If you’ve considered purchasing a HDB resale flat, you may have heard of this thing called the Cash Over Valuation (COV). The COV is the difference between the sale price of the flat and its actual valuation by HDB. The term applies specifically to HDB resale flats, which are flats that were owned by someone else and are now being sold on the open market after fulfilling the Minimum Occupation Period (MOP) of at least five years.

Typically, HDB valuation is calculated based on the market value of the units in the same area. After a seller and buyer agree on a price and the Option to Purchase (OTP) is granted, HDB will assign a valuer to the flat to determine its valuation. HDB may decide to assign a valuer to the flat to determine its valuation. If the resale flat’s valuation is lower than the agreed price, the buyer has to pay COV in cash and upfront. It cannot be paid by grants, CPF or home loans from HDB or the bank.

With growing demand in HDB resale flats, COV is rising. Singapore’s property market is witnessing higher resale prices despite the pandemic. In this guide, we’ll explain how you can estimate the COV you may need to pay and properly budget for it.

HDB Resale Valuation: What Is It?

When buying a resale HDB flat, it is compulsory to submit a request for valuation from HDB. This is an estimation of how much the resale flat is worth by HDB. A resale buyer can only request for an HDB valuation after negotiating with the seller on the selling price and paying the option fee.

Once the seller has granted the buyer the OTP, the valuation request can be submitted to HDB. If HDB decides that a valuation is required to determine the value of the flat, an assigned valuer will come to the flat to inspect it.

Read more about the HDB valuation process here.

How to Estimate COV When Negotiating The Price

COV refers to the amount the buyer ‘overpays’ for an HDB resale flat. From the agreed sale price of the property, the actual valuation of the resale flat by HDB is subtracted. The difference is the COV value to be paid in cash.

Here’s an example:

|

Agreed sale price of the HDB resale flat |

$550,000 |

|

Actual valuation of the HDB resale flat (by HDB) |

$520,000 |

|

Cash Over Valuation (COV) to be paid |

$30,000 (cash) |

The math is straightforward. The tricky part is that HDB will only provide the valuation after you agree on the price, which means, if the COV exceeds what you expected or budgeted for, you may find it hard to cough up the COV in cash.

There’s no way around this. HDB cannot conduct the valuation process any earlier. However, you can do your own due diligence and get a good estimation of the valuation. Often, the valuation of an HDB resale flat is based on the prices of past resale transactions. A good way to estimate its value is to search and compare prices of similar properties within the estate.

If you’re shopping for property on PropertyGuru, it is very convenient: Under each listing, you will find a ‘pricing insights’ section, which automatically pulls up all the data you need, including recent transaction prices and price trends.

If you are worried that the current asking prices are inflated, you can look at past transaction prices (using the HDB resale portal), then apply the percentage of price growth to date, then estimate the cash outlay of COV.

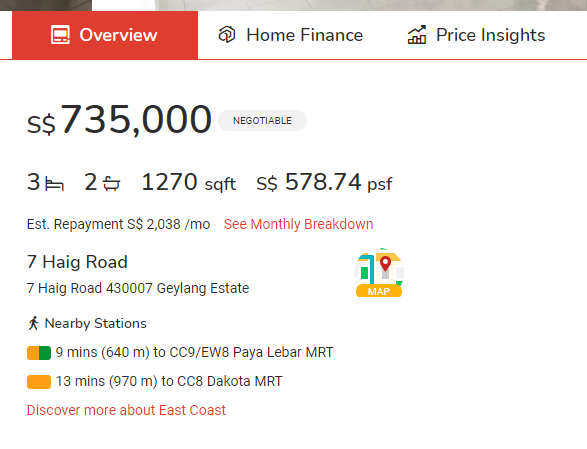

For example, say you’re eyeing this 5-room flat at 7 Haig Road which is asking for $735,000.

Source: PropertyGuru

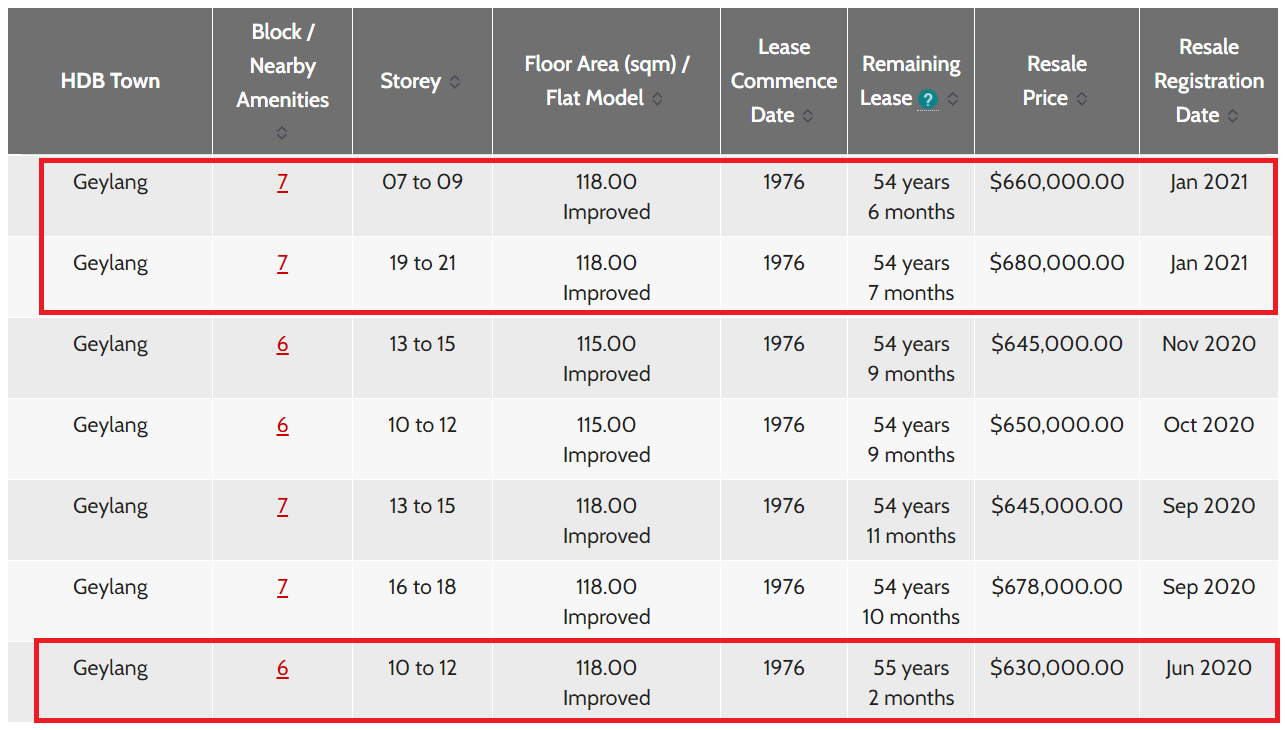

If you look at the most recent transactions, you will realise that the two most recent transactions of similar units in the same block were $660,000 and $680,000 (Jan 2021). This means the asking price is significantly higher, and is likely to require paying COV if you agree to it.

So, you decide to bargain. But how low should you go? You can use the Jan 2021 transactions as a benchmark, but if you want, you can also go one step further:

There was a transaction in June 2020 (i.e. before the rising trend of COV) in the neighbouring block for a similar unit that went for $630,000.

Source: HDB

According to HDB, the HDB resale price index rose 8.1% year-on-year in Q1 2021. By adding on the 8.1% to $630,000, you will get $681,030. You can expect the valuation to be around this range, and hence, try to bargain with that in mind.

Other Factors That May Affect An HDB Flat’s Price And/Or Valuation Include:

| Things That Affect HDB Flat Valuation | Description |

| Condition | If the flat is well maintained, it is likely that the COV will be higher. If the flat is run down, COV tends to be lower (if any at all). Often, flats with extensive renovations and furnishings come with high COV. |

| Size | If the flat is a larger unit and is no longer being built by HDB, it is likely to come with a higher price and maybe COV. |

| Lease | The price you pay should be based on the remaining years left on the lease. A resale buyer won’t get the full 99-year lease, but most flats should have enough for buying a home to stay in. As the remaining lease shortens, the property’s price, value and usually COV will also reduce. |

| Location | Flats on the higher floors and close to key amenities usually command a higher COV. Generally, flats in older estates will be higher in price, as most conveniences would have built up over time in the estate. Resale flats located near MRT stations, have many bus routes and within reach of the CBD or town area will also typically come with COV. |

| Scarcity | Rare units like executive maisonettes and flats in mature estates like Tiong Bahru command higher prices as they are no longer being built by HDB. COV may be higher, unless the market value is already high due to the scarcity, and the asking price has taken this into account. |

COV: Is Paying Above Valuation A Bad Thing?

COV is unique to the buying of HDB resale flats, but there are many reasons why many buyers still go ahead with it.

The more expensive resale flats are often found in mature estates, which are well-serviced by public transport networks, supermarkets, provision shops, hawker centres, shopping malls and even ‘good’ schools. What’s more, these resale flats are also typically more spacious than new BTO flats, and are often move-in ready (without the three- to five-year wait).

As such, many buyers are willing the pay a premium for the above. Especially now that there are many construction delays in new projects, those who need a roof over their heads urgently may have little choice.

If you have the means, paying COV might not be a bad thing at all. Depending on the buyer’s urgency to move in, COV can expedite the sale process when the seller accepts a higher transaction price. In short, you can offer a higher price to ‘chope’ your preferred unit.

Pros and Cons of COV

If you are looking to move into a new home immediately, offering a higher price and paying COV can help secure the home buyer’s preferred HDB resale flat unit. The downside is forking out COV in cash.

The Loan-to-Value ratio (LTV) will also apply to the valuation of the resale HDB flat, excluding the COV amount that must be paid in cash. For example, if you paid $550,000 for a property valued at $520,000, the LTV will apply to the $520,000 valuation and not the full $550,000 you agreed on.

It is important to note that valuation of the HDB resale flat also affects the amount of Buyer’s Stamp Duty (BSD) to be paid. This is calculated based on the purchase price or market value of the property, whichever is higher (i.e. you will pay more).

More FAQs on Cash Over Valuation (COV)

What Is COV In Property?

COV stands for Cash Over Valuation. The COV is the amount that a buyer pays for an HDB resale flat, minus the valuation of the property.

What Happens If Valuation Is Lower Than Offer for HDB Flat?

If the valuation of the HDB resale flat you’re buying is lower than the agreed price you’re buying it at, the difference is the Cash Over Valuation or COV. You must pay this difference in cash.

How Do I Stop HDB COV?

There is no sure-fire way to ‘prevent’ paying Cash Over Valuation (COV), but you can research past transaction prices to estimate the valuation and hence the COV you expect to pay.

Does Condo Have COV?

It is possible to pay over valuation for a private property like condos, but it is not called Cash Over Valuation (COV). The term is specific to HDB resale flat transactions.

Need More Help?

If you need more guidance on financing your home—e.g. to calculate how much you can loan, or compare mortgage packages—our team of home loan advisors can help. The service is free, and personalised to your unique situation!

Disclaimer: Information provided on this website is general in nature and does not constitute as financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.