With HDB resale prices rising for the 29th straight month in November 2022, many homeowners might be planning to sell their property for some profit.

It’s not uncommon for first-time homeowners to sell their BTO after hitting the 5-year MOP for their HDB flat.

But what’s next? After selling your home, you might wonder which property you can and should upgrade to. If you’re planning to sell your property in future, you’ll also be interested in the prospective gains.

The average Singaporean homeowner

The property type you’re eligible for will depend on your finances and your profit from selling your home.

The median monthly household income from work in Singapore in 2021 is S$9,520. 4-room HDB flats are the most common property type, making up 31.5% of all resident households by type of dwelling.

Hence, in this article, we’ll be looking at a persona of a couple with the abovementioned median household income and estimated cash sale proceeds from a 4-room HDB BTO flat. Let’s call them the Tans.

How much profit would you get from selling a 4-room HDB flat?

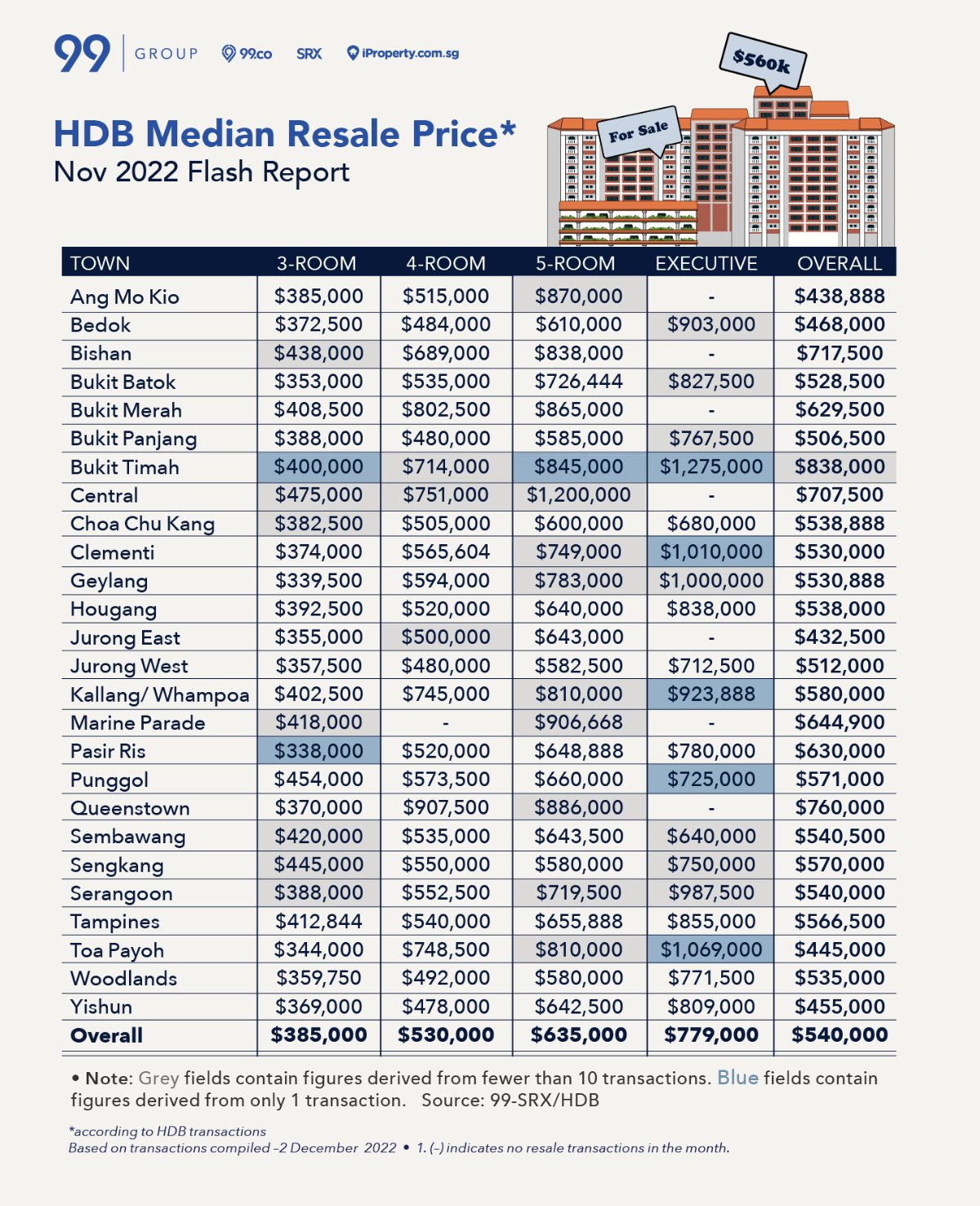

Here’s the median price of HDB resale flats in November 2022, split by HDB towns:

We’ll use Punggol as the location for the Tans’ first home. Hence, they are planning to sell their flat for S$573,500.

Assuming their HDB flat MOPs in 2022, they would have bought their home in 2013 and moved into their home in 2017. The average price of Punggol BTOs in 2013 was S$328,000.

Considering that the median household income in 2013 was S$7,870, we’re assuming that the grant received by the Tans was around S$15,000. The Tans also paid a monthly instalment of S$1,324.32 with a 25-year HDB loan. The total HDB loan with interest is S$397,296.

After selling your house, you’d have to refund the principal amount you took from your CPF account, including accrued interest. If you had received any housing grant, you’d have to return it to your CPF Ordinary Account (OA) with accrued interest.

Here’s a calculation of how much funds the Tans would have to return to their CPF accounts:

- Housing grant: S$15,000 + accrued interest = S$16,971.12

- CPF used to pay for BTO downpayment: S$32,800 (based on 90% LTV ratio in 2013) + accrued interest = S$37,110.19

- CPF used to pay for mortgage so far: S$79,459.20 + accrued interest = S$89,900.79

Total amount = S$143,982.10

With the S$573,500 from the sale of the flat, the Tans would have to use that sum to pay their remaining HDB loan of S$317,836.80 and return the CPF funds used. This would leave them with S$111,681.10 of sale proceeds. (You can use HDB’s sale proceeds calculator to find out how much you might profit from the sale of your property).

However, this isn’t the final sum as sellers have to factor in other costs like agent commissions and administrative and legal fees. Agent commissions are around 1-2% of the selling price, while administrative and legal fees can be around S$3,000.

After deducting these costs, the Tans would be left with around S$97,211. Not to mention that they can also use the funds that they have put back into their CPF for their next home purchase. This would give them about S$241,193.10 in cash and CPF to finance their downpayment, buyer’s stamp duty (BSD) and other miscellaneous fees.

Their monthly instalments cannot exceed S$2,856 due to the Mortgage Servicing Ratio (MSR) of 30% if they buy a resale HDB. If they are looking to buy a resale EC or private condo, their monthly instalment cannot exceed S$5,236 due to the Total Debt Servicing Ratio (TDSR) of 55%. (If they have other monthly loans such as car loan, this figure would be lower.)

SELLING YOUR PROPERTY? Would you like to know how much your property is worth? Or maybe you’re considering listing your property for sale? Let us know, and we’ll have a consultant reach out to you!

Scenario 1: Upgrading to a bigger resale flat

Home sellers might want to upgrade to a bigger flat for multiple reasons. For instance, they might plan to start a family. A 5-room HDB resale flat would be a possible choice in this case.

A figure of around S$800,000 to S$850,000 is reasonable for the Tans’ next HDB purchase. However, this figure does not include other cash savings and CPF funds that they have, which means what they can afford is higher.

Suppose the Tans are looking to live near their parents in a mature estate like Tampines. They can expect the average price of a 5-room HDB resale flat to be S$655,888.

Based on the cooling measures in September 2022, the LTV ratio for HDB loans is 80%. Hence, the HDB loan downpayment is S$131,177.60. The downpayment can be paid by cash, CPF or a combination of both. This figure is still well within the Tans’ CPF funds and cash proceeds from their previous sale.

With the current HDB loan interest rate of 2.6%, the monthly mortgage payment for the couple would be S$2,380.45, which is below their MSR limit.

Another huge payment that buyers need to consider is the Buyer’s Stamp Duty (BSD), which is S$14,277. This can also be paid by cash or CPF.

Those who buy resale flats are also eligible for additional housing grants like the Proximity Housing Grant (PHG), Family Grant and more. In this case, the Tans are eligible for a S$20,000 PHG but won’t be able to get the Enhanced Housing Grant (EHG) as they have previously enjoyed housing subsidy with their BTO.

Alternatively, the Tans may want to explore a 5-room flat in more central areas like Bishan or Toa Payoh as it still falls within their budget.

Price appreciation of 5-room HDB resale flats

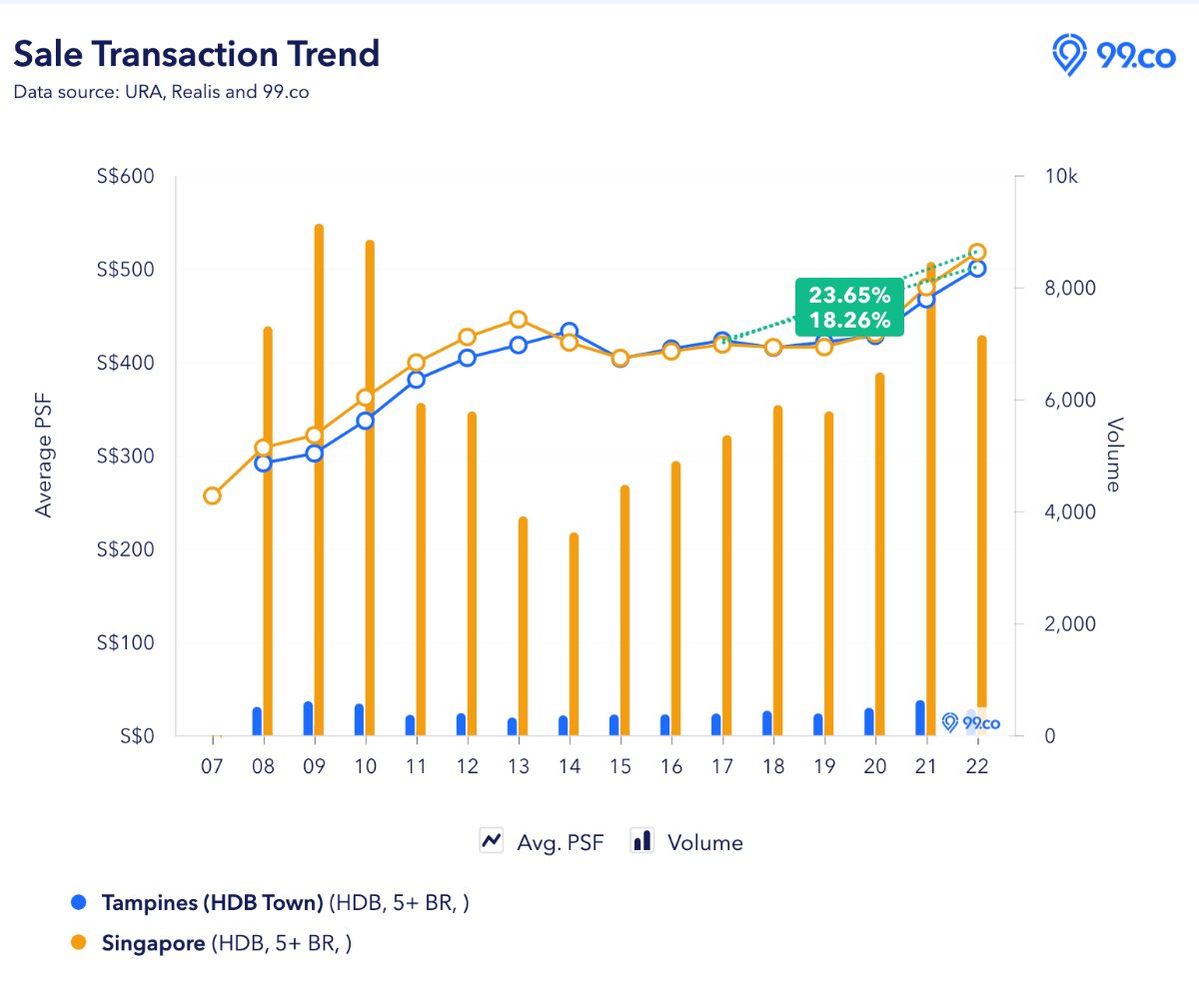

The graph below shows the price appreciation trend of resale 5-room HDB flats in Tampines and Singapore.

Average psf prices of 5-room resale flats have generally been on an upward trend. In the last 5 years, the increase was 23.65% for Singapore and 18.26% for Tampines.

Average psf prices of 5-room resale flats have generally been on an upward trend. In the last 5 years, the increase was 23.65% for Singapore and 18.26% for Tampines.

There were slight dips from 2013-2015 and 2017-2018 due to cooling measures specific to HDB like MSR.

While this isn’t the most accurate depiction of how much profit you’re likely to get from selling a 5-room HDB flat in future, it gives a rough idea of the price trend in previous years.

Ultimately, how much you gain will depend on the demand and supply of 5-room flats in your estate. As it is now, the limited supply of 5-room flats has already led to the rise of million-dollar transactions. In the August 2022 BTO exercise, there was strong demand for 5-room flats in Ang Mo Kio even though prices were up to S$877,000.

Scenario 2: Upgrading to a resale EC

Another popular option for HDB upgraders is to move to an executive condominium (EC). It’s perfect if you want full condo facilities and privacy at subsidised prices.

Furthermore, if you purchase an EC which has just MOP-ed, it will be fully privatised within the next five years. This might mean a higher value as it will be open to all buyers, including foreigners.

Resale EC buyers also won’t need to fulfil the MOP requirement but it will only be eligible to Singaporeans/PRs. However, if they sell their resale EC within 3 years, they’ll be subjected to a Seller’s Stamp Duty (SSD).

As the Tans are moving from a 4-room HDB flat, a 2 or 3-bedroom EC would be ideal. If they are looking for a larger space, they might also consider a 4-bedroom EC.

Based on data from URA, Realis and 99.co researcher, here are the average resale prices of 2, 3 and 4-bedroom ECs in 2022:

- 2-bedroom – S$909,778

- 3-bedroom – S$1,219,384

- 4-bedroom – S$1,502,498

One thing to note is that ECs aren’t eligible for HDB loans, so the Tans would have to take a bank loan. This also means that the LTV ratio is 75%, so they would have to fork out a downpayment of 25%. 5% of the downpayment will need to be in cash.

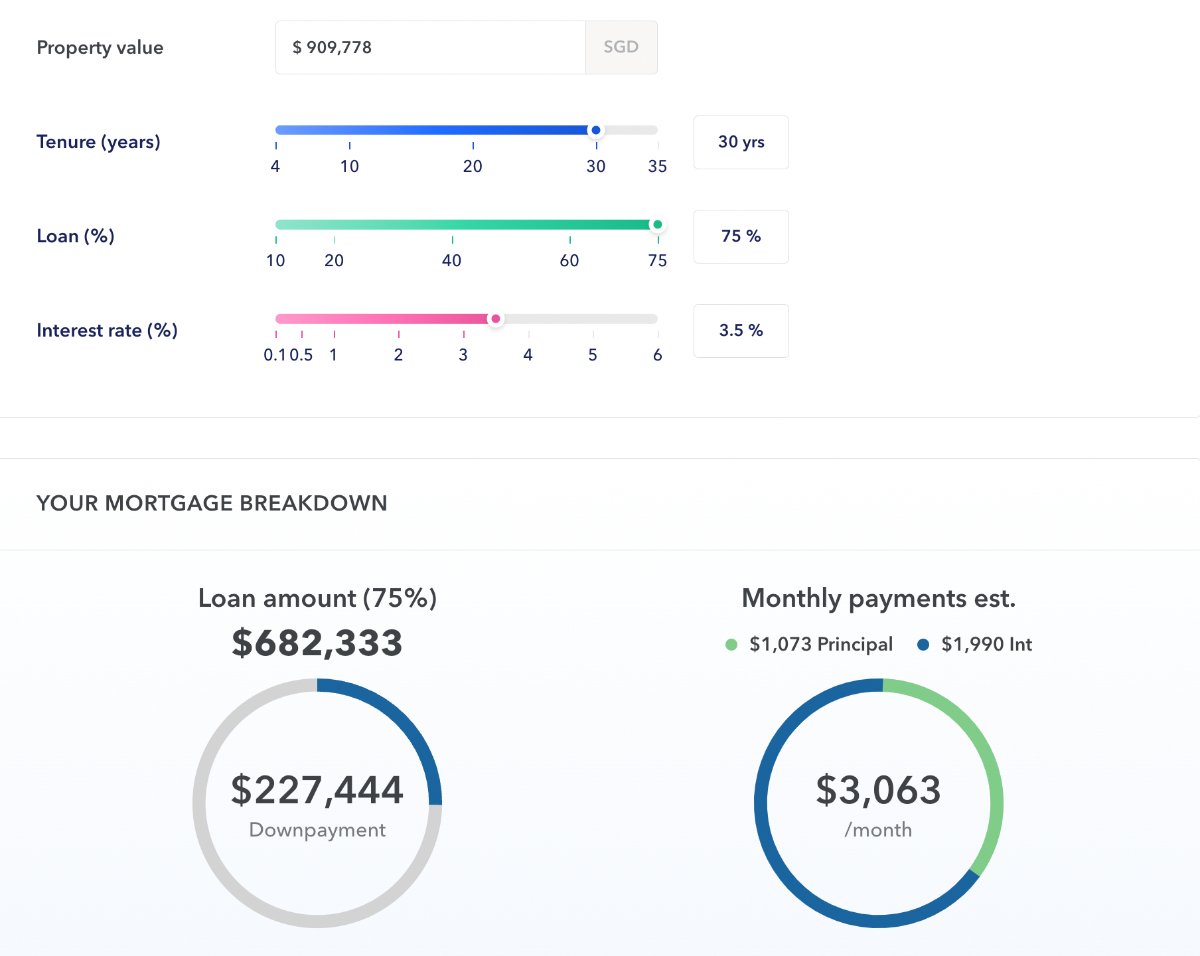

Mortgage breakdown for 2-bedroom EC

We’ve used 99.co’s mortgage calculator to determine how much the Tans would have to pay to finance a resale EC. These are based on these assumptions:

- The full 75% financing is taken to maximise the LTV ratio

- The loan comes with a 30-year tenure and a 3.5% interest rate per annum

- For illustration purposes, there are no other loans to service, including property loans, car loans, personal loans and student loans

- Top-up required for 25% downpayment – $0 (Since this can be covered by the S$241,193.10 cash proceeds and CPF funds from the previous house)

- 5% downpayment – S$45,989 (cash, which can be covered by the cash proceeds and CPF funds)

- BSD – S$21,893 (cash/CPF)

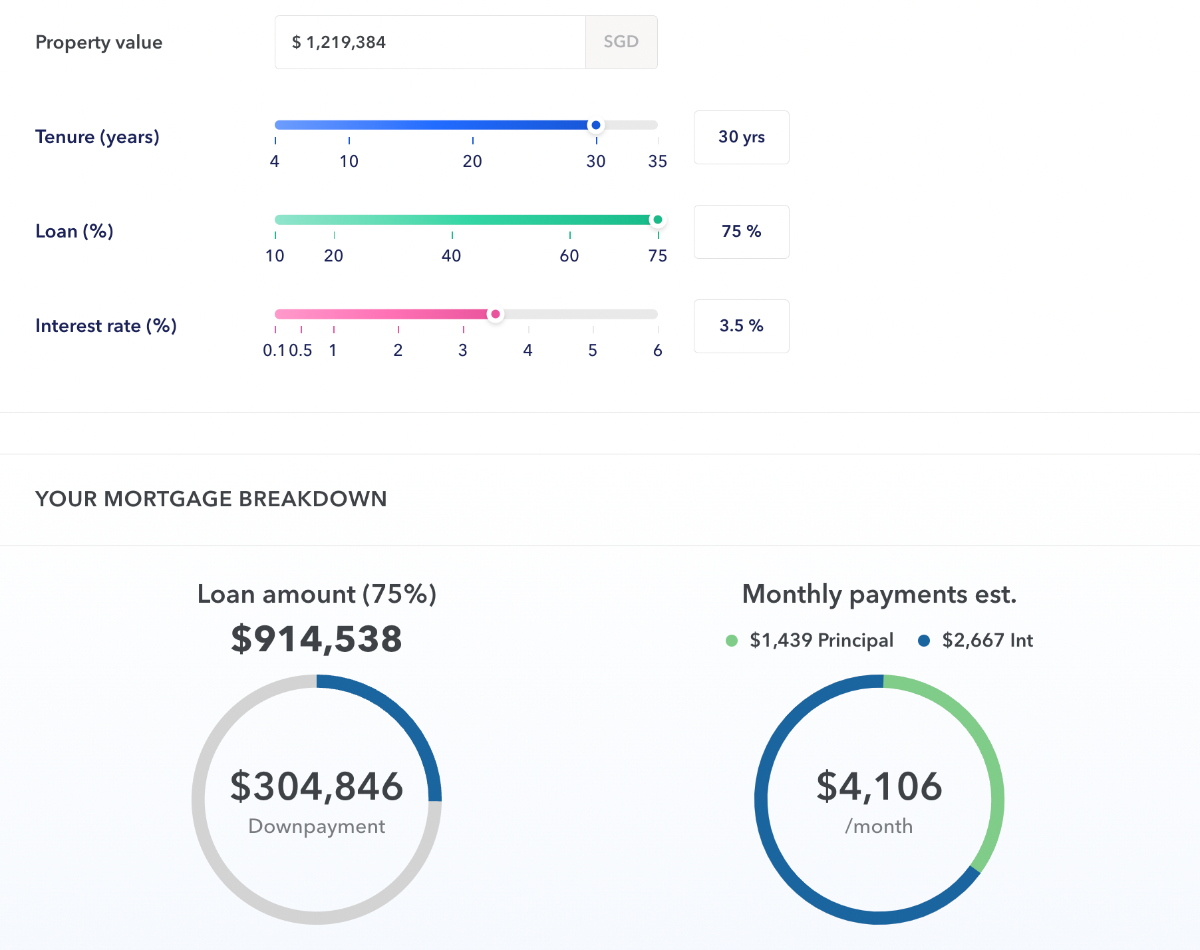

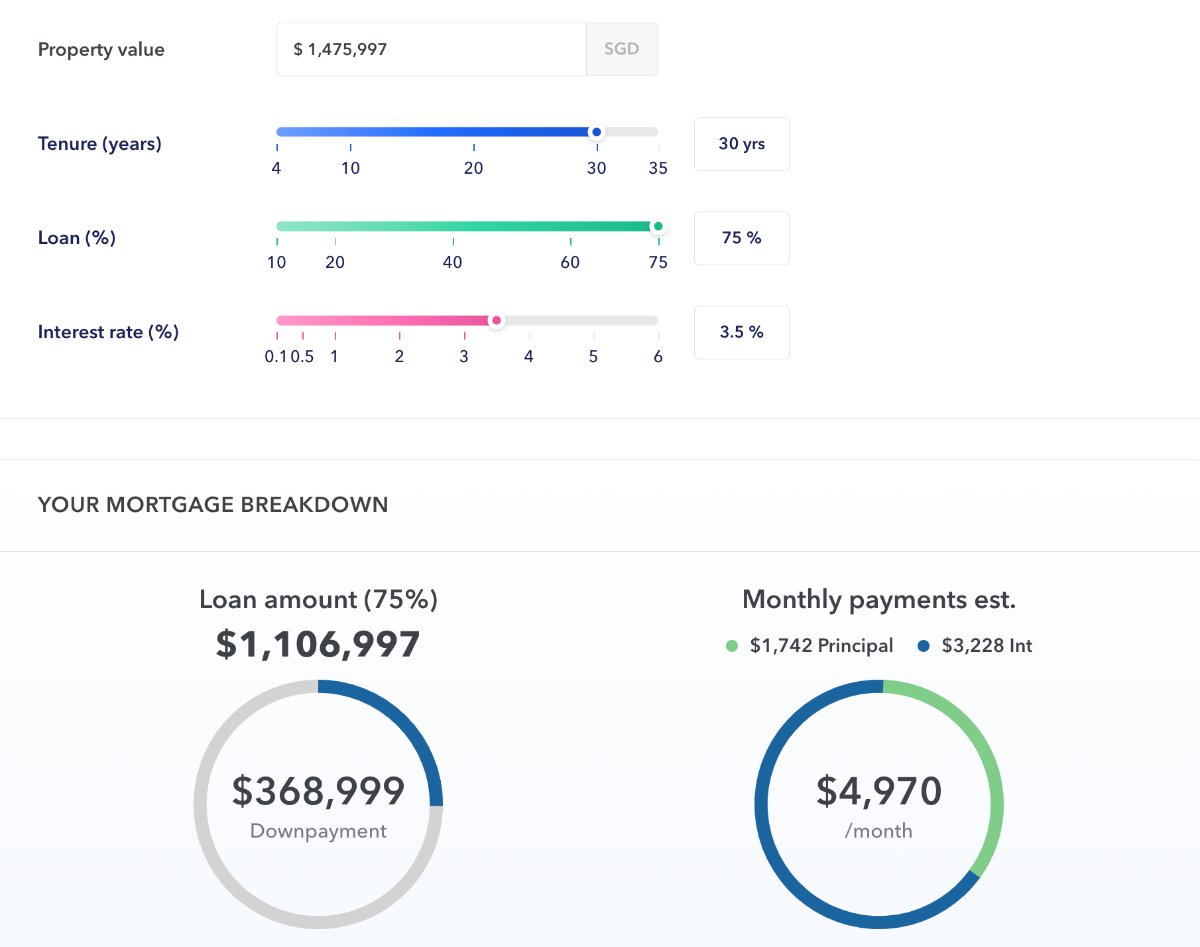

Mortgage breakdown for 3-bedroom EC

- Top-up required for 25% downpayment – S$63,653 (cash or CPF)

- 5% downpayment – S$60,969 (cash)

- BSD – S$33,375 (cash/CPF)

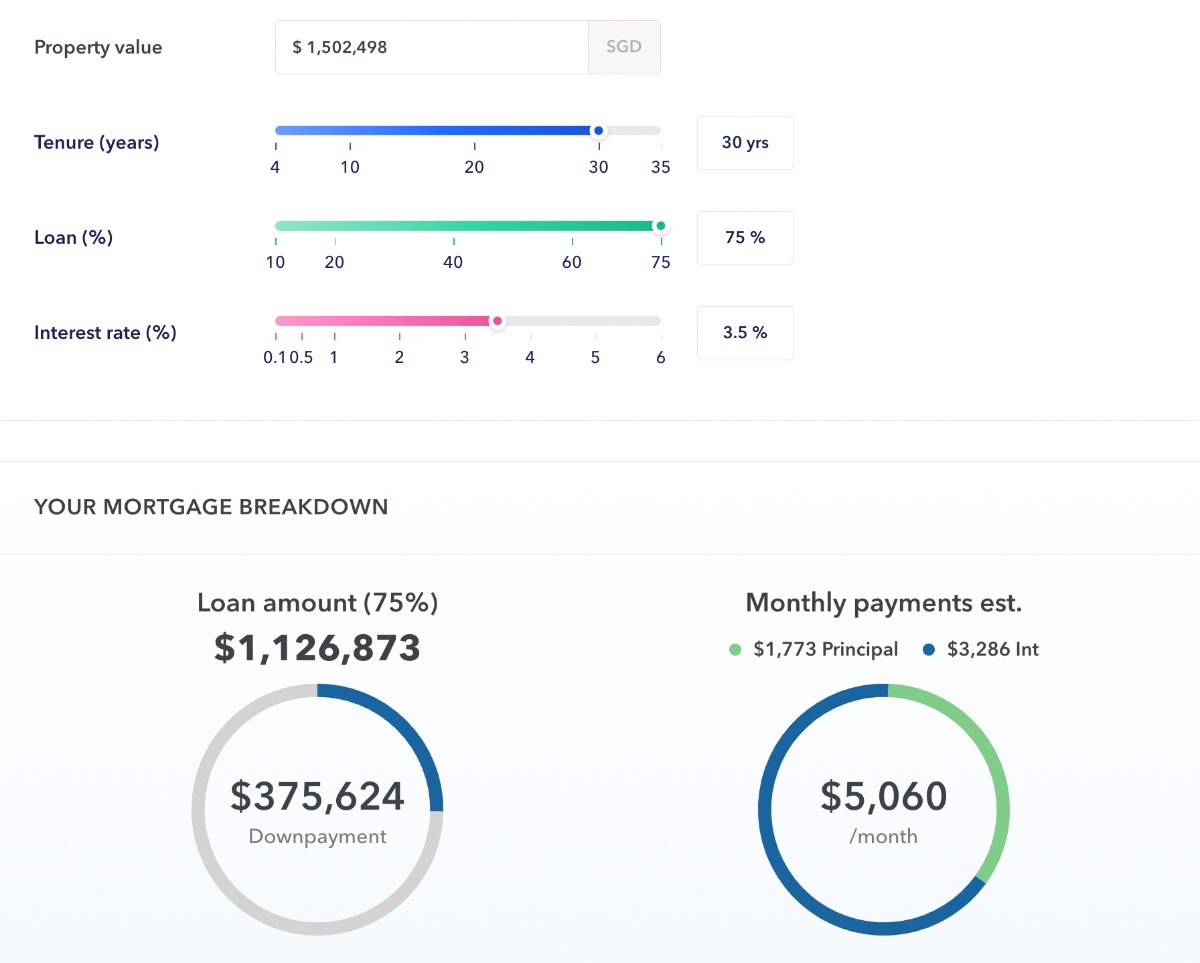

Mortgage breakdown for 4-bedroom EC

- Top-up required for 25% downpayment – S$134,431 (cash or CPF)

- 5% downpayment – S$75,125 (cash)

- BSD – S$44,700 (cash/CPF)

As the monthly instalment for the 4-bedroom EC is close to the TDSR limit, the Tans may also want to fork out a higher downpayment and take a lower bank loan.

The 2 and 3-bedroom resale EC prices seem to be more comfortable for the Tans compared to the 4-bedroom resale EC prices. Unless the couple has a lot of savings and CPF funds, it might not be ideal for them to purchase a 4-bedroom resale EC.

They also have to consider additional costs like legal fees which could be around S$3,500 and monthly maintenance fees for ECs which can be around $200-$400. The latter depends on the unit type and size of the project.

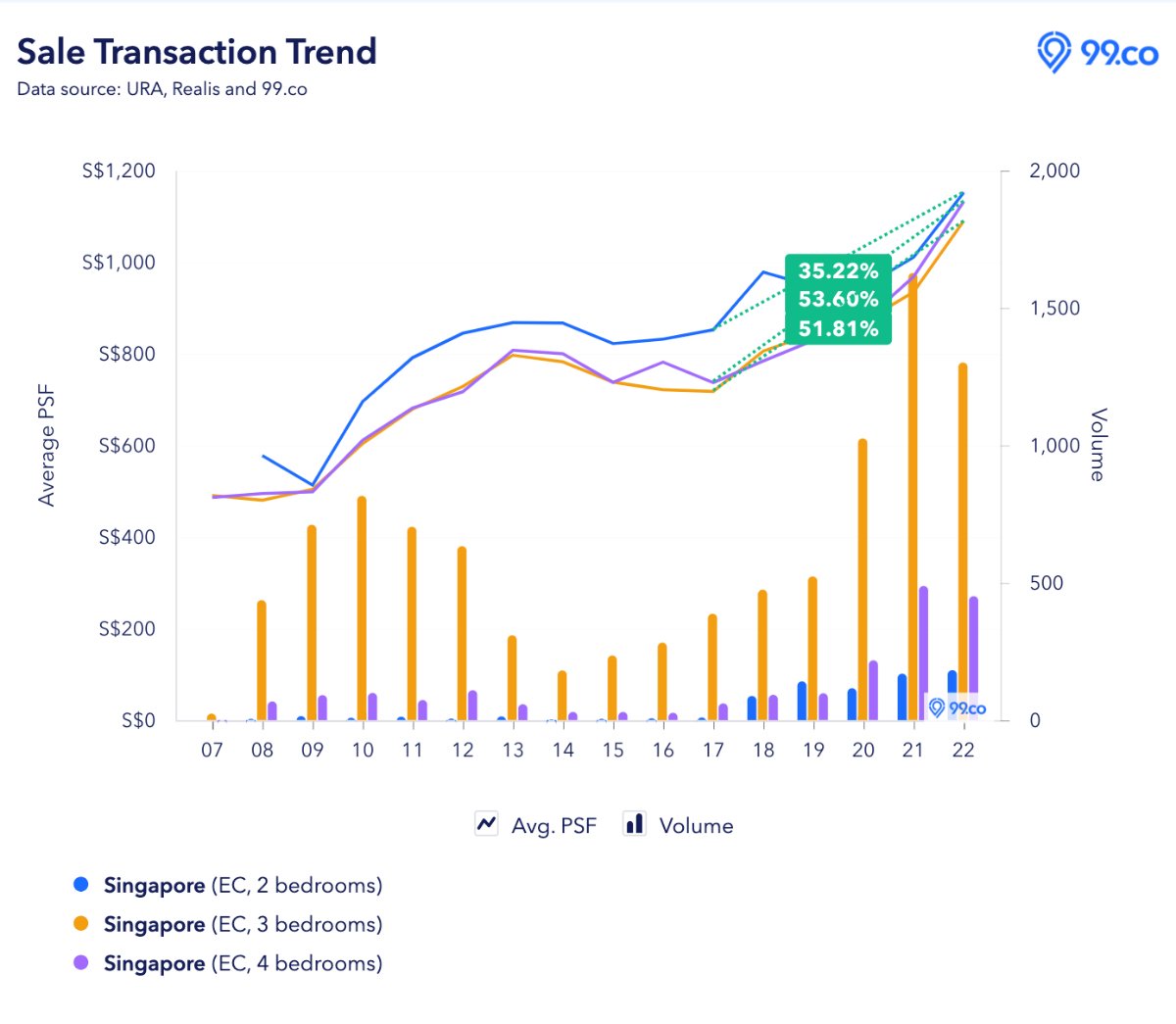

Price appreciation of resale ECs

The graph below shows the price appreciation of resale ECs in Singapore, based on the number of bedrooms.

In the last 5 years, all three types of resale ECs have seen an appreciation in their average psf prices. 4-bedroom resale ECs have seen the highest increase of 53.6%.

There was a price dip from 2013 to 2017 across all EC types. This could have been due to the implementation of TDSR and MSR.

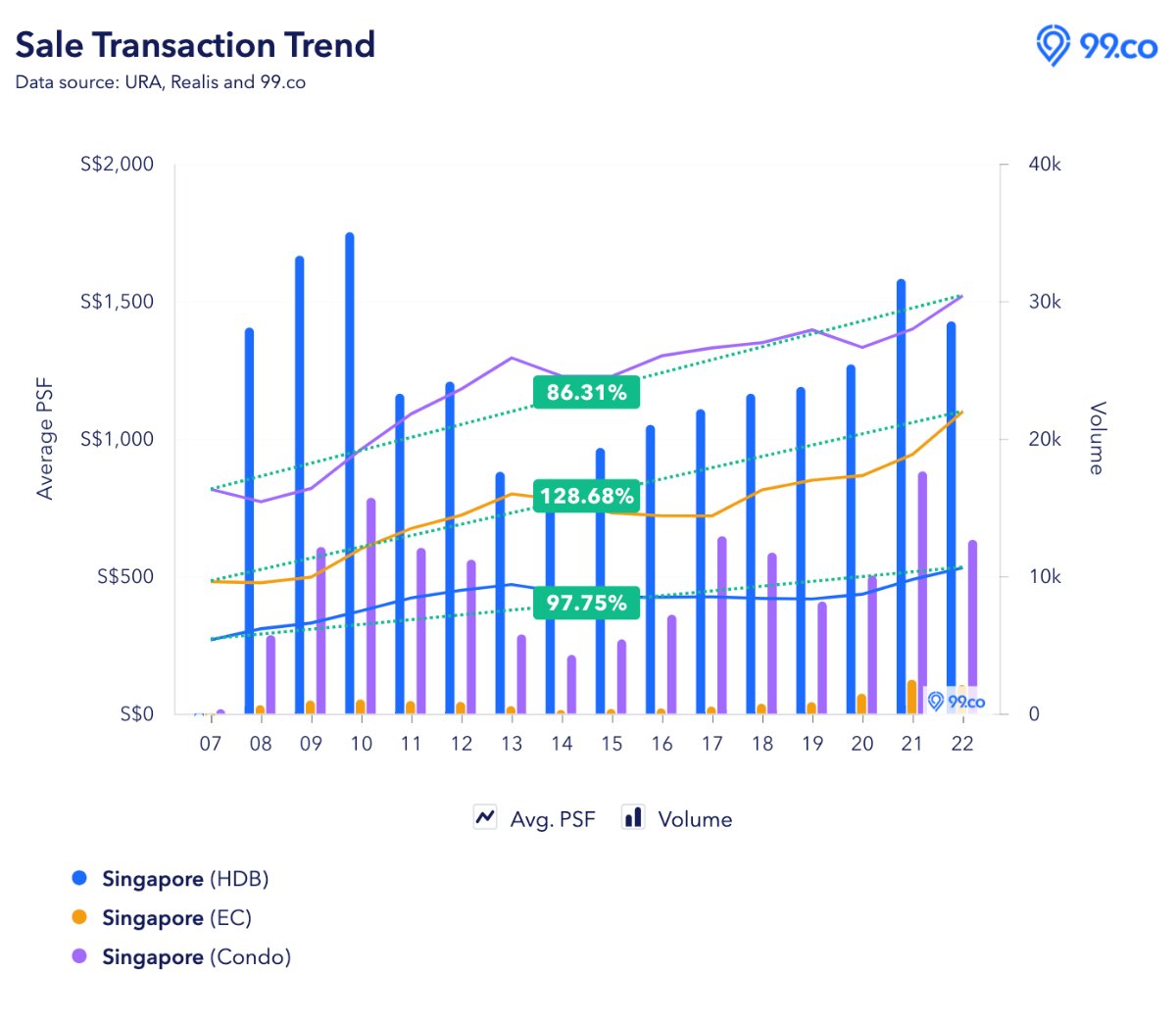

When compared against resale HDBs and private condos, ECs have seen the highest increase in their average psf price at 128.68% compared to 86.31% for private condos and 97.75% for HDBs. This might be due to the low supply of ECs.

Scenario 3: Upgrading to a private resale condo

Upgrading to a private resale condo is very similar to a resale EC. The only difference is that private condos are open to all buyers, not just Singaporeans/PRs.

The payment scheme for private resale condos and resale ECs is the same and resale condo buyers will also have to pay SSD if they sell their property within 3 years.

Here are the average resale prices of private condos in Singapore based on URA, Realis and 99.co researcher data:

| CCR | RCR | OCR | |

| 2-bedroom | S$2,093,292 | S$1,444,323 | S$1,080,440 |

| 3-bedroom | S$3,595,040 | S$2,192,014 | S$1,475,997 |

| 4-bedroom | S$5,462,916 | S$3,578,823 | S$1,940,321 |

Based on the Tans’ monthly household income, they will be able to afford a 2 and 3-bedroom private condo in the OCR and a 2-bedroom private condo in the RCR.

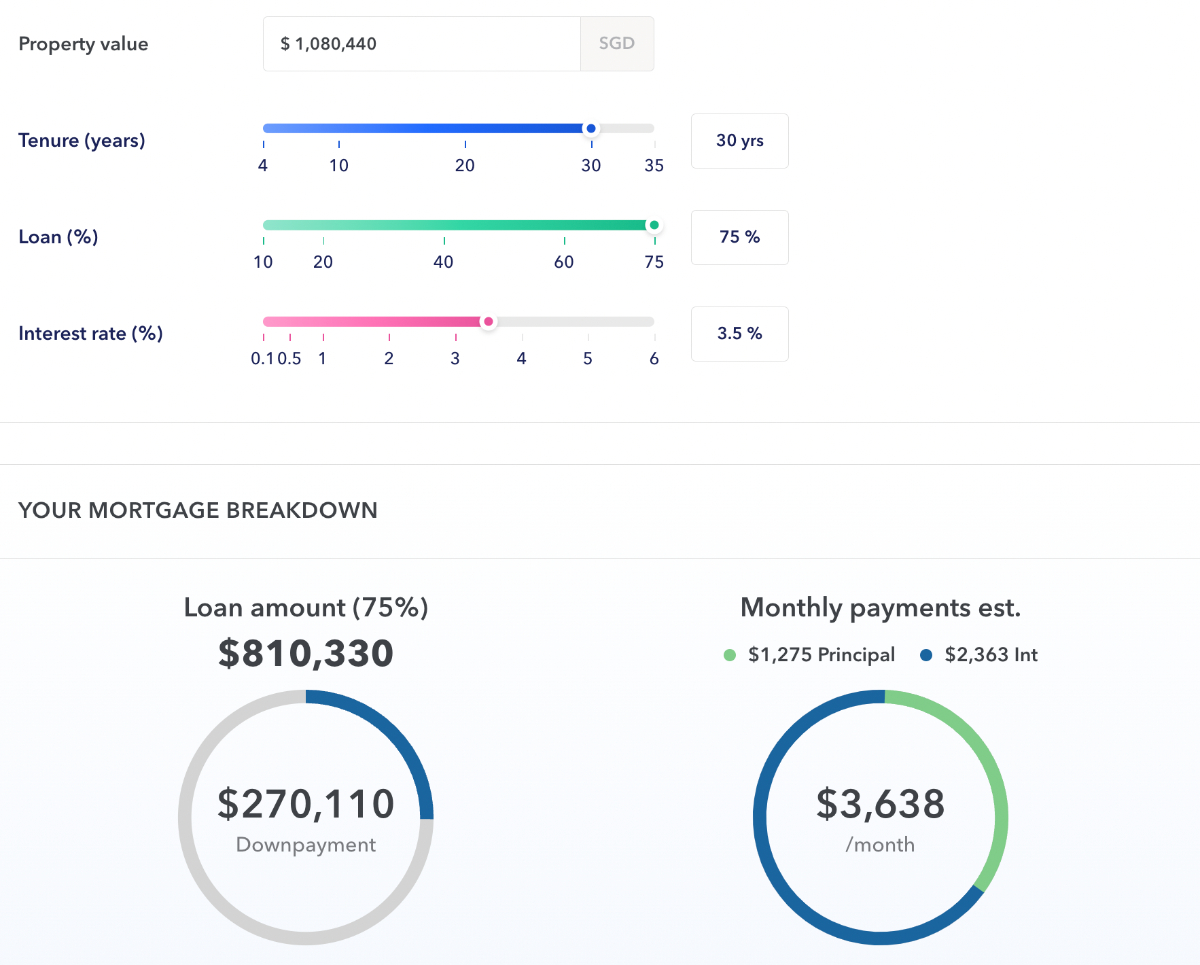

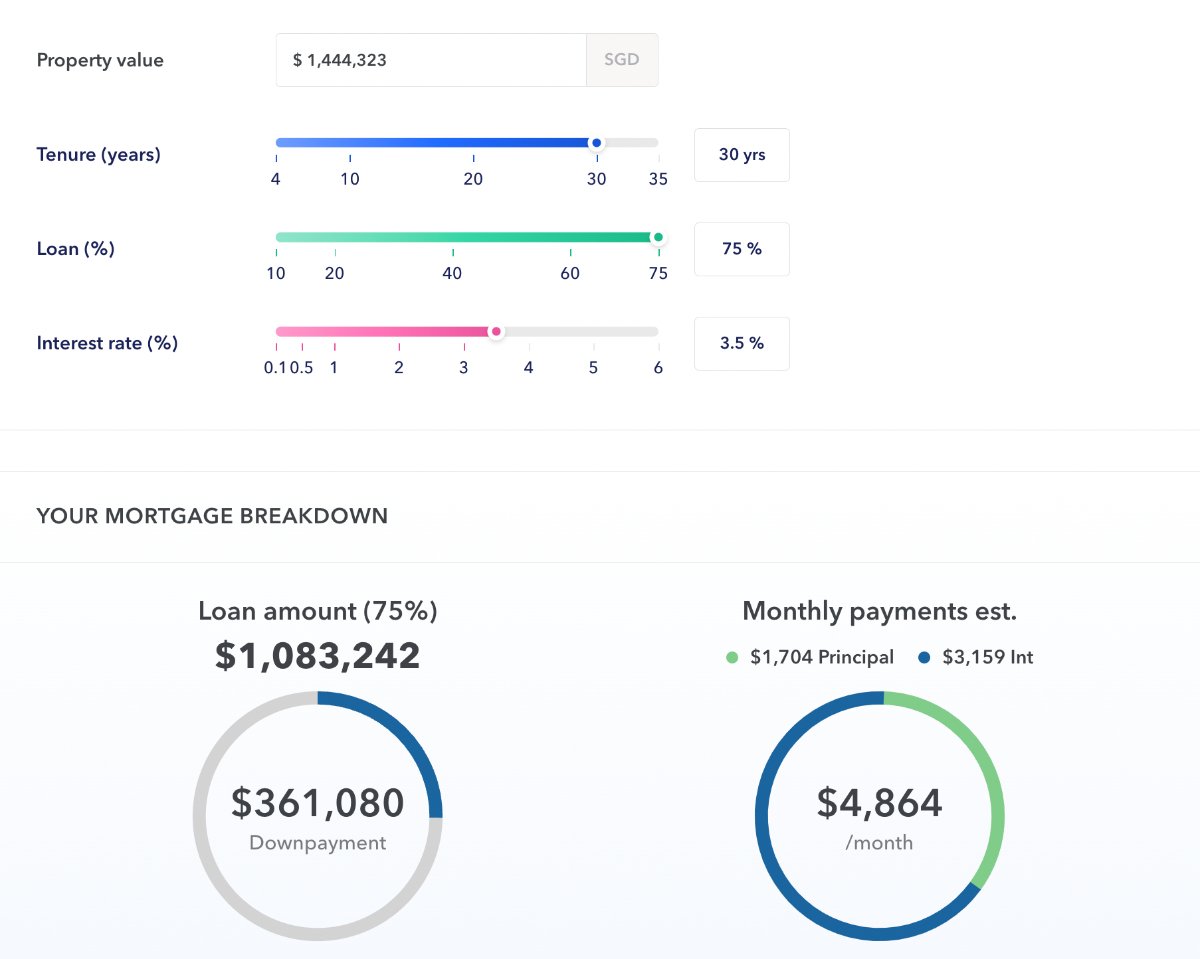

Mortgage breakdown for 2-bedroom OCR condo

We’ve used 99.co’s mortgage calculator to determine how much the Tans would have to pay to finance a private resale condo. These are based on these assumptions:

- The full 75% financing is taken to maximise the LTV ratio

- The loan comes with a 30-year tenure and a 3.5% interest rate per annum

- For illustration purposes, there are no other loans to service, including property loans, car loans, personal loans and student loans

- Top-up required for 25% downpayment – S$28,917 (cash or CPF)

- 5% downpayment – S$54,022 (cash)

- BSD – S$27,818 (cash/CPF)

Mortgage breakdown for 3-bedroom OCR condo

- Top-up required for 25% downpayment – S$127,806 (cash or CPF)

- 5% downpayment – S$73,800 (cash)

- BSD – S$43,640 (cash/CPF)

Mortgage breakdown for 2-bedroom RCR condo

- Top-up required for 25% downpayment – S$119,887 (cash or CPF)

- 5% downpayment – S$72,216 (cash)

- BSD – S$42,373 (cash/CPF)

Like resale ECs, buying private resale condos would also require legal fees and there would be monthly maintenance fees as well.

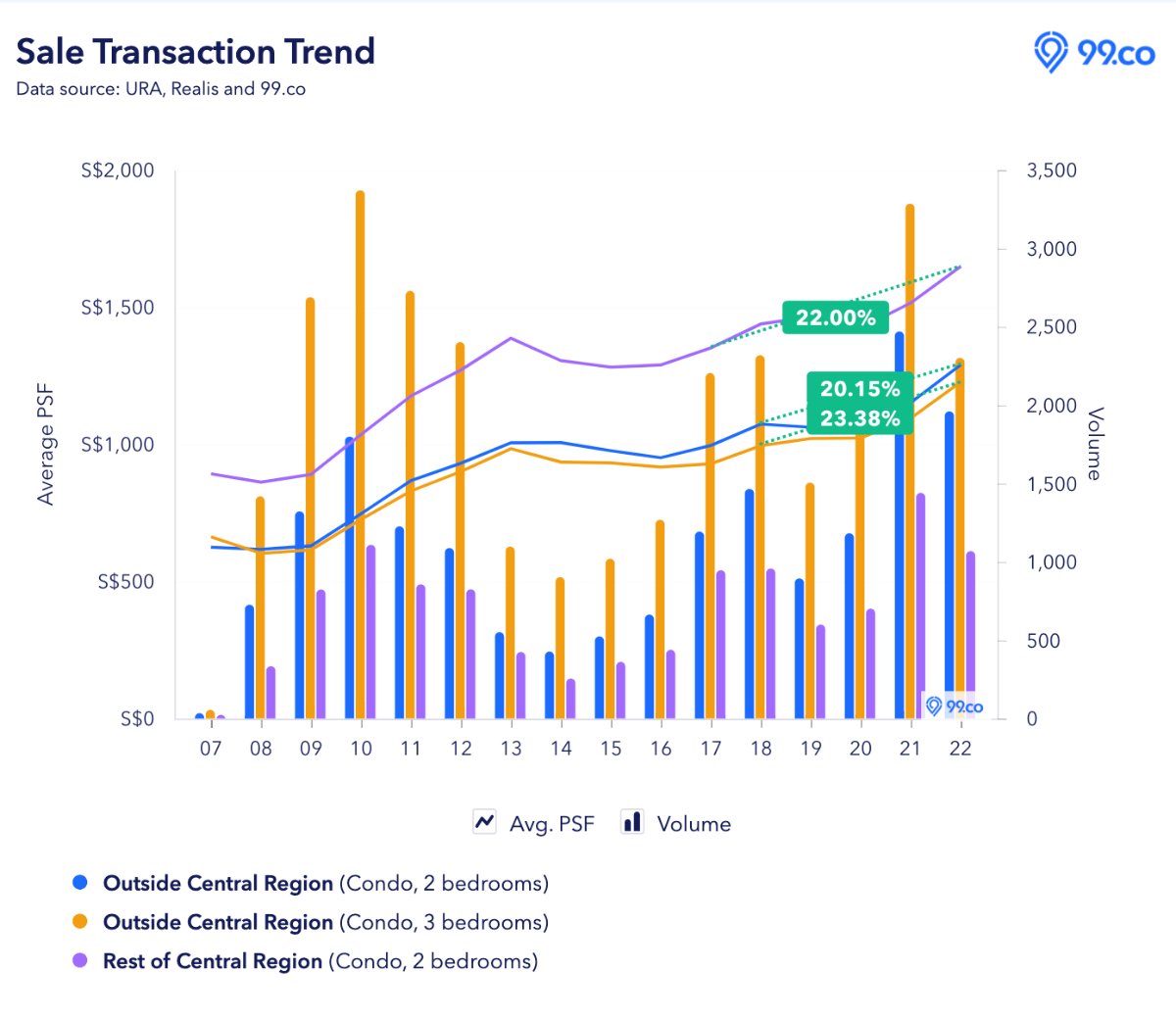

Price appreciation of private resale condos in OCR and RCR

According to the price graph above, the three unit types affordable for the Tans have seen almost the same rate of price appreciation over the last 5 years.

How much profit they gain in future will depend on the location of their next home, whether it’s near an MRT station/amenities and the developments in the area. The limited supply of new launches in the RCR and OCR has driven up prices and prospective buyers might look to resale condos as an alternative. This could also cause a price appreciation of resale condos in the RCR and OCR.

If you’re in the same situation as the Tans, we hope we have given you a clearer picture of how much you can gain from selling your first home and what property options you can upgrade to. Whether you’re finding a bigger home or have dreams of living in an EC/condo, there are options that might suit your budget.

Are you planning to sell your BTO and upgrade to an EC or condo? Let us know in the comments section below.

If you found this article helpful, 99.co recommends Top districts with the most profitable sales in the last 5 years and Upgrading from a HDB flat to a condo? The guide to end all guides.

The post Which property types to upgrade to after selling your first BTO? appeared first on .