Singapore’s HDB resale market started 2026 on a firmer note, with both prices and transaction volumes rebounding in January after a softer December close. According to Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, the recovery follows a familiar seasonal pattern, as buyer activity typically resumes after year-end holidays and deferred transactions are completed in the new year.

Table of contents

- HDB resale price trend: +1.2% month-on-month

- Resale volumes recover sharply in January 2026

- Million-dollar HDB flats remain a consistent feature

- Market outlook

HDB resale price trend: +1.2% month-on-month

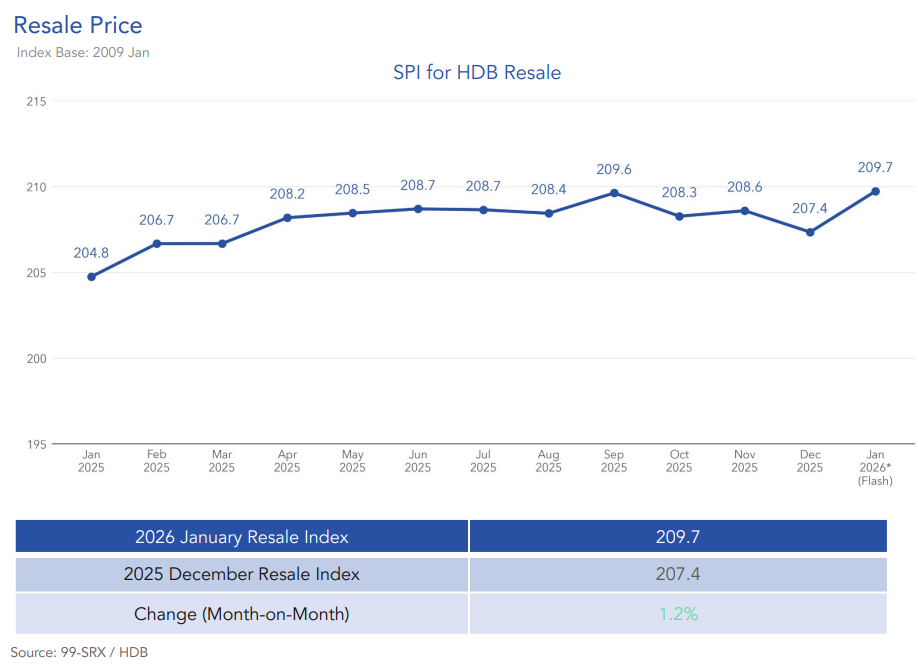

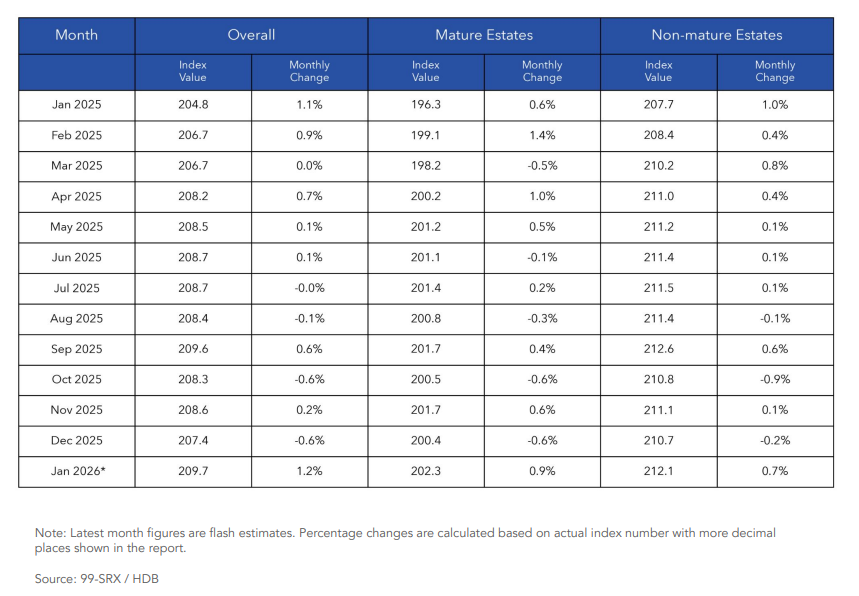

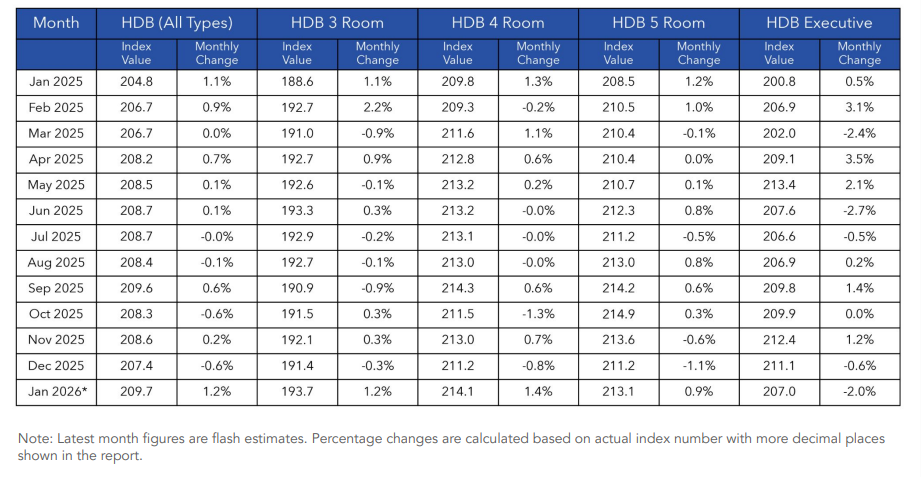

In January 2026, the HDB resale price index rose by 1.2% month-on-month to 209.7, up from 207.4 in December. On a year-on-year basis, prices were 2.4% higher than in January 2025.

Price growth in January was broad-based across locations. Both Mature and Non-Mature Estates recorded month-on-month price increases of 0.9% and 0.7%, respectively, suggesting that the rebound was not concentrated in any single market segment.

By flat type, 3-room flats saw prices increase by 1.2%, 4-room flats recorded the strongest growth at 1.4%, and 5-room flats rose by 0.9%. Executive flats bucked the trend with a 2% decline month-on-month, though this comes after a relatively strong performance in previous months.

When viewed on a year-on-year basis, prices increased across all flat types. 3-room flats rose by 2.7%, 4-room flats by 2.1%, 5-room flats by 2.2%, and Executive flats by 3.1%. Mature Estate prices were 3.1% higher than a year ago, while Non-Mature Estates recorded a 2.1% increase, indicating that price support has remained intact across both established and newer towns.

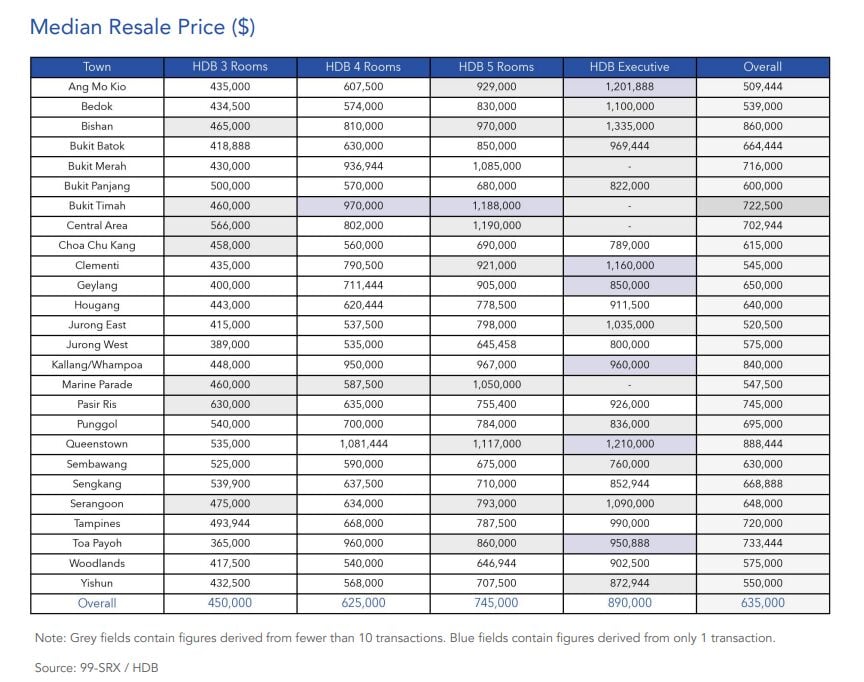

Median HDB resale price in January 2026

Resale volumes recover sharply in January 2026

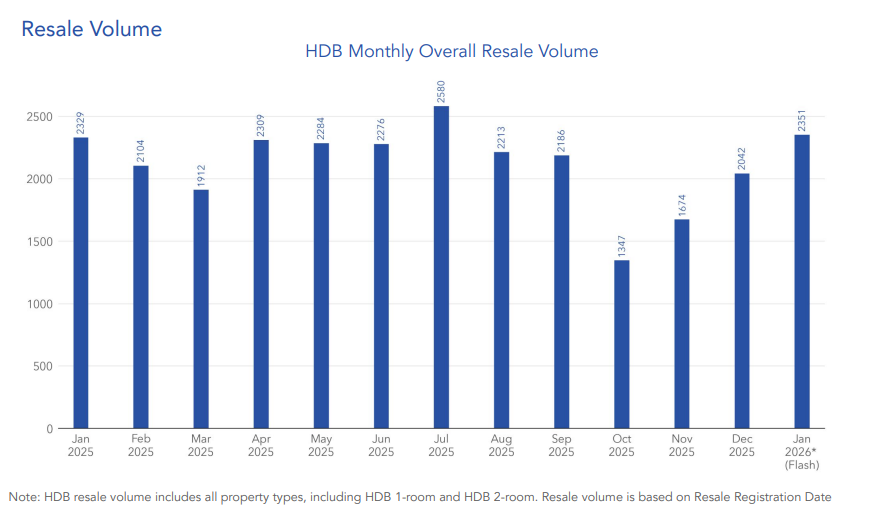

A total of 2,351 HDB resale flats were transacted in January 2026, marking a 15.1% month-on-month rebound from December 2025. This pattern is consistent with historical patterns, as December typically sees fewer transactions due to holidays, longer processing timelines, and buyers postponing decisions to the new year.

On a year-on-year basis, resale volumes were 0.9% higher than in January 2025, reinforcing the view that overall market activity has remained steady rather than accelerating sharply.

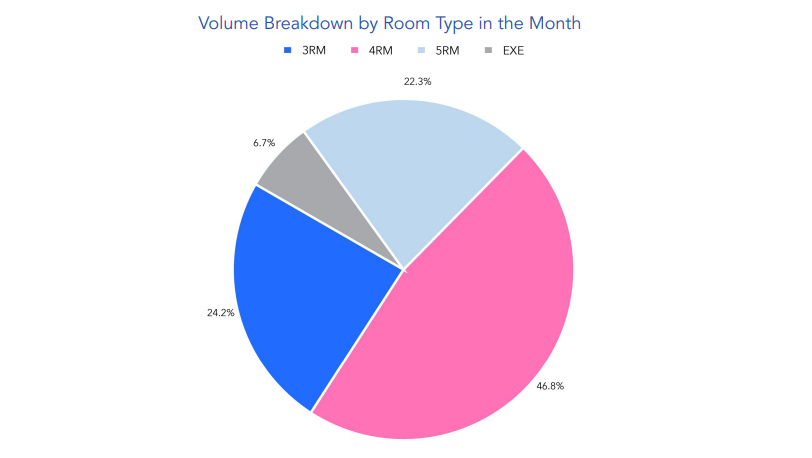

4-room flats continued to dominate resale activity, accounting for 46.8% of all transactions in January. 3-room flats made up 24.2% of resale volume, followed by 5-room flats at 22.3%, and Executive flats at 6.7%. This distribution highlights the continued central role of bigger flats in the resale market, both for family upgraders and first-time buyers who appreciate spacious layouts.

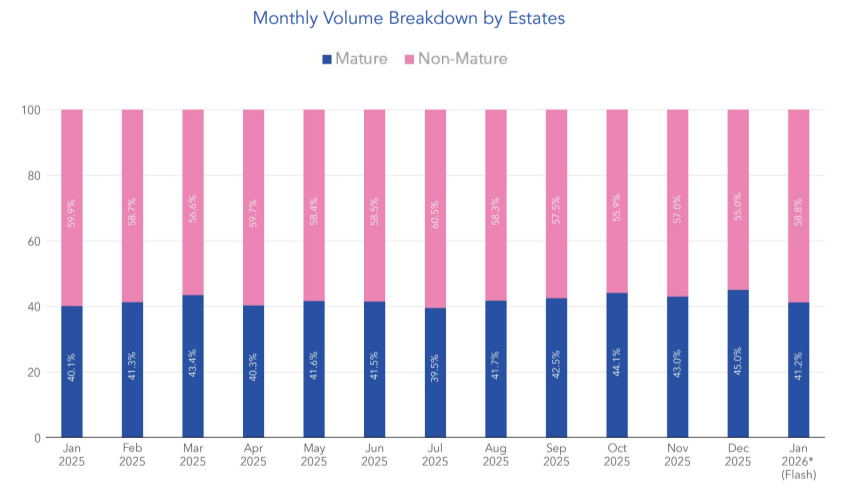

From a geographic perspective, Non-Mature Estates accounted for 58.8% of total resale volumes in January, while Mature Estates contributed 41.2%. This split reflects the larger supply base in Non-Mature towns, as well as affordability-driven demand amid higher overall price levels.

Million-dollar HDB flats remain a consistent feature

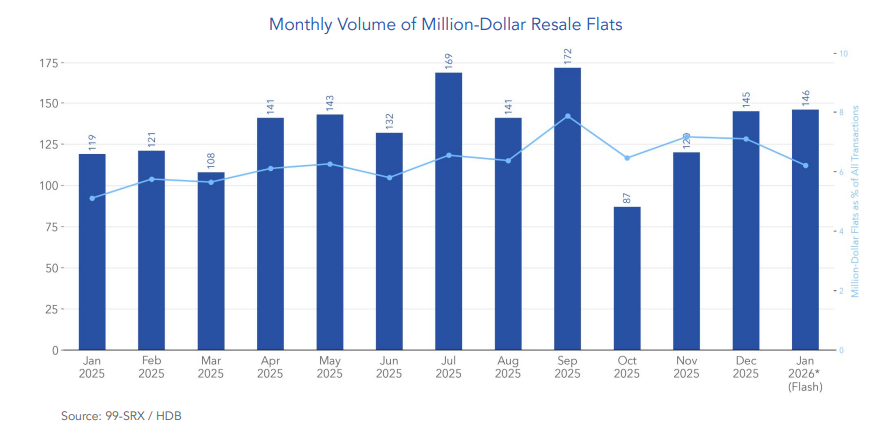

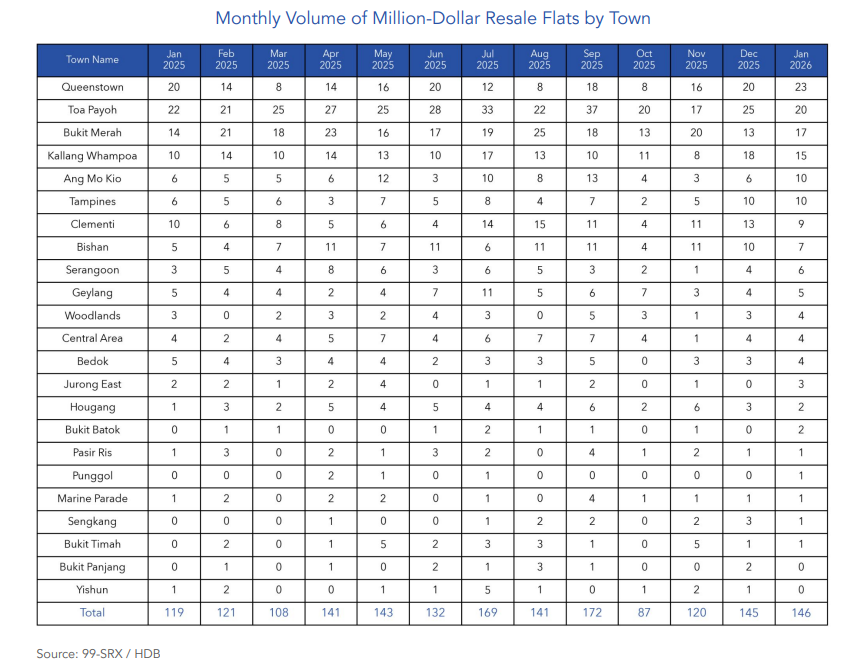

The million-dollar HDB segment continued to hold firm in January. A total of 146 flats were sold for at least S$1 million, slightly higher than the 145 units recorded in December. These transactions accounted for 6.2% of total resale volumes for the month.

Queenstown led all towns with 23 million-dollar transactions, followed by Toa Payoh with 20 units and Bukit Merah with 17 units. Other towns contributing to million-dollar sales included Kallang/Whampoa, Ang Mo Kio, Tampines, Clementi, Bishan, Serangoon, Geylang, Woodlands, Central Area, Bedok, Jurong East, Hougang, Bukit Batok, Pasir Ris, Punggol, Marine Parade, Sengkang, and Bukit Timah.

The highest transacted price in January was S$1.56 million for a 5-room flat at The Pinnacle @ Duxton, reinforcing its status as one of Singapore’s most expensive HDB developments. In Non-Mature Estates, the highest recorded transaction was S$1.18 million for an Executive flat at Bukit Batok Street 25.

Market outlook

Looking beyond the monthly rebound, the broader trend remains measured. As Mr. Luqman summarised, “despite month-to-month fluctuations, the 2.4% year-on-year price increase and 0.9% year-on-year growth in resale volumes suggest that market conditions have largely held steady over the past year.”

For buyers, this suggests continued resilience in resale values without the urgency of a rapidly overheating market. For sellers, realistic pricing remains key, especially as supply continues to come largely from Non-Mature Estates. If seasonal patterns hold, the coming months are likely to see stable activity levels rather than dramatic swings in either direction.

The post HDB resale prices edge up as volumes rebound in January 2026 appeared first on .