Your family is itching to move to a new home. You have made up your mind — you are going to sell your current home in exchange for a bigger and fancier home. But there is just one problem: You are unsure of the expenses to be paid before selling your house.

Here are the things you need to pay before selling off your home:

- Outstanding home loan

- Legal fees (also known as conveyancing fees)

- Property agent commission

- CPF savings plus accrued interest (to be paid back into your own account)

- Seller’s Stamp Duty (if applicable)

- Property tax

- Maintenance fee

If you’re selling your HDB flat, you may also have to pay for the following:

- Resale application admin fee

- Resale levy

- HDB upgrading costs

Fees and costs to pay before selling your house

1. Outstanding home loan

If your home loan isn’t fully paid off yet, you’ll need to pay off the outstanding amount to HDB or the bank before you can sell your house.

On top of that, if you’re selling your house during the lock-in period of the home loan, the bank will charge you an early redemption fee.

2. Legal fees

Legal fees are also known as conveyancing fees. This is for the process of transferring the property title from you to your buyer.

For HDB flat

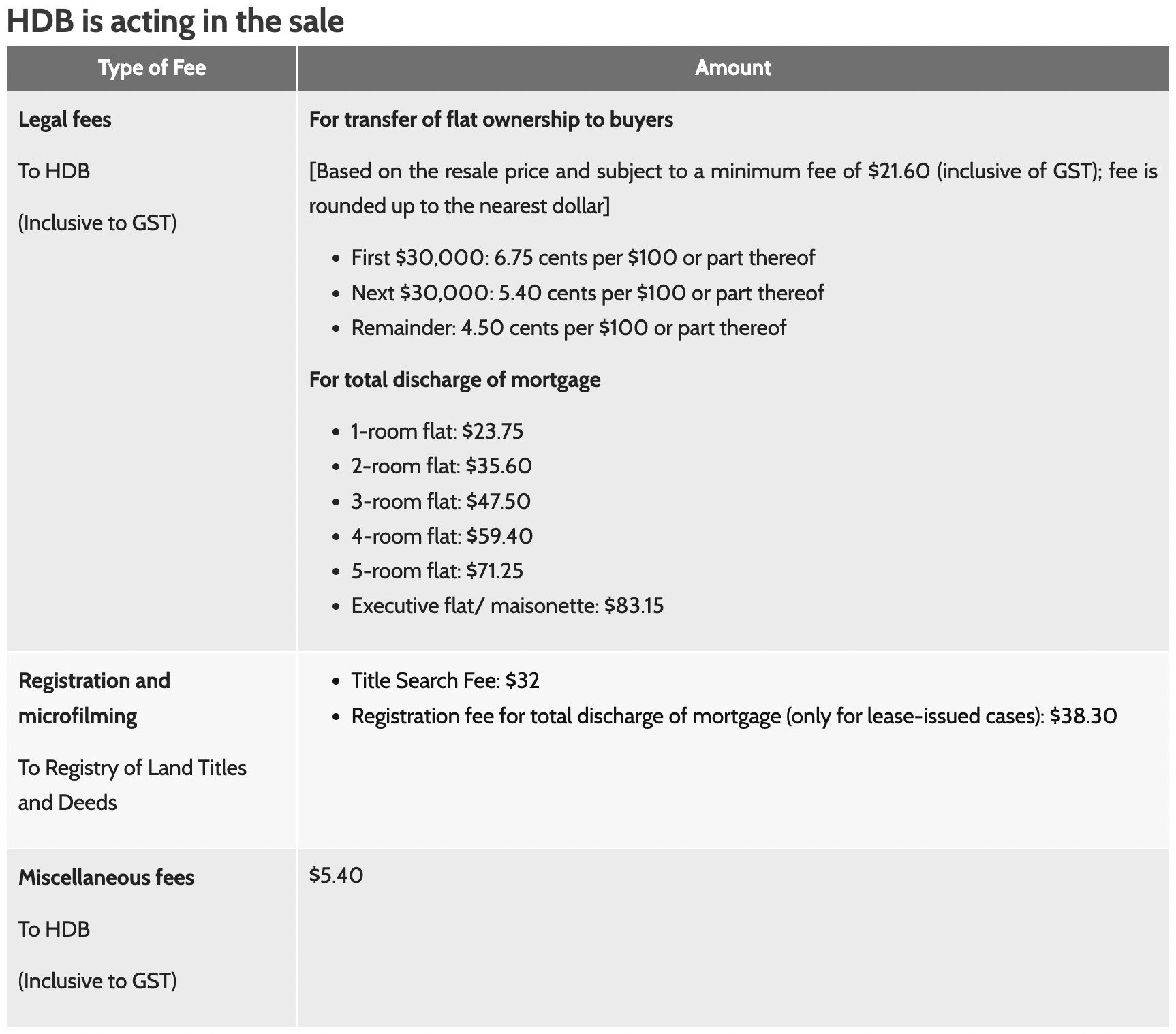

After HDB has received the resale application from both the buyer and seller, you will be asked to endorse the resale documents via the HDB Resale Portal. This is when you need to pay the legal fees.

You have the option to engage HDB’s solicitor to act for you, or hire a private lawyer to handle the necessary paperwork. The cost will depend on this.

If you want to get a quick estimate of the legal fees, you can use HDB’s Legal Fees Enquiry Facility.

If you’re hiring a private attorney, the conveyancing fee for the discharge of the housing loan will be the same if it’s an HDB loan. But for the rest, it will depend on the lawyer.

Thus, you will want to first discuss their fees before appointing one to act on your behalf.

There are three main accepted payment methods, namely credit card, AXS and PayNow. You can also use your CPF savings to pay for the legal fees portion (i.e. excluding Title Search Fee, Registration fee and Miscellaneous fees).

For private property

The conveyancing fee is about S$2,500 to S$3,000. Depending on the law firm, you may be able to pay it with CPF.

3. Property agent commission

If you’re using a property agent to sell your house, you’ll have to pay the agent commission too.

While there’s no fixed rate as to how much you need to pay your agent, these rates (as a percentage of the selling price) are a common practice:

- HDB flat: 2%

- Condo: 2% – 4%

- Landed: 2% (or more)

If the agency is GST-registered, you’ll also have to pay GST on the commission.

There’s no hard and fast rule on the commission rates; it’s negotiable. Before appointing a property agent to help you sell the house, be sure to discuss with them on the commission rate.

You can read more about the property agent commission rates here.

4. CPF savings plus accrued interest

When you sell your house, you’ll need to refund to your CPF account the CPF savings you’ve used to pay for the house. For instance, you’ve used your CPF savings to pay for the downpayment and monthly instalments, so you’ll have to refund the amount back (in cash) to your CPF account.

For HDB flats, if you’ve taken CPF grants before, you’ll need to refund the amount back to your own CPF account as well.

On top of all these, you’ll have to refund the 2.5% accrued interest that you would have earned if your CPF savings were not withdrawn to pay for the house.

Read this article to find out more on how this affects your property sale proceeds.

If it’s any consolation, the good news is that the refunded amount (principal + accrued interest) can be used to pay for your next house. So depending on how you look at it, this may or may not be a cost.

HDB flats for sale

2

2

2

2

2

2

2

2

3

2

2

1

2

2

2

2

2

1

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

1

2

2

2

2

2

2

2

2

2

2

3

2

3

2

2

2

2

1

2

2

2

1

2

2

2

2

2

2

2

1

2

2

3

1

See all 3-room flats below S$400k >

3

1

3

2

3

2

3

2

3

2

3

2

3

2

3

1

3

2

3

2

3

2

3

2

3

2

3

1

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

See all 4-room flats below S$600k >

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

4

2

3

2

4

2

3

2

4

2

3

2

3

2

4

2

4

2

3

2

3

2

3

2

3

2

4

2

3

2

3

2

3

2

4

2

4

2

4

2

3

2

3

2

3

2

3

2

3

2

3

2

3

2

See all 5-room flats below S$700k >

4

2

4

2

4

3

4

3

4

3

3

3

4

2

4

3

4

2

4

2

4

2

4

2

3

2

3

2

4

3

4

2

3

2

3

2

3

2

4

2

4

2

4

2

4

2

3

2

4

2

4

2

3

2

4

3

3

2

3

2

3

2

4

3

3

2

4

2

3

2

See all Executive flats below S$800k >

5. Seller’s Stamp Duty (SSD)

The Seller’s Stamp Duty (SSD) is payable if you sell or transfer your property within three years. So for most HDB owners, they don’t have to pay this due to the five-year MOP.

(Although you may be able to enjoy a remission if the property is transferred due to a divorce or if it’s an HDB flat to be transferred within the family. Head over to IRAS’ page on SSD for more information on this.)

Here’s the rate for properties bought from 11 March 2017 onwards. The SSD payable is rounded to the nearest dollar.

|

Period of ownership |

SSD rate based on purchase price/ market value (whichever is higher) |

|

Up to 1 year |

12% |

|

Over 1 year, up to 2 years |

8% |

|

Over 2 years, up to 3 years |

4% |

|

Over 3 years |

No SSD payable |

There are several ways of paying the Seller’s Stamp Duty. This includes:

- GIRO

- PayNow

- AXS

- Internet Banking

- SingPost

- Cheque/Cashier’s Order

6. Property tax

The annual property tax is usually paid in January for the whole year. So if you sell your flat in June, this means you’ve paid the buyer’s portion of the property tax in advance as well.

But this isn’t exactly a cost, as you can get the buyer to reimburse you.

Before the house is transferred to the buyer, the lawyer or HDB officer (for HDB flats) will help apportion the current year tax between you and the buyer.

So for HDB flat, you’ll need to submit the tax payment receipt during the flat sale completion appointment.

The property tax is calculated by multiplying your flat’s Annual Value (AV) with the applicable tax rate. The AV is your flat’s estimated gross rent for one year if it has been leased out. IRAS determines it based on prevailing market rates.

Here are the median AVs for HDB flats and private residential properties for 2021. (As of this update, the figures for 2022 have not been published yet.)

| Property category | Property type | Median Annual Value (S$) for 2021 |

| HDB | 1- or 2-room | 5,340 |

| 3-room | 8,220 | |

| 4-room | 10,140 | |

| 5-room | 10,980 | |

| Executive and Others | 11,340 | |

| Private | Non-landed (including Executive Condominiums) | 23,400 |

| Landed | 37,200 |

For owner-occupied homes

Owner-occupied homes enjoy a lower tax rate.

As of 1 January 2023, owner-occupied homes with an AV between S$8,000 and S$30,000 are subject to a tax rate of 4%.

For those with an AV of more than S$30,000, the tax rate on the excess is 5% to 23%. From 1 January 2024 onwards, the tax rate on the excess will be increased to 6% to 32%.

For non-owner-occupied homes

Meanwhile, the tax rates for non-owner-occupier residential properties are higher.

As of 1 January 2023, the tax rate ranges from 11% to 27%, before increasing to 12% to 36% from 1 January 2024.

You can use the IRAS Interactive Property Tax Calculators to find out the property tax you need to pay.

The preferred method of payment for property tax is GIRO. Other acceptable payment modes include:

- PayNow

- AXS

- Internet banking

- SingPost

Condos for sale

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

See all 1-bedders below S$1m >

2

2

2

1

2

2

2

2

2

1

2

1

2

1

2

2

2

2

2

2

2

1

2

3

2

2

2

2

2

1

2

1

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

1

2

2

2

2

2

2

2

2

2

2

2

2

2

1

2

1

2

2

See all 2-bedders below S$1.5m >

3

2

3

2

3

2

3

2

3

2

3

3

3

2

3

3

3

2

3

2

3

3

3

2

3

3

3

2

3

2

3

3

3

2

3

3

3

3

3

2

3

2

3

2

3

3

3

3

3

2

3

2

3

2

3

3

3

3

3

2

3

2

3

2

3

3

3

3

3

2

See all 3-bedders below S$2m >

4

3

4

3

4

4

4

2

4

3

4

3

4

3

4

2

4

3

4

2

4

3

4

4

4

3

4

3

4

3

4

3

4

4

4

3

4

4

4

3

4

4

4

4

4

4

4

4

4

3

4

4

4

3

4

3

4

3

4

3

4

3

4

4

4

3

4

3

4

3

See all 4-bedders below S$3m >

5

5

5

5

5

4

5

5

5

4

5

4

5

4

5

4

5

4

5

4

5

4

5

5

5

5

5

5

5

5

4

5

3

5

3

5

3

5

5

5

5

6

4

5

4

5

3

5

6

5

5

5

4

5

4

5

4

5

4

5

5

5

2

5

4

5

4

5

5

See all 5-bedders and bigger below S$4.5m >

7. Maintenance fee

For HDB flats, this is the Service and Conservancy Charges (S&CC), which you’ll have to pay up to the day of the resale completion. Be sure to settle this before the resale completion appointment.

As for condos, the monthly maintenance fee is usually paid every quarter. So you may need to get reimbursement from the buyer for it.

Selling your HDB flat? Here are the fees you may need to pay

On top of the above-mentioned fees, you may have to incur things like the resale levy when you sell your HDB flat.

1. Resale application administrative fee

Both the seller and buyer are required to fork out the administrative fee when they submit their respective portion of the resale application through the HDB Resale Portal.

| Flat type | Resale application fee (inclusive of GST) |

| 1-room or 2-room flat | S$40 |

| 3-room or larger flat | S$80 |

There are three accepted payment methods for the administrative fee. Via the HDB Resale Portal, you can pay with either

- Credit card (Mastercard or Visa)

- PayNow

- AXS

If you have engaged a licensed property agent, they can help you submit the application using their Estate Agent Toolkit.

2. Resale levy

You’ll need to pay the resale levy if you’re buying a second subsidised flat. Here are a few scenarios in which you have to pay it:

| First HDB flat | Second HDB flat | Need to pay resale levy? |

| BTO/ SBF/ open booking (i.e. buying directly from HDB) | BTO/ SBF/ open booking | Yes |

| BTO/ SBF/ open booking | New launch EC | Yes |

| Resale flat with grants | BTO/ SBF/ open booking | Yes |

| New launch EC | BTO/ SBF/ open booking | Yes |

When you’ll need to pay for it depends on when you sell off your first subsidised flat. For instance, if you sell your first subsidised flat before getting the keys to your second subsidised flat, you’ll have to pay your resale levy in cash upon getting the keys to your second flat.

On the other hand, if you complete the purchase of your second subsidised flat (i.e. key collection) before selling your first subsidised flat, your resale levy will be deducted from the sale proceeds, with any shortfall to be paid in cash.

Learn more about the resale levy here.

3. HDB upgrading costs

If your flat has undergone any of these upgrading programmes, you’ll need to pay the upgrading costs:

- Home Improvement Programme (HIP)

- Lift Upgrading Programme (LUP)

Before the resale transaction can be completed, you’ll have to pay the outstanding upgrading cost in full.

This can be deducted from the cash proceeds of selling the flat, after deducting the outstanding mortgage, HDB charges and CPF refund. Otherwise, you’ll have to pay it in cash.

Otherwise, if the invoice is issued after the resale completion is completed, the buyer will have to pay for it.

Head over to HDB’s website for more information on this.

Planning to sell your HDB flat? Let us help you by connecting you with a property consultant.

If you found this article helpful, 99.co recommends What an HDB second-timer must know before deciding to sell and 6 signs and steps to find out if your house has unrealised gains.

The post What hidden costs are there when selling your house? appeared first on .