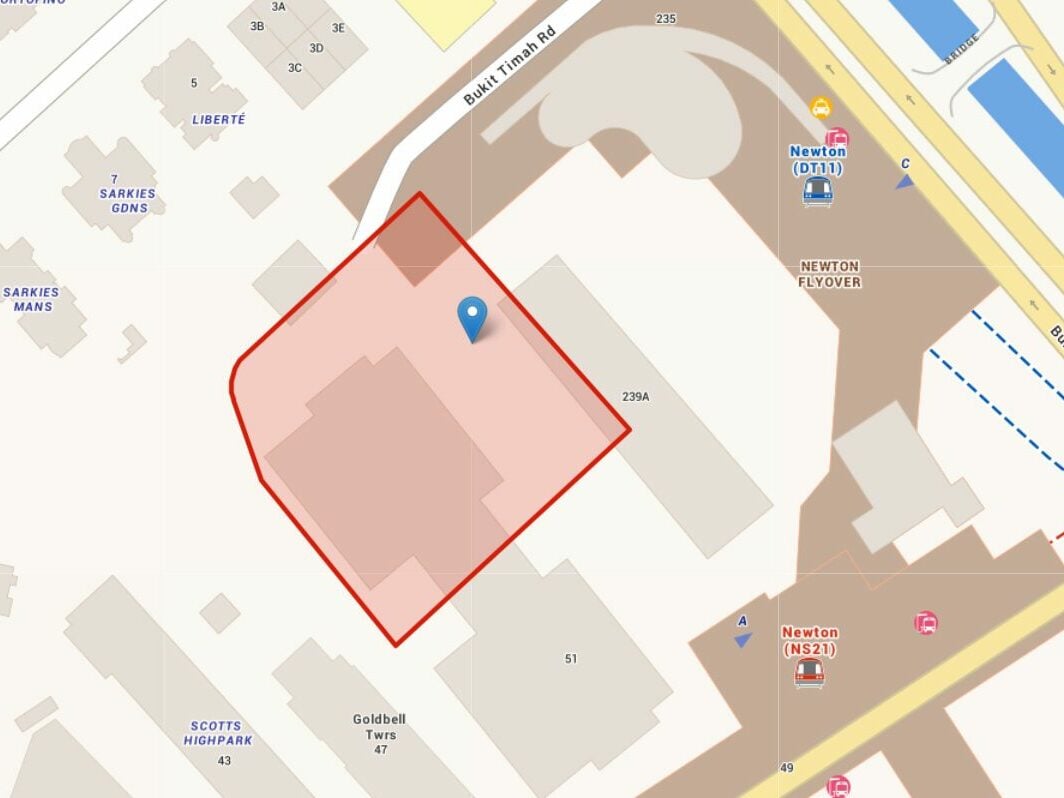

The Urban Redevelopment Authority (URA) has awarded the tender for the site at Bukit Timah Road to HH Investment Private Limited on 21 November 2025. The first Newton Government Land Sale (GLS) tender in nearly two decades concluded earlier this month with a strong response from developers. HH Investment, the Singapore arm of Taiwan’s Huang Hsiang Construction Corp, emerged at the top for the Bukit Timah Road tender, offering S$566.29 million or S$1,820 per square foot per plot ratio (psf ppr).

That price makes it the highest psf ppr bid for a GLS site in the Core Central Region (CCR) since 2018, when Cuscaden Reserve’s land parcel went for S$2,377 psf ppr. The result underlines how developers are once again confident about the prime district market — and how Newton could be entering a new phase of rejuvenation.

Bukit Timah Road GLS tender result

Drawing a total of eight bids, the Bukit Timah Road plot received a healthy interest for a prime site in the current cautious climate. HH Investment’s winning offer came in 12.3% above the second-highest bid of S$504.38 million (S$1,621 psf ppr) by the Hoi Hup Realty–Sunway Developments joint venture.

| Rank | Tenderer | Bid Price (S$) | Land Rate (S$ psf ppr) |

|---|---|---|---|

| 1 | HH Investment Private Limited | 566,291,712 | 1,820 |

| 2 | Hoi Hup Realty Pte Ltd and Sunway Developments Pte. Ltd. | 504,380,000 | 1,621 |

| 3 | Winclass Investment Pte. Ltd. | 483,988,888 | 1,555 |

| 4 | CL Emerald Pte. Ltd. and MJR Investment Pte. Ltd. | 483,960,000 | 1,555 |

| 5 | COLI (Singapore) Pte. Ltd. | 460,800,000 | 1,481 |

| 6 | Garden Estates (Pte.) Limited and Intrepid Investments Pte. Ltd. | 460,509,323 | 1,480 |

| 7 | Aster Residential Pte. Ltd. | 450,800,000 | 1,449 |

| 8 | Japura Development Pte Ltd | 408,000,000 | 1,311 |

The 38.8% gap between the top and bottom bids shows how widely opinions differ on this Newton site’s potential. The 99-year leasehold site, spanning 63,498 sqft, comes with a gross plot ratio of 4.9 and a maximum GFA of 28,907 sqm — translating to an estimated 340 residential units.

Why this site drew strong interest

Even before tender results were announced, analysts had predicted a competitive turnout — and the location explains why. The plot is located directly next to Newton MRT Interchange, and it offers seamless access to both the Downtown and North-South Lines. It sits a stone’s throw from Newton Food Centre, while also being close to reputable schools like Anglo-Chinese School (Junior) and St Joseph’s Institution Junior.

Bukit Timah Road has long been associated with prestige, but most of its surrounding private estates are older freehold developments with limited new supply. This GLS release introduces something new to the mix: a modern, mid-sized condo right in the heart of Newton, appealing to both investors and families seeking central convenience.

It’s also one of the few remaining sites within walking distance of Newton MRT that can yield a full-scale private condominium. The combination of city-fringe connectivity and CCR prestige makes it a rare find. The last GLS site in the area dates back to 1997, which eventually became Draycott 8, a luxury project where resale units have now changed hands at an average of S$2,176 psf.

Part of Newton’s long-term transformation

The Bukit Timah Road GLS is part of a much larger vision under the URA Draft Master Plan 2025. The plan reimagines Newton as a vibrant urban village, spanning around 26 hectares of land earmarked for 5,000 new private homes and community spaces across three key clusters: Newton Circus, Scotts Road, and Monk’s Hill.

URA’s vision also includes a new central community plaza near Newton MRT and Newton Food Centre, expected to bring more dining, retail, and recreational options to the area. That kind of mixed-use integration could further enhance the site’s long-term desirability.

Market outlook and expected launch prices

With HH Investment’s land price at S$1,820 psf ppr, market watchers estimate that the future launch prices could hover around S$3,400 to S$3,600 psf — competitive for the Core Central Region, especially given the direct MRT access and central positioning.

Developers may take comfort from how well recent CCR projects have performed. According to URA’s private home report in Q3 2025, CCR led the charge with a 1.7% increase, extending its strong 3% rise in Q2. Over the first nine months of 2025, CCR prices have risen 5.6%, outperforming other regions as the high-end market continued its recovery.

Buyers are showing renewed interest in CCR homes as the price gap between prime and city-fringe condos narrows. For instance, recent launches in the Rest of Central Region (RCR), such as Zyon Grand, are already reaching the S$3,000 psf benchmark, which reduces the relative premium of owning in the CCR.

Stay updated with the latest news and insights on Singapore’s new launch market here.

The post Bukit Timah Road GLS site officially goes to HH Investment for S$1,820 psf ppr appeared first on .