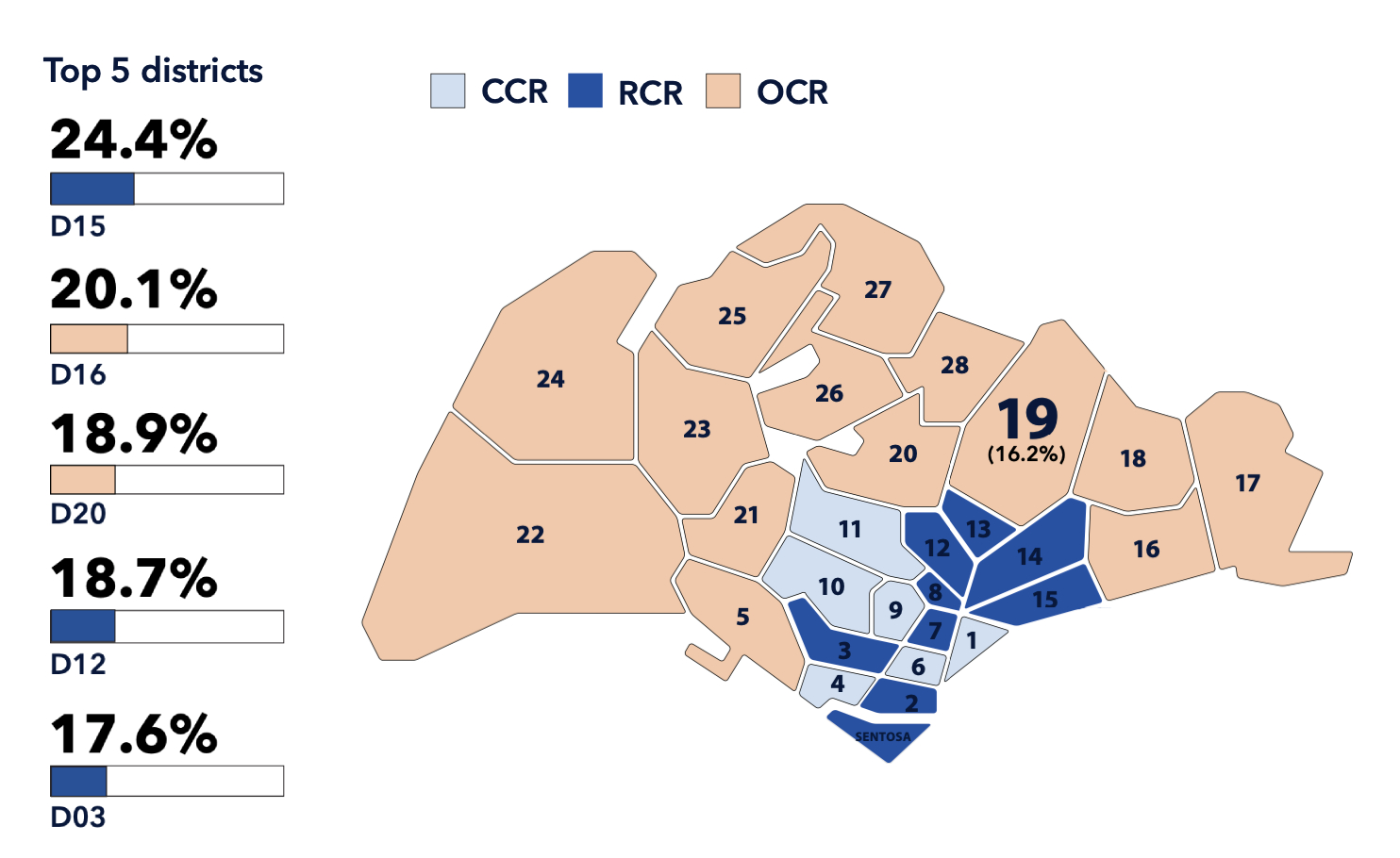

Key observation #3: 3 out of 5 most prefer buying a condo in the RCR district

Top 5:

- District 15 (East Coast / Marine Parade): 24.4%

- District 16 (Bedok / Upper East Coast): 20.1%

- District 20 (Ang Mo Kio / Bishan / Thomson): 18.9%

- District 12 (Balestier / Toa Payoh): 18.7%

- District 3 (Alexandra / Commonwealth): 17.6%

- District 15 retains its pole position as the most favoured district for new sale condos, with a market share of almost 12% in H1 2022. For resale condo volume, it takes second place with 8.4% of the 28 districts.

- We see three out of five of the most preferred districts being RCR condos – its sales volume jumped from 25.4% in Q3 2021 to 36% in Q2 2022, thanks to more new sale units offered in the city fringe.

- While District 19 (Hougang / Punggol / Sengkang) topped the list in transaction volume for resale and new launch condos since 2015, it fell to seventh place in this sentiment survey. However, buyers should note that its average psf of S$1,829 (as of 4 August 2022) is almost 22% lower than the overall average of S$2,231 across all districts in Singapore, making it a budget-friendly option.

There are also many new and resale condos to choose from in District 19.

Survey respondents ranked convenience as a high priority when it comes to selecting a condo. Almost 40% ranked walking distance to MRT as the most important, followed by distance to nearby supermarkets and retail shopping malls (33.3%).

Condo amenities came in third place, followed by having affordable food choices in the vicinity and distance to childcare facilities rounding up the list.

Key observation #4: 65.7% would purchase star-buy units

- 65.7% felt star-buy units were a lucrative purchase and would go for one. These units are usually sold at a discounted price when a condo nears its TOP date.

- 31.8% viewed star-buy units as being more value-for-money, with 17.1% seeing its shorter wait time and its discounted price contributing towards a more viable investment choice as a good thing.

- Of the 34.3% who disagreed, 26.1% perceived star-buy units as a marketing gimmick for developers to quickly offload units to avoid ABSD, citing inauspicious numbers or poor-facing views as reasons for the over-supply.

According to Pow, “Anecdotal evidence from recent years shows that units of similar sizes in specific projects were sold for lower prices post-launch, which might be influenced by the unit’s layout, location or the direction it’s facing. Developers also set their pricing strategies according to market conditions during the point of transaction.“

Key observation #5: 59.5% feel property prices have fallen out of their range, while 17.8% felt they could afford them within their budgets

- 61.1% of respondents felt that current mortgage or home loan interest rates (used to combat inflation) were high, with 17.7% saying it was extremely high. 19.2% felt the rates were still reasonably fair.

- 64.6%, or more than half of the respondents, felt pessimistic about the current property climate, with 59.5% finding property becoming increasingly unaffordable and out of their budget. 27% cited unfavourable government policies as a culprit, and 20% said property investments could not cinch high returns in this climate.

- 35.4% viewed the current climate in a more positive light, while 17.8% felt they could find affordable properties within their budget and net high returns from their investments (13.3%)

- 49.9% said the current climate was somewhat likely to affect their condo-buying decision, with 34.7% stating it was extremely likely their buying decision would be influenced. This could partially be a factor of cooling measures introduced in December 2021 combined with rising interest rates.

In Q1 2022, the overall sales volume of condos was down by more than one-third from the previous quarter due to seasonal events (e.g. Chinese New Year) and cooling measures.

However, it rebounded swiftly in Q2 2022 with a 31.6% increase quarter-on-quarter, albeit lower than the same quarter in Q1 2022. June 2022 marked an unbroken price increase of 23 months in the 99-SRX Condo Resale Index, suggesting that even higher prices are on the horizon for potential condo buyers.

When asked what could be done to help them as property owners or investors, many voted for Additional Buyer’s Stamp Duty (ABSD) being reduced or even completely removed.

Others called for lower interest rates and better financing options to keep housing options affordable.

There was also an unanimous agreement on having more transparent property information in the form of articles and seminars, which is exactly what 99.co strives to provide to our readers.

The post Singapore Consumer Sentiments Study Q2 2022 appeared first on .