Woodlands has reached a new all-time high in the HDB resale market, with an executive flat changing hands for S$1.27 million. It is the first time a flat in the town has crossed the S$1.2 million mark, underscoring the continued demand for spacious executive units despite their ageing leases.

Table of contents

- Record S$1.27M for executive flat along Woodlands St 82

- First HDB flat in Woodlands to fetch above S$1.2M

- Executive flats vs. big condo units in Woodlands

- What’s behind the price surge?

Record S$1.27M for executive flat along Woodlands St 82

The record-breaking transaction took place at 850 Woodlands Street 82, where an executive flat was sold for S$1.27 million (S$667 psf). The deal was registered on 3 October 2025. Sized at 1,905 sqft and occupying the 10th to 12th storeys, the unit offers the kind of space few HDB flats today can match.

With a lease that began in 1995, the flat has about 68 years and 9 months left. While some may question paying over a million dollars for a unit with less than 70 years remaining, the rarity of such flats keeps demand high. As HDB has long ceased building this category, buyers are willing to pay a premium for the space and flexibility they provide.

Curious if your home could be a million-dollar resale? Check its value in under a minute with 99.co’s Property Value Tool.

First HDB flat in Woodlands to fetch above S$1.2M

This marks the first time a flat in Woodlands has crossed the S$1.2 million threshold. The previous record was set just months earlier, when another executive flat at 816 Woodlands Street 82 fetched S$1.19 million (S$625 psf) in June. Both units are similar in size and layout, and are located within walking distance of each other. However, the Block 816 unit comes with a slightly shorter lease, which began in 1994.

Before these two transactions, the previous town record stood at S$1.155 million (S$606 psf), set in October 2024. That unit, also located at 816 Woodlands Street 82, shared the same size and layout as the others. At the time of sale, it had a remaining lease of 69 years and 3 months.

Woodlands’ most expensive HDB flats

| Transaction Date | Address | Type | Storey | Area (sqft) | PSF | Price |

|---|---|---|---|---|---|---|

| 03/10/25 | 850 Woodlands Street 82 | Executive | 10 to 12 | 1,905 | S$666 | S$1,270,000 |

| 26/06/25 | 816 Woodlands Street 82 | Executive | 10 to 12 | 1,905 | S$624 | S$1,190,000 |

| 01/10/24 | 816 Woodlands Street 82 | Executive | 10 to 12 | 1,905 | S$606 | S$1,155,000 |

At present, the top three HDB resale transactions in Woodlands all come from these large executive flats within the same estate. Like in many other HDB towns, the highest resale prices in Woodlands are set by executive flats, which remain scarce in supply but highly attractive to buyers seeking extra space.

The scarcity of executive flats

According to the latest HDB annual report, there are around 6,100 executive flats (including 3Gen), making up only around 9% of all HDB flats in Woodlands. This scarcity alone sets them apart from the entire segment, but layout plays an equally important role. Executive flats often feature an extra space next to the living room that can be repurposed into a study, balcony, or helper’s room with some simple adjustments.

This added flexibility has proven timeless. From creating a dedicated work-from-home corner to carving out a more open entertainment area, these flats offer room to adapt to changing lifestyles. For many buyers, the ability to customise on top of a generous living space more than justifies the higher price.

Executive flats vs. big condo units in Woodlands

When it comes to size, few HDB options come close to executive flats. Even the newer 5-room layouts fall short. Buyers seeking comparable space often look towards the private market instead — but at a much steeper price.

As of early October 2025, resale non-landed private homes larger than 1,500 sqft in Woodlands averaged around S$960 psf. In contrast, executive flats transacted at about S$555 psf. To put it into perspective, the S$1.27 million record flat would have cost more than S$1.8 million if it were a private unit of the same size.

It’s also worth noting that many of these bigger private homes are not new either. For example, Woodgrove Condominium (TOP 1999) saw a similarly sized unit change hands in January for S$1.95 million (S$985 psf). With its 99-year lease starting in 1997, the remaining tenure is not far off from the executive flats, making the latter seem all the more attractive value-wise.

Price growth in the last 5 years

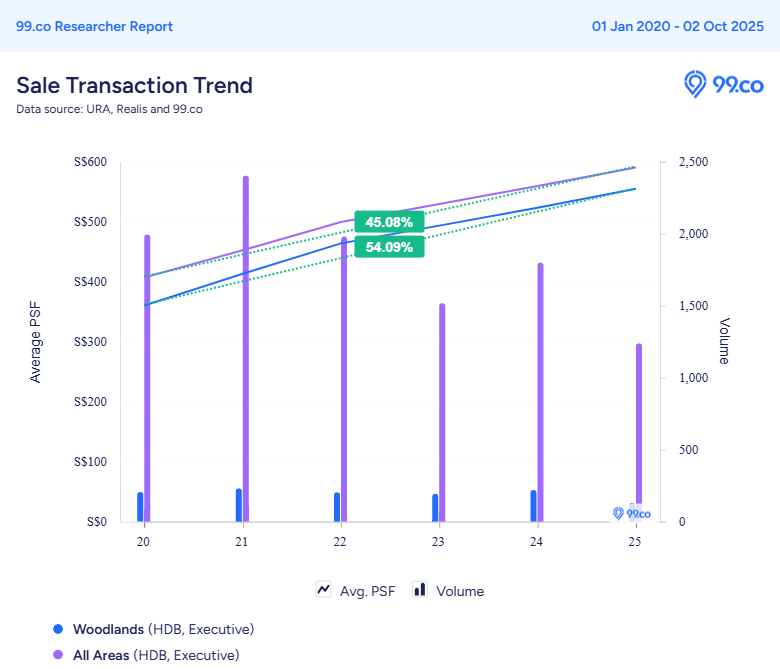

Executive flats in Woodlands have appreciated by 54% over the past five years. This rate of growth is faster than the 45% increase seen nationwide for the same flat type.

Interestingly, this growth also outpaces the private condominium market in Woodlands. Larger non-landed homes above 1,500 sqft have seen prices rise by 48% since 2020. The gap is even wider compared to the national average, where spacious private homes only gained 32% in the same period.

What’s behind the price surge?

Woodlands’ HDB resale market is heating up faster than expected. In just four months, the town’s price record jumped from S$1.19 million in June to S$1.27 million in October — a 7% climb that usually plays out across a full year. On average, executive flats in Woodlands have grown by about 6% annually since 2022, making this recent jump all the more notable.

A major reason lies in the upcoming Johor Bahru–Singapore Rapid Transit System (RTS) Link. Expected to open by the end of 2026, the link will connect Woodlands North directly to Bukit Chagar in Johor Bahru in just five minutes.

Read more: Transforming Woodlands: Singapore’s northern gateway is all set for major development

For residents, the RTS means faster commutes and greater convenience. For investors, it represents stronger rental demand as cross-border commuters look to live nearby. Woodlands, often seen as far-flung, will suddenly become a gateway for both work and lifestyle across two countries.

This shift could further lift property values. With connectivity set to improve drastically, Woodlands may transform from a fringe town into a highly strategic location. Executive flats, with their size and scarcity, are well placed to benefit most.

Wrapping up

The S$1.27 million record for the executive flat shows that buyers continue to place strong value on space and flexibility, even when leases are shorter. Against the national record for executive flats, this sale is still way below the S$1.588 million record in Bishan. However, with the RTS Link on the horizon, the town is likely to see further upward momentum. It would not be surprising if more Woodlands executive flats dominate the upper tier of the HDB resale market in the years ahead.

Interested in more All-Time High (ATH) covers? Head on over here!

The post Woodlands executive HDB flat sets town’s new high at S$1.27 million appeared first on .