That’s probably the second thing that many first-time homeowners are wondering, after figuring out where their first home should be. Overwhelmed with all the jargon and fine print? Don’t worry, we’re here to break down the differences between HDB loans and bank loans.

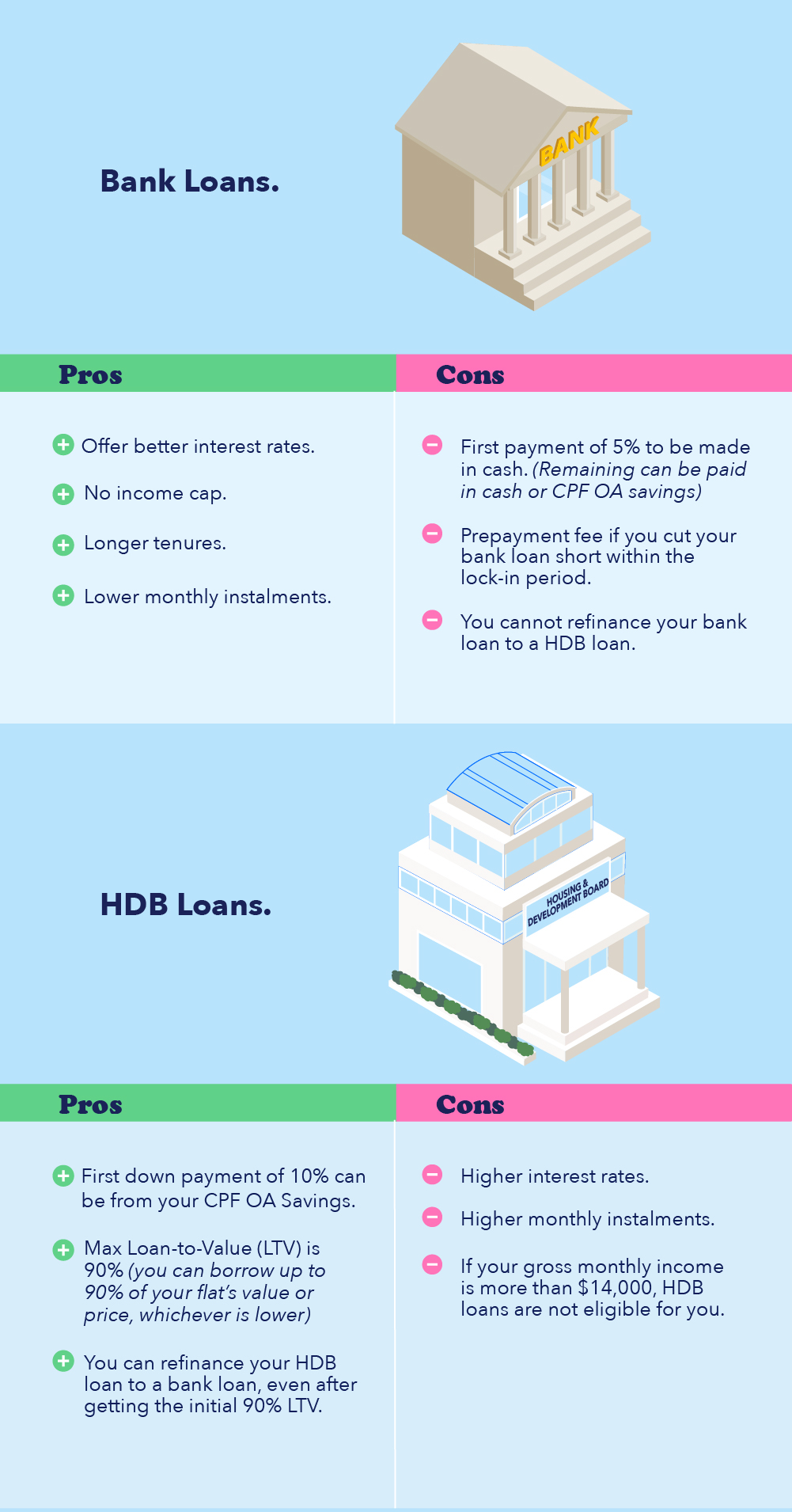

Key points about HDB loans vs bank loans

- HDB loans require a smaller cash outlay

- Interest rates of bank loans are highly variable, whereas HDB loan rates seldom change

- Bank loans have been cheaper than HDB loans for about a decade

- You can switch from an HDB loan to a bank loan, but not the other way around

- In terms of late payments, HDB is more lenient than banks

Downpayment

A huge advantage of taking an HDB loan is that you’ll be able to fork out a smaller amount of cash for downpayment.

The maximum loan-to-value (LTV) ratio for HDB loans is 90%. So you can borrow up to 90% of your flat’s value or price, whichever is lower. For the remaining downpayment of 10%, you can use a combination of cash or your CPF OA savings.

On the other hand, the maximum LTV ratio for bank loans is 75%. This translates to an extra 15% in downpayment.

What’s more, 5% must be paid in cash for the downpayment, with the remaining 20% to be paid in cash and/or CPF OA savings.

Interest rates and monthly instalments

The interest rate for HDB loans is always fixed at 0.1% above the prevailing CPF rate. With the current CPF rate at 2.5%, the interest rate for HDB loans is 2.6% per annum.

In contrast, depending on the market conditions, bank loan rates are more variable. This applies to loan packages that are pegged to fixed interest rates as well. After a lock-in period of two to five years, these so-called fixed rate home loans follow a floating rate.

So technically, there is no perpetual fixed rate home loan in Singapore.

Bank loan interest rates are mainly determined by these three floating rate benchmarks:

- Singapore Interbank Offered Rate (SIBOR), which will be replaced by Singapore Overnight Rate Average (SORA) by the end of 2024

- Board Rate (BR)

- Fixed Deposit Home Rate (FHR)

Whether you’re taking a SIBOR, SORA, BR or FHR home loan, the interest rate is the prevailing rate plus the bank’s spread.

So “3M SIBOR + 0.75” means the interest rate is the prevailing three-month SIBOR rate, plus 0.75% charged by the bank (the spread). Every three months, when the SIBOR rate changes, the interest rate will be changed to match the new rate.

This means that if you have a 1M SIBOR rate home loan, the loan repayment amount will change every month. If you have a 3M SIBOR rate home loan, the loan repayment amount will change every three months, and so forth.

Likewise, “BR + 0.5” means that the interest rate is the current board rate plus the bank’s spread of 0.5%. The difference is that the board rate is set entirely by the bank.

An FHR home loan is pegged to the bank’s fixed deposit rates, so it’s pretty similar to a BR home loan as the rate is essentially determined by the bank.

Why are bank loans cheaper?

The historical interest rate for bank home loans is between 3% to 4% per annum. This is more expensive than HDB loans.

However, due to the Global Financial Crisis in 2008, bank interest rates have been at record lows for around 10 years. Currently, bank loans are around 1.8% per annum, as opposed to HDB’s 2.6%.

The lower interest rates translate to lower monthly instalments.

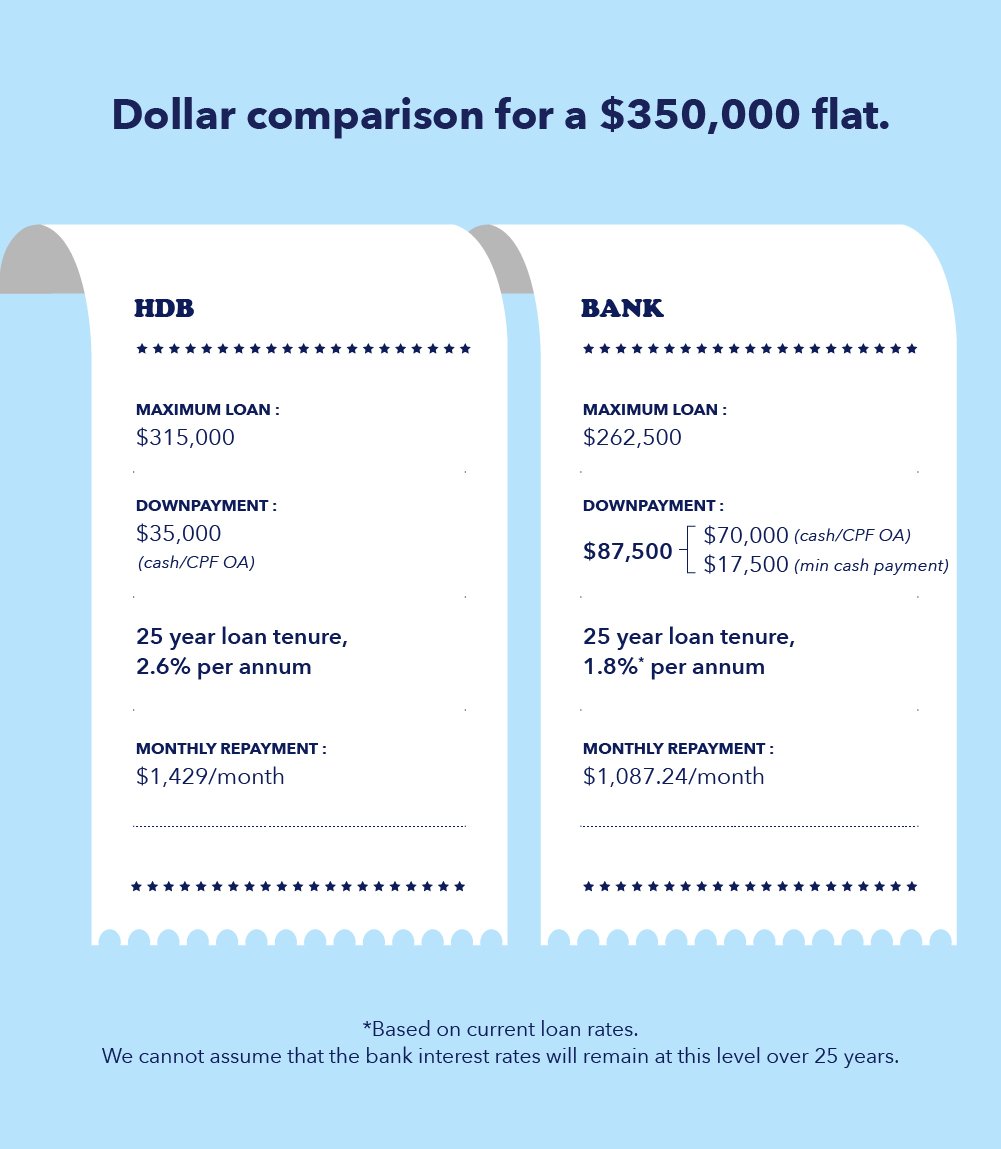

Here’s an example

With an LTV of 90%, the maximum loan quantum for an HDB loan is S$315,000 and downpayment is S$35,000. If you’re taking a 25-year loan tenure, the monthly repayments will be $1,429.

In contrast, if you’re taking a bank loan with an LTV of 75%, the loan quantum will be S$262,500. And the downpayment will be S$87,500.

On a 25-year loan tenure, assuming an interest rate of 1.8% per annum*, the monthly repayments will be cheaper at S$1,087.24.

*This is based on current, typical loan rates. We cannot assume that the bank interest rates will remain at this level over 25 years.

Income cap

Whether you’re buying a BTO or resale flat, HDB loans come with stricter eligibility criteria, including the income ceiling. If your gross monthly household income is more than S$14,000, you won’t be eligible for an HDB loan.

Conversely, bank loans don’t have an income cap, so it’s suitable for those with a higher income.

Tenure

HDB loans are capped at 25 years, while bank loans for HDB flats have a longer maximum loan tenure of 30 years. (However, the LTV will be reduced to 55% if the loan tenure exceeds 25 years.)

Having a longer tenure can be a good thing, as it allows you to lower your monthly repayments and spread it out. On the other hand, it also means paying a higher interest.

Refinancing

You can refinance your HDB loan into a bank loan (subject to the bank’s approval), even after getting the initial 90% LTV. By taking a home loan with a lower interest rate, you can reduce your monthly repayments.

However, you can’t refinance your bank loan into an HDB loan. What you can do is reprice it with the same bank or switch to another bank to refinance it.

Late payments

HDB charges 7.5% for late payments. At the same time, they’re generally more lenient and open to negotiations for late payments. But this doesn’t mean you can get away without paying your home loan; you can still be asked to sell the flat and downgrade.

On the other hand, banks are generally less forgiving to minimise their losses.

Early repayment

Another good thing about HDB loans is that they don’t have an early repayment penalty. So you can pay it off earlier to reduce the financial burden on your plate.

But if you’re taking a bank loan, it’s better not to pay it off early. The bank will charge a prepayment fee if you cut short your bank loan within the lock-in period, since they earn from the interest.

Which is better?

If you’re on a tight budget, HDB loans should be considered first, as there is a smaller cash outlay. The fixed interest rate also gives you a better idea of how much you’re paying monthly for your home loan. And if you find the interest is too high, you can always refinance from an HDB loan to a bank loan later, but not the other way around.

If you intend to upgrade fast (e.g. sell the flat and buy private as soon as you can), you may want to consider a bank loan, or quickly refinance into a bank loan from an HDB loan. This could reduce monthly repayments, and minimise the interest eating into your resale gains.

But everyone’s case is different. To better understand which home loan is best for you, speak to a mortgage broker. They can help you break down your finances and help you decide on a suitable loan.

If you found this article helpful, 99.co recommends Common mistakes you’ll want to avoid when paying off your mortgage.

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co!

The post Deciding between HDB loans and bank loans? Here’s a quick reference. appeared first on 99.co.