When you think about a 3-room HDB flat, affordability likely comes to mind first. For many buyers, this flat type has long been seen as a more budget-friendly entry point into the resale market. However, over the past couple years, that long-held belief has been steadily challenged. Prices have been moving up, records have been falling, and expectations have been rewritten.

In December, for instance, a 3-room resale flat in Sembawang changed hands for S$673,000, setting a new benchmark for the non-mature estate. That transaction alone raised eyebrows. After all, if a town like Sembawang can command such a price for a smaller flat, what about mature, centrally located estates?

As a result, it comes as little surprise that a 3-room HDB resale flat in Bukit Merah was sold for S$910,000 on January 16. With that single transaction, several records were broken at once. It became the most expensive 3-room flat within its project. More importantly, it also became the highest-priced 3-room HDB resale ever recorded in Bukit Merah.

Table of contents

- The S$910,000 record-setter at Tiong Bahru View

- How this compares with Bukit Merah’s previous 3-room record

- Tiong Bahru View has set records before – and it may do so again

- Could a 3-room flat hit S$1 million in 2026?

- A larger MOP supply in 2026 could help ease price pressures

The S$910,000 record-setter at Tiong Bahru View

The record-setting flat is located at Block 10B along Boon Tiong Road, within the Tiong Bahru View development. The unit sits on a high floor, somewhere between the 22nd and 24th storeys, which already places it at an advantage compared to many other 3-room flats in the area.

In terms of size, the unit measures 667 square feet. Based on its transacted price of S$910,000, this works out to approximately S$1,364 psf. For a 3-room HDB flat, that is a striking figure. Yet, buyers appear to have been willing to pay this premium for a combination of factors rather than size alone.

One of the biggest draws is the project’s lease profile. Tiong Bahru View obtained its lease in 2016, which means it still has about 89 years remaining. This healthy lease balance offers long-term security, especially for buyers who are thinking ahead about resale value or future financing options.

Location also plays a major role here. The development sits in a highly connected part of Bukit Merah. From the project, you can reach Tiong Bahru MRT station via a sheltered walk in about four minutes. In addition, Havelock MRT station is roughly a 10-minute walk away. With two MRT lines within easy reach, daily commuting becomes far more convenient, which clearly adds to the project’s appeal.

Wondering how much your home could sell for in today’s market? Check its value in under a minute with 99.co’s X-Value Tool.

How this compares with Bukit Merah’s previous 3-room record

Before this S$910,000 transaction, the 3-room price record in Bukit Merah was held by a unit at Havelock View. That project sits along Havelock Road and is located just about seven minutes away from Tiong Bahru View on foot.

Back in July last year, a 3-room unit there was sold for S$860,000. That flat was actually larger, offering around 743 sqft of space. This worked out to about S$1,157 per square foot.

In absolute terms, the new S$910,000 record is S$50,000 higher than the previous high. That translates to an increase of roughly 5.8%. While that may not sound dramatic at first, it is significant when you consider that both units are located within the same town and are relatively close to each other.

This trend is also visible in current asking prices. Based on active listings on 99.co, 3-room units at Havelock View are currently available from about S$728,000 onwards. In contrast, the lowest asking prices for similar units at Tiong Bahru View start much higher, at around S$868,000.

One reason for this price gap could be proximity to transport. While Havelock View is still within walking distance of MRT stations, it generally requires a slightly longer walk compared to Tiong Bahru View. For some buyers, an extra five or six minutes on foot may not matter much. However, for others, especially those who commute daily, that difference clearly carries value.

As a result, if you are looking for a 3-room flat in Bukit Merah and are more price-sensitive, Havelock View could offer a more accessible entry point. You may trade off a bit of convenience, but you could also save over S$100,000 in the process.

Tiong Bahru View has set records before – and it may do so again

This is not the first time Tiong Bahru View has made headlines for record-breaking resale prices. In fact, the project has consistently pushed boundaries across different flat types.

Earlier, in March 2024, a 5-room flat within the development was sold for S$1.588 million. At that time, it became the most expensive HDB resale flat ever recorded in Singapore. Since then, several other high-value transactions have followed, all involving 5-room units within the same project:

| Date | Address | Floor | Price | Price (psf) |

| Jun 2024 | 9B Boon Tiong Road | 34–36 | S$1.588M | S$1,316 |

| Sep 2025 | 9A Boon Tiong Road | 31–33 | S$1.58M | S$1,310 |

| Jul 2025 | 9A Boon Tiong Road | 19–21 | S$1.568M | S$1,300 |

| Aug 2025 | 9A Boon Tiong Road | 25–27 | S$1.528M | S$1,266 |

| Mar 2024 | 9A Boon Tiong Road | 19–21 | S$1.45M | S$1,202 |

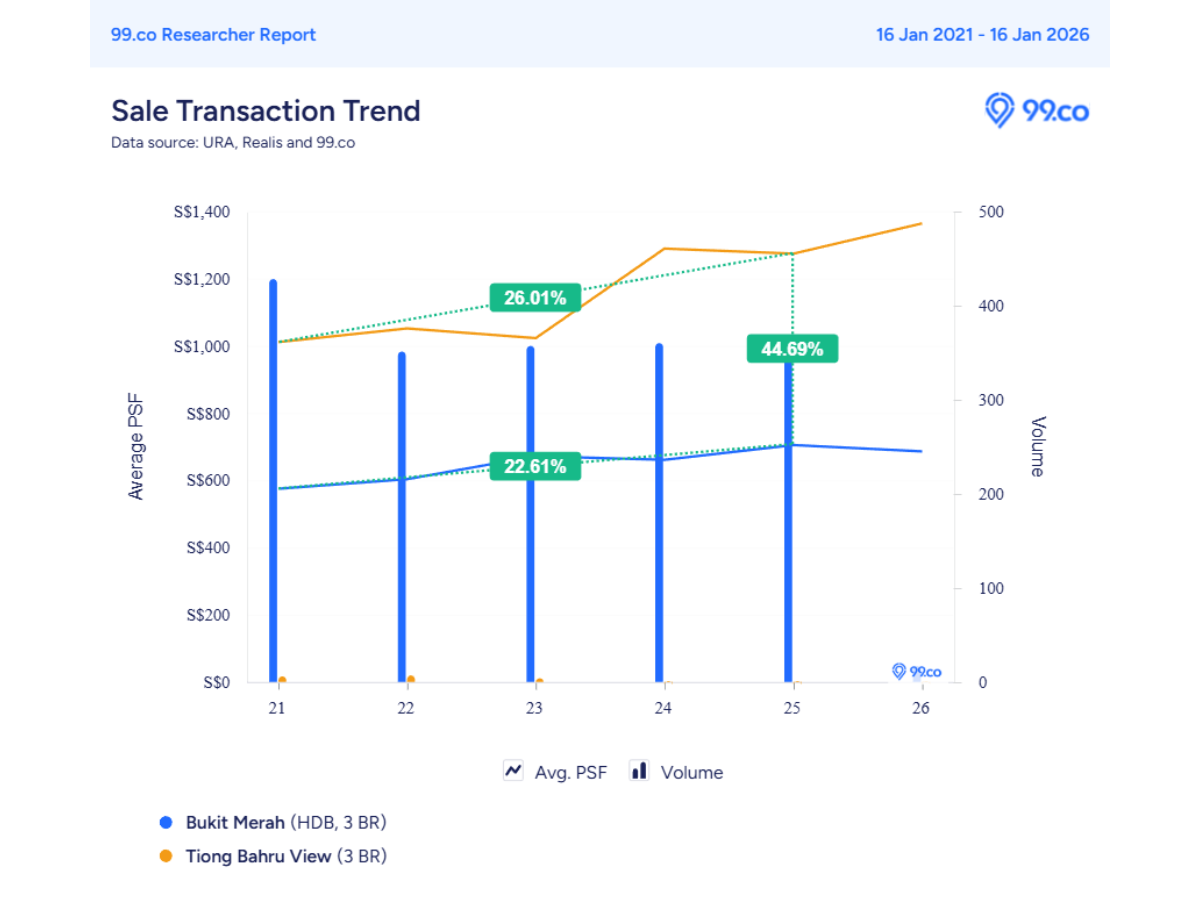

Over the past few years, prices at Tiong Bahru View have shown strong upward momentum.

Looking specifically at 3-room units, the average price per square foot in the project has grown by about 26% over the last four years. During the same period, the wider Bukit Merah market saw 3-room prices increase by around 22.6%.

By 2025, the average psf for 3-room flats at Tiong Bahru View stood at roughly S$1,200. In comparison, the average psf for 3-room units across Bukit Merah was closer to S$705. That is a difference of nearly 45%, which is substantial by any measure.

Even when compared with nearby alternatives, the premium remains clear. For instance, Havelock View’s average psf sits at about S$1,083. While still high, it remains noticeably below Tiong Bahru View’s levels. This suggests that buyers continue to see added value in Tiong Bahru View’s location, design, and overall profile.

Could a 3-room flat hit S$1 million in 2026?

At S$910,000, you might assume that the Bukit Merah transaction is already the most expensive 3-room HDB resale in Singapore. Unfortunately, that is not the case.

The current national record belongs to a 3-room unit at SkyParc @ Dawson, which was sold in April 2025 for S$935,000. That unit was located between the 34th and 36th storeys, within a 43-storey block. It also offered a larger floor area of about 710 square feet, translating to roughly S$1,317 psf.

With prices now approaching the S$1 million mark, the conversation has shifted. What once seemed impossible now feels increasingly realistic, at least for a very select group of flats.

As of January 2026, most 3-room resale flats still transact at an average price of around S$470,000. That means the vast majority of buyers are nowhere near the S$1 million range. However, the current “ceiling” for this flat type is already sitting at S$935,000. From there, the gap to S$1 million is no longer huge.

Some analysts believe that crossing the million-dollar threshold is now a matter of timing rather than feasibility. With annual price growth for prime HDB flats averaging between 3% and 5%, a unit priced at S$935,000 would only need about a 7% increase to reach S$1 million. Under these conditions, that could happen as early as late 2026 or 2027.

If it does happen, most expect it to occur in highly specific locations. Queenstown, especially the Dawson area, remains the top contender, given its track record and central positioning. Bidadari is another area to watch, as newer flats there have already crossed S$900,000 due to their location and modern layouts. Bukit Merah, including projects like City Vue @ Henderson and Tiong Bahru View, also remains firmly in the conversation.

That said, not everyone is convinced that a S$1 million 3-room sale will happen so soon. Some analysts point out that moving from S$900,000 to S$1 million is not just a numerical jump. It is also a psychological barrier. Buyers of 3-room flats are often singles or small households, many of whom operate with tighter budgets. A seven-figure price tag could require significant cash outlay, which may limit the pool of willing buyers.

A larger MOP supply in 2026 could help ease price pressures

While headline prices often draw the most attention, it is also important to look at what is coming next. One key factor worth noting is the number of flats reaching their Minimum Occupation Period (MOP) in 2026.

More than 13,400 flats are expected to reach MOP next year, which is almost double the number seen in 2025. This increase matters because it introduces more relatively young flats into the resale market. As supply rises, buyers are likely to have more choices, especially across a wider range of towns and flat types.

With more options available, price growth may become more measured. Instead of buyers feeling pressured to stretch for a small pool of listings, transactions could spread out more evenly. This dynamic can help reduce urgency and bring negotiations back onto steadier ground.

Interested in more All-Time High (ATH) covers? Head on over here!

The post Bukit Merah’s first S$900K 3-room HDB resale – how far is S$1 million? appeared first on .