Following 28 months of price growth in the HDB resale market, price resistance may be kicking in.

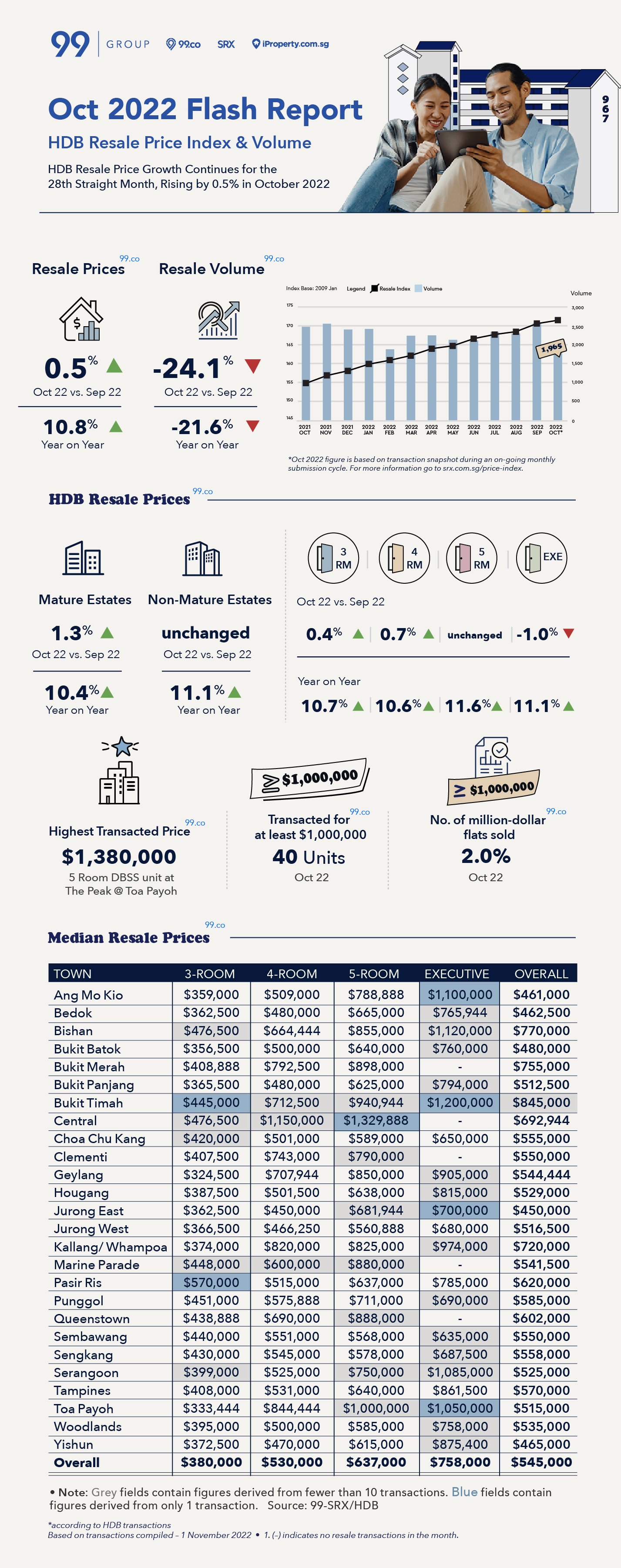

As reported in the 99.co and SRX flash report on the HDB resale market in October, prices of HDB resale flats increased by 0.5%.

On the other hand, the number of HDB resale flat transactions has dropped by 24.1%, as 1,965 HDB resale flats were transacted last month.

Pow Ying Khuan, Head of Research at 99 Group, noted that the decline in volume is uniform across the board for almost all room types, ranging from 22.8% to 26.0%.

Christine Sun, Senior Vice President of Research and Analytics at OrangeTee and Tie, added that the 24.1% drop is the steepest monthly decrease since April 2020, when sales plunged 78.3% from 1,949 units in March 2020 to 423 units in April 2020 during the Circuit Breaker period.

“The total number of transactions for the first 10 months of the year stands at 22,425 now, and it is likely that we will see lower volumes than last year’s 29,181 when the year concludes,” said Pow.

Drop in resale volume may not be due to cooling measures

The drop in HDB resale volume came after the latest round of cooling measures that took effect on 30 September. Measures include a higher stress-test for HDB and bank loans, a higher loan-to-value (LTV) ratio limit for HDB loans and a 15-month wait for private property owners before they can buy an HDB resale flat.

At the same time, Pow highlighted the cooling measures may not have led to last month’s drop in volume yet, as it typically takes about eight weeks to complete an HDB flat sale.

“Rather, this could be due to some degree of price resistance kicking in, considering that the median price of an HDB resale flat is at an all-time high at S$545,000, or 34.6% higher than its pre-pandemic level in October 2019 when the median price was S$405,000,” Pow elaborated.

“As a result, some buyers could remain on the sidelines to monitor what may come next in relation to the changing macroeconomic circumstances such as rapidly rising interest rates.”

Lower demand for bigger flats temporarily

In terms of room types, 4-room HDB resale flats saw the highest price increase at 0.7%, followed by 3-room HDB resale flats at 0.4%. 5-room HDB resale flat prices remained unchanged. On the other hand, prices of executive flats dropped by 1.0%.

Given the price change for the bigger flats, Sun commented, “Demand for bigger flats may continue to experience a temporary pullback since some private homeowners may be put off by the long waiting period and no longer wish to buy a resale flat.

“However, some young couples or upgraders looking for resale flats may still purchase big flats when the prices moderate or stabilise.”

2% of last month’s resale transactions are million-dollar HDB resale flats

Last month saw 40 HDB resale flats transacted for at least a million dollars. According to Pow, this is also the second-highest monthly record, and twice as high as October last year.

Sun explained that the option to purchase (OTP) for some of these units might have been issued before the cooling measures took effect. Some buyers may also have been successful in their appeals.

In addition, she noted that last month saw the highest number of 4-room units sold over a million dollars, with six of such units being transacted in October.

This includes the S$1.37 million sale for a 4-room resale flat at Pinnacle@Duxton, making it the most expensive 4-room HDB resale flat.

Looking to buy or sell an HDB resale flat soon? Let us know in the comments section below.

If you found this article helpful, 99.co recommends Rent analysis: Punggol tops list, with 40-41% rise in median rent across HDB flat types since Q3 last year and HDB incurred a record deficit of S$4.367 billion in FY 2021, 86% higher than previous year.

The post HDB resale volume dropped by 24.1% in October appeared first on .