After 3 years together, “Javier” (not his real name), who was in his late 20s, and his girlfriend decided that maybe it was time to settle down.

In Singapore’s context, more often than not, “settling down” among hopeful couples means securing a BTO flat early rather than immediate wedding bells.

This is because BTO construction times usually take anywhere between 3.5 to 4.5 years. So, anecdotally, that becomes the window for lovebirds to save up and plan ahead, including their wedding, honeymoon and so on.

Bukit Merah BTO

Financially, Javier and his girlfriend were “okay”. He’s been working in the finance industry for 9 years, while his girlfriend for five.

In 2021, a chance conversation with his girlfriend’s mum brought up the possibility that they may stand a chance of getting a good ballot number in the upcoming BTO exercise.

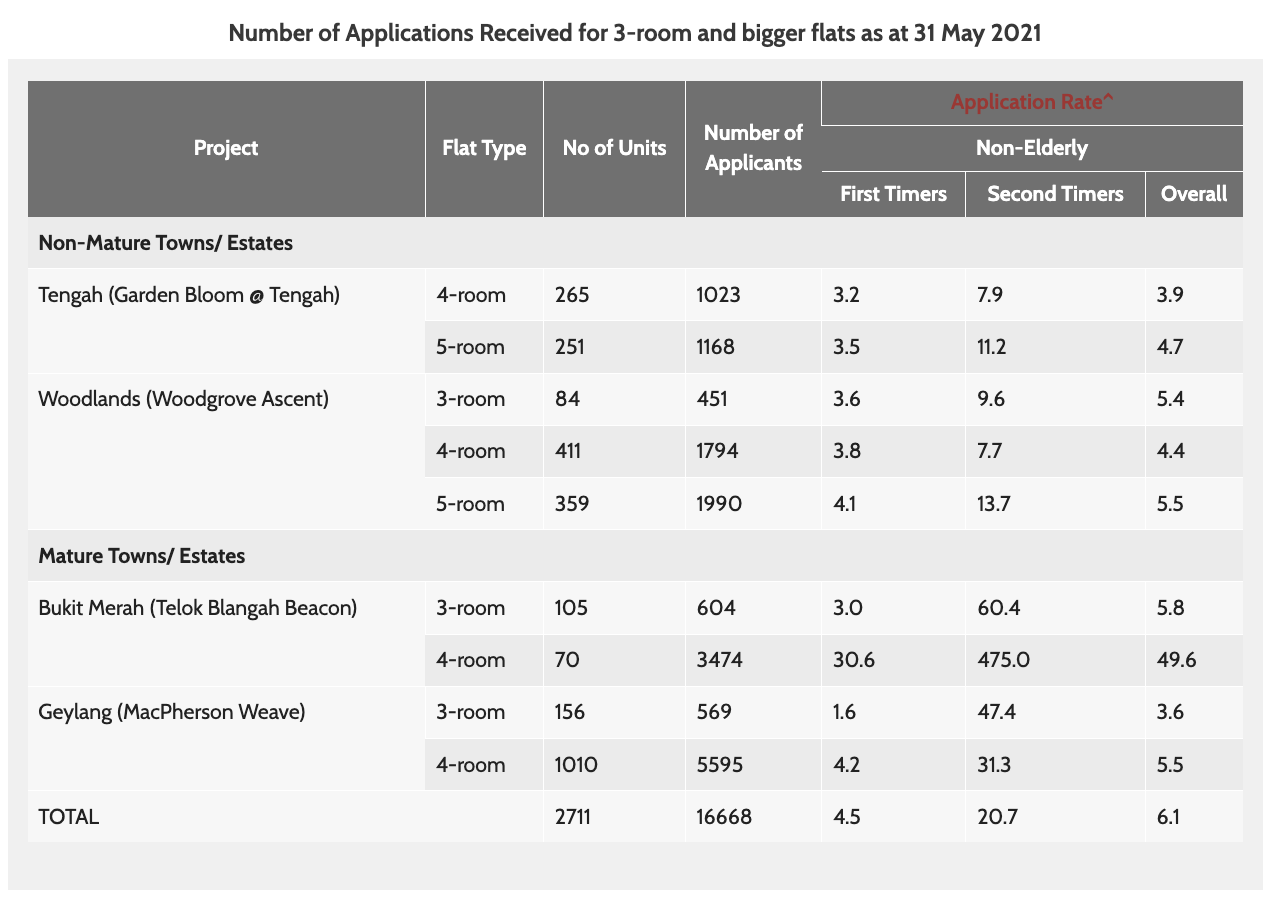

The BTO they applied for was for Bukit Merah’s Telok Blangah Beacon in the May 2021 exercise.

As a single-block project, it offered 105 3-room units and 70 4-room units for sale and was due to complete in Q1 2027. The price range (excluding grants) for a 3-room unit was between S$419k and S$504k. For 4-rooms, it was S$602k-S$710k.

Not only that, the BTO project is within a 10-minute walk of Telok Blangah MRT and Labrador Park MRT. Being at the city fringe, it is near the Greater Southern Waterfront and VivoCity.

Furthermore, Prime Location Public Housing (PLH) had yet to be introduced until November 2021. Notably, the subsequent Bukit Merah BTO launch in May 2022 was PLH-based (eg. minimum 10-year MOP).

In other words, Javier and his partner could potentially sell or rent out their flat after 5 years of collecting their keys, instead of 10 (if the project had been a PLH one).

Naturally, it was definitely a good consideration for the young couple.

Balloting surprise

“The BTO location was a 10-minute walk away from my partner’s home, so her mother asked her to try to BTO. After all, as we’ve read in the news, it was not always a guaranteed success,” Javier told us.

Indeed, by the end of the sales launch on 31 May 2021, the application rates at Telok Blangah Beacon were 5.8 for 3-rooms and a whopping 49.6 times for 4-room flats!

So imagine the surprise Javier and his partner had when they got a ballot number.

“Unexpectedly, or surprisingly, we managed to get a good ballot number due to its location being near her parents’ home. So we went ahead with the option fee in 2021 (S$1k) and then the downpayment in 2023,” Javier said.

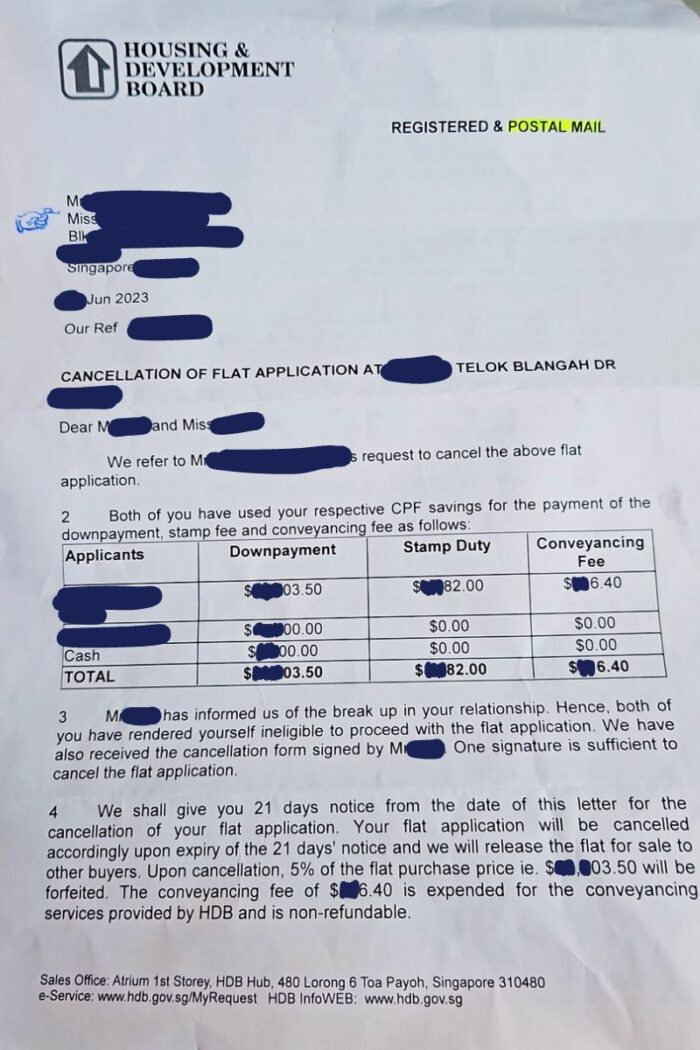

“The cost of our 3-room BTO flat was S$460k+. After paying our option fee, we had to pay a downpayment that’s 5% of the price, which came up to about S$20k+. The stamp duty plus other fees came up to S$8k+.”

Initially, Javier’s girlfriend wanted him to use all of his CPF savings to pay for the downpayment. Fortuitously, Javier and his girlfriend used the CPF housing grant they got (about S$20k+), which was split 50:50 between them, to make the downpayment.

The stakes and split-up

Unfortunately for the couple, several months after signing the lease agreement, Javier’s girlfriend wanted for them to part ways. However, she told him that she wanted to retain the flat. The idea is that they’ll hold on to the flat as long as possible but live separate lives.

Javier, however, wasn’t too keen on doing that. “I don’t want to wait for her to find another partner and then transfer my name over.”

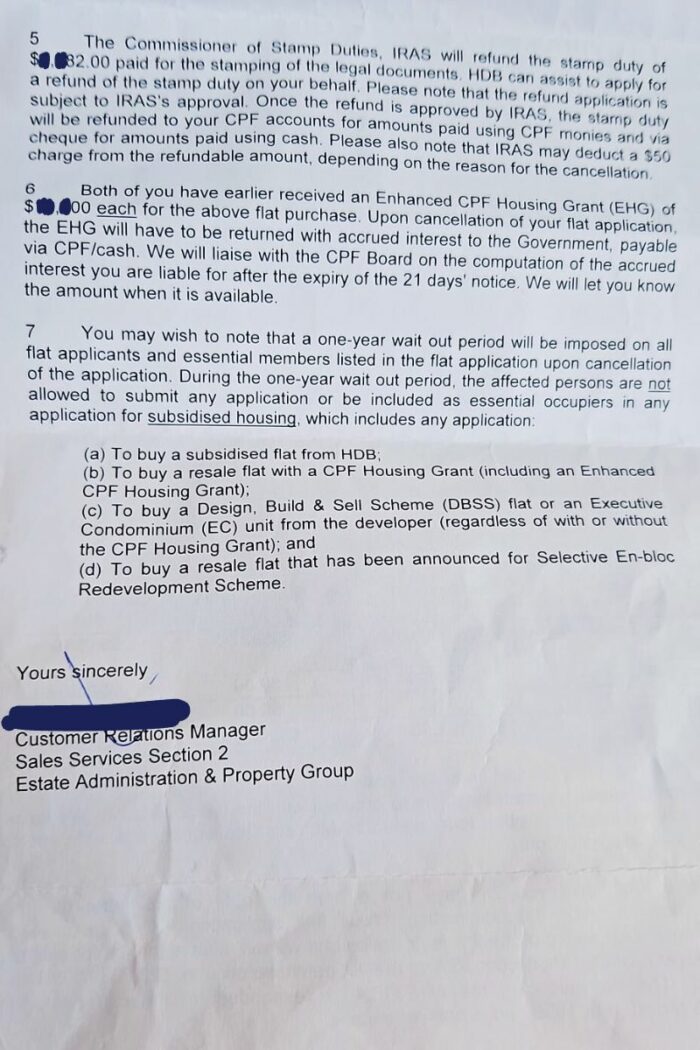

When Javier made the decision to cancel the purchase, he’d initially thought that he would need to fork out cash to pay back the CPF used to pay for the HDB loan.

So he called HDB to verify this. “Thankfully, they told me I will only lose the downpayment, while the stamp duty, after some other deductions, can be refunded. So I went ahead to cancel the purchase.”

There was however a penalty for cancelling his purchase. Javier (and his now former girlfriend) will need to wait at least a year before they can apply and buy a BTO/resale flat again.

“At the back of my mind, I knew I’d want to apply for a BTO with my own partner eventually, and I can’t wait for another year after the cancellation. So I went ahead and cancelled the flat purchase immediately after we broke up.”

All in all, Javier lost slightly over S$10k from his downpayment plus additional fees (his stamp duty was refunded) while his former partner lost about the same amount from her CPF savings.

Lessons learned

In hindsight, Javier says it’s better to cancel the BTO purchase and lose that money than be with the wrong person for life.

“It’s never too late to start afresh. Just because you paid for a house that has yet to be built does not mean you must remain knee-deep committed to the purchase all the way through.”

Javier feels that through this experience, he’s become a much more mature individual now and he’s confident he’ll find a better partner in time.

–

–

Planning to sell your HDB flat soon? Let us help you get the right price by connecting you with a premier property agent.

If you found this article helpful, 99.co recommends Eh, is it dumb to buy a 40+ Year Old resale HDB? and Is it better to sell your HDB resale flat before, during or after a BTO month?

The post Couple bought a 3-room Bukit Merah BTO flat for S$460k+, but lost S$20k+ after they broke up appeared first on .