URA recently closed the GLS tender for Bukit Timah Link and Hillview Rise sites on 3 November 2022. Both sites were the first to be launched for tender under the H2 GLS Confirmed List on 31 August 2022.

The Bukit Timah Link site attracted five bids, with the top bid submitted by Bukit One, a subsidiary of Bukit Sembawang Estates at S$200 million or S$1,343 psf ppr.

Meanwhile, four bids were submitted for the Hillview Rise site, with Far East Organisation and Sekisui House placing the highest bid at S$320.78 million or S$1,024 psf ppr.

Referring to the number of bids received for both sites, Steven Tan, CEO of OrangeTee and Tie, commented that demand for the land parcels was healthy.

“As the sizes of the parcels are not large, developers may have been attracted by the lower risks and costs involved. The land parcels are situated near MRT stations with ample amenities. Further, developers may have confidence that the projects will be well received when launched for sale since there is limited supply in the area. Moreover, projects in the vicinity are either fully or substantially sold.”

The tender closing comes after the September cooling measures and changes in the definitions of the gross floor area.

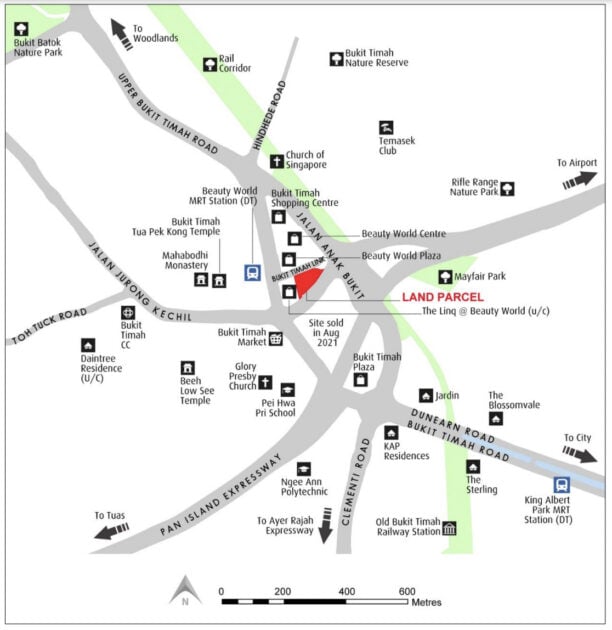

Bukit Timah Link site

Spanning 4,611.1 sqm and a maximum gross floor area of 13,834 sqm, the Bukit Timah Link site is estimated to yield 160 units. It is located within walking distance of Beauty World MRT.

Notably, it is located behind The Linq @ Beauty World and opposite the mixed-use development The Reserve Residences at Jalan Anak Bukit. The Linq @ Beauty World has since sold out, while The Reserve Residences is expected to launch in Q1 2023.

Lee Sze Teck, Senior Director of Research at Huttons Asia, commented that the small size and palatable quantum of the site attracted many bidders. He also highlighted the various amenities in the area, such as the nearby MRT and expressways, as well as the Bukit Timah Nature Reserve and the Rail Corridor. The popular Pei Hwa Presbyterian Primary School is within a short walking distance as well.

“The upcoming mixed-use development at Jalan Anak Bukit, The Reserve Residences will bring in more retail space and community spaces as well.”

Tan added, “A shopping mall and transport hub will be built next to this project, which will be a strong selling point for the development.”

He predicts the eventual selling price will range from S$2,300 to S$2,400 psf.

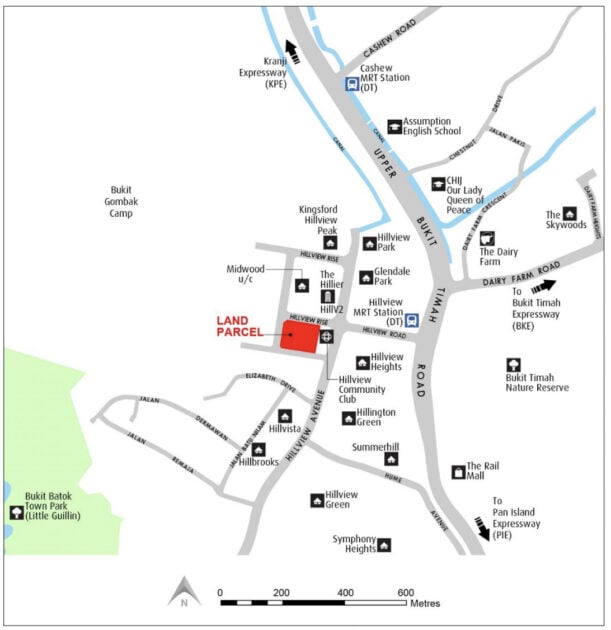

Hillview Rise site

The Hillview Rise site spans 10,395.2 sqm and has a maximum gross floor area of 29,107 sqm. It is estimated to yield 335 units.

Similarly, the site is within walking distance of Hillview MRT and located next to Hillview Community Club. Other notable amenities nearby include HillV2 and The Rail Mall.

Lee pointed out that the nearby Midwood has sold out, so there is no other competition in the Hillview area.

“This may give the developer some pricing advantage.”

In the same vein, Tan added that the Dairy Farm Walk site will not be a direct competitor since it is located further away.

The Dairy Farm Walk site drew seven bids and was awarded to Sim Lian for S$347.0 million or S$980 psf ppr in March this year.

As for the Hillview Rise site, Tan believes the eventual selling price may range between S$1,950 and S$2,050 psf.

Will you be planning to buy a unit at one of these sites? Let us know in the comments section below.

If you found this article helpful, 99.co recommends With two new Lentor sites launched under GLS, we review Lentor’s developments in relation to nearby primary schools and 3 recent rule changes to floor area, land betterment and remnant land that will likely affect future property prices and en blocs.

The post Bukit Timah Link GLS site received a top bid of S$1,343 psf ppr appeared first on .