55% of Singaporeans are unsure about property prices in the future because of COVID-19, according to findings from PropertyGuru’s H2 2020 Consumer Sentiment Study.

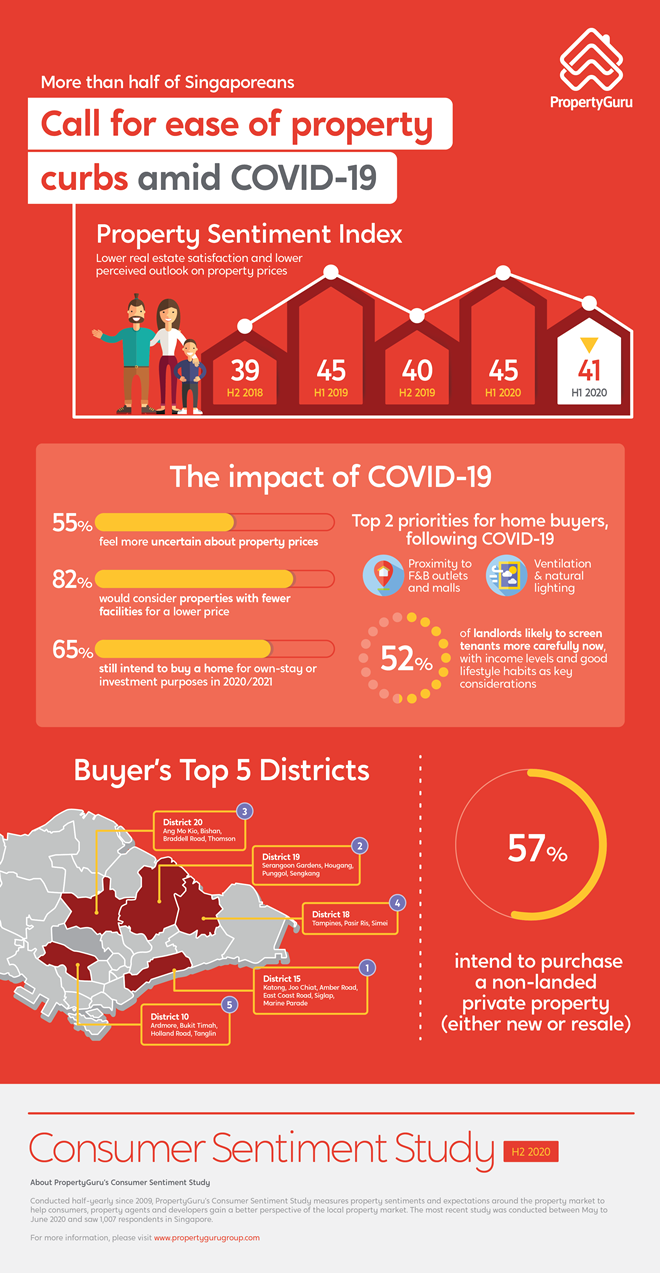

This comes as the study’s overall Sentiment Index dipped by four points from 45 in H1 2020 to 41 in H2 2020. The Sentiment Index measures a series of concerns raised around housing affordability, proper property prices, the overall real estate climate, interest rates, property prices, and the perceived government efforts in the property market amid the current pandemic. Those dissatisfied with the current real estate landscape cite property prices not softening to levels they expect in the current situation as a major reason.

Here are the key findings in the survey:

Key finding #1: Desire for more government stimulus amid a looming recession

To help homeowners cope with the COVID-19 pandemic, the Singapore government introduced several temporary property relief measures, such as a six-month extension for the remission of Additional Buyer’s Stamp Duty (ABSD) as well as home loan deferments for existing homeowners.

Despite the reliefs, 63% of Singaporeans are still hoping for the government to further ease property curbs by lowering the cost of ABSD. This number is highest among middle-aged Singaporeans at 70% and dominated by investors and landlords.

Conversely, 68% of younger Singaporeans looking to buy or rent a home for own-stay purposes are more interested in seeing a further reduction in home loan interest rates, while 59% say they would like a reduction in down payment costs. 62% of those surveyed also said they want to government to reduce Buyer’s Stamp Duty (BSD).

Commenting on the findings, Tan Tee Khoon, Country Manager of PropertyGuru Singapore, said, “The call for the government to ease property cooling measures like the lowering of ABSD, especially amongst property investors and landlords that this tax was chiefly targeted at, comes in the face of a looming economic recession and the estimated overhang of 30,000 unsold residential units. Besides, the macroprudential safeguard of the Total Debt Servicing Ratio (TDSR) will continue to rein in property seekers from overleveraging on borrowing even if ABSD is reduced or relaxed. On the flip side, younger Singaporeans would have just entered their peak home-buying years, so feedback would sway toward lower loan interest rates and downpayment costs to help curb one of their largest lifetime expense.”

Key finding #2: Higher uncertainty over property prices present more room for compromise

When asked how the current COVID-19 situation has impacted their property-related decisions, more than half (55%) of Singaporeans said they are uncertain of property prices in the current climate. As a result, sellers are holding off property sales in hopes of receiving better offers, while buyers are evaluating the market for lower prices. The study also found that about two in five (42%) property buyers have become more price-sensitive and 82% of property buyers were willing to compromise on home facilities in exchange for a more affordable home.

Tee Khoon said, “It is no surprise that buyers are taking a more cautious approach towards property decisions given the heightened levels of market volatility brought by the COVID-19 pandemic,” said Tee Khoon. “That said, the eventual decline of COVID-19 cases in the community and subsequent resumption of the economy should see the release of pent-up demand for property buyers and sellers.”

Interestingly, two in five (40%) property buyers still intend to make a home purchase for own-stay purposes within the next year, particularly 60% of those renting out or and 76% of those living with parents.

Singaporeans also say that the most popular districts to buy a property are District 15 (Katong, Joo Chiat, Amber Road, East Coast Road, Siglap), District 19 (Serangoon Gardens, Hougang, Punggol) and District 20 (Bishan, Ang Mo Kio, Thomson Road).

Key finding #3: Equal reliance on developers and banks to stabilise property market

Unsurprisingly, most Singaporeans have been financially affected by the COVID-19 pandemic and are counting on property developers and banks to help stabilise the property market amid the global recession.

79% of Singaporeans say that developers should lower property prices and 62% think that developers should focus on affordable housing projects, while 51% expect more attractive home loan refinancing packages from banks.

Meanwhile, 78% of Singaporeans surveyed say they prefer bank loans over HDB loans when looking for a new home. This preference was distinct among older (89%), high-income earners (91%). Younger (43%), lower (27%) to mid-income earners (44%), on the other hand, say they prefer HDB loans for repayment. Similar differences were observed for home loan refinancing, with 71% and 78% of older, high-income earners, respectively, indicating more familiarity with the refinancing process. Collectively, these findings reveal ample room to grow awareness about alternative home-financing options in Singapore, especially amongst younger homeowners – once they can afford to.

It is noteworthy that 72% of younger Singaporeans (22 to 29 years old) are keeping their eyes on more affordable housing projects, while 36% of property investors are open to fewer luxury features in favour of lower property prices from developers.

Paul Wee, Managing Director of Fintech at PropertyGuru Group, pointed, “While HDB loans are a go-to option for those with a lower risk appetite given its stable interest rates, now is the opportune time for homebuyers to take a bank loan, or refinance, as the low interest rate environment is likely to persist for some time. Today’s home refinancing options are also more accessible with banking or independent home loan experts like PropertyGuru Finance that will be able to provide a perspective on which home loan applications are worthwhile opting for based on current needs, as well as guide them through the process.”

Key finding #4: More Singaporeans are keeping an eye out for overseas property investments

The study pointed out that Singaporeans’ appetite for overseas property investment remains steady, with nearly 40% planning to purchase property overseas within the next few years. Of the respondents surveyed, Australia, Malaysia and Thailand were indicated as the most popular overseas locations among Singaporean property investors, chosen by 23%, 18%, and 10% survey participants respectively. Singaporeans chose ‘affordability of properties overseas’ and ‘for retirement’ as the top reasons for purchasing overseas properties.

Tee Khoon added, “Overseas property investment has always been a draw for Singaporeans as property prices can be far more attractive than locally, and can also be used to fund a retirement. Those with a healthy balance sheet and strong finances who are still on the fence on overseas property investments should consider this as a viable option for diversifying their investment portfolio, and to balance risk and reward amid the bearish market.”