January 2026 marked a seasonal reset for Singapore’s rental market. Transaction volumes rose across both private and public segments, even as pricing trends began to diverge. Commenting on the latest figures, Mr Luqman Hakim, Chief Data & Analytics Officer at 99.co, noted that the increase was largely driven by the post-holiday completion of deals carried over from December, alongside “the typical start-of-year corporate cycle that brings a fresh wave of expatriates to the city”.

Table of contents

- Condo rental market

- 11.7% jump m-o-m in volumes

- Rental prices increased by 0.6%

- HDB rental market

- Rental activity edged up 6% y-0-y

- Rental prices eased by 0.3% in January

- Market outlook

Condo rental market

11.7% jump m-o-m in volumes

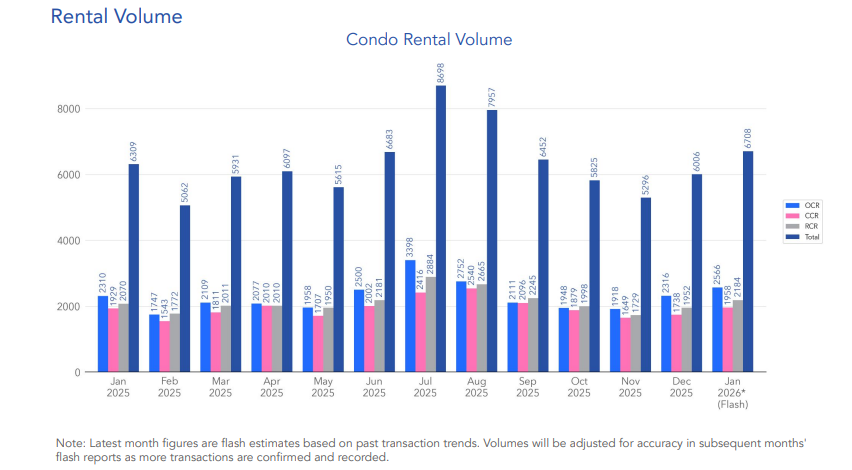

The private rental market started the new year on firmer footing, following a softer period in the fourth quarter of 2025. Compared to last December, condo rental volumes rose 11.7%. An estimated 6,708 units were rented in January, compared to 6,006 in December. Volumes were also 6.3% higher than a year ago, although they came in 0.6% below the five-year average for January.

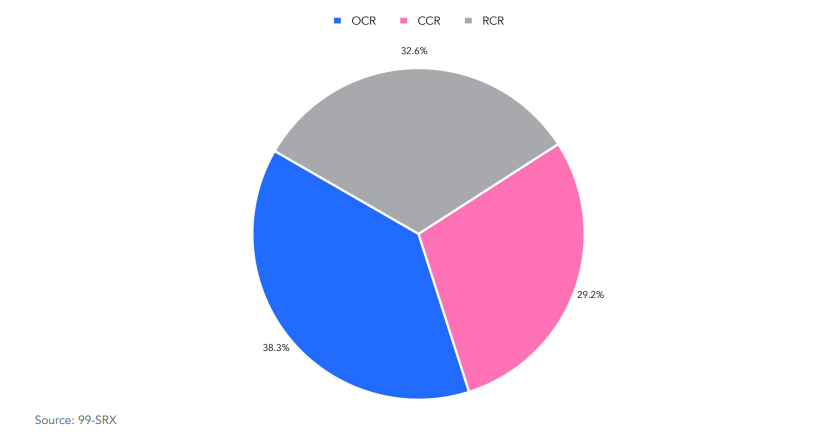

In terms of distribution, 38.3% of transactions took place in the Outside Central Region (OCR), 32.6% in the Rest of Central Region (RCR), and 29.2% in the Core Central Region (CCR). This spread suggests that tenants continue to seek value and space in city fringe and suburban locations, even as prime districts hold their appeal.

Mr Luqman also noted that part of the surge in activity may have come from tenants who had adopted a wait-and-see approach in 2025, hoping for a price correction. As the Lunar New Year lull approached, many likely decided to move ahead and secure a home rather than delay their plans further.

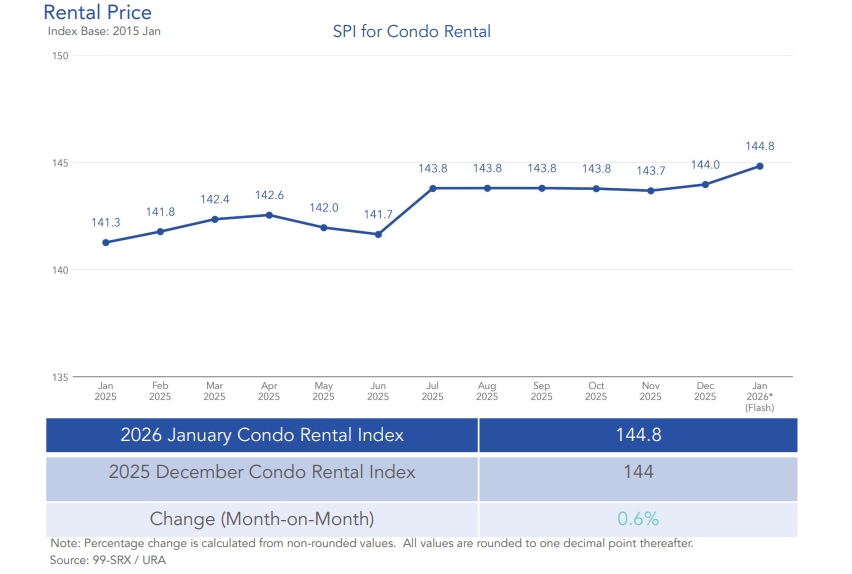

Rental prices increased by 0.6%

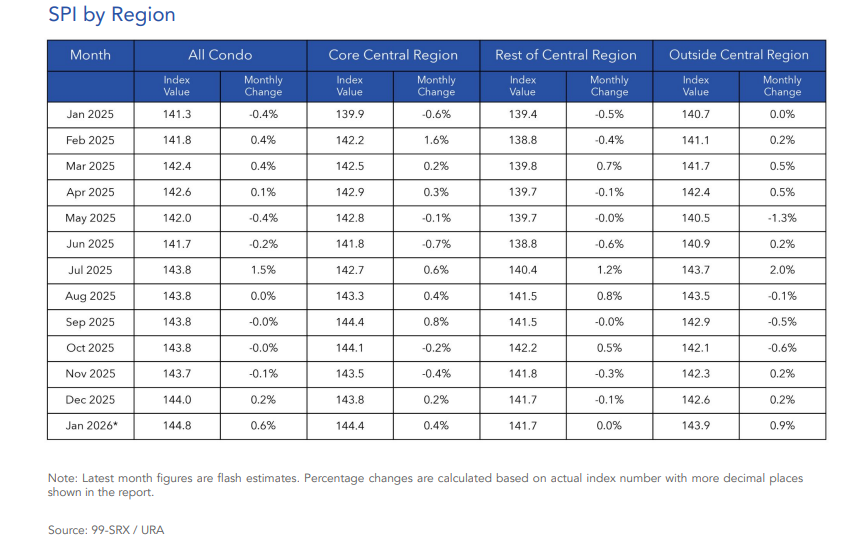

Rental prices, on the other hand, rose at a more measured pace compared to the sharper increase in volumes. Overall condo rental prices increased by 0.6% month-on-month, with the rental index rising from 144.0 in December 2025 to 144.8 in January 2026. On a year-on-year basis, prices were 2.5% higher than in January 2025.

Regionally, price movements varied. The OCR led gains with a 0.9% increase, followed by a 0.4% rise in the CCR. The RCR remained stable compared to the previous month. Over the past year, CCR rents climbed 3.2%, while RCR and OCR recorded increases of 1.7% and 2.2%, respectively.

Overall, the upward trend in January 2026 reflects timing and seasonality rather than a sudden surge in underlying demand. Still, the steady price growth shows that landlords retain pricing power in the private segment.

HDB rental market

Rental activity edged up 6% y-0-y

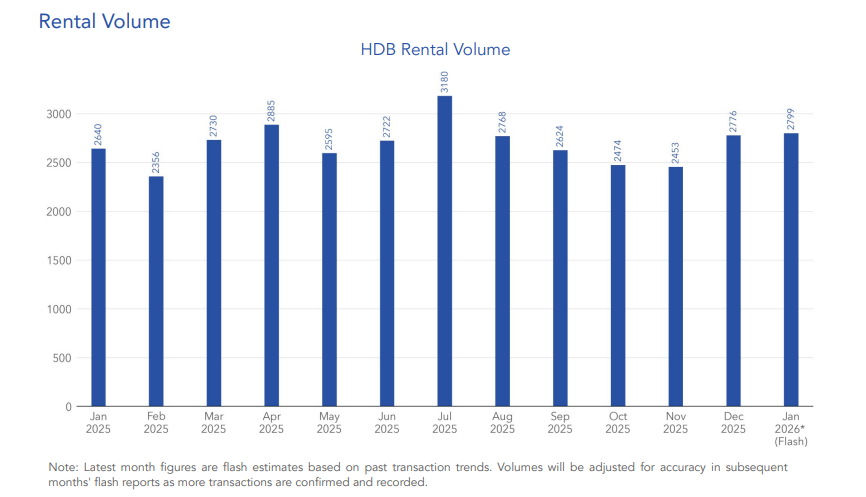

In the public housing segment, leasing volumes also edged up. An estimated 2,799 HDB flats were rented in January, up 0.8% from 2,776 units in December. Compared to January 2025, volumes rose 6%, though they remained 1.4% below the five-year average for the month.

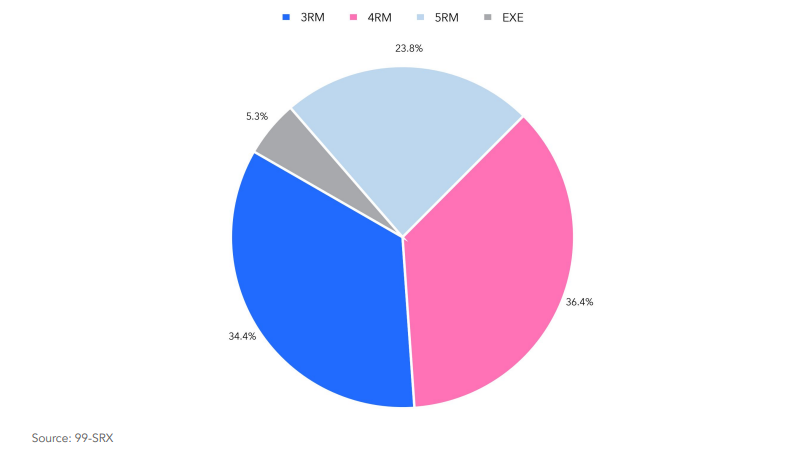

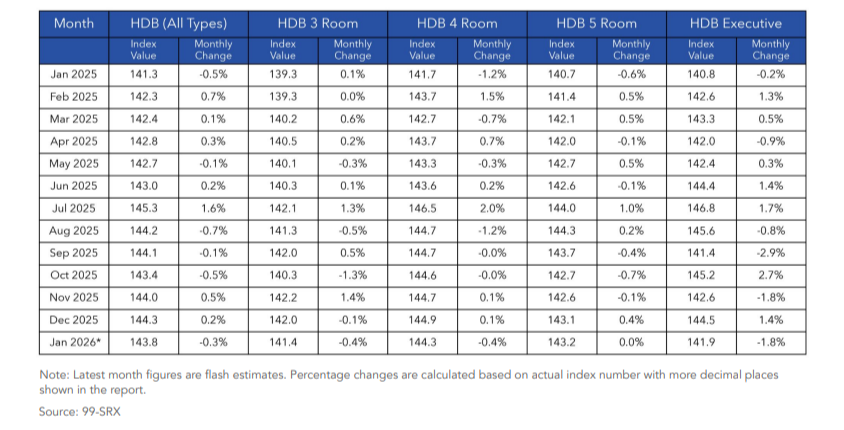

Transaction breakdown by flat type shows that 4-room flats accounted for 36.4% of total rental volume, followed by 3-room flats at 34.4%, 5-room flats at 23.8%, and Executive flats at 5.3%. This mix reinforces the central role of 3- and 4-room units in the public rental market, particularly among families and budget-conscious tenants.

Rental prices eased by 0.3% in January

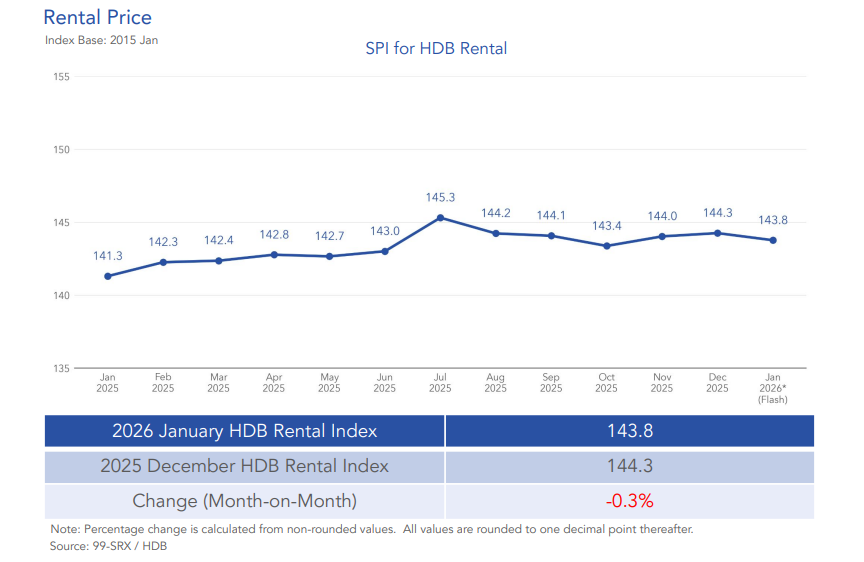

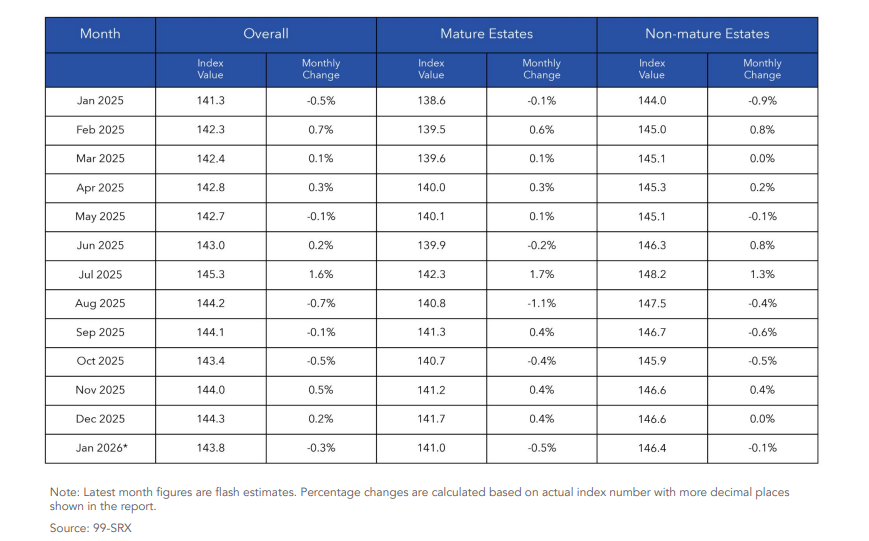

While rental volumes showed an upward trend, the softening in prices points to a structural shift. HDB rental prices fell 0.3% month-on-month in January, with the rental index slipping from 144.3 in December 2025 to 143.8.

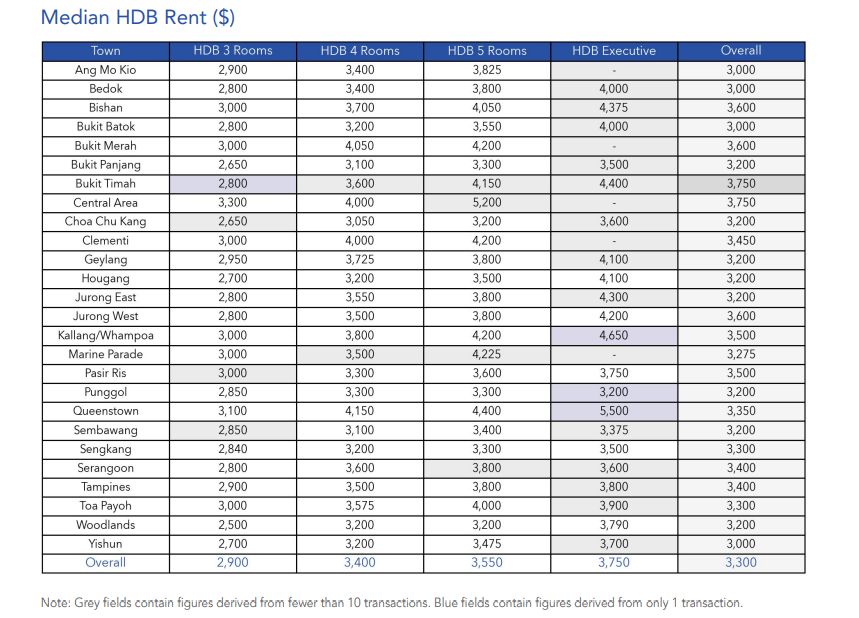

The median HDB rental price in January 2026 is as follows:

As Mr Luqman observed, “the most notable shift occurred in the public housing market”. He attributed this to the significant 2026 MOP wave, with an estimated 13,484 flats reaching their five-year Minimum Occupation Period, nearly double the previous year’s figure. “The resulting influx of supply likely intensified competition among landlords,” he added.

In January 2026, both Mature and Non-Mature estates recorded declines of 0.5% and 0.1%, respectively. By flat type, rents for 3-room and 4-room flats each eased by 0.4%, while Executive flats saw a sharper 1.8% drop. Only 5-room flats held steady.

Despite the monthly dip, prices remain higher than a year ago. Overall HDB rental prices rose 1.7% year-on-year. Both Mature and Non-Mature estates posted identical annual growth of 1.7%. By flat type, 4-room flats led with a 1.9% increase, followed by 5-room flats at 1.8%, 3-room flats at 1.5%, and Executive flats at 0.7%.

Market outlook

January’s data highlights a clear divergence between the private and public segments. In the condo market, stronger leasing activity translated into modest price growth. In contrast, the HDB market saw higher volumes but slightly weaker rents due to a surge in available supply.

Both segments benefited from seasonal factors. Corporate relocations, expatriate arrivals, and deals carried over from December supported transaction numbers. Yet structural forces now play a larger role in shaping prices, especially in the HDB segment.

The sizeable MOP pipeline in 2026 will remain a key variable. “As supply continues to outpace demand in certain HDB towns, bargaining power may gradually shift towards tenants, signalling a move toward longer-term market stabilisation.” Mr Luqman explained. Over in the condo rental market, we may continue to see stable to mildly positive price growth if expatriate demand remains firm and new completions stay manageable.

The post Condo and HDB rental volumes continue an upward trend in January 2026 appeared first on .