Go back a few decades, and property was all about rental yield and nothing else. People were happy to buy 50 year-old properties with no elevator and half a working toilet, just because rental income was enough to make the place “practically free”. But today’s real estate market has begun to raise questions about the primacy of rental yields:

What is rental yield?

The gross rental yield (the number often given as a ballpark figure) is a ration of the annual rental income, to the cost of the property. That is:

(Annual rental income) / (Cost of property) x 100

So if a property has an annual rental income of $42,000, and costs $1.5 million, the gross rental yield would be 2.8% per year.

The net rental yield, which is more precise, measures the rental income to the total costs of the property, inclusive of things like mortgage interest rates, maintenance fees, and stamp duties. In most cases, private residential properties have net rental yields of between 2 to 3% (assuming there is no Additional Buyers Stamp Duty).

HDB flats may have much higher yields of 5 to 6%, due to their lower costs and pricing. Commercial properties often have rental yields of between 3 to 5% (although the Covid-19 outbreak may have put a huge dent in that this year).

[We’ve previously covered rental yield in greater detail here.]

Is rental yield the most important part of a property investment?

It is an important aspect, but not the most important. Rental yield alone ignores some other key elements, such as:

- Rentability

- Capital gains

- Foreign influx

- Impact of upcoming supply

#1: Rentability

Rental yield and rentability are not the same, and can even have an inverse relation. Rentability refers to how quickly you can find a tenant for the property, whereas rental yield is the ratio of rental income to cost.

An expensive, premium property in a prime location – such as Marina One Residences or Van Holland, is going to have lower rental yields. This is just by nature of the cost (probably $2 million or higher, with steeper maintenance fees). However, the benefits of the location – such as being near retail and MRT stations – will mean it’s in high demand among tenants.

Conversely, a lower cost property that’s less accessible, or downright tiny, may cost much less and have a higher rental yield. However, it may be harder to find a tenant for such properties.

A property investor needs to balance rentability and rental yield: a 40-year old condo that’s 15 minutes from the nearest MRT station, or a unit that’s a tiny 350 square feet, may have rental yields that can potentially top three per cent. But that’s meaningless if, after buying it, the property remains untenanted for three or four months every calendar year.

Note that vacancies can lower the overall Return On Investment (ROI) much more than just a low rental yield. Any rental income beats no rental income.

#2: Capital gains

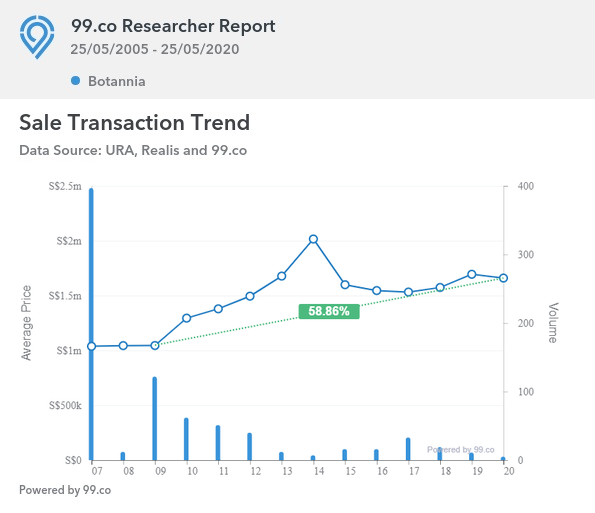

Rental yields don’t take into account capital gains, or the profits you make when you resell the property. For example, Botannia at West Coast Park is considered one of the less accessible condos in the area. It’s harder to rent out due to lack of MRT access, and gross rental yield is seldom above a modest 2.6 per cent for most of its units.

However, Botannia stands out for having seen capital gains of almost 59 per cent, since its TOP in 2011:

It’s possible for a unit with low rental yields to be sold at high gains, thus offsetting the low cash flow from rent. The inverse is also true. The prime example of this would be the 191 homes in Geylang that the government is taking back this year: the last transaction was for a unit in 2015, at a price of just around $88,000.

It’s been estimated at around $1.93 psf (the average rental rate in Geylang Lorong 3), the rental yield from a property at that price and size could be over 25%. But there’s obviously zero resale value, given the few months left on the lease.

#3: Foreign influx

Singapore’s real estate market is different from most other countries. There is no even mix between local and foreign tenants. Over 92% of Singaporeans are home owners, and the vast majority of tenants are foreign workers or students.

This adds an additional layer of risk for investors. Rental yield may fall if—due to government policies or wider economic issues—the number of incoming foreigners decreases. Even policy tweaks, such lowering the number of maximum unrelated tenants (currently this stands at six for private properties), can cause rental yields to fall.

As such, most investors are careful not to count on just rental yield.

#4: Impact of upcoming supply

It is very difficult to predict how much a bigger supply of housing impacts rental yield; but one thing is for sure: having more competition tends to lower the rental rate.

This is a common fear regarding mega-projects (i.e. projects with over 1,000 units, such as Treasure at Tampines, currently the largest condo development in Singapore). While mega-projects may be great for genuine home owners (e.g. maintenance costs tend to be much lower and facilities are more generously sized), landlords have to consider the impact on rental yield if hundreds of units in the same development become available for rent.

As those other units are in more or less the same location, it can be hard to differentiate your unit in ways other than price.

You also need to consider upcoming developments as seen in the URA Master Plan. If there is a large plot across the road zoned for residential use, a newer condo development could come along and poach tenants. For example, there are currently worries that One Holland Village could end up poaching tenants from nearby parts of Holland V, due it’s proximity to amenities and status as an integrated development. That could drive down rental income (and hence yields) in competing developments.

As such, most investors know better than to assume the rental yield they see now will remain the same. You should buy with the consideration that, 10 years or so down the road, the yield may change for the worse.

[Recommended article: URA Master Plan for Property Buyers: How to understand it]

So what else other than rental yield should property investors look for?

The first thing to watch for is rentability, in addition to yield. Investors should take note of high vacancies (which makes the yield a moot point). In addition, they need to research:

- Turnover rates (if there are many tenants who keep signing short leases and leaving then something could be wrong with the property, even if yields are presently high)

- Surrounding developments (few or no future residential developments nearby is preferable. Also, if there are plans to upgrade the amenities or build and MRT station, these can mean rental yield will improve).

- Development size (as mentioned above, mega-projects provide a lot of competition and can lead to lower yields. But note that boutique developments don’t always have high yields as well, as facilities tend to be a bit more limited, and maintenance costs will climb)

- Overall appreciation of the property (the gains upon resale can sometimes justify a lower rental yield. Likewise, a high rental yield may not justify a purchase, if there are poor or even no resale prospects; this is often the case in very old properties).

To get an estimate of rental income for any project or area, you can check out the 99.co search tool. But do remember to follow it up by researching all the above.

Property investing is an art as well as a science. There’s no “fixed formula” to picking a property that guarantees success; and rental yield is just one of many tools. Treat it as an indicator, which must be read in context with other important details.

Certain tactics used by investors—such as buying super-tiny or aging properties for high yields—can be risky. New investors should rethink such extreme decisions, as it’s not easy to offload such properties if they make a mistake.

What’s your take on property investment and rental yield? Share your thoughts in the comments below!

Looking for a property? Find the home of your dreams today on Singapore’s most intelligent property portal 99.co!

The post Is rental yield the only thing property investors should focus on? appeared first on 99.co.