1. HDB July 2025 BTO and SBF sales launch Overview:

Overall Launch:

-

A total of flats were launched for sale.

-

This comprises Build-To-Order (BTO) flats and Sale of Balance Flats (SBF) units.

BTO Exercise Details:

-

BTO flats are available across projects.

-

The projects are located in Bukit Merah, Bukit Panjang, Clementi, Sembawang, Tampines, Toa Payoh, and Woodlands.

-

out of BTO flats in this exercise have waiting times of years or less.

-

This includes Shorter Waiting Time (SWT) flats at Bangkit Breeze and Clementi Emerald, with waiting times of less than years.

-

An additional flats at Sembawang Beacon will have a waiting time of years.

-

SBF Exercise Details:

-

SBF units are available island-wide.

-

For buyers looking to move in sooner, (more than one-third) of these SBF flats are already completed.

Subsidy Recovery Rates for Prime Flats:

For Prime Location Public Housing (PLH) flats, buyers will need to pay back a portion of the additional subsidies received when they eventually sell their flats. This is known as the subsidy recovery rate.

-

For recent PLH projects, such as Alexandra Peaks, Alexandra Vista, and Toa Payoh Ascent, the subsidy recovery rate is 11% of the resale price.

-

For Clementi Emerald, the rate is 12%.

This means that when the flat is sold on the open market (after fulfilling the Minimum Occupation Period), the seller needs to return the stated percentage of the resale price to HDB. This policy ensures fairness and keeps these prime flats accessible and affordable for future buyers.

Here’s a quick look at what’s available:

Flat Prices in July 2025 BTO Exercise

| Town | Project | Flat Type | Selling Price (Excl. Grants) |

Selling Price (Incl. Grants) |

Nearby Resale Prices |

|---|---|---|---|---|---|

| Standard Projects | |||||

| Bukit Panjang | Bangkit Breeze~ | 2-room Flexi | From S$149,000 | From S$29,000 | – |

| 3-room | From S$289,000 | From S$184,000 | S$480,000 – S$513,000 | ||

| 4-room | From S$362,000 | From S$282,000 | S$585,000 – S$639,800 | ||

| 5-room | From S$518,000 | From S$463,000 | S$685,000 – S$745,888 | ||

| Sembawang | Sembawang Beacon | 2-room Flexi | From S$148,000 | From S$28,000 | S$338,000 – S$395,000 |

| 3-room | From S$267,000 | From S$162,000 | S$510,000 – S$548,888 | ||

| 4-room | From S$328,000 | From S$248,000 | S$570,000 – S$690,000 | ||

| 5-room | From S$487,000 | From S$432,000 | S$745,000 – S$830,000 | ||

| 3Gen | From S$497,000 | From S$442,000 | – | ||

| Tampines | Simei Symphony | 2-room Flexi | From S$193,000 | From S$73,000 | – |

| 4-room | From S$529,000 | From S$449,000 | S$648,000 – S$715,000 | ||

| 5-room | From S$658,000 | From S$603,000 | S$712,000 – S$888,000 | ||

| Woodlands | Woodlands North Grove | 2-room Flexi | From S$160,000 | From S$40,000 | S$370,000 – S$400,000 |

| 3-room | From S$305,000 | From S$200,000 | S$520,000 – S$540,000 | ||

| 4-room | From S$388,000 | From S$308,000 | S$660,000 – S$720,000 | ||

| 5-room | From S$517,000 | From S$462,000 | S$755,888 – S$825,000 | ||

| Prime Projects | |||||

| Bukit Merah | Alexandra Peaks / Alexandra Vista | 2-room Flexi | From S$205,000 | From S$85,000 | – |

| 3-room | From S$403,000 | From S$313,000 | S$628,000 – S$838,000 | ||

| 4-room | From S$547,000 | From S$492,000 | S$970,000 – S$1,155,000 | ||

| Clementi | Clementi Emerald~ | 2-room Flexi | From S$214,000 | From S$94,000 | – |

| 3-room | From S$388,000 | From S$298,000 | S$775,000 – S$840,000 | ||

| 4-room | From S$562,000 | From S$507,000 | S$963,000 – S$1,130,888 | ||

| Toa Payoh | Toa Payoh Ascent | 2-room Flexi | From S$212,000 | From S$92,000 | – |

| 3-room | From S$406,000 | From S$316,000 | S$780,000 – S$830,000 | ||

| 4-room | From S$583,000 | From S$528,000 | S$1,070,000 – S$1,170,000 | ||

2. Deferred Income Assessment is now available

First off, this launch will be the first time HDB is offering the Deferred Income Assessment option. This is especially helpful if you’re a young couple – where one of you is a recent graduate or just completed National Service (NS). If you’ve met the eligibility conditions within the 12 months before applying for your HDB Flat Eligibility (HFE) letter, you can now request to have your income assessed closer to your key collection date.

This assessment determines your eligibility for the Enhanced CPF Housing Grant (EHG) and how much you can borrow through the HDB loan. To qualify for this deferment, at least one of you must be under 30, and either a full-time student or NS man who just finished service or studies. Plus, one of you must be a first-timer, and you’ll need to apply as a married couple or under the Fiancé/Fiancée Scheme.

The key benefit here? You might qualify for a higher housing loan later – especially useful if you’re looking at Plus or Prime flats, which tend to be more expensive. But don’t forget, it’s always wise to plan based on conservative income estimates, even with this new flexibility.

Please note: Deferred Income Assessment now requires only one party to be a recent graduate or NSman for grant eligibility (previously it was both).

2. Shortlisting quotas have been tightened

Another change that you’ll want to be aware of is how shortlisting works. In previous BTO launches, the number of shortlisted applicants could go up to 300% of the units available. But starting from this launch, that’s been reduced to 200%.

What this means for you: fewer queue numbers will be issued. However, if you do get shortlisted, your chances of selecting a unit will be much higher. If you aren’t selected, you’ll know sooner and can move on to other options without having to wait unnecessarily.

3. Expect shorter wait times for some projects

For those of you eager to move into your new home quickly, here’s something else to look forward to.

About 3,800 flats in 2025 will come with a Shorter Waiting Time (SWT) – meaning you could get your keys in less than 3 years.

That’s nearly one-fifth of all HDB flats for 2025, and it’s a step up from the 2,876 SWT flats launched in 2024. If a faster move-in timeline is your priority, make sure to check which projects are part of this category before balloting.

4. Another Sale of Balance Flats (SBF) exercise will run concurrently

You’ll also have another option during this period: a Sale of Balance Flats (SBF) exercise will be held at the same time.

Around 3,000 balance flats will be offered, including completed units or those already under construction. These are perfect for those of you with immediate housing needs.

This is the second SBF exercise in 2025, and it brings the total for the year to about 10, 200 flats – the largest supply since 2017. Earlier in February, there were 5,590 SBF units released, and those saw over 22,000 applications. The high demand could be why HDB has brought the second SBF round back.

Looking ahead, HDB has also announced a third SBF exercise to be held in October 2025, adding even more balance flats for those who may have missed out earlier in the year, making 2025 an unprecedented year for SBF supply.

The pricing for these SBF flats will be as follows:

| Flat Type | Selling Prices (Before EHG) | Selling Prices (After EHG ) |

|---|---|---|

| Community Care Apartment (CCA) (30-year Lease) | From S$81,000 | From S$5,000 * |

| 2-room Flexi (99-year / Remaining Lease) | From S$111,000 | From S$6,000 * |

| 3-room | From S$163,000 | From S$58,000 |

| 4-room | From S$224,000 | From S$144,000 |

| 5-room | From S$351,000 | From S$296,000 |

| 3Gen | From S$524,000 | From S$469,000 |

| Executive | From S$645,000 | From S$645,000 |

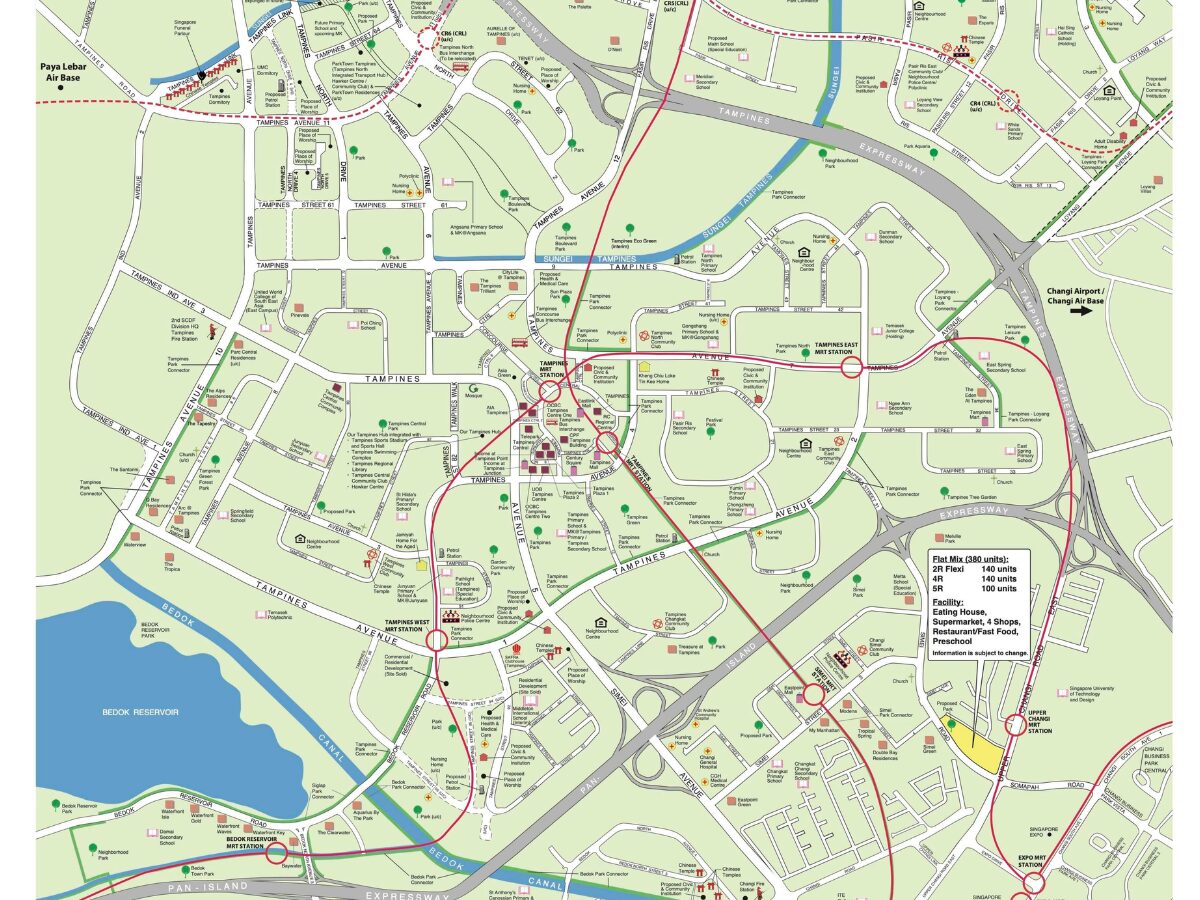

5. Simei to see its first BTO project in over 10 years

Although it’s officially listed under Tampines, this BTO project sits much closer to Simei itself – and it’s the first time in over a decade that the area is getting a launch. Around 380 units of 2-room Flexi, 4-room, and 5-room flats will be available.

What makes this site appealing is its proximity to Upper Changi MRT, with Simei MRT also nearby. You’ll also be close to Singapore Expo, SUTD, and a mix of food, schools, and everyday amenities – including a preschool, supermarket, and fast food outlets. This one’s likely to be classified as a Standard flat.

6. Family Care Scheme to replace existing Priority Schemes from mid-2025

Singles will finally be given priority when applying for BTO flats to live with or near their parents – a shift from the current system that favours only married children. This is part of the new Family Care Scheme (FCS), which will be introduced in two phases.

Currently, priority access is limited to married children through three schemes: the Married Child Priority Scheme (MCPS), Senior Priority Scheme (SPS), and Multi-Generation Priority Scheme (MGPS). MCPS helps married children live near their parents, SPS supports seniors aged 55 and above who are applying for a 2-room Flexi flat, and MGPS allows two related households to apply for flats in the same BTO project.

With the introduction of FCS, all three schemes will be replaced. Under this new approach, both married and single children will be able to apply for new flats with their parents or near them, and still receive priority access. The scheme will apply to parents and their children across different household types and aims to better support intergenerational living needs.

While it hasn’t been confirmed whether the July BTO 2025 launch will be the first to implement the new scheme, the timeline suggests it’s possible. Since the rollout is expected to begin from mid-2025, this upcoming launch may mark the start of the FCS – though applicants will need to wait for final confirmation from HDB.

7. More options for Singles and larger households

If you’re applying as a single, you now have more choices than before. Since the October 2024 BTO launch, singles have been allowed to apply for 2-room Flexi flats in mature estates – not just in non-mature ones. This opens up access to more central and desirable locations across Singapore.

But that’s not all. The July BTO 2025 launch also caters to larger households. This time, you’ll find a good number of multi-generation flats (3Gen units) available, which is ideal if you’re planning to live with your parents or have a bigger family under one roof.

Previously, second-timer families were allocated up to 15% of 3-room and larger BTO flats in non-mature estates and up to 5% in mature estates. To better support their upgrading aspirations and right-sizing plans, HDB has increased the allocation quota for second-timer families by 5 percentage points. This means they can now access up to 20% of such flats in non-mature estates and up to 10% in mature estates.

8. Fresh Start Housing Grant (FSHG): Enhanced support for second-timer families

To strengthen support for families seeking a new start in public housing, the Fresh Start Housing Grant (FSHG) has been increased to $75,000, up from the previous grant amount of $50,000. This initiative specifically targets second-timer families who previously owned subsidised HDB flats and are now looking to purchase a new home under the Fresh Start Housing Scheme.

Under the updated scheme:

-

Families will receive $60,000 when they collect the keys to their new flat, providing an immediate boost to help with their housing costs.

-

The remaining $15,000 is disbursed in equal annual installments over five years. This phased support encourages long-term stability and helps families to settle smoothly into their new homes.

The enhancements to the FSHG are designed to make public housing more accessible for families who are rebuilding their lives, offering both immediate financial relief and continued assistance during their resettlement journey.

9. New BTO exercise in October 2025

Looking ahead, HDB will launch approximately 9,100 new BTO flats across eight towns in October 2025. This will be one of the largest releases for the year. The upcoming projects will be located in Ang Mo Kio, Bedok, Bishan, Bukit Merah, Jurong East, Sengkang, Toa Payoh, and Yishun, offering a wide spread of choices across both mature and non-mature estates.

Notably, the launch will also feature Singapore’s fifth Community Care Apartment (CCA) project, this time in Sengkang, continuing efforts to provide integrated living options for seniors who prefer to age in place with access to care services.

To be eligible to apply, all prospective buyers must have a valid HDB Flat Eligibility (HFE) letter, with documents submitted before the 15 September 2025 deadline. If you’ve missed out in earlier exercises, this launch offers another opportunity to secure a home in a location that meets your lifestyle and future planning needs.

The October launch will also mark part of HDB’s broader plan to roll out 102,300 BTO flats between 2021 and 2025, reinforcing the government’s commitment to keeping public housing accessible and responsive to evolving household needs.

Planning to apply for the July 2025 BTO? We’ve broken down everything you need to know – all in one place.

The post July BTO 2025: HDB Launches 10,209 Flats in the July 2025 BTO and SBF Sales Exercises appeared first on .