March 30, 2021

Residential property prices in Orchard and Newton in the Core Central Region (CCR) are set to benefit from the upcoming URA Master Plans to enhance both districts. We look at what these Master Plans entail and how both districts are expected to change over the coming decade. The URA Master Plan is what savvy property...

The post Rejuvenating the Core Central Region: URA’s Master Plans for Orchard and Newton appeared first on 99.co.

Residential property prices in Orchard and Novena (and Newton) in the Core Central Region (CCR) are set to benefit from the upcoming URA Master Plans to enhance both districts. We look at what these Master Plans entail and how both districts are expected to change over the coming decade. The URA Master Plan is what...

The post Rejuvenating the Core Central Region: URA’s Master Plans for Orchard and Novena appeared first on 99.co.

Properties in Singapore are not only becoming more expensive, but they are shrinking in size as well. As such, if you’re searching for a larger home (without breaking the bank), one option is to go for larger HDB flats types such as HDB maisonettes, jumbo HDB flats, and 3Gen flats.

But which should you pick? This article will take a look at the biggest HDB flat types available and what sets them apart.

|

Flat type |

Size |

Price |

|

HDB Maisonette |

1,527 to 1,700 sq ft |

From $620,000 |

|

Jumbo flat |

1,442 sq ft to 1,830 sq ft |

From $650,000 |

|

3Gen flat |

1,238 sq ft |

From $246,000 |

|

Executive apartment |

1,507 sq ft to 1,615 sq ft |

From $550,000 |

|

5-Room flat |

1,184 sq ft to 1,474 sq ft |

From $394,000 |

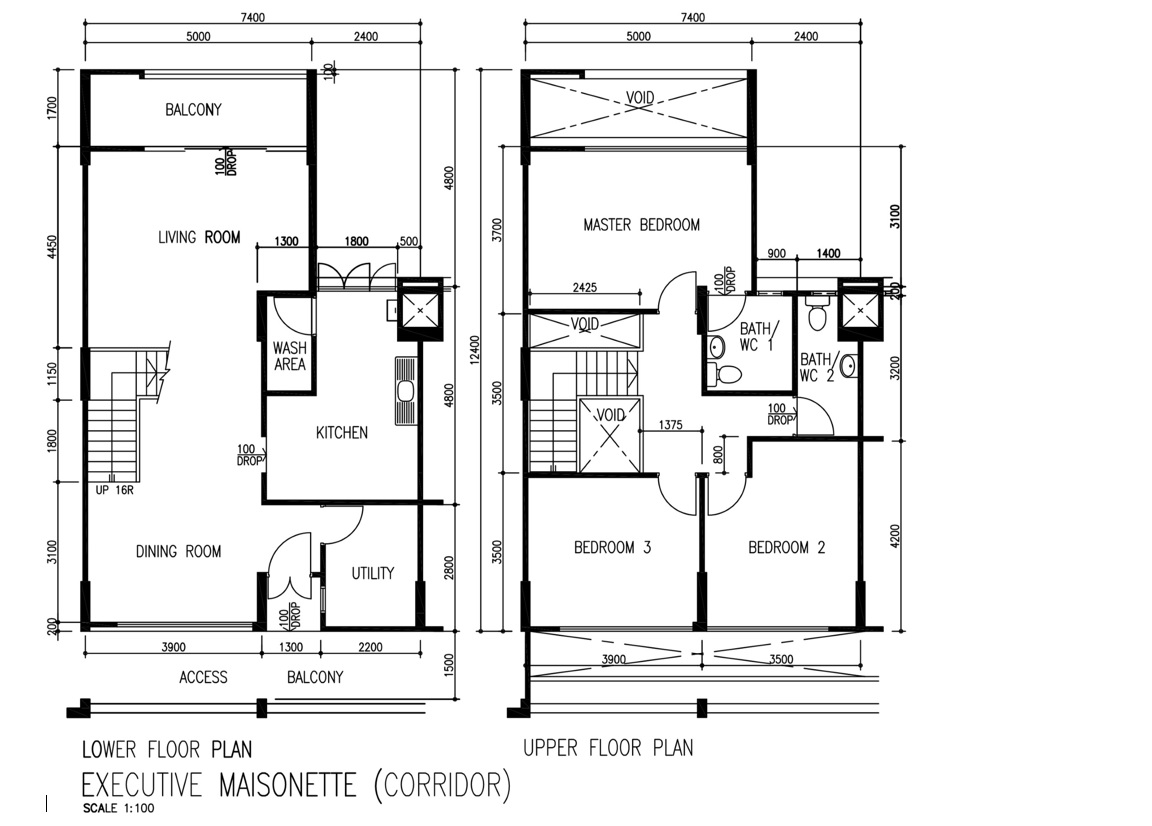

1. HDB Maisonette

Though they have been discontinued since 1995, HDB maisonette (or executive maisonette) flats are still highly sought after by buyers because of their spacious interiors and unique two-storey design. As such, HDB maisonettes tend to fetch higher prices despite their dwindling lease. In fact, HDB maisonettes start from around $620,000 and it’s not uncommon to see these flats transacting above $1 million in prime locations.

Apart from having two storeys, HDB maisonettes typically range between 1,527 to 1,700 sq ft, with some as large as 2,314 sq ft. This makes them popular among couples or families who require more room.

HDB maisonettes also have three bedrooms and three bathrooms, which is one more than conventional HDB flats. The bedrooms are located on the top floor, offering the occupants some privacy. In addition, maisonette flats also come with balcony space, which is great if you want to air-dry your clothes or have a mini outdoor garden.

As these flats were built in the olden days, they’re mostly located in mature estates such as Ang Mo Kio, Bishan, Bedok, Bukit Panjang, Bukit Batok, Choa Chu Kang, Hougang, Pasir Ris, Queenstown, Serangoon and Sembawang.

Find HDB maisonette flats for sale on PropertyGuru

2. Jumbo HDB Flats

Combined flat via HDB's Conversion Scheme. Source

Jumbo HDB flats are another popular HDB flat type that is no longer in production. They were built by HDB in 1989 by combining unsold 3-room and 4-room flats in estates such as Yishun and Woodlands. As such, these flats are known to be super spacious, ranging approx. 1,442 sq ft to 1,830 sq ft.

In terms of characteristics, jumbo flats have a large living and kitchen area because of the combined space. The large floor area makes them popular among large, multi-generational families who desire more space. However, it's not uncommon for owners to convert the space into extra bedrooms.

Though they come at a premium price of $650,000 to $950,000, it’s unlikely that you will find a home that’s as roomy for the same price, especially within the condo or executive condo (EC) market.

But with only about 2,900 jumbo flats remaining in Ang Mo Kio, Bishan, Bedok, Hougang, Jurong East, Pasir Ris and Tampines, you may have difficulties finding one in the resale market. You can however, create your own jumbo flat via HDB’s Conversion Scheme — by combining two adjoining 3-room (or smaller) flats. Read more about the scheme here.

Find jumbo HDB flats for sale on PropertyGuru.

3. 3Gen Flat

Three-Generation flat, or more commonly known as 3Gen Flat, was introduced by HDB for multi-generational families who want to live together. Since their introduction in 2013, they’ve become extremely popular among larger families. They’re usually launched alongside BTO sales launches in the year, though these are far and few between. As such, 3Gen flats are usually priced around the same as new BTO flats, starting from around $246,000 to $589,000, depending on the area.

In terms of size, they’re 115 sqm (approx. 1,238 sq ft), which is slightly bigger than 5-room flats (110 sq m). However, what sets them apart from 5-room flats is they have four bedrooms and three bathrooms, two of which are attached bathrooms, though the bedrooms may be smaller.

As 3Gen flats are designed for multi-generation families; the bedrooms are located on opposite sides of the shared living area to give the occupants more privacy (think of it like dual-key condos but without a main and sub-unit).

To buy a 3Gen flat, you need to form a multi-generation family with your parents and children as they would be listed as occupiers. This means that all occupiers (including your parents) must not own any property both locally and abroad. Additionally, their income will also be taken as part of the monthly household income (which is up to $21,000).

Lastly, you can only sell your flat to another multi-generation family once the 5-year MOP is up. You also can’t rent the rooms out, even after the MOP.

Read more about the eligibility of 3Gen flats on HDB’s site here.

4. Executive Apartment

Executive apartments (EAs) were first built in the 1980s for families who want bigger homes. Like most HDB flat types on this list, EAs are no longer in production as they were phased out in 2005.

In terms of design and size, they have three bedrooms and two bathrooms (similar to 5-room flats). However, the EAs come with a larger living area which can be converted into a study room. They’re also larger than 5-room flats, ranging from 140 sq m to 150 sq m (appox. 1,507 sq ft to 1,615 sq ft). EAs in the 1990s were the biggest in size.

EAs are priced from around $550,000 to over $1M, based on location.

Find executive apartments for sale on PropertyGuru here.

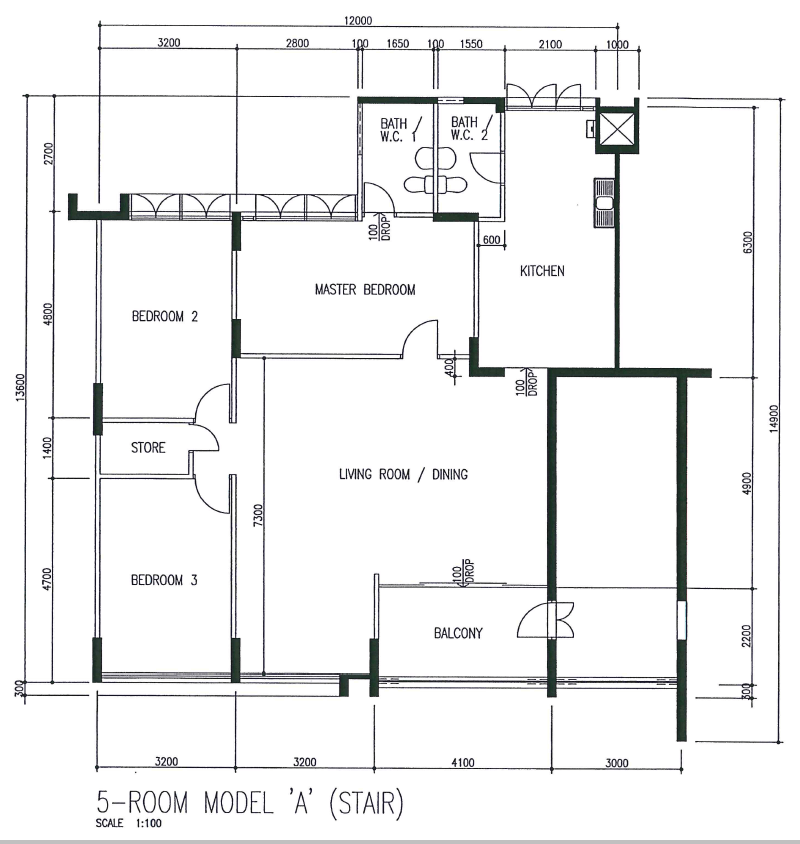

5. 5-room Flat

5-room flats are the only new flat type that most can BTO for (you need to apply as a multi-generation family for 3Gen flat). They come with three bedrooms and are one of the two (the other being 4-room flats) most popular flat types during HDB BTO launches. Take the November 2020 BTO launch, for example, 5-room flats across the various launches, including those in Bishan and Bidadari, were heavily oversubscribed.

At 110 sq m (1,184 sq ft), it may be the ‘smallest’ flat type on this list, but it’s still suitable for large families or those we desire more space. Older 5-room flats built before the 2000s were also larger than present-day ones, ranging from 117 sq m to 137 sq m (approx. 1,259 sq ft to 1,474 sq ft).

Based on February’s 2021 BTO launch, new 5-room flats in Tengah start from around $394,000, while resale units are priced from $575,000 on PropertyGuru.

Find 5-room flats for sale on PropertyGuru here.

More FAQs Related to Maisonette Flat, Jumbo Flat and 3Gen Flat:

1. Can Singles Buy HDB Maisonette Flat?

Singles 35 years old and above can buy resale HDB maisonette flats under the Single Singapore Citizen Scheme or Joint Singles Scheme.

2. How Can I Buy a Jumbo Flat?

As jumbo HDB flats have been discontinued, you can only find them in the resale market. They are typically located in areas such as Ang Mo Kio, Bishan, Bedok, Hougang, Jurong East, Pasir Ris and Tampines.

3. What Is a 3Gen Flat?

Three-Generation Flat, or 3Gen flat, is a flat type that is designed for multi-generation living. They have four bedrooms and three bathrooms that are located on opposite ends of the shared living area to give privacy.

4. What Is the Executive Apartment?

The executive apartment is an HDB flat type that was built in the 1980s for families who desire bigger space. They have three bedrooms and two bathrooms but are larger than 5-room flats, ranging from 140 sq m to 150 sq m as they have an additional space that can be used as a study room or living room.

5. How Big Is a 5-Room Flat?

5-room flats are 110 sq m (1,184 sq ft). But older 5-room flats built before the 2000s were larger than present-day ones, ranging from 117 sq m to 137 sq m (approx. 1,259 sq ft to 1,474 sq ft).

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.

Are you looking to buy a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Already found a new home? Let PropertyGuru Finance's home finance advisors help you with financing it.

When it comes to investing in a property, most people would prefer to buy a residential over commercial property because it’s just so much easier. However, with the implementation of tighter Additional Buyer’s Stamp Duty (ABSD) rules in the 2018 cooling measures, it has become even more restrictive to buy a second or subsequent residential property.

As such, you may be wondering if it makes more sense to invest in a commercial property instead. After all, you may have heard whispers that you won’t have to pay ABSD for commercial property purchases. While this is true, this shouldn’t be the main basis for your decision as it’s important to understand the risks of buying a commercial property, because remember, it’s a big-ticket item that involves a lot of funds.

So, if you’re interested in investing in a commercial property, here’s a basic guide to help you out.

What is a Commercial Property?

Unlike a residential property where you can reside and live in, a commercial property is a building mainly for business purposes or work. For the property owner, it is used to generate profit, either through rental income or capital gains.

There are three types of commercial properties: retail, industrial and commercial, and hotel:

|

Type of commercial property |

Examples |

|

Retail |

Shopping malls, pet shops, gyms, restaurants, bars, shophouses, HDB shophouses |

|

Industrial and commercial |

B1 (Offices, warehouses), B2 (factories) |

|

Hotel |

Hotels, hostels |

Since commercial properties are mainly for rental income or capital gains, interested buyers are usually investors or businessmen. As there is also no ABSD involved, they’re also attractive to foreign buyers.

Can Foreigners Buy Commercial Properties in Singapore?

Yes. While there are restrictions for foreigners when it comes to buying residential properties (generally, foreigners can only buy non-landed private homes and landed properties in Sentosa Cove), there are no such restrictions for commercial properties.

In fact, according to the Residential Property Act, foreigners can buy the following commercial properties:

- Shophouses (for commercial use);

- Industrial and commercial properties; and

- Hotels (registered under the provisions of the Hotels Act)

(Note that foreigners may be allowed to buy landed properties if they manage to obtain special approval from the Singapore Land Authority (ahem, James Dyson)).

In other words, foreigners have the same privileges as locals for commercial property purchases.

For locals, there are no income caps or eligibility restrictions. However, buying a commercial property is quite different from residential as there are several key considerations to take note of:

Things to Consider Before Buying a Commercial Property

1. Which Commercial Property Type Should You Choose?

As explained above, there are various different types of commercial properties available, ranging from B1 industrial buildings and retails shops to office buildings and restaurants. Not only do they vary in costs, but each also has its own traits and risks.

For example, heritage shophouses are limited and prized in Singapore as they’re conserved by the government. They are also mostly located in the Central Areas and often have lower rents, making them popular among startups and small businesses who value the location but cannot afford the high rent costs of traditional offices.

Therefore, investing in a shophouse may make sense because they’re highly in demand, and you can expect to get good rental yields. They also hold well in value, so you can also expect to get good capital gains should you sell them in the future.

However, shophouses aren’t cheap (they can be as expensive as a landed property), and depending on the type of shophouse, their usage may be restricted to their zones; some shophouses are for commercial use only, while others can be both residential and commercial.

So before deciding which property to buy, choose one that has the potential to generate good rental income or capital appreciation.

2. Can You Change the Property’s Intended Use?

Like residential properties, commercial properties are also zoned according to their uses on the URA Master Plan. Depending on the type of property and its uses, you may need to apply for planning permission from URA.

For example, if you plan to convert a retail shop into a commercial school, you need to adhere to URA’s guidelines or seek approval from them. Each commercial property has its own guidelines and regulations, which you may refer here.

3. Does the Location Matter?

Location plays an important role because it affects the type of property that you’re interested in and its tenure.

For example, if you’re interested in buying an industrial property in Woodlands or Punggol, you may only be limited to those with 60 years lease.

Additionally, while investing in a commercial property near MRT stations and densely populated residential areas may have a good track record, the location is also highly dependent on the developments in the area.

For example, if there’s an en bloc sale or if the government decides to redevelop the land, it could potentially affect human traffic and therefore also your business.

4. Do You Need to Pay ABSD?

As mentioned above, unlike residential property purchases, you won’t have to pay ABSD when buying a commercial property even when you already own a residential home. Depending on your residence status (i.e. whether you’re a Singapore citizen, permanent resident or foreigner), it means saving between 12 to 20% ABSD, which is a substantial amount.

Suggested read: Should You Invest In Commercial Or Industrial Property To “Escape” ABSD?

5. Do You Need to Pay Seller’s Stamp Duty (SSD)?

You don’t need to pay SSD for commercial properties except when buying industrial properties such as factories. According to IRAS, the SSD amount you need to pay depends on the holding period (number of years that you own the property before you sell it).

|

Holding period |

SSD rate (on the actual price |

|

1 year |

15% |

|

1 to 2 years |

10% |

|

2 to 3 years |

5% |

|

More than 3 years |

No SSD payable |

6. Can You Use Your CPF to Finance The Property?

While you can use your savings in your CPF account to pay the downpayment and mortgage for a residential property, you can’t do the same for a commercial property; the mortgage and downpayment must be paid in cash.

7. How Much Can You Borrow?

You can borrow a bank loan of up to 80% of the loan-to-value (LTV), which is higher than residential properties (up to 75%). But since you can’t use funds from your CPF account, you need to fork out at least 20% of the downpayment in cash.

Also, depending on whether you’re buying for investment or for your own use, the LTV may be lower and stricter if you’re buying for investment because banks consider commercial properties to have higher risks.

Like residential property loans, there are also fixed rate and floating rate loans. However, interest rates for commercial properties are higher, even though the loan tenure for commercial loans is also shorter (capped at 30 years), compared to home loans (up to 35 years).

8. What Other Costs Do You Need to Consider?

GST

When buying a commercial property, you also need to pay 7% GST. Note that you also can’t use your CPF funds or the bank loan to pay for it, so you must fork it out on your own.

Property Tax

Like residential properties, you also need to pay property tax for commercial properties. However, the difference is the tax rate for residential properties varies from 0% to 20% depending on whether you’re an owner-occupier. For commercial properties, you pay a flat rate of 10% of the annual value, which is the estimated gross annual rent if it were rented out. It is based on the market rental value of similar properties in the area.

Price

When buying a commercial property, the cash outlay required is dependent on the property type. For example, small offices and independent shops are cheaper, but bigger properties such as factories require more funds.

Apart from that, prices are also influenced by economic conditions. For example, tenants and rental demand will increase if the sector is doing well and the opposite is also true during a recession, which would drive down rental yield.

9. Lease for Commercial Properties

Residential properties usually have a lease of either 99 years, 999 years, or freehold.

In contrast, commercial properties usually have shorter leases and it’s not uncommon to see properties with 30 years or 60 years lease. Though freehold commercial properties do exist, they’re rarely located in prime areas and usually command a premium.

10. Do Commercial Properties Have Higher Rental Yields?

On average, commercial properties have a rental yield of around 5%. This is higher compared to residential properties, which is usually around 2 to 3%.

However, remember that commercial properties also have higher maintenance costs, such as utility bills and general maintenance.

How to Finance A Commercial Property

You can apply for a commercial property loan as an individual or as a company. Like residential property loans, you will be subjected to Total Debt Servicing Ratio (TDSR).

If you’re buying as an individual, then TDSR will apply to your individual income. In other words, your total debt obligations can’t be more than 60% of your monthly income.

For companies, banks will evaluate the TDSR based on the company’s annual net operating income and annual debt. If the company’s financial health isn’t well, then banks may also take the directors’ annual incomes as part of TDSR evaluation.

Where to Find Data on Commercial Properties

To check for information such as commercial property projects in the pipeline, median rentals, vacancy rates, and commercial transactions in the last few years, you may refer to URA’s site.

How Do You Check for Upcoming Sites for Sale?

The URA will announce Government Land Sales (GLS) sites for sale twice a year. There will be a mix of both residential and commercial sites that are on the Confirmed List and Reserved List. The land will be awarded via an open tender process. If you’re looking for White Sites or Hotel Sites, then you should check URA’s website for the latest sites for sale.

Need Help to Apply For a Commercial Property Loan?

The loan process for commercial property loans tends to be more personalised than residential property loans.

Banks have their own eligibility conditions and processes for commercial loans. Applicants usually have to get in touch with specific banks in order to discuss their commercial property transactions. Based on the particulars of the situation, the bank will advise on what documents to submit in your application.

If you need to find and compare commercial loans across different banks, or get unbiased recommendations on the best loan to take, speak to our Home Advisors on PropertyGuru Finance for free now.

Other common FAQs Related to Commercial Property

1. How Much is Commercial Property Tax in Singapore?

Commercial properties are taxed 10% of the Annual Value.

2. Can You Use CPF to Buy Commercial Property?

Unlike residential properties, you can’t use your CPF funds to buy/pay for a commercial property.

3. How is The Annual Value Calculated?

The Annual Value is based on the market rental value of surrounding properties in the area. If the rental value is up, so will the AV rate. Similarly when the rental value heads south, so will the AV rates. The Annual Value is calculated based on the rental value minus reasonable furniture rental and maintenance fees.

4. How Much Is The Downpayment for Commercial Property?

The LTV for commercial properties is 80%, meaning that you need to pay the remaining 20% downpayment in cash (you can’t use CPF funds).

If you’re planning to buy a condo or HDB flat, then one of the biggest considerations is deciding between a high floor or low floor unit.

Generally, most would pick units on higher floors because the general consensus is that they are better as they offer more privacy and better views, among other things.

As such, it’s not uncommon to see high floor units snapped up first even though they cost a premium.

But are high floor units that much better? Let’s take a look at the pros of each.

|

Pros of living on a higher floor |

Pros of living on a lower floor |

|

Better natural wind ventilation |

More convenient |

|

Less prone to pests |

Not as dusty |

|

More privacy and lower noise levels |

Cheaper |

|

Better views |

Better pool/garden views |

|

Better resale value |

Easier if you’re a pet owner |

|

Less prone to litter (including killer litter) |

More floor space |

|

Not vulnerable to floods |

|

|

Better security |

Pros of living on a higher floor:

1. Has Better Wind Ventilation

Units on higher floors are usually unblocked and therefore are therefore windier. As such, you’ll also spend less on your energy bills as your home would be cooler. If the unit is north-south oriented, then you have the added bonus of receiving natural wind ventilation all-year long.

2. Less Prone to Pests

Pests like cockroaches, mosquitoes, and rats are commonly found on lower floor units since it’s easier for them to make their way into your home. This is especially true if the unit is close to the garbage chute.

Having said that, living on a higher floor doesn’t mean that your home is immune to pests; your personal hygiene and overall cleanliness also play a big role. If you leave food all around, or don’t clean your home regularly, then it only encourages pests to breed and roam around. If you need tips to keep your home free from pests, read our pest control article guide.

3. More Privacy and Lower Noise Levels

If you enjoy peace and quiet, then you may prefer a higher floor unit. Broadly speaking, the higher the unit, the further away you are from the clamouring sounds of people, drilling noises from nearby construction sites, honking horns, and noises from the pool and BBQ pits.

However, some condos have facilities on higher floors or on the rooftop, so the reverse may also be true if you live on a higher floor in such developments. So before buying, make sure you know where the facilities are located.

Also, noise doesn’t just come from below. For instance, if you have noisy neighbours, then you may have to get used to the sound of footsteps, chatter, moving furniture or renovation noise. Higher floors may also be more prone to the sound of planes, which may affect you if you’re working from home.

Suggested read: 5 Tips for Soundproofing Your Home From Noisy Neighbours for Better Work Productivity

4. Better Views

Higher floor units offer better views of the surrounding area, be it the city, sea, or sunset. This is especially true if you live in a low-density neighbourhood. However, expect to pay more the higher you go, especially if the property has great views (e.g. sea-facing). This is one reason why penthouse units or units located on the highest floor are always the priciest.

5. Better Resale Value

Homes located on higher storeys tend to command higher premiums. In fact, it’s not uncommon to see a price difference of thousands of dollars based on the floor level alone. As such, you can sell (or rent) your home at a higher price in the future.

6. Less Prone to High-Rise Litter (Including Killer Litter)

It’s not uncommon for residents living on lower floors (especially those on the ground floor) to be victims of high-rise litter. Common trash include tissue paper, cigarette butts and food waste, but there have also been cases where people have tossed ‘unusual’ items such as human faeces, empty bottles, glass panels, and meat cleavers — resulting in injuries and even death.

7. Not Vulnerable to Floods

Granted, it’s not very common, but given that there are quite a few low-lying housing estates in Singapore, your home may be prone to floods if you live on the ground floor of these flood-prone areas. But if you live on higher floors, then you don’t have such concerns.

8. Better Security

Though crime isn’t very rampant in Singapore, but ‘low crime doesn’t mean no crime’ as they say. Burglaries are less likely to happen on higher floors since it takes much more effort.

Pros of Living On Lower Floors:

1. More Convenient

You spend much less time waiting for and waiting in lifts, which is a common problem if you live on higher floors. Additionally, in case of fire, emergencies, or if the lift breaks down, it’s safer and easier to leave the building, as taking the stairs won’t be a drag.

Living on lower floors is also good for families with elderly/disabled members since it’s more accessible for them. And if you live in an apartment or condo, then it’s also more convenient to access facilities such as pools, which are typically on the ground floor.

2. Not as Dusty

Whilst you may not enjoy the wind breeze as much as your fellow residents living on top, it also means that you’ll be less exposed to the dust that comes with the wind.

3. Cheaper

Although higher floor units have better resale value, they’re also much more expensive. For example, if a 20-storey project has an average price difference of $5,000 per floor, the difference between the unit on the 20th floor and the second floor is $90,000. That’s a huge amount of money to fork out especially if you’re tight on cash.

4. Better Garden/Pool Views

Higher floors may give you better views of the surrounding and from afar, but lower floor units are great if you prefer up-close views of the pool or greenery, or if you enjoy people-watching.

5. Easier If You’re a Pet Owner

Some neighbours may feel uncomfortable around your pet, especially in the lift. If you’re a pet owner, then it’s less awkward if you live on a lower floor as you can avoid this by taking the stairs.

6. More Floor Space

Some lower floor units, especially those on the ground floor are larger than most because of Private Enclosed Spaces (PES). These units usually have a patio area that is usually closed off with a gate, providing an outdoor yard.

Higher Floor or Lower Floor Unit: How to Decide?

So which one should you pick? The best way to decide is to choose according to the needs of you and your family.

If you don’t mind the hustle and bustle of the area, and don’t think it’s worth forking out more to live in essentially the same development, then lower floor units are recommended for you.

Furthermore, lower floor units are also safer if you have young children or elderly members. But perhaps the main benefit of living on a lower floor is that you spend less time waiting for the lifts, which can be tormenting especially when they break down.

On the other hand, if you value your privacy and want jaw-dropping views of the surrounding area, then higher floor units — particularly those at the top — will suit you better. Not only that, your home will get windy at different parts of the year and there would also be fewer pests overall. More importantly, your home would likely fetch a higher resale value in the future as buyers would generally pay more for units that are located on higher floors.

Other FAQs About Higher Floor vs Lower Floor Units:

1. Is It Better to Live On a Higher Floor?

Higher floor units are better because you get fewer visits from pests. You also have better views of the surrounding and get more wind ventilation all year long. Furthermore, higher floor units tend to command higher resale value.

2. Why Is High Floor Units More Expensive?

Living on higher floors means you have more privacy as you’re further away from the hustle and bustle of the area. Upper floor units also offer better views and ventilation.

3. Is It Better to Buy A Ground Floor or Low Floor Unit?

If you don’t like waiting for the lifts and want convenient access, then ground floor or lower floor units are better for you. Some ground floor units offer an outdoor patio which can be used for gardening, plus you also get good views of the pool or greenery.

4. Which Floor Unit Is The Best?

Higher floor units offer more privacy, better security and better resale value. Lower floor units on the other hand, are more convenient especially when the lift breaks down. They’re also cheaper and safer for children and the elderly.

Find, Finance and Own Your Home With PropertyGuru

Discover thousands of homes for sale on PropertyGuru and narrow your search results with filters such as floor level and price.

Need expert help to finance your dream home instead? Get in touch with our Home Loan Advisors for free on PropertyGuru Finance.