Forget the big 30 or 40. 35 is the age that many Singaporean singles look forward to. Reach this age, and they become eligible to buy public housing, be it an HDB resale flat or an HDB BTO flat*. And like couple applicants, singles can also benefit from HDB housing grants.

In this article, we outline all the available HDB grants for singles. No more renting or living with your parents when you can soon look forward to your very own — and highly affordable — bachelor or bachelorette pad!

*5% of Sale of Balance Flats (SBF) in non-mature estates have also been reserved for first-timer singles.

HDB grants for singles applying for BTO/SBF flats

Flats under the BTO and SBF schemes are sold at a subsidised price by HDB, so they may be the most cost-effective option for singles. On the other hand, singles can only apply for 2-room Flexi units in non-mature estates under current HDB schemes, with the exception of the Orphans Scheme.

Another thing to note is that the grants for singles are only eligible for first-timer applicants.

If you’re applying under the Single Singapore Citizen Scheme

Under this scheme, you can apply as a single applicant and are eligible for the following grant:

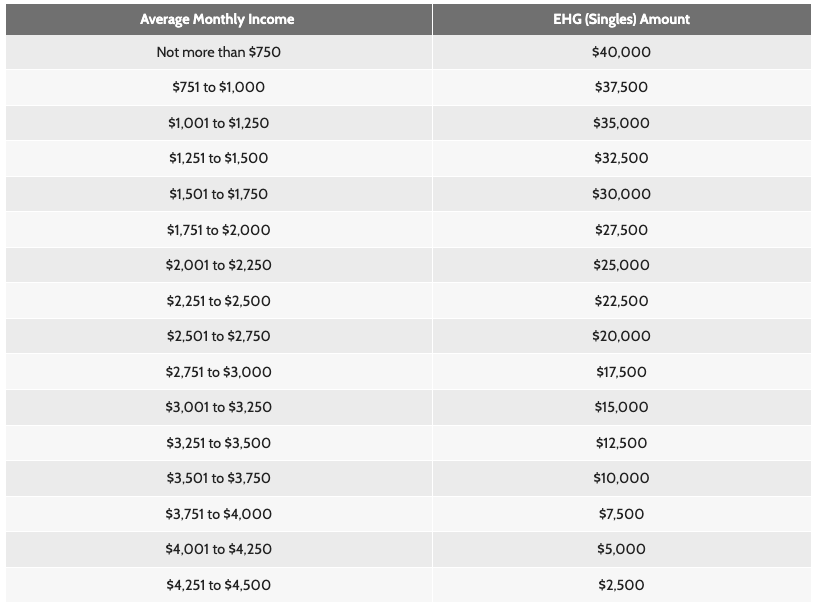

- Enhanced CPF Housing Grant (EHG) (Singles): up to S$40,000. To qualify, your average gross monthly household income for the 12 months prior to the flat application date must be within S$4,500. The actual grant amount will be according to your income. So the higher your income is, the lower the grant amount you get.

There’s also another catch: singles applying for BTO flats under the Single Singapore Citizen Scheme must also pay a S$15,000 premium. According to HDB, the subsidy is meant to benefit couples.

So, in other words, if you’re applying under this scheme, the premium you must pay will cancel out a portion of the grant amount you’ll receive.

If you’re applying under the Joint Singles Scheme or the Orphans Scheme

Through the Joint Singles Scheme, you can apply for a flat with up to three other Singaporean singles.

As for the Orphans Scheme, it allows those with at least one deceased SC or PR parent to apply for a flat with their single siblings. Unlike the other two schemes, this scheme doesn’t limit the flat type you can apply.

Whether you’re applying under the Joint Singles Scheme or the Orphans Scheme, you’re eligible for the following grant:

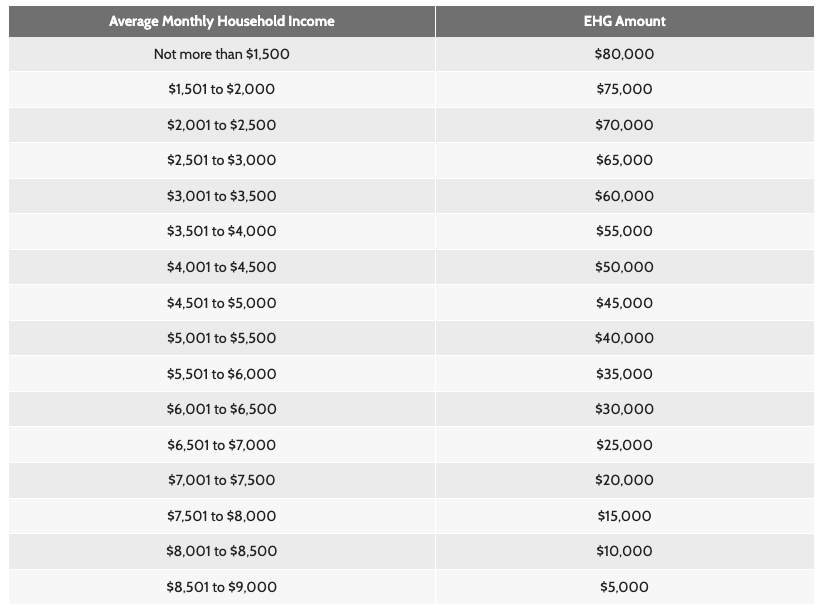

- Enhanced CPF Housing Grant (EHG): up to S$80,000. You and your co-applicants’ average gross monthly household income must be within S$9,000 during the 12 months prior to the flat application date. Likewise, the grant amount will be based on your income.

HDB grants for singles buying HDB resale flats

The availability of grants, absence of a S$15,000 premium, a wide selection of flat types and the freedom to choose any location are reasons why most eligible single buyers prefer to go for resale HDB flats. In fact, single Singaporeans can buy any flat of their choice in the open market.

If you’re buying under the Single Singapore Citizen Scheme

- Singles Grant: S$25,000 2- to 4-room resale flats, S$20,000 5-room resale flats. To qualify, your average gross monthly household income must be within S$7,000.

- Enhanced CPF Housing Grant (EHG) (Singles): up to S$40,000. The income ceiling for this grant is lower at S$4,500, with the actual grant amount you can get to be based on your income.

If you live with your parents or children (i.e. they’re listed as occupants):

- Proximity Housing Grant (PHG): S$15,000, for any flat type. Your parents or children will need to be listed as occupiers.

If you live near your parents or children (within a 4km radius of their home):

- Proximity Housing Grant (PHG): S$10,000, for a 2- to 5-room resale flat. Your parents or children can be living in either public housing or private property to fulfil the distance requirement.

Unlike the other two grants, there’s no income ceiling for the PHG.

If you’re buying under the Joint Singles Scheme or the Orphans Scheme

- Singles Grant: S$50,000 (S$25,000 ⨉ 2) for 2-room to 4-room resale flats, or S$40,000 (S$20,000 ⨉ 2) for 5-room resale flats. In other words, you and your co-applicants can get a maximum of 2 Singles Grant. To qualify, the average gross monthly household income of you and your co-applicant(s) must be within S$14,000.

- Enhanced CPF Housing Grant (EHG): up to S$80,000. Likewise, the average gross monthly household income of you and your co-applicant(s) must be within S$9,000 during the 12 months prior to the resale flat application date. Take note that the actual grant amount will be based on your income.

Those applying under the Joint Singles Scheme may also qualify for the Proximity Housing Grant (PH). The grant amount will be S$15,000 if you’re going to live with your parents or children, or S$10,000 if you’re going to live within 4km of their house.

What if I get married after buying a flat under the Singles Scheme?

If you get married after getting the Singles Grant to buy an HDB flat, you and your spouse may be entitled to the following grant:

- Top-Up Grant: The amount of the Family Grant amount you are eligible for currently, minus the Singles Grant amount you had previously received*. The monthly income is capped at S$14,000.

*Exception: For Singapore Citizen/Singapore Permanent Resident (SC/SPR) households with the SPR spouse now obtaining Singapore Citizenship status, they are eligible for a Citizen Top-Up Grant of S$10,000 with no maximum household income restrictions.

How will the HDB grants for singles be disbursed?

All grants will be credited into the CPF Ordinary Accounts of eligible Singapore Citizen applicants.

Here’s the breakdown of how the CPF grants will be disbursed if you’re applying under the Joint Singles Scheme or the Orphans Scheme:

No cash will be disbursed.

Another thing to keep in mind is that you’ll have to refund the grant amount, any CPF savings used to pay for your house and accrued interest to your own CPF account if you sell your flat.

For singles, the first S$30,000 of the housing grants will be credited back to your CPF OA account. The remainder will go to your CPF Special Account / Retirement Account and Medisave Account.

If it’s any consolation, you can still use the refunded money to pay for your next property purchase.

(Looking for BTO and resale HDB grants for couples instead? Check out this article!)

What do you think of the BTO and resale HDB grants for singles? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Below 35, Single, Desperate, and Looking to Move Out. How Ah? and Buying an HDB flat as a single parent: How to do it.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

[Additional reporting by Virginia Tanggono]

Frequently asked questions

Can singles buy BTO?

Yes, singles can buy a BTO flat. However, they can only apply for a 2-room Flexi flat, in a non-mature estate. On the other hand, they can buy a flat of any type and location from the resale market.

Can singles buy Sale of Balance Flats (SBF)?

Yes, singles can buy through the Sale of Balance Flat (SBF) scheme. However, like the BTO scheme, they can only apply for a 2-room Flexi flat in a non-mature estate. The flat allocation set aside for singles is only 5% under this scheme.

How much HDB grant can a single get?

If you’re a first-timer getting a BTO flat as a single, you can get up to S$40,000 HDB grant. The maximum grant amount is double if you buy a resale flat.

The post Quick guide to BTO, SBF and resale HDB grants for singles appeared first on 99.co.