CapitaLand Ascendas Reit has added two major commercial properties to its Singapore portfolio. The acquisitions of 5 Science Park Drive and 9 Tai Seng Drive are now complete, with both deals amounting to around S$700 million.

Table of contents

- Acquisition of 5 Science Park Drive

- Acquisition of 9 Tai Seng Drive

- Funding the acquisitions

- Strategic rationale behind the deals

Acquisition of 5 Science Park Drive

| Property type | 6-storey business space property |

| Address | 5 Science Park Drive, Singapore Science Park 1, Singapore 118265 |

| Accessibility | Next to Kent Ridge MRT, 1 stop from one-north, 7 min drive to AYE |

| Size | 25,533 sqm GFA |

| Current tenant | Fully occupied by Shopee (regional HQ) |

| NPI Yield | 6.1% |

| Remaining land tenure | 56 years |

The property sits close to Kent Ridge MRT station, only a single stop away from the one-north business district. By car, it’s just a quick 7-minute drive to the Ayer Rajah Expressway (AYE). For tenants, this means easy connectivity to other parts of Singapore.

Currently, the entire building is fully leased to Shopee, one of Southeast Asia’s largest e-commerce platforms. In fact, this property serves as the company’s regional headquarters. With a strong tenant like Shopee, you get a sense of the long-term stability that the property can bring to the Reit’s portfolio.

From a financial standpoint, 5 Science Park Drive generates an NPI yield of 6.1% and has around 56 years left on its land tenure. It also comes with a BCA Green Mark Platinum certification, underscoring its sustainable design.

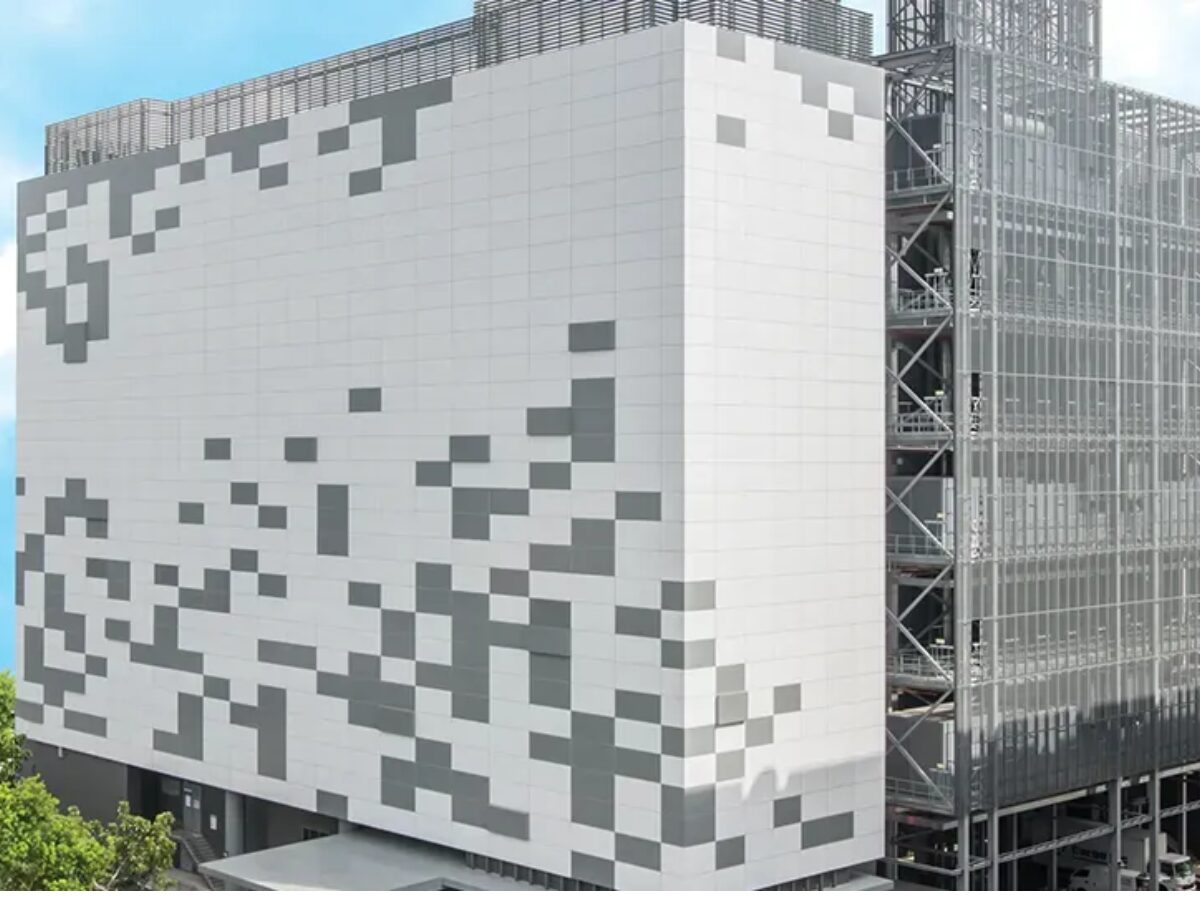

Acquisition of 9 Tai Seng Drive

| Property type | 6-storey Tier III carrier-neutral data centre |

| Address | 9 Tai Seng Drive, Singapore 535227 |

| Accessibility | Near Tai Seng MRT (Circle Line) |

| Size | 20,307 sqm GFA with 5 levels of IT white space |

| Current tenants | Fully committed by digital, e-commerce, and financial firms |

| NPI Yield | 7.2% |

| Remaining land tenure | 30 years |

Like 5 Science Park Drive, this asset is fully committed. Its tenants are reputable companies from digital, e-commerce, and financial services industries. The property boasts a weighted average lease expiry of 4.4 years, offering consistent income stability for CapitaLand Ascendas Reit.

The financials here are also attractive. The property provides an NPI yield of 7.2%, with about 30 years of land tenure remaining. Just like the Science Park property, it holds a BCA-IMDA Green Mark Platinum certification, reflecting its eco-friendly and efficient standards.

It’s also worth noting that this purchase expands the Reit’s data centre presence in Tai Seng, where it already owns the Kim Chuan Telecommunications Complex and 38A Kim Chuan Road. This cluster strategy strengthens its position in Singapore’s fast-growing digital infrastructure landscape.

Looking for more office spaces?

See all For sale >

See all For rent >

Funding the acquisitions

Both these purchases were supported by the S$500 million raised earlier through a private placement. The trust had carefully allocated the funds across multiple needs:

- Around S$137.1 million (27.4% of proceeds) was used for the 5 Science Park Drive purchase.

- About S$81.6 million went towards repaying borrowings tied to earlier investments and asset enhancements.

- Roughly S$5 million was used for placement-related fees and expenses, leaving a small unutilised balance of $0.8 million at first.

- Finally, S$275.5 million (55.1% of proceeds), together with the reallocation of the S$0.8 million balance, was directed towards the 9 Tai Seng Drive acquisition.

With the completion of both acquisitions, the entire S$500 million raised from the placement has now been fully deployed.

Strategic rationale behind the deals

It’s clear that CapitaLand Ascendas Reit is making deliberate choices to strengthen its portfolio in sectors tied to digital transformation and technological growth. By securing these two prime properties, the Reit is:

- Deepening its foothold in the data centre space, a sector seeing rising demand due to cloud services, e-commerce, and the financial industry.

- Strengthening its business space portfolio within Science Park, a hub for innovation and life sciences.

- Enhancing income resilience by partnering with well-established tenants in fast-growing industries.

- Diversifying its customer base across technology-driven sectors.

Together, 5 Science Park Drive and 9 Tai Seng Drive represent a total purchase of around S$700 million. These additions don’t just expand CapitaLand Ascendas Reit’s Singapore portfolio, but they also highlight the manager’s focus on aligning with global growth trends in the digital economy.

The post CapitaLand Ascendas Reit acquires 5 Science Park Drive and 9 Tai Seng Drive for a total of S$700M appeared first on .