According to The Straits Times, 1 in 3 HDB resale flat buyers paid cash over valuation (COV) on their HDB resale flats in 2021.

We’ll explain COV in greater detail later, but it means they agreed to purchase their flats above market value (as determined by HDB). And as the word “cash” implies, any amount over HDB’s valuation has to be paid out of your pocket. Ick.

If you’re in the market for an HDB resale flat, then COV is something you want to avoid as much as possible. But how do you figure it out before committing to the purchase?

What does cash over valuation or COV mean?

First, let’s talk about what COV is and why it’s important to most people (unless you’re rich enough to buy the HDB flat in cash, lucky you).

HDB resale prices are negotiated on a “willing buyer, willing seller” basis. HDB does not step in to set prices or stop sellers from overcharging. But, HDB does have its own idea of how much each resale flat is worth and this will affect home financing in some cases.

Let’s say you’ve found the flat of your dreams in Yishun. The seller quotes you S$600,000, and you’re pleased with the price.

After you pay S$1,000 for the Option to Purchase (OTP) and request the valuation report from HDB, it turns out that HDB values your dream home at S$550,000. Your COV is thus S$600,000 – S$550,000 = S$50,000.

If you proceed with the purchase, your home loan will be based on S$550,000 as the total amount. You’ll have to pay the S$50,000 COV in cash — and that’s on top of your downpayment.

Otherwise, you can also back out of the deal and resume your HDB hunt. But you’ll forfeit the S$1,000 option fee.

To save yourself the heartache, here are 3 ways to gauge the COV of a resale HDB flat BEFORE you pay the option fee.

1. Check HDB resale transaction data

We’re not saying you need a Data Science degree to buy an HDB flat, but it’s good to do your own market research.

HDB’s resale transaction portal is good for when you’re just starting the search and only have an idea of which neighbourhood you want to stay in. Key in the “Flat Type” and “HDB Town” of your choice and look at the last 6 or 12 months’ transactions to get a sense of flat prices in the area.

HDB resale prices can vary hugely among similar-sized units in the same HDB town, though. A freshly-MOP-ed unit near the MRT station can fetch way higher prices than one in the outskirts of the ‘hood.

So once you can narrow things down to specific blocks on specific streets — i.e. using Street Name and Block No. — you can get much more accurate data.

Had you realised that the blocks around your dream home in for example, Yishun or Punggol, had units transacting at $5XX,000 in the past year, then you can easily guess that its S$600,000 price tag might land you in a COV situation.

2. Check transaction history on 99.co listings

House-hunting on 99.co? Here’s how you can gauge potential COV on a listing you like. Simply take note of the property’s asking price, then scroll down to “Transaction history” and calculate the discrepancy.

Here’s an example of an HDB flat with an asking price of S$645,000.

Scrolling down to the transaction history section shows us that recent transactions in this block were closer to S$500,000.

This flat’s asking price of S$645,000 is S$115,000 more than the highest transacted price of S$530,000. So it’s quite likely to incur cash over valuation.

Do note that if the flat’s purchase price is fairly close to the existing transactions — let’s say a S$20,000 difference — HDB may accept this as the market value of the flat and you might avoid having to pay COV.

3. Use 99.co’s Property Value Tool

Here’s a sneaky little tip: you can use a free property valuation tool like 99.co’s Property Value Tool to figure out the market rate of that HDB resale flat you’re eyeing.

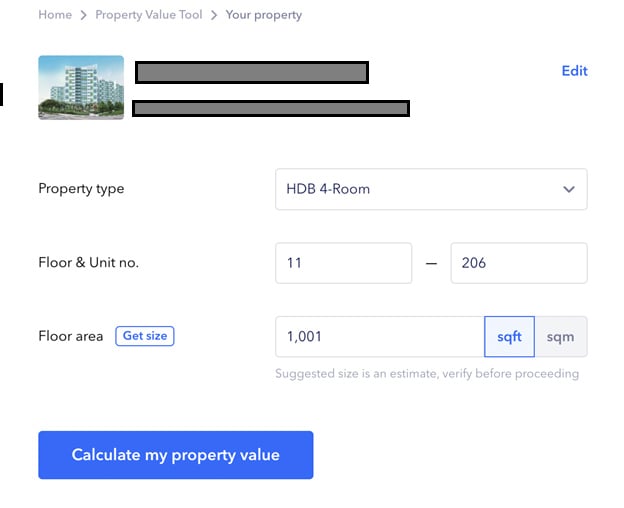

First, key in the address and unit number of the flat you’re looking at.

After clicking on “Calculate my property value”, you’ll get prompted to log in to see the full results. My search garnered the following result:

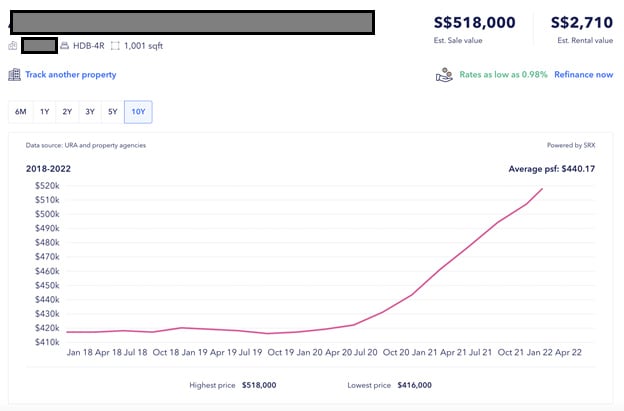

See that S$518,000 Est. Sale Value in the top right corner? 99.co crunches data from HDB, URA, and other property agencies to get a reasonable gauge of the market value of the flat. If the place you’re looking at exceeds this benchmark significantly, then it’s likely to incur COV.

Of course, 99.co’s tool is no substitute for an HDB valuation. Paying the option fee and triggering a valuation request is the ONLY way to know for sure what the market value of the resale flat is. But hey, at least it won’t cost you S$1,000.

So before you commit to an HDB flat purchase, it’s a no-brainer to run it through 99.co’s property value tool first.

What if you can’t avoid cash over valuation?

Right now, the HDB resale market is a sellers’ market. As a prospective buyer, you’ll be competing with hordes of house-hungry Singaporeans who cannot wait for a BTO.

If you’re eyeing areas with high demand and a limited supply of flats, you should be mentally and financially prepared to fork out a COV. With that in mind, what you want is to minimise cash over valuation so that you don’t burn a massive hole in your bank account.

For a start, use the 99.co property listing portal to search for more options in your dream home’s vicinity. Because HDB resale pricing varies with personal circumstances, you might snag a cheaper unit if the sellers are motivated to move out (e.g. to upgrade to a condo). And now that you know the market rates in the area, you can move fast if you spot a good deal.

But what if you still have your heart set on your overpriced dream home? Then use all your newly-acquired intel to negotiate a lower price on that resale flat. Yes, it may be a sellers’ market but as long as the flat hasn’t been sold yet, there’s still a chance.

–

How much COV would you be willing to pay? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends checking out With the recent surge in home resale prices, is it possible to avoid high cash over valuations? and Singapore Budget 2022: Potential impact on property owners in a post-pandemic world.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post 3 ways to gauge the cash over valuation (COV) of a resale HDB flat appeared first on 99.co.