A lot of Singaporeans think of their house as a retirement plan. Come the age of 65, when we walk out of the office for the last time, we’ll need some sort of income. If the plan is to look at the house, then it’s logical to ponder which type is the real money maker. Not everyone can get a condo, so…should you look at BTO, ECs, or resale for the most profit?

A key consideration: Location

For the purposes of argument, assume that the following pertains to units in the same general location. Otherwise, location is a more significant determinant of flat values, when compared to the type of flat in question.

#1: BTO flats

How much: From $200,000 for a four-room flat in a non-mature estate (after grants)

Pros:

- High potential appreciation/profit margin

- Typically cheaper to renovate, compared to resale flats

- Unit layout more aligned to modern lifestyles compared to older flats

Cons:

- Long wait for completion (can consider Sale of Balance Flats, which are new flats closer to completion/already completed)

- Limited choice of location

- Fewer grants available, compared to resale flats

- Low chances of successful balloting for popular projects

The main advantage of Built-to-Order (BTO) flats is that it’s always sold at a discount to market value, even though BTO prices have been creeping up steadily. But despite gripes about BTO prices, Singaporean first-time homebuyers still flock to them is simply because a BTO flat will always be worth more than market value once it hits its five-year Minimum Occupation Period (MOP).

Here’s a recent case-in-point: Four-room flats in Sembawang’s Montreal Ville, which cost $255,000 to $310,000 when they were launched in April 2011, are now being sold between $359,000 and $428,000 on the open market, in the period from January to December 2020. Profits for sellers exceed $100k, which makes this BTO project a surer and more profitable bet than most things you can put your money on.

Price-wise, BTO flats in non-mature estates are sold at a higher discount. Combined with upside from future developments, the BTO flats here could see higher potential appreciation, percentage-wise, than pricier BTO flats in mature estates, at times even exceeding Pinnacle @ Duxton.

Alas, the difficulty of balloting for a BTO flat means not every Singaporean first-time homebuyer can get one, especially if they can’t wait four to five years for a home to call their own.

For those who are looking to make a profit, be warned that oversupply of new flats in estates such as Punggol (and the upcoming Tengah and Tampines North) will also make it more challenging for flat owners to sell flats upon MOP. The supply may also result in downward price pressure, and owners could find themselves in danger of selling below valuation even though there’s a mathematical profit. Such sellers could fall into the trap of making a Negative Sale, with dire financial consequences.

So, it’s worth being open to options when BTO owners have reached the five-year MOP period. Even for owners who want to upgrade, it’s important to consider the option of retaining your HDB flat for rental yield, even if doing so will entail having to pay ABSD for buying a second property. Even though this may take you a few years more to save up to upgrade, it could be a better long-term asset progression strategy than selling your BTO flat.

#2: Resale flats

How much: From $200,000 for a four-room flat in a non-mature estate (after grants)

Pros:

- Very wide selection; can choose any location you want

- The additional grants available for buyers of resale flats can make them even cheaper than BTO

- Some unit configurations may be larger than BTO flats

- Cheap financing, just take a HDB loan than refinance into a low-interest bank loan

Cons:

- Not a fresh 99-year lease

- Higher renovation cost if hacking/disposal is needed

- Older flats could mean maintenance issues down the road

- Newer resale flats are expensive

To be blunt, buying a resale flat is probably going to net you the lowest profit when you sell it again. This is because resale flats are primarily bought for reasons beyond profitability.

What’s certain is that buyers of million-dollar resale flats such as this can’t expect to make huge profits. Given the large sum they paid for their resale units, it’s unlikely that the value will appreciate in 10 or 15 years. The value of the flat could even depreciate due to lease decay.

One reason buyers tolerate the higher price is that the flat is already completed and ready-to-move in. There’s no construction wait time, and it is one way to immediately get a flat in a mature area, or in the exact location you want. Also, the government offers a greater variety of housing grants and a higher total grant amount (up to $160,000) for buyers of resale flats, versus BTO flats, which is a huge incentive.

Also, some buyers, such as families with only Permanent Residents, can only buy resale flats.

Despite higher prices, rental yields of resale flats still average around 7%, so factor this into your asset progression strategy, or adopt a diversified investment approach rather than relying on your flat’s value as a nest egg.

Some owners just treat their nicely renovated resale flat as a liability (i.e. an expense) rather than an asset, and that isn’t a bad option if you have a sound long-term financial plan in place and all you want is just a decent roof over your head.

#3: Executive Condominiums

How much: From $700,000 for a three-bedroom unit (after grants)

Pros:

- Cheaper than a comparable new launch condo

- Units are more spacious than a comparable new launch condo

- Some grants available

- Full condo facilities

- Minimal renovation required upon moving in

- Can be sold to PRs after a five-year MOP period, can be sold to foreigners after 10 years

- Nearly guaranteed appreciation upon MOP

Cons:

- Price is out of reach for most first-time buyers, unless their combined income exceeds $11,000

- 25% downpayment needed, 5% of which must be in cash

- Income ceiling of $16,000

- Limited locations, mostly inaccessible

- Rising prices mean that some resale condos are cheaper than ECs

- Lower rental yield than HDB flats and some condos

- Though leasehold, condo value is less resistant to the effects lease decay. They can also undergo en bloc

- Buyers must sell their existing HDB flat

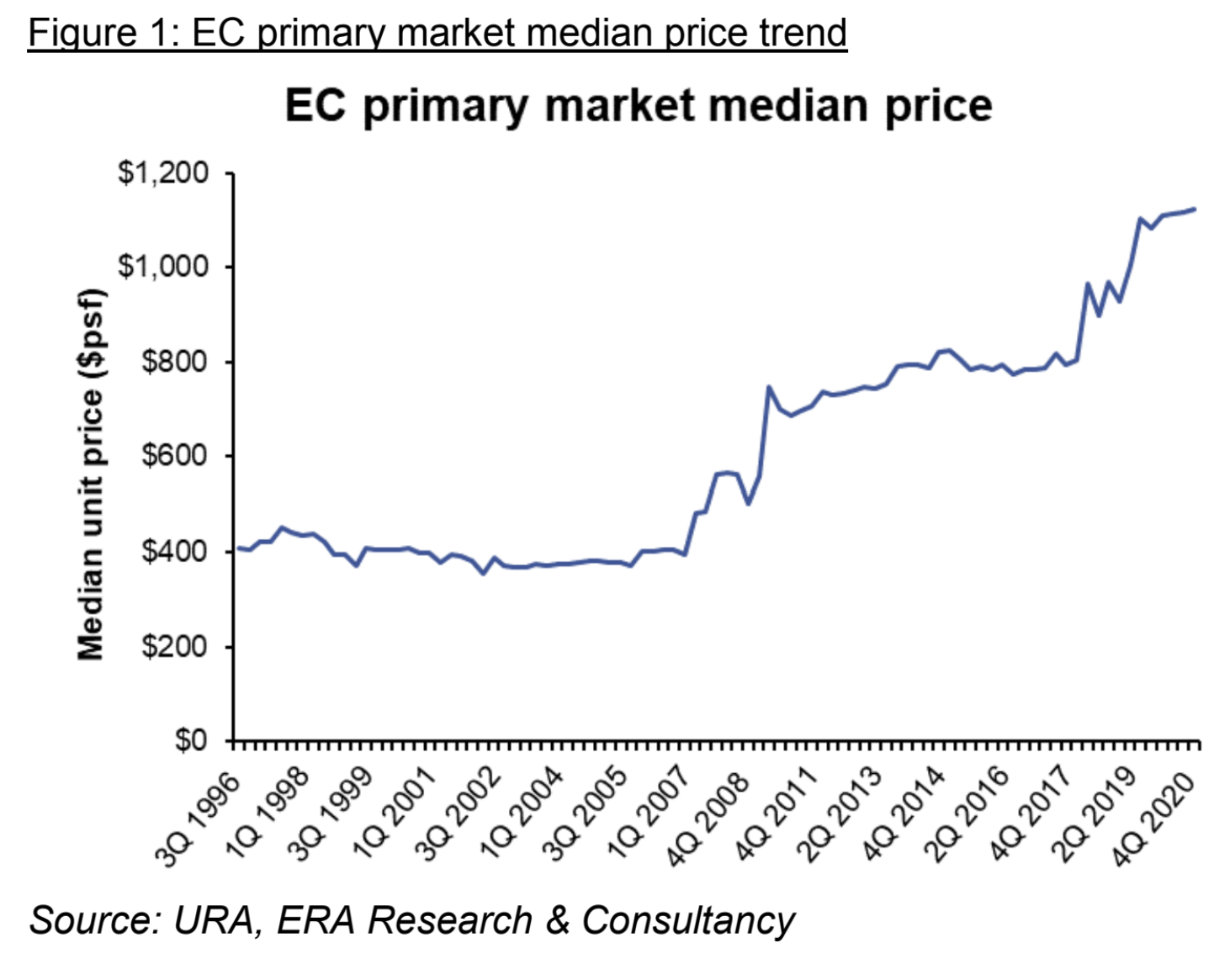

Like BTO flats, ECs also promise stellar price appreciation upon MOP.

Let’s compare a EC (Prive) and non-EC (Parc Centros) launched in roughly the same location in Punggol less than one year apart in December 2011 and July 2012 respectively. Prive’s three-bedder prices were around $695 per square foot (median figure) in the first three months of its launch versus $920 psf for three-bedroom units at Parc Centros.

In 2020, such units at Parc Centros transacted at a median of $1,147 psf, whereas similar units at Prive transacted at a median of $978 psf.

This translates to a 24.7% profit for Parc Centros three-bedder units, and a eye-popping 40.7% for Prive’s three-bedder units.

Over a few more years, especially when Prive is fully-privatised, prices there are expected to further bridge the gap, potentially netting even more profit for sellers.

That being said, developers are raising the prices of ECs. The latest EC to hit the market, Parc Central Residences in Tampines, is offering three-bedroom units at around $1,100 psf.

While EC prices are getting higher, it’s reasonable to argue that buyers still can get a healthy profit upon MOP, especially if the location of the EC carries upside from future developments.

Undoutably, there’ll be a group of buyers in the mid-high income bracket weighing between buying a new resale HDB flat in a mature estate, and a new launch EC in a suburb. They’ll be wondering which is the better purchase for own-stay, and which will fit better into a plan for asset progression.

If ECs still feel a bit of a stretch for you right now, in terms of finances, then quickly securing a HDB flat in a good location could be your best bet to kick start your asset progression journey.

The money you save by buying a resale flat can be used to grow in investments to prepare you for your private property purchase 5 to 10 years down the road, thereafter you get to rent our your resale flat at a high rental yield, or sell the flat to fund an upgrade to a private home (if you’re averse to paying Additional Buyers’ Stamp Duty).

And the takeaway here is, don’t be too fixated on getting that BTO flat. If you’re unsuccessful too many times, it could be time to give resale or an EC (if you can afford it) a go.

Can buying a resale HDB flat be a good move for investment? Let us know in the comments below!

If you found this article useful, check out Million-dollar HDB flats are hiding a worrying resale price trend. Here’s proof. and Govt looking to limit resale prices of prime location BTO flats, says Minister

Looking for a property? Find your dream home on Singapore’s most intelligent property portal 99.co!

The post BTO vs Resale vs EC: Which is best for investment? [2021 edition] appeared first on 99.co.