Despite how Singaporeans like to refer to HDB flat locations as “mature” or “non-mature” like they’re some kind of cheese, HDB’s own classification of non-mature estates and mature estates is surprisingly unclear.

In fact, the Housing Board does not give an exact definition of non-mature estates and mature estates, and the only time these terms appear on HDB’s official website is when it concerns the quarterly Build-to-Order (BTO) and Sales of Balance Flat (SBF) sales exercises, during which new flats in towns classified under “non-mature” are typically priced lower than those in towns classified as “mature”.

For the sales exercises, towns classified as non-mature also have a differ slightly in eligibility criteria and flat allocation. We’ll elaborate on this later. But first…

What are the non-mature estates and mature estates in Singapore?

Looking at how HDB has grouped flats in its BTO and SBF sales exercises, this is the list of non-mature vs mature HDB towns/estates in Singapore:

Non-mature estates: Bukit Batok, Bukit Panjang, Choa Chu Kang, Hougang, Jurong East, Jurong West, Punggol, Sembawang, Sengkang, Woodlands, Yishun

Mature estates: Ang Mo Kio, Bedok, Bishan, Bukit Merah, Bukit Timah, Central Area, Clementi, Geylang, Kallang/Whampoa, Marine Parade, Pasir Ris, Queenstown, Serangoon, Tampines, Toa Payoh

Popular (but flawed) definitions of non-mature estates vs mature estates

One apparently straightforward definition of non-mature estates is that they are located further away from the city.

This is however, inaccurate. Pasir Ris town, which is about 14 kilometres from the city at the far eastern end of Singapore, is listed as a mature estate by HDB. However, towns elsewhere that are a similar distance away from the CBD, namely Bukit Batok, Jurong East and Yishun, are all classified by HDB as non-mature estates.

Another easily debunked definition of non-mature estate vs mature estates is that mature estates are over 20 years of age.

But look at Yishun and Bukit Batok. Although the bulk of its flats in these two towns have crossed the 30-year mark, they are still being classified as non-mature estates in recent BTO/SBF sales exercises.

Conversely, Pasir Ris is a younger town than both Yishun and Bukit Batok, yet it’s classified as a mature estate according to HDB.

Singaporeans also argue that non-mature estates are less developed and have fewer amenities than mature estates, but the bustling commercial hub at Jurong East is proof that this definition is flawed.

A non-mature town like Woodlands can also have more MRT stations (five in total across two lines) compared to a mature town like Clementi, which is served by only one MRT station at the moment.

Non-mature estates like Yishun, Sengkang and Punggol are also chock-full of amenities. In fact, it can be argued that the government builds new amenities in non-mature estates at a faster pace, partly to attract Singaporeans to live there. This can translate to a higher percentage upside in property value in the long-run, compared to mature estates. Just take a look at this example.

Then there is the misconception that flats in non-mature estates are cheaper, when the fact is that the age of a flat is often the biggest determinant of its price. This explains why median resale prices of four-room flats in Punggol ($477,500 in December 2020), currently the newest town in Singapore, is higher than that of similar flats in the mature estates of Serangoon ($442,000) and Ang Mo Kio ($419,000).

The legit differences between non-mature estates and mature estates

The reality is that the true differences between non-mature estates and mature estates can only be seen in HDB’s BTO/SBF sales exercises.

Firstly, single Singaporean flat applicants at or above the age of 35 may apply for a two-room Flexi BTO/SBF flat, but only in a non-mature town/estate.

Secondly, HDB also reserves a higher percentage of flats in mature estates for first-timers. This article provides a full rundown of the BTO and SBF flat allocation percentages by HDB.

In general, it’s more difficult for second-timer BTO applicants to secure a flat in a mature estate than in a non-mature estate.

Thirdly, and this is an obscure one: there’s a grant called Step Up Grant and that’s only for occupants of 2-room subsidised flats who want to buy a 3-room flat in a non-mature estate.

Last but certainly not least, HDB’s pricing for BTO flats differs widely between non-mature estates and mature estates. BTO projects in mature estates are sometimes said to bear a hefty price premium.

For instance, 4-room flats in Pasir Ris’s Costa Grove, which start from $374,000, is more than $100k more expensive than 4-room flats in Sembawang’s Canberra Vista, which starts from $272,000, even though both are roughly the same travel time away from the city and Canberra Vista—being right next to an MRT station—has the edge in terms of amenities.

Non-mature estates vs mature estates: the verdict

The truth of the matter is, unless you’re purchasing a BTO or a Sales of Balance flat directly from HDB, you shouldn’t really care too much about whether a flat is in a non-mature estate or not.

In fact, when choosing a home, what HDB resale flat buyers should focus on are factors like remaining lease of the flat, condition of the flat and the accessibility to key amenities such as MRT stations, eating places and schools.

Resale flat buyers might also want to take advantage of the Proximity Housing Grant (PHG), which gives flat buyers a $20,000 CPF grant for living within a 4km radius of their parents/children. This incentive often makes the ‘non-mature vs mature estate’ argument irrelevant.

Non-mature estates have also come a long way from 10 or 20 years ago, when the differences in amenities are more drastic. With a comprehensive (and still growing) MRT network and the development of regional centres and heartland amenities, non-mature estates are finally shaking off the reputation of being ‘ulu’.

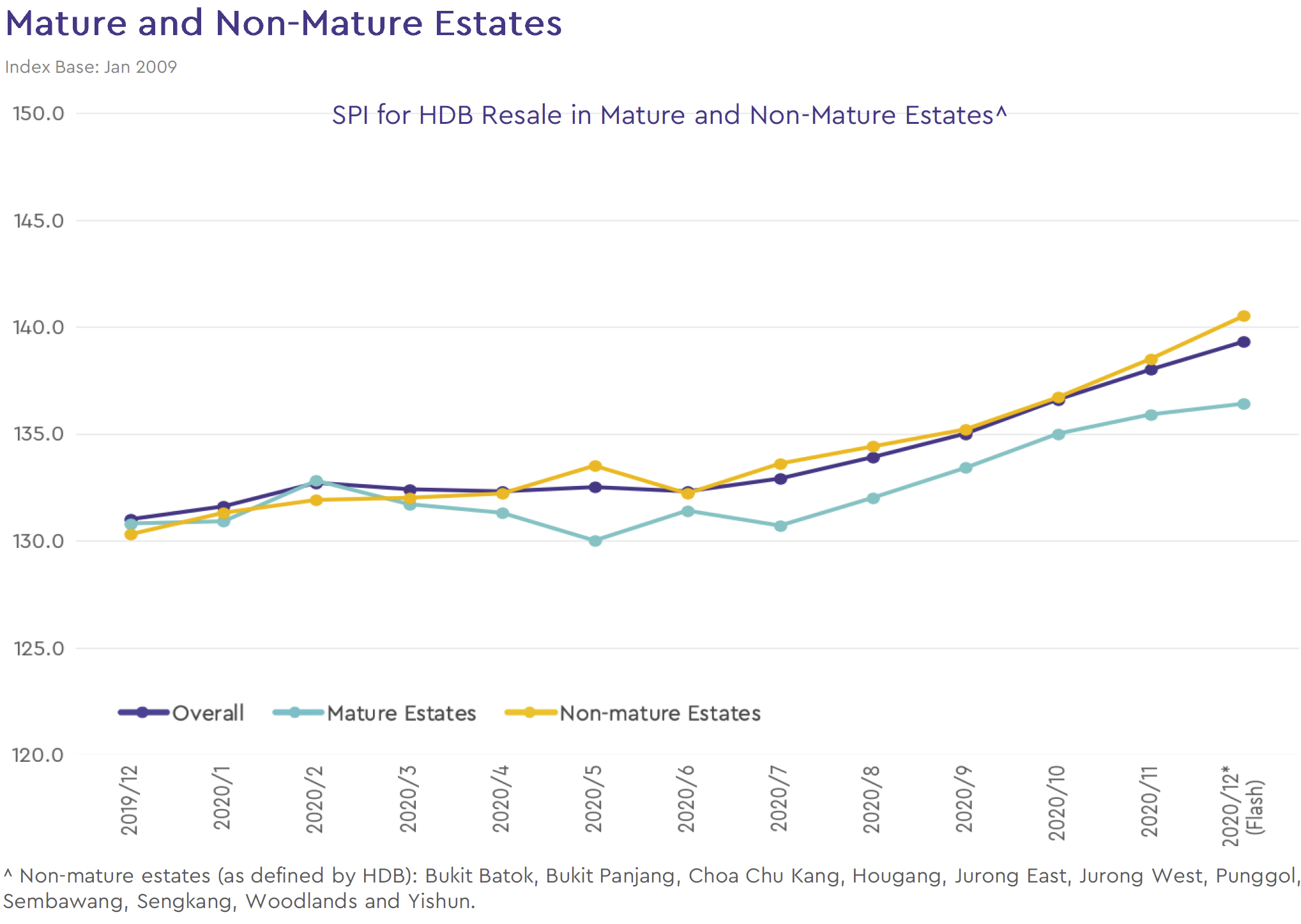

And the proof is in the data. In 2020, HDB resale prices of non-mature estates began outperforming its mature estate counterparts, according to SRX’s Singapore Property Price Index (SPI):

During the year, prices of HDB resale flats in non-mature towns increased by 7.8%, far greater than the 4.3% in mature estates. Perhaps it’s not coincidental that this echoes the private residential market, which has seen condos in the Outside Central Region (OCR) outperform since 2019.

What this all means is that, when it comes to choosing where to live, Singaporean homebuyers are making their actions loud and clear: non-mature estates are no longer the “uglier sibling” of public housing, and they’re willing to take out their wallets to prove it.

Are mature estates neccessarily better? Share your views in the comments below!

If you liked this article, check out Million-dollar HDB flats are hiding a worrying resale price trend. Here’s proof. and Govt looking to limit resale prices of prime location BTO flats, says Minister

Looking for a property? Find your dream home on Singapore’s most intelligent property portal 99.co!

The post Non-mature estates vs Mature estates: The truth and why it matters appeared first on 99.co.