After a quieter August, Singapore’s HDB resale market bounced back in September. Transaction activity held steady despite a modest pullback in volume, while prices reached a fresh record high. The month also saw a surge in high-value transactions — with 172 flats sold* for at least S$1 million, setting a new all-time record.

*Sold transactions are based on Resale Registration Date. Resale registered applications are generally representative of completed resale transactions.

At a glance…

-

HDB resale prices: +0.6% MoM, +4.8% YoY (Index: 209.7) -

Sales volume: 2,186 flats sold, down 1.2% MoM -

Million-dollar flats: 172 units, new record high (7.9% of total sales) -

Top towns with million-dollar sales: Toa Payoh (37 units), Queenstown (18), Bukit Merah (18) -

Highest transaction: S$1.59M for a 5-room flat in Central Area

Table of contents

- HDB resale prices reached a new high in September 2025

- Resale volume dipped slightly, but demand stayed steady

- Million-dollar flats surged to a record high of 172 units

- Market interpretation: Confidence despite a softer backdrop

HDB resale prices reached a new high in September 2025

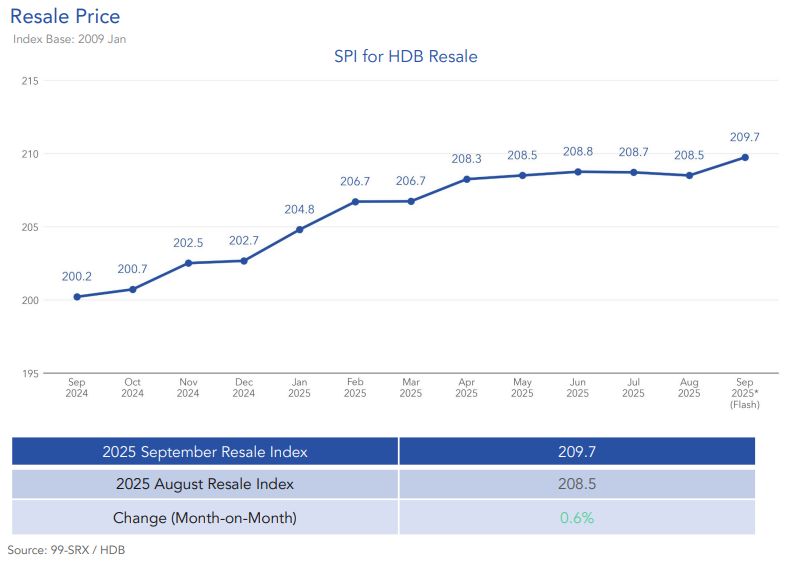

The HDB resale price index reached a new high in September. Now at 209.7, it was a 0.6% month-on-month increase from 208.5 in August, and 4.8% higher than a year ago. This steady climb continues a trend of moderated but persistent price growth since early 2025, signalling that the market remains well-supported despite broader economic headwinds.

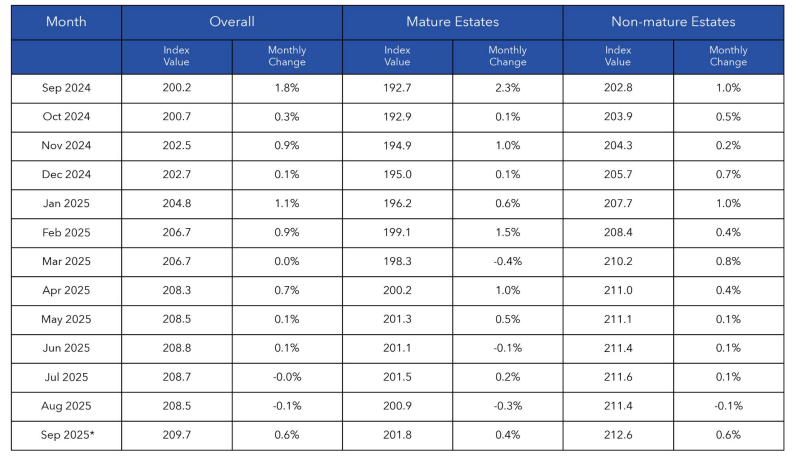

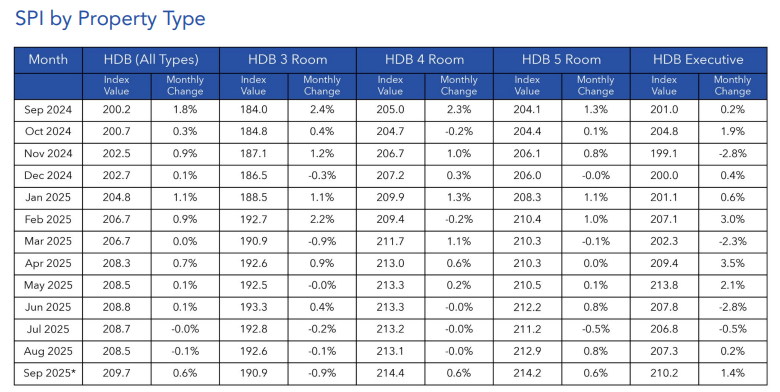

Both Mature and Non-Mature estates recorded price gains, rising 0.4% and 0.6%, respectively, since August. By room type, Executive flats led with a 1.4% monthly gain, reflecting higher demand from multi-generational families. 4-room and 5-room flats also advanced by 0.6%, while 3-room flats slipped 0.9%, suggesting smaller units may be feeling the pinch from cautious first-time buyers affected by financing limits.

Over the past year, all flat categories have appreciated between 3.7% and 4.9%, underscoring stable demand across the board. Here’s the breakdown of the year-on-year increase for each flat type:

- 3-room: +3.7%

- 4-room: +4.6%

- 5-room: +4.9%

- Executive: +4.6%

This steady performance signals ongoing confidence in the HDB resale market, driven by a mix of upgrader demand, tight BTO supply in mature areas, and the widening gap between new launch and resale condo prices.

Resale volume dipped slightly, but demand stayed steady

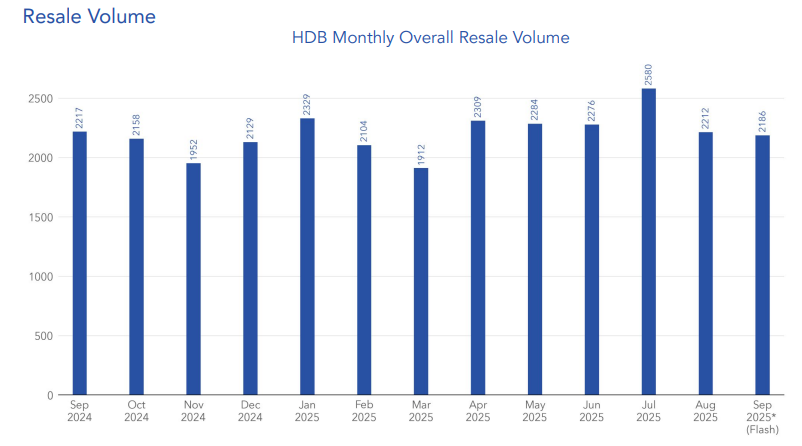

In September, 2,186 resale flats were transacted — a modest 1.2% drop from August and 1.4% below September 2024. While this suggests a mild slowdown, the overall number remains healthy for a traditionally quieter period following the Hungry Ghost Month.

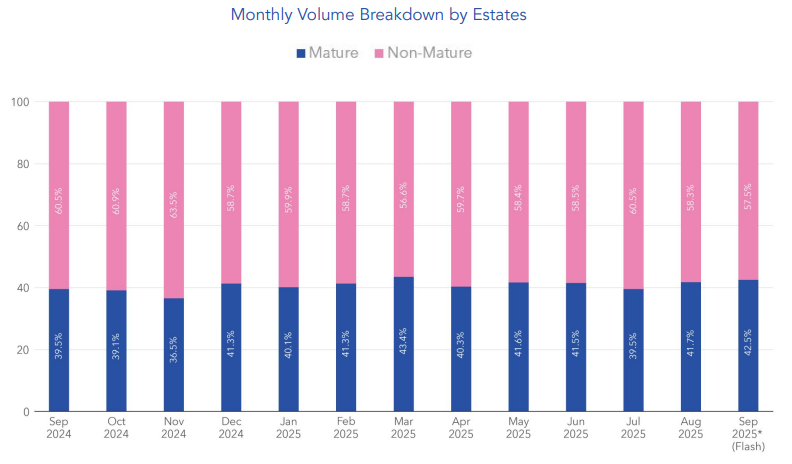

More than 57% of transactions came from Non-Mature estates, highlighting how towns such as Sengkang, Woodlands, and Jurong East continue to absorb a significant portion of market activity. Meanwhile, Mature estates accounted for 42.5%, reflecting limited supply but steady interest from buyers willing to pay premiums for proximity to amenities and established neighbourhoods.

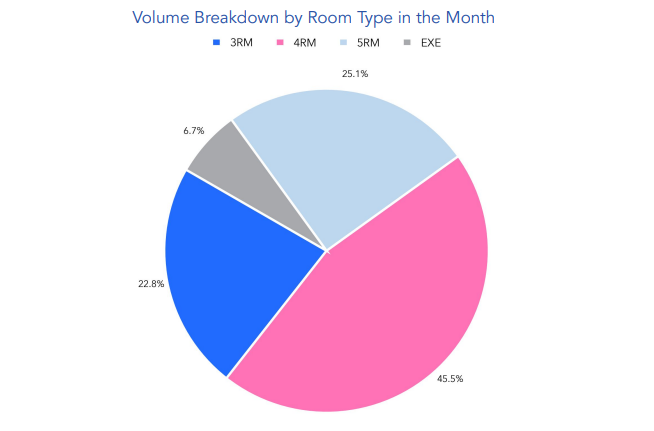

In terms of flat type, 4-room units dominated the market, contributing 45.5% of total transactions, followed by 5-room (25.1%), 3-room (22.8%), and Executive flats (6.7%). This mix points to the continued appeal of mid-sized flats — large enough for families, yet relatively affordable compared to condominiums.

Some of the pullback in volume may also stem from shifting buyer behaviour. As 99.co’s Chief Data & Analytics Officer, Mr. Luqman Hakim, noted, “In August, only two new launches were rolled out – Springleaf Residences on the 16th and One Holland Village Residences on the 21st – and September had none, with Skye at Holland only previewing on the 25th.”

These fewer private options might divert buyers’ attention to the HDB resale segment in September, sustaining demand even as overall transactions ease.

Million-dollar flats surged to a record high of 172 units

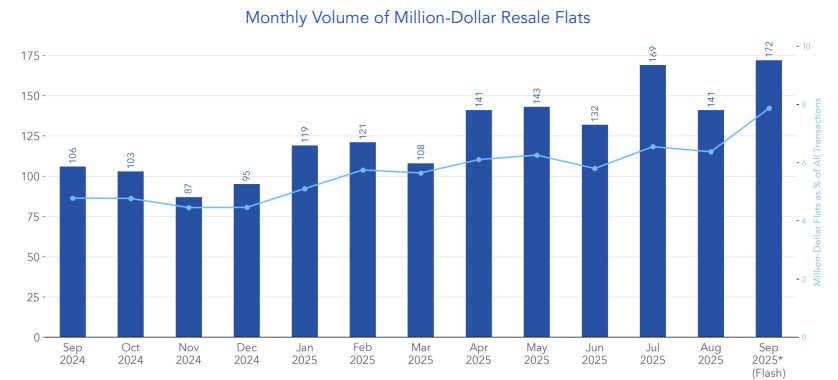

One of the most striking developments in September was the surge in million-dollar HDB flat transactions. The month saw 172 such sales, a sharp jump from 141 in August. They account for 7.9% of all resale transactions, the highest monthly proportion ever recorded.

The top transaction of the month was a 5-room flat in the Central Area, which fetched S$1.59 million — a reflection of how central, rare flat types continue to command exceptional value. In the Non-Mature estates, Woodlands saw an Executive flat sold for S$1.12 million. This shows how demand for spacious homes is spreading beyond the city-centre locations.

JUST IN: Woodlands executive HDB flat sets town’s new high at S$1.27 million in October 2025

Toa Payoh emerged as the top-performing town with 37 million-dollar flats in September, followed by Queenstown and Bukit Merah with 18 each. These mature estates, known for their central locations and proximity to MRT lines, remain prime choices for buyers willing to pay a premium for convenience and scarcity.

Mr. Luqman Hakim observed that, “With fewer condo options, some buyers, particularly potential HDB upgraders, may have returned to resale flats instead, as even at S$1M and above they still offer more space at lower prices than nearby condos.”

This perspective sheds light on why the million-dollar segment remains robust — it’s not just about prestige, but also practicality. For many, the trade-off between space and price makes these premium flats an appealing alternative to compact new condominiums.

Market interpretation: Confidence despite a softer backdrop

While the broader property market has seen mixed signals, the HDB resale segment continues to demonstrate remarkable stability. The record-high price index and historic number of million-dollar flats reflect sustained buyer confidence, especially among homeowners seeking ready-to-move-in options.

Executive and larger flats are seeing particularly resilient demand, fuelled by families upgrading from smaller units or private homeowners cashing out and re-entering the market for long-term security. Even as transaction volume slipped slightly in September, the sustained high-value activity suggests that serious buyers are still active — though increasingly selective.

The market now seems to be splitting into two groups. First-time buyers are struggling with affordability as prices climb, while higher-income buyers are paying more attention to location, condition, and space. This mix supports prices while keeping speculation in check.

On top of that, the concentration of million-dollar transactions in central towns such as Toa Payoh, Queenstown, and Bukit Merah also underscores a structural reality: older estates with strong amenities and transport connectivity remain evergreen favourites, particularly when newer supply is limited.

Read the HDB flash estimate for the complete Q3 2025 resale market here.

The post Record 172 million-dollar HDB flats sold in September 2025 as prices hit new peak appeared first on .