You could be a local looking to settle down with a same-sex partner, or an expatriate who is looking for a gay-friendly place to rent in Singapore. Either way, when it comes to living happily ever after in Singapore, the LGBTQIA+ may run into some obstacles as there are no laws here that specifically safeguard their rights.

Same-sex marriages are not recognised in Singapore. So when it comes to housing and the legal aspects of it, same-sex couples do not enjoy the same rights as heterosexual couples.

This guide aims to help singles and couples of all orientations find their home in Singapore, be it buying or renting property. Here’s what we’ll cover in this article that may help:

- Renting property in Singapore for LGBTQIA+

- Rental tips for LGBTQIA+ in Singapore

- Buying a home in Singapore for LGBTQIA+

- Buying an HDB flat under one name

- Buying an HDB flat under joint names

- Buying a condo unit

- Buying an Executive Condo unit

- The difference between a joint tenancy and tenancy-in-common for LGBTQIA+ buyers

Renting property in Singapore for LGBTQIA+

Up till Section 377A of the Penal Code was officially repealed on 3 January 2023, for a very long time, sex between males had been criminalised in Singapore (although no one was prosecuted and charged under this archaic Colonial-era law).

Moreover, the standard Tenancy Agreement (TA) used by many landlords and agents contains a clause stating that the tenant cannot use the rented premises for any illegal purpose or activity of an improper nature. So some troublesome landlords may have relied on the vague definition of ‘improper nature’ to evict same-sex tenants.

But with the repeal, the clause should no longer be used as grounds for rental application rejections.

Nevertheless, it’s easier for LGBTQIA+ individuals to rent entire units in Singapore (e.g. studio apartment or a three-room HDB flat) than a single room with common tenants or a stay-in landlord. This is because many landlords in Singapore still hold a conservative attitude towards LGBTQIA+ singles and couples. It’s a mindset that, hopefully, will change sooner rather than later.

Rental tips for LGBTQIA+ in Singapore:

- Be transparent: This doesn’t have to mean explicitly disclosing your orientation or gender identity, but do that if you feel comfortable, or in subtle ways such as wearing a pride shirt or a PinkDot shirt. You can also mention your partner in passing conversation (those with partners of the same sex may try “oh my boyfriend/girlfriend and I are looking to get married overseas next year” and observe the response. Before viewing, you may ask the landlord’s agent if it’s a friendly place for the LGBTQIA+ or if people from varying backgrounds and lifestyles are welcomed. Being transparent is a good way to weed out potential landlords or roommates that might be harbouring prejudices.

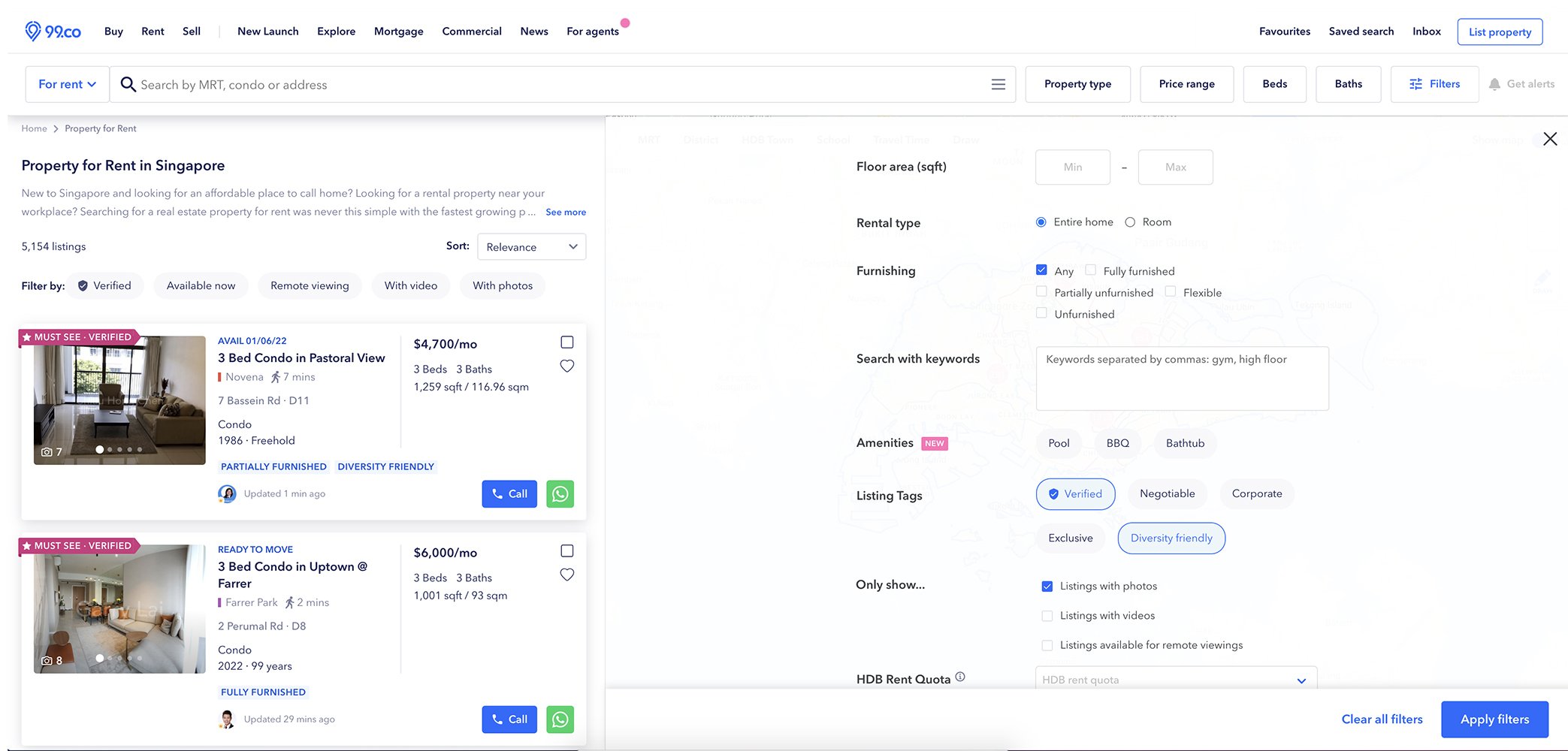

- Search diversity-friendly rentals on 99.co: You can use the “diversity-friendly” tag on 99.co to search for listings that welcome tenants of all backgrounds, regardless of race, religion, gender identity and sexual orientation.

- Walk away from housing that gives you a bad feeling: Of course, this tip should be within reason; not all of us have the luxury to be picky with the home we choose. Gut feelings, however, shouldn’t be ignored. If a potential property agent, landlord, housemate, etc. isn’t sitting well with you, then chances are that the place is not the right choice. Walk away and look for better options.

- Beware of clauses limiting visitors to the home, if there is no stay-in landlord: Such clauses are not part of a conventional TA and could indicate a potentially troublesome landlord.

- Participate in neighbourhood activities: Singapore’s different towns have their own demographics and quirks, and moving into a new neighbourhood can feel unsettling for the LGBTQIA+. So, it’s good to join in neighbourly activities (check out your block or condo notice board) to help you ease into your new community and build your neighbourhood support network.

Read this: Renting as a queer in Singapore: 9 tips from the LGBTQIA+ community

Buying a home in Singapore for LGBTQIA+

This is where many Singaporean* LGBTQIA+ singles or same-sex couples—many of whom only have the budget for HDB flats—run into problems.

Firstly, non-heterosexual couples cannot buy an HDB flat unless they’ve reached the age of 35. At the age of 35, Singaporean Citizens may purchase a flat as

- A sole single person under the Single Singapore Citizen Scheme (SSCS), or

- Two to four singles jointly under the Joint Singles Scheme (JSS).

Under the schemes, they are eligible to buy the following HDB flats:

- A new two-room BTO flat in a non-mature estate (subject to an income ceiling), or

- An HDB resale flat of any size anywhere in Singapore (no income ceiling)

*Foreigners are not allowed to buy HDB flats in Singapore, only private condominiums. Singapore Permanent Residents (SPRs) are also not allowed to buy an HDB flat as a single. Only Singapore PR heterosexual couples (and their family members) can buy HDB resale flats.

You can find out more about the Single Singapore Citizen Scheme (SSCS) and Joint Singles Scheme (JSS) here.

Read this: Quick guide (with infographic) to BTO and resale HDB grants for singles

Buying an HDB flat under one name

You could be an LGBTQIA+ single aged 35 or above who is buying an HDB flat in your own name, or an LGBTQIA+ couple where only one party is aged 35 or above if choosing to buy an HDB flat.

If you are a couple intending to buy an HDB flat in one name (i.e. under the SSCS) but with the intention that the person who is the registered owner of the flat holds a share of the flat on trust for the other person, it is vital to note that this private arrangement is not recognised in court:

- Trust over an HDB flat is prohibited and is null and void without the written consent of HDB (under sections 58 (9) to (11) of the Housing and Development Act)

- It does not matter that you may have gotten a trust document drawn up by a lawyer — it is not recognised in court unless HDB had given its written consent

- Any cash contribution you make towards the downpayment or monthly instalments for the HDB flat which is not in your name will not be recognised by law such as to give you a beneficial interest in the flat. If the two of you break up one day after you have made substantial cash contributions towards the flat which is not registered in your name, you cannot claim a share of the HDB flat. You will have to try to claim the money back from the other party as debt and they may argue that you had paid the money as a gift to them.

- As it is registered in the name of one person, the flat will not automatically be transferred to you upon the other person’s death. If the intention is for you to be given the HDB flat should the registered owner die, you must ensure that he or she makes a Will leaving the flat to you. However, you should note that a Will can be changed any time by the maker without your knowledge, unlike having your name on the title deeds.

If you have no choice but to buy the HDB flat in a single name under SSCS, then consider getting a loan agreement drawn up by your bank or financial institution.

This can act as proof of your contributions to the flat’s financing. This way, if things don’t work out, at least you are in a better position to get your money back.

Buying an HDB flat in joint names

If both of you are Singapore Citizens aged at least 35 years old and do not own private property, the best option is for both of you to apply for an HDB flat together as joint owners (under the JSS).

Buying a condo unit

Many LGBTQIA+ couples may think that they can only afford an HDB flat, but the truth is there is a handful of affordable studio or one-bedder condominium units in Singapore.

Condos for sale under S$800k

Of course, this still represents a greater outlay (compared to an HDB flat) for both parties involved, but there’s no minimum age, location, or unit type restrictions for private properties such as condos.

That said, there are still a number of things LGBTQIA+ couples must note when making the big financial commitment to buy a condo.

For those taking a first housing loan for a resale condo, 25% of the purchase price will have to be paid upfront as a downpayment (at least 5% in cash, with the rest from cash or CPF Ordinary Account savings).

In contrast, the mortgage repayments for a new launch (i.e. uncompleted) condo is progressively scaled up under the Progressive Payment Scheme (PPS).

Whatever your choice, speak to a financial advisor before you decide whether to commit.

With both parties as co-owners, LGBTQIA+ couples may use their CPF monies to fund the mortgage. And unlike for HDB flats, an informal trust can arise if one partner makes contributions to the mortgage without obtaining legal title to the property.

However, to avoid uncertainty and potential disagreements, it is still recommended for the couple to draft a trust document, witnessed by a lawyer, in the event that the couple in question intends for the party with no legal title to have some interest in the property.

LGBTQIA+ couples should also make CPF nominations and draft wills to ensure that their estate will be distributed in a manner consistent with their intentions.

Buying an Executive Condo (EC) unit

Executive condos, or ECs, are more affordable, subsidised variants of condos launched and sold by the HDB. As such, they come with a set of strict rules for buyers.

The key difference between ECs and HDB flats is that singles cannot buy ECs on their own even if they reach the age of 35. Only two or more singles aged 35 or above can buy an EC jointly, under the JSS.

While an EC has the facilities and the looks of a condo, it’s only considered private property after the 10th year has elapsed. These are the limitations of selling the property during this period:

- First five years: Like HDB flats, ECs come with a five-year Minimum Occupation Period (MOP). So they cannot be sold to anyone until five years from the date of the EC’s completion date.

- Sixth to 10th year: the unit can only be sold to a Singapore Citizen or PR

- From the 11th year onwards: Selling restriction no longer applies; the unit can be sold to anyone, including a foreigner

Bear in mind that, while a trust document drafted between two parties with an interest in the property may not be valid in the first 10 years, the document will nevertheless come into effect from the 11th year onwards, since the EC has been privatised.

Read this: Buying resale EC vs new launch: The key differences you need to know

Before you buy, know the difference between a joint tenancy and tenancy-in-common for LGBTQIA+ buyers.

A joint tenancy (JT) means that the entire property is owned by both of you jointly; there is no demarcation of percentage. Both of you own 100% of the property.

For a tenancy-in-common (TIC), you specify the percentage of the ownership of each owner, for example, 50%-50% or 60%-40% according to your contribution or agreed percentage of ownership.

In a joint tenancy, when one owner dies, the property automatically passes to the remaining owner. For a tenancy-in-common, there is no automatic right of transfer of the deceased’s share of the property to the surviving owner.

This means that for a tenancy-in-common arrangement, the other person must transfer their share of the property to you before their death or leave it to you in their Will.

If neither of these is done, then under intestacy laws, the deceased owner’s share of the property will pass to immediate relatives. The surviving owner may then find that the deceased person’s relatives now own say, 50% of the property together with him or her. The relatives may demand that the surviving owner pay rent or even sell the property and split the sale proceeds.

So, to avoid this situation, weigh the benefits of taking up a joint tenancy versus a tenancy-in-common. If unsure, consult legal expertise.

99.co wishes all LGBTQIA+ singles and couples a fruitful and rewarding experience buying and renting a property in Singapore!

Renting or buying a property as an LGBTQIA+ individual/couple? Let us know in the comments section below.

If you found this article helpful, 99.co recommends Tenant tips for viewing properties to rent in Singapore and Below 35, single, desperate, and looking to move out. How ah?

The post The LGBTQIA+ guide to renting (and buying) property in Singapore [2023 update] appeared first on .