All eyes are now on The Sen, which is expected to wrap up the list of private condo launches for 2025. While it doesn’t have the advantage of an MRT right at its doorstep, it offers something different — a quieter and greener setting in Upper Bukit Timah. Whether that trade-off feels like a compromise or an opportunity depends on buyers’ preferences and how well it delivers on value.

So the real question is: Would you trade MRT convenience for lush surroundings? If so, is The Sen a smart buy in the relatively packed landscape of Bukit Timah?

Table of contents

- The Sen – Project overview

- Value comparison with nearby condos in District 21

- Resale outlook in Upper Bukit Timah

- Looking through an investor’s lens

- ⚖️ Our final take on The Sen

The Sen – Project overview

| Project Name | The Sen |

| Developer | Sustained Land, H10 Holdings, and Greatview Development |

| Location | Jalan Jurong Kechil, Upper Bukit Timah (D21) |

| Tenure | 99 years (from 20 Jan 2025) |

| Site Area | 19,245 sqm / 207,155 sqft |

| No. of Units | 347 |

| No. of Blocks | 5 (10-storey each) |

| Unit Types | 1 to 4 bedrooms |

| Launch Date | 15 November 2025 |

| Starting Price | From S$993,900 (S$2,199 psf) |

| Expected TOP | Q2 2029 |

| Expected Legal Completion | Q2 2033 |

The Sen is a 347-unit, 99-year leasehold condominium by Sustained Land, designed with a focus on wellness and livability. Spanning five 10-storey blocks, the development combines modern architecture with lifestyle-centric facilities, offering residents a calm, nature-inspired retreat in Upper Bukit Timah. It also comes with a 1:1 car park lot ratio, a rarity for new launches today, but one that aligns well with its location, where residents may rely more on private transport.

Make sure you know everything The Sen has to offer — Read our full new launch review

here

What makes The Sen stand out is its value-driven land cost. While most recent RCR sites have been sold at much higher rates, Sustained Land secured this plot along De Souza Avenue for S$841 psf ppr in 2024 — notably below market norms and even lower than the neighbouring Verdale’s S$1,002 psf ppr bid back in 2018. This lower land price gives The Sen room to launch at more competitive prices, making it an appealing option for buyers looking for long-term value in the Upper Bukit Timah area.

Attractively priced for an RCR new launch

| Unit Type | Area (sqft) | No. of Units | % of Total Units | Starting Price (S$) | PSF (S$) |

| 1 Bedroom | 452 | 10 | 3% | 993,900 | 2,199 |

| 2 Bedroom | 678 | 110 | 32% | 1,499,000 | 2,212 |

| 2 Bedroom + Study | 732 | 57 | 16% | Undisclosed | Undisclosed |

| 3 Bedroom | 872 – 1,109 | 90 | 26% | 1,936,000 | 2,220 |

| 3 Bedroom + Study (Prestige) | 1,259 | 40 | 11.5% | 2,899,000 | 2,303 |

| 4 Bedroom + Study (Prestige) | 1,453 | 40 | 11.5% | 3,340,000 | 2,299 |

Need more guidance on whether the Sen is the right one for you?

Sitting in a tranquil pocket of Upper Bukit Timah, The Sen is now launching at prices that lean closer to OCR levels than typical RCR benchmarks. In terms of overall quantum, it’s roughly on par with Springleaf Residence in Upper Thomson — an OCR project — yet The Sen offers noticeably larger units and the added prestige of an RCR address. Viewed by psf value, it stands out as one of the more appealing options among the 2025 new launches, especially for buyers seeking both space and long-term value.

Efficient layouts and well-designed homes

From a design standpoint, Sustained Land has adopted a modern approach by creating smaller but highly efficient layouts. This design choice helps to keep overall purchase prices manageable, opening the project to a broader range of buyers while still preserving a strong sense of space and liveability.

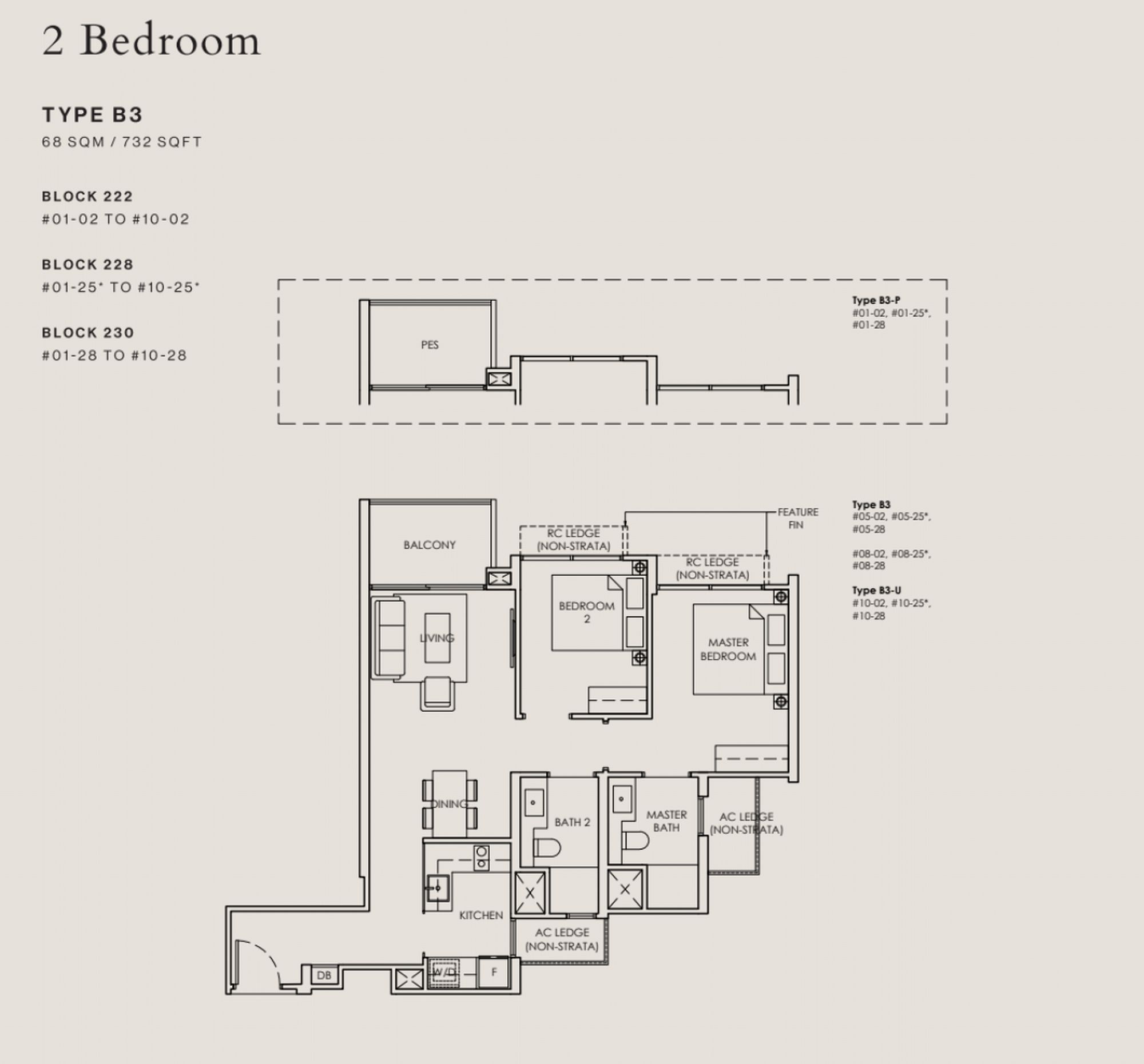

Take the 2-bedroom units as an example. The entry size starts from 678 sqft, which is generous by current market standards, considering it is a post-GFA harmonisation project, where AC ledges are not included in the floor area. For comparison, the smallest 2-bedder at Springleaf Residences measures just 527 sqft, underscoring the extra breathing room The Sen provides. The largest 2-bedder here spans 732 sqft and includes a study — about the size of a compact 3-bedder in some other projects.

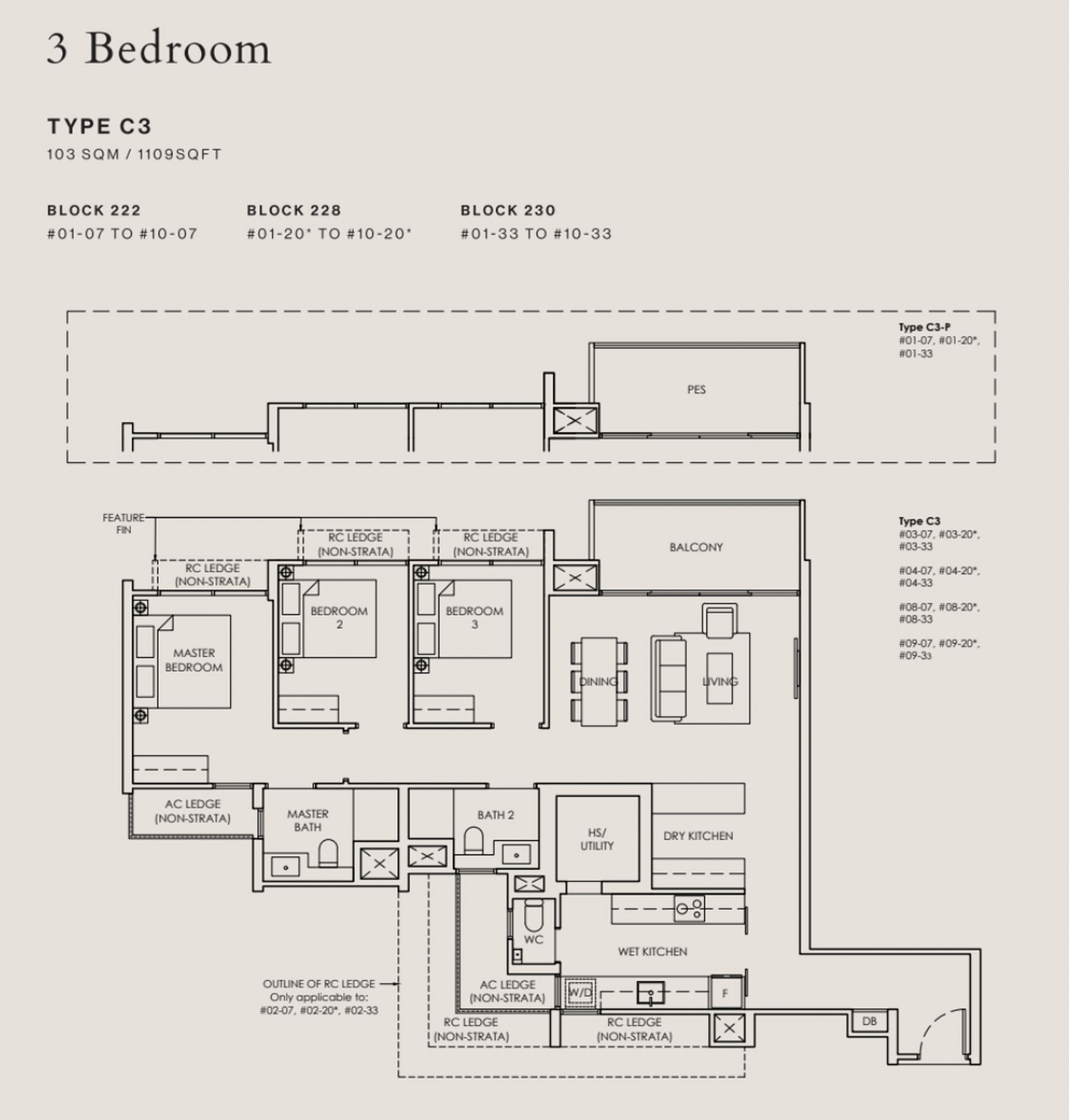

The 3-bedroom units, which make up roughly 37.5% of the project, range up to 1,109 sqft, offering ample space for families. Those seeking even more room can look to the 3-bedroom + study units, which reach 1,259 sqft, exceeding the size of some 4-bedders in recent launches.

Certain stacks also come with landscaped frontages, giving the living areas a broader visual depth and a stronger connection to the outdoors. Notably, both first- and tenth-floor units enjoy ceiling heights of up to 3.9 metres, a bonus not included in the saleable area. Altogether, The Sen feels clearly tailored for own-stay buyers who prioritise thoughtful design, space efficiency, and a serene living environment — with the best stacks overlooking Bukit Batok Nature Park for lush, open views.

Value comparison with nearby condos in District 21

To better understand how The Sen is positioned, it helps to view it within the broader Upper Bukit Timah landscape. For most buyers, proximity to Beauty World MRT serves as the key reference point when assessing projects in the area. As mentioned before, The Sen doesn’t offer this immediate MRT access.

This raises an important question for buyers: How much does immediate MRT access matter if it comes at a premium, when the alternative offers savings, more space, and a calmer setting?

Recent launches near Beauty World MRT

Recent launches located within walking distance to Beauty World MRT, such as 8@BT (TOP 2027) and The Reserve Residences (TOP 2027), can serve as the upper-bound benchmarks. Due to their locations, these projects are naturally more expensive.

For instance, 3-bedroom units at 8@BT currently hover around S$2.5 million, with layouts reaching close to 1,000 sqft. Meanwhile, larger 4-bedders at The Reserve Residences now average close to S$5 million. As of 2025, average psf prices across all unit types sit at S$2,778 for 8@BT and S$2,584 for The Reserve Residences.

Here is the average PSF breakdown for each comparable unit type:

| Recent Launch | 1BR | 2BR | 3BR | 4BR |

| 8@BT (2024) | S$2,793 | S$2,761 | S$2,776 | S$2,629 |

| The Reserve Residences (2023) | S$2,571 | S$2,519 | S$2,553 | S$2,584 |

| The Sen | From S$2,199 | From S$2,212 | From S$2,220 | From S$2,299 |

While we only know the developer’s indicative starting prices for now, this gap in pricing highlights The Sen’s value advantage. In practical terms, this means a lower entry price relative to newer projects in the Beauty World area, which could help preserve long-term resale value and offer a more comfortable buffer against market fluctuations.

Direct comparables: Verdale and Daintree Residence

A fairer comparison for The Sen would be with nearby projects along Jalan Jurong Kechil, such as Verdale (TOP 2024) and Daintree Residence (TOP 2023). Like The Sen, these developments are not within immediate walking distance to Beauty World MRT, yet they share similar surroundings and target demographics. Another relevant reference point is View at Kismis (TOP 2024), located just off Lor Kismis within the neighbouring Toh Yi precinct.

The Sen enters the market at roughly a 10% premium compared to these older resale projects. However, this price gap appears reasonable, considering its newer lease start.

| Project | Tenure | Avg. PSF (2025) |

| Verdale | 99-year from 2018 | S$1,960 |

| Daintree Residence | 99 years from 2017 | S$2,039 |

| View at Kismis | 99 years from 2019 | S$2,080 |

| The Sen | 99 years from 2025 | From S$2,199 |

Recent resale data support this comparison. Average transaction prices for these surrounding projects are as follows:

- 1-bedroom unit: Around S$900K

- 2-bedroom unit: From S$1.2 million to S$1.4 million

- 3-bedroom unit: From S$1.4 million to S$2 million

- 4-bedroom unit: From S$2.3 million to S$3.3 million

The resale prices of older nearby developments are broadly in line with The Sen’s launch range, giving buyers a strong case for choosing a brand-new project instead. With its efficient layouts, wellness-oriented concept, and modern facilities, The Sen presents an attractive entry point for both homeowners and long-term investors. Its taller building profile also sets it apart, offering residents wider, unblocked views of the surrounding greenery.

Another key distinction lies in The Sen’s status as a GFA-harmonised project. Under the updated planning framework, unit sizes are now measured based on true liveable area, providing a more transparent reflection of usable space. Unlike older projects that include external ledges or voids in their floor area, The Sen gives buyers clearer value for every square foot.

As more post-harmonisation projects enter the market, they’re expected to redefine how buyers perceive affordability and resale potential. In this context, The Sen positions itself as a forward-looking development that aligns with today’s planning standards while maintaining a competitive price advantage.

99.co New Launch Concierge will help you further with the comparison analysis!

Resale outlook in Upper Bukit Timah

Looking ahead, The Sen’s resale prospects will likely be shaped by the next wave of developments planned under the URA Master Plan. The plot directly beside the site has already been designated for future housing, while several Reserve Sites are scattered throughout the area.

This part of Upper Bukit Timah feels much like Lentor in its early transformation phase — lush, low-rise, and poised for gradual renewal. Once these future projects are launched, they could help push benchmark prices higher, potentially lifting the overall value perception of the neighbourhood.

However, that same growth will also bring greater supply, intensifying competition for resale buyers. The long-term outcome will depend on whether The Sen maintains enough pricing headroom compared to newer projects entering the market

Currently, the Upper Bukit Timah condo landscape is already dense. Unlike districts such as Clementi or Toa Payoh, where HDB upgraders have limited private options, this area is crowded with smaller freehold developments and mid-sized 99-year leasehold condos, all competing for buyers’ attention. This fragmentation makes it challenging for any single project to stand out strongly in the resale market.

That said, The Sen’s positioning as one of the newer wellness-themed projects could help it differentiate itself over time, especially as lifestyle-focused living gains traction among younger families and working professionals.

On average, resale condos in this district have posted annualised capital gains below 3%, with few developments sustaining performance above 3.5%. The main reason lies in the area’s competitive supply and overlapping buyer segments, which tend to cap resale upside despite the appeal of its green surroundings and proximity to good schools.

Looking through an investor’s lens

From an investment standpoint, Upper Bukit Timah has traditionally offered modest rental performance. Data shows that rental yields for condos in this area typically fall below the 3% benchmark often used to gauge healthy returns for private properties. This remains the case even for projects situated nearer to MRT stations, which usually enjoy stronger rental traction in other parts of Singapore.

There are two main reasons for this trend. First, high purchase quantums tend to raise entry costs and, in turn, compress yield percentages. Second, tenant demand in Upper Bukit Timah is comparatively weaker than in other city-fringe or central districts, where corporate tenants and expatriates are more concentrated. As a result, rental rates here remain moderate relative to overall property prices.

For investors eyeing The Sen, the proposition is therefore less yield-driven. Its appeal lies instead in capital appreciation potential — supported by its relatively lower entry, newer lease, and long-term transformation prospects in the area. In short, The Sen is better viewed as a value-entry play with growth potential, rather than a project aimed purely at generating rental income.

By unit types – Which offer the most value?

It’s well established that larger 3- and 4-bedroom units in Upper Bukit Timah tend to deliver stronger resale performance. A good example is Daintree Residence, where resale data shows average profits of about S$430,000 for 3-bedroom units and a remarkable S$742,000 for 4-bedroom units. What’s interesting, though, is that 2-bedroom units have also held their ground fairly well in this sub-market.

Here’s a closer look at how The Sen’s neighbouring projects have performed in the resale market:

| Project | Unit Type | Average Size (sqft) | Average Profit (S$) | Average Annualised Capital Gain (%) |

| Verdale | 1 | 463 | 102,267 | 3.3 |

| 2 | 653 | 154,544 | 3.4 | |

| 3 | 1,004 | 370,400 | 5.6 | |

| Daintree Residence | 2 | 724 | 262,856 | 5 |

| 3 | 1,061 | 429,874 | 5.5 | |

| 4 | 1,485 | 742,000 | 5.3 |

While the data comes from just two nearby projects, the trend is consistent with what’s happening on the broader ground. Buyers in Bukit Timah are generally not chasing the lowest prices. Instead, they prioritise space, livability, and long-term comfort — traits that larger units naturally provide.

This helps explain why family-sized layouts, such as Daintree’s 1,400 sqft 4-bedders, have performed exceptionally well despite their higher upfront costs. For The Sen, this suggests that larger 3- and 4-bedroom units may hold stronger long-term value, especially for own-stay buyers looking for both quality of life and potential capital upside.

Interested in New Launches? Calculate your payments with 99.co’s

Progressive Payments Calculator

Weighing potentials and risks

The Sen presents both opportunity and caution for investors. To wrap it all up:

Potential upsides

- Competitive RCR pricing: The Sen could be seen as an undervalued way to own a prime address, with psf prices comparable to OCR launches like Springleaf Residences.

- 2025 new launch at near-resale pricing: Its launch prices are close to older resale condos in the area, offering a rare opportunity to buy new at almost resale levels.

- Price catalysts ahead: If buyers respond well, future GLS plots nearby could lift overall benchmarks, creating upside for The Sen’s early buyers.

- Balanced home-and-investment appeal: Ideal for those who want to live in Bukit Timah while holding for long-term gains.

- Bukit Timah Turf City transformation: The upcoming 20,000-home redevelopment nearby could significantly raise demand and area values, benefiting The Sen’s long-term positioning.

Investment risks

- Heavy competition: Upper Bukit Timah already has many similar condos, both freehold and leasehold, which may limit resale momentum.

- Sub-3% rental yields: Rental returns in this district are generally lower. For investors targeting smaller units purely for rental yield, The Sen might not be the safest option. Alternatives like Penrith or Zyon Grand may present clearer opportunities for this segment.

⚖️ Our final take on The Sen

The Sen may not have the best convenience of an MRT right next door, but it offers something quietly compelling — a chance to own a new, well-designed RCR home at near-resale pricing. In a market where new launches often feel priced to perfection, The Sen stands out for keeping its entry point relatively grounded.

Its appeal lies in balance. The project blends Upper Bukit Timah’s lush calm with practical layouts and competitive PSF values, giving homebuyers a realistic entry into one of Singapore’s most sought-after residential districts. For investors, the competitive pricing, new lease start, and future transformation of nearby Bukit Timah Turf City together provide a reasonable buffer for long-term growth.

Still, it’s not a one-size-fits-all proposition. Those banking on strong rental yields may find limited upside, and the dense local supply means resale gains will require patience. But for genuine homebuyers prioritising space, tranquillity, and the reassurance of entering the Upper Bukit Timah market at a fair price, The Sen makes a strong, considered case.

Stay updated with the latest news and insights on Singapore’s new launch market here.

The post From S$2,199 psf, is The Sen in Upper Bukit Timah a smart buy? appeared first on .