The HDB resale market recorded another month of steady performance in November 2025. Although the price increase was modest, the data continued to reflect stability across various room types and estates. According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, this gradual upward movement aligns with the broader resilience of the market, even as shifting interest rates and ongoing policy adjustments shaped buyer behaviour.

Demand has remained firm, particularly for renovated units and flats located close to MRT stations and schools. These attributes continue to influence purchasing decisions and have helped support overall price levels throughout the year.

Table of contents

- Prices rose moderately, with gains across most room types

- Year-on-year price trend

- Resale volumes rebounded, but context matters

- Breakdown by room type

- Breakdown by estate type

- The highest transacted flats of the month

- Million-dollar flat market remains strong

- Where were these flats located?

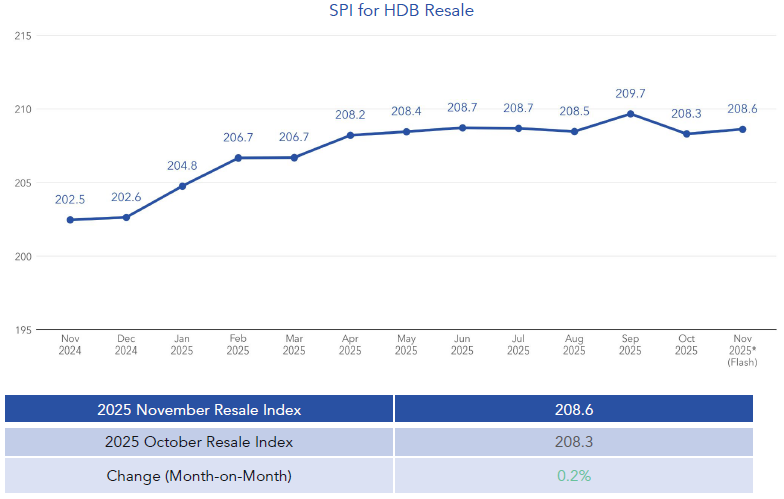

Prices rose moderately, with gains across most room types

HDB resale prices in November rose by 0.2%, signalling continued market stabilisation after a softer October. Both Mature and Non-Mature Estates recorded increases as well. Mature Estates led with a 0.6% rise, while Non-Mature Estates saw a smaller increase of 0.1%. This difference reflects the ongoing preference for more established areas that offer stronger connectivity and a wider range of amenities.

By room type, most flat categories experienced monthly gains. 3-room flats rose by 0.3%, 4-room flats strengthened by 0.7%, and Executive flats climbed 1.3%. The only category that declined in November was the 5-room segment, which saw a 0.6% drop.

Year-on-year price trend

On a year-on-year basis, overall resale prices rose 3% compared to November 2024. All room types recorded annual increases. 3-room flats increased by 2.6%, 4-room flats grew by 3.2%, 5-room flats rose by 3.6%, and Executive flats posted the strongest annual growth at 6.9%, supported by consistently strong demand for larger layouts.

Prices also climbed across both estate categories, with Mature Estates up 3.5% and Non-Mature Estates rising 3.3% from a year ago.

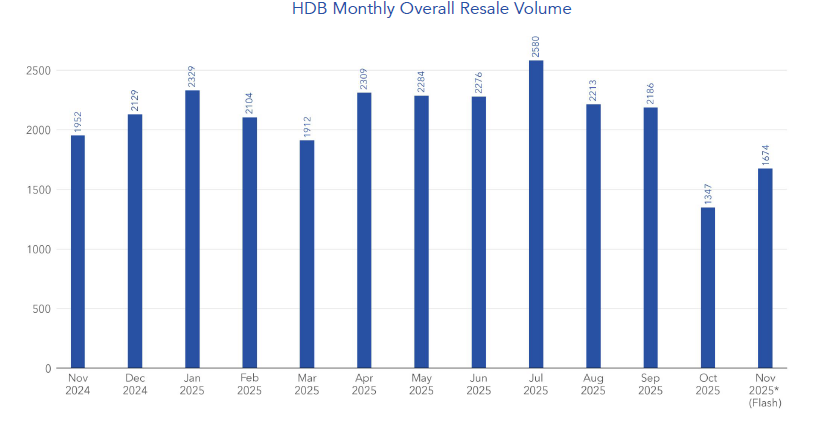

Resale volumes rebounded, but context matters

A total of 1,674 resale flats were transacted in November 2025, representing a 24.3% increase from October. At first glance, this suggests a sharp rebound in activity. However, as Mr. Luqman noted, October’s unusually steep drop of 38.4% makes November’s increase appear more dramatic than it truly was. In reality, volumes simply returned to a more typical level.

Despite the month-on-month rise, resale volumes were still 14.2% lower than November 2024. This points to a more selective buyer pool amid evolving affordability considerations and fluctuating market conditions.

Breakdown by room type

In terms of distribution, 3-room flats made up 27% of November’s transactions. 4-room flats accounted for the largest share at 45.5%, reflecting their balance of space, price, and availability. 5-room flats represented 22.2% of sales, while Executive flats formed the remaining 5.3%.

Breakdown by estate type

Non-Mature Estates accounted for 57% of all transactions, while Mature Estates made up the remaining 43%. This split is consistent with the broader trend of buyers exploring more cost-friendly options in Non-Mature towns.

The highest transacted flats of the month

Several high-value transactions continued to draw attention in November.

The highest transacted flat for the month was a 5-room unit at Natura Loft, which sold 1for S$1,632,000. Natura Loft has consistently attracted strong interest due to its central location and contemporary design, making it a frequent contender for the highest transaction each month.

In Non-Mature Estates, the most expensive flat sold was an Executive unit along Yishun Avenue 4, which achieved a price of S$1,288,000. This highlights the growing appeal of larger flats in areas outside the central region, especially when these units offer space, modern layouts, and desirable surrounding amenities.

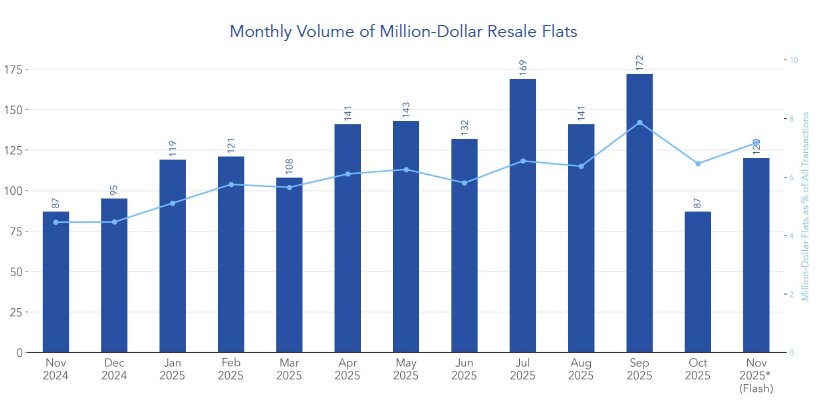

Million-dollar flat market remains strong

The month also saw a continued rise in million-dollar resale transactions. A total of 120 flats sold for at least S$1 million in November, up from 87 in October. This increase was partly supported by the overall volume recovery, but also by steady demand for well-renovated flats in attractive locations. As pointed out by Mr. Luqman, interest in these rare, high-quality homes remains resilient.

Million-dollar flats accounted for 7.2% of all resale transactions in November. This proportion has stayed consistent in recent months, hinting at strong underlying demand for premium HDB options.

Where were these flats located?

Bukit Merah recorded the highest number of million-dollar transactions, with 20 units changing hands in November. This was followed by Toa Payoh with 17 units and Queenstown with 16 units. These estates have long been popular, offering excellent accessibility, mature amenities, and unique flat types that often command higher prices.

The remaining million-dollar transactions were spread across many other towns, including Bishan, Clementi, Kallang/Whampoa, Hougang, Tampines, Bukit Timah, Ang Mo Kio, Geylang, Bedok, Pasir Ris, Sengkang, Yishun, Marine Parade, Central Area, Serangoon, Bukit Batok, Woodlands, and Jurong East. The wide dispersion shows how premium HDB demand is no longer limited to a few estates, but is now present across the island.

Closing observations

As 2025 edges toward its final month, the HDB resale market continues to show resilience. Prices remain stable, volumes are holding at healthy levels, and interest in million-dollar flats is still strong. With demand anchored by location, flat condition, and accessibility, the market remains well-supported despite monthly shifts.

- Sold units are based on the resale registration date. Registered resale applications are generally representative of completed resale transactions. ↩︎

The post HDB resale prices edge up 0.2% in November 2025 as market stabilises appeared first on .