Singapore’s HDB resale market showed signs of transition in December 2025. While resale prices eased slightly, transaction volumes continued to recover after a pullback in October, suggesting a gradual alignment between buyer and seller expectations as the market heads into 2026.

Table of contents

- Slight HDB resale price dip in December: -0.6% MoM

- Resale volumes continue to recover after the October pullback

- Buyers and sellers adjust expectations amid future supply

- Million-dollar flat transactions rise further

- A transition toward a more balanced resale market

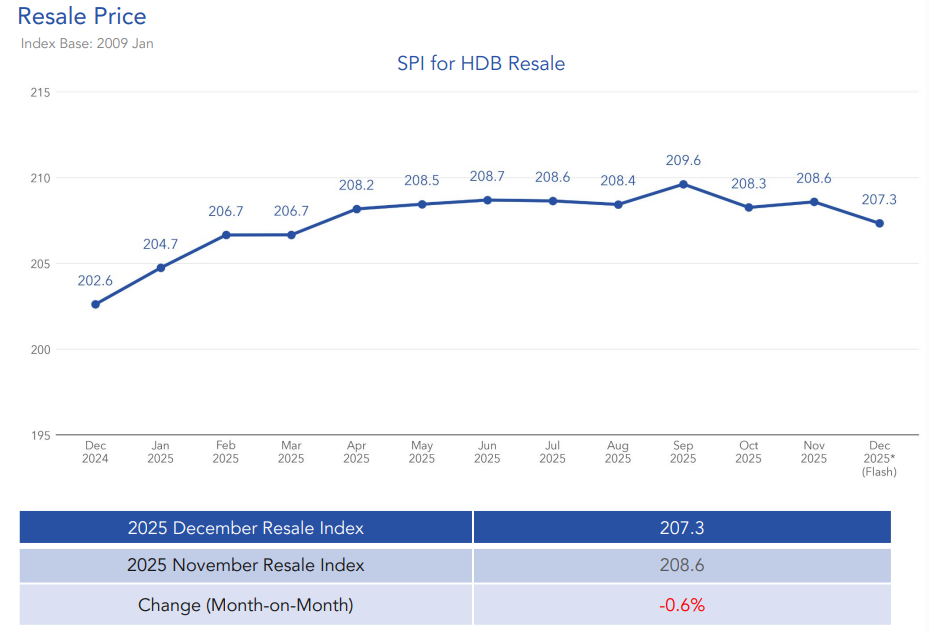

Slight HDB resale price dip in December: -0.6% MoM

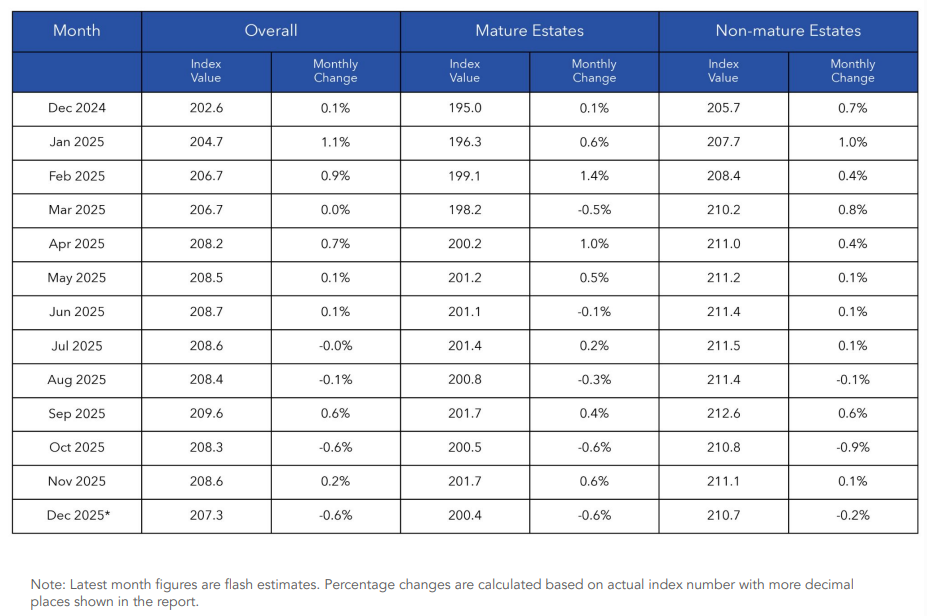

In December 2025, overall HDB resale prices declined by 0.6% compared to last month. Both Mature Estates and Non-Mature Estates recorded price declines of 0.6% and 0.2%, respectively.

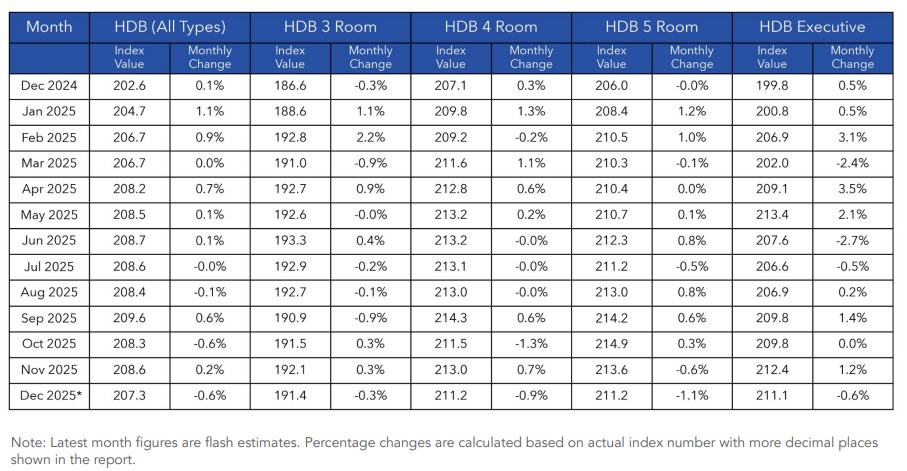

By flat type, prices also softened across the board. 3-room flat prices dipped 0.3%, 4-room prices fell 0.9%, 5-room flats declined 1.1%, and Executive flats eased 0.6% month-on-month.

Commenting on the latest figures, Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, noted that December’s price movement should be viewed in context. “The price dip may partly reflect typical December seasonality rather than a definite change in underlying price trends.” The broad-based pullback also points to price moderation rather than weakness concentrated in a specific segment.

Despite the monthly decline, prices remained higher compared to a year ago. Overall resale prices were 2.3% higher than in December 2024. Prices in both Mature and Non-Mature Estates rose 2.8% and 2.4%, respectively, on a year-on-year basis.

All flat types also recorded annual price increases as follows:

- 3-room flats: +2.6%

- 4-room flats: +2.0%

- 5-room flats: +2.5%

- Executive flats: +5.7%

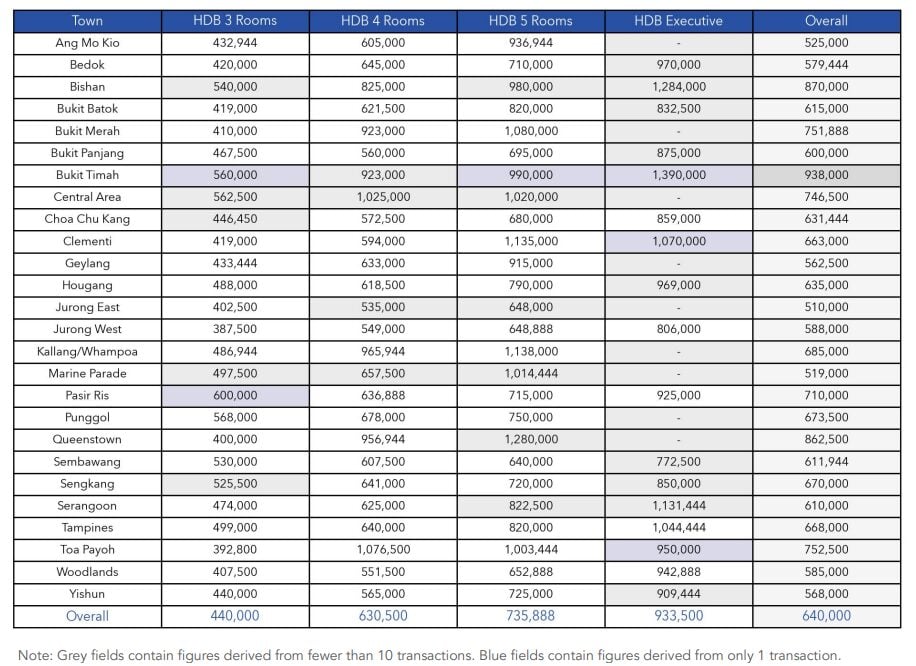

Median HDB resale price in December 2025

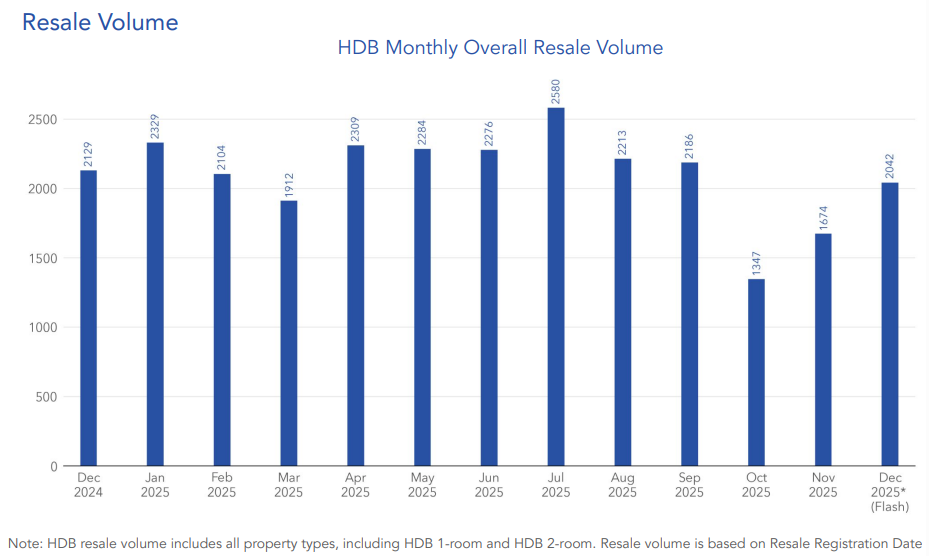

Resale volumes continue to recover after the October pullback

Transaction activity strengthened further in December. A total of 2,040 HDB resale flats were sold* during the month, representing a 21.9% increase from November. This follows a 38.4% drop in October, after which volumes rebounded 24.3% in November and continued to rise into December.

On a year-on-year basis, December resale volumes were still 4.2% lower than December 2024, suggesting that while momentum has improved, overall activity remains below last year’s levels.

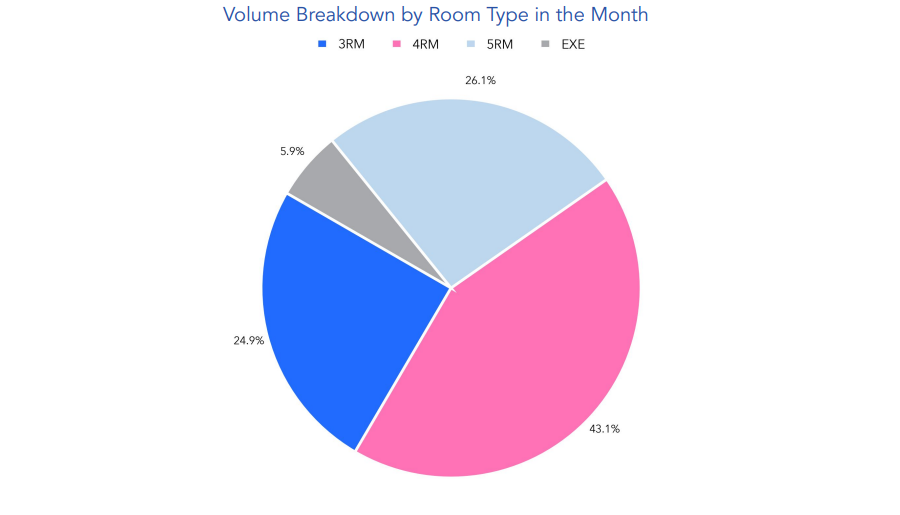

By flat type, 4-room flats made up the largest share of the month’s transactions at 43.1%, followed by 5-room flats at 26.1%, 3-room flats at 24.9%, and Executive flats at 5.9%. In terms of location, Non-Mature Estates accounted for 55% of resale volumes, reinforcing their role as the primary driver of HDB resale activity.

*Sold units are based on the resale registration date. Registered resale applications are generally representative of completed resale transactions.

Buyers and sellers adjust expectations amid future supply

Mr. Luqman highlighted that the recovery in activity alongside softer prices in December may reflect improving market balance. “This increase in transaction volumes, occurring alongside slight price softening, points to a possible alignment between buyer and seller expectations.”

The evolving price–volume dynamics appear to reflect forward-looking considerations among both buyers and sellers. With more than 13,000 HDB flats expected to reach their Minimum Occupation Period (MOP) in 2026, future resale supply is likely weighing on pricing expectations.

As Mr. Luqman explained, “current sellers may have been more receptive to realistic pricing and flexible negotiations, seeking to conclude transactions ahead of potentially stiffer competition.”

From the buyer’s perspective, December’s price moderation may have created a timely window to enter the market. “Instead of waiting and potentially facing greater competition for well-located or higher-quality units next year, many buyers appear to have acted while choices remained relatively ample and prices more measured,” he further explained.

Million-dollar flat transactions rise further

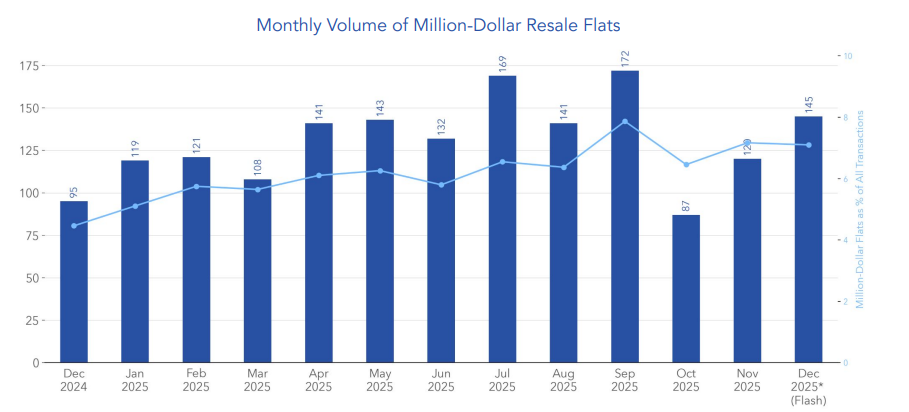

Despite the slight softening in prices, demand for premium resale flats remained firm. In December 2025, 145 HDB flats were transacted for at least S$1 million, up from 120 units in November. These transactions accounted for 7.1% of total resale volumes for the month.

The highest transacted price in December was S$1.525 million for a 5-room flat at The Peak @ Toa Payoh. In Non-Mature Estates, the top transaction was an Executive flat in Hougang Street 21 sold for S$1.45 million.

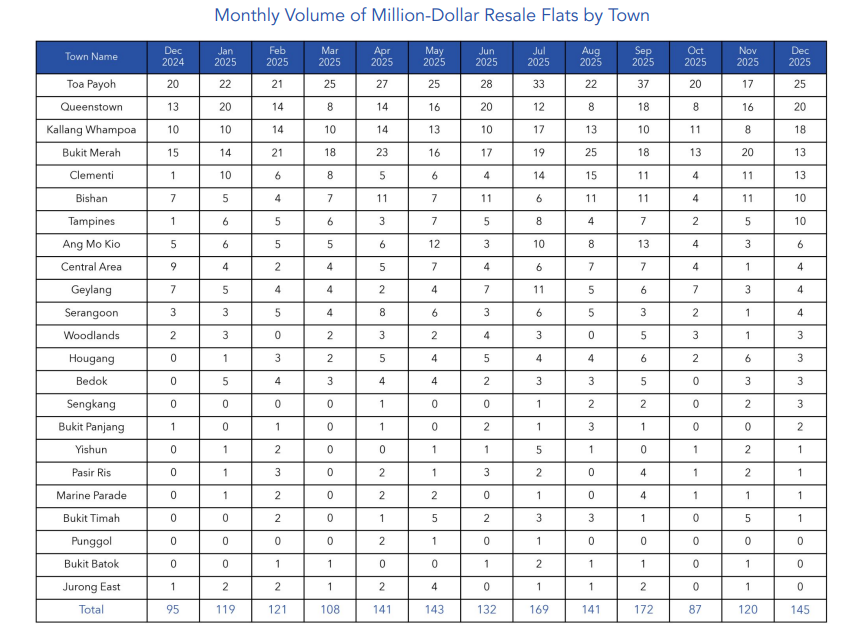

By town, Toa Payoh led with 25 million-dollar flats, followed by Queenstown with 20 units and Kallang/Whampoa with 18 units. Other million-dollar transactions were spread across a wide range of towns, including Bukit Merah, Clementi, Bishan, Tampines, Ang Mo Kio, Bedok, Woodlands, and Sengkang, underscoring the broadening geographical spread of high-value resale activity.

A transition toward a more balanced resale market

Taken together, December’s data suggests that the HDB resale market is entering a phase of adjustment rather than decline. Prices have softened modestly, but volumes are recovering, indicating improving alignment between demand and supply.

Summing up the broader outlook, Mr. Luqman noted “this transition points to the emergence of a healthier and more sustainable equilibrium as supply and demand begin to stabilise heading into 2026.”

As the market moves into the new year, price movements and transaction volumes will likely be influenced by how quickly upcoming MOP supply enters the resale market and how buyer sentiment evolves amid changing competition dynamics.

Read HDB flash estimate for the complete Q4 2025 resale market here.

The post Prices ease slightly as HDB resale transactions rebound in December 2025 appeared first on .