Singapore’s rental market softened further in November 2025, as leasing activity slowed across both private condominiums and HDB flats. The moderation, however, aligns closely with seasonal patterns rather than signalling a downturn, with rental prices remaining broadly stable despite lower transaction volumes.

Commenting on the latest figures, Mr. Luqman Hakim, Chief Data & Analytics Officer at 99.co, noted that the slowdown was expected for this time of year.

“Building on the seasonal softening observed in October, November saw rental volumes ease further across both the condo and HDB markets, reinforcing the typical year-end slowdown as we lead into the holiday season,” he said.

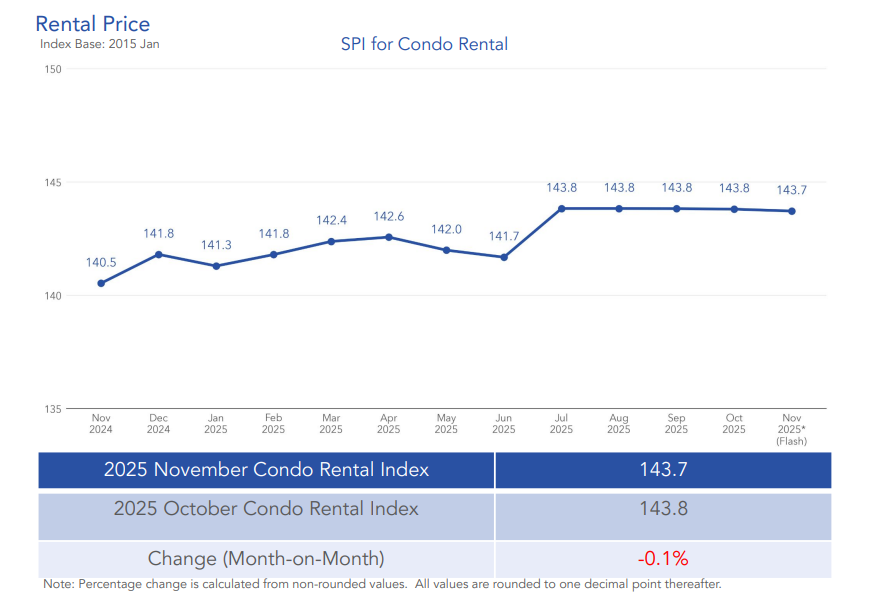

Condo rental volumes decline, while prices show resilience

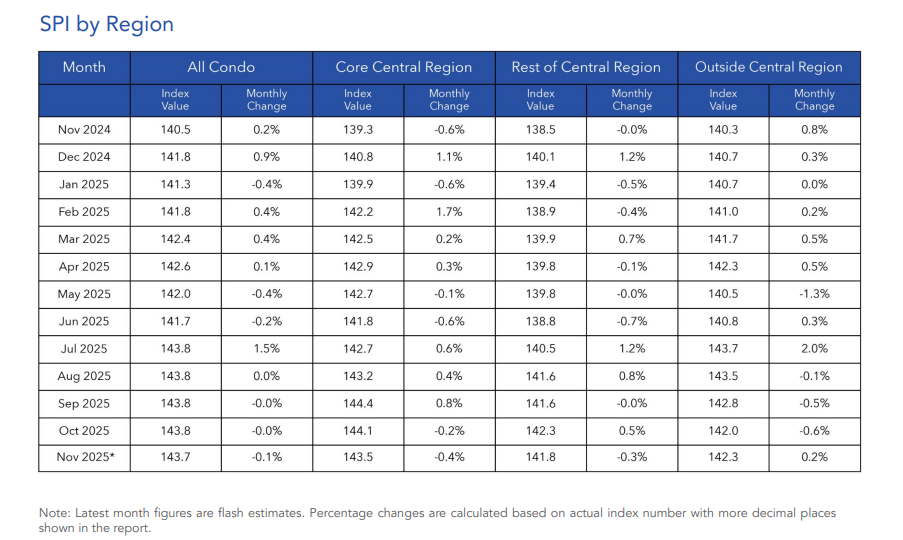

In November 2025, overall condo rental prices dipped marginally by 0.1% month-on-month. This masked differing movements across regions, with suburban demand continuing to support the condo rental market.

Rental prices in the Core Central Region (CCR) fell by 0.4%, while the Rest of Central Region (RCR) declined by 0.3%. In contrast, the Outside Central Region (OCR) showed greater price stability with a 0.2% increase.

Despite the slight monthly pullback, the broader trend remains intact. On a year-on-year basis, condo rental prices were 2.3% higher than in November 2024, with gains recorded across all regions. This suggests that recent movements reflect short-term adjustments rather than a weakening of rental fundamentals.

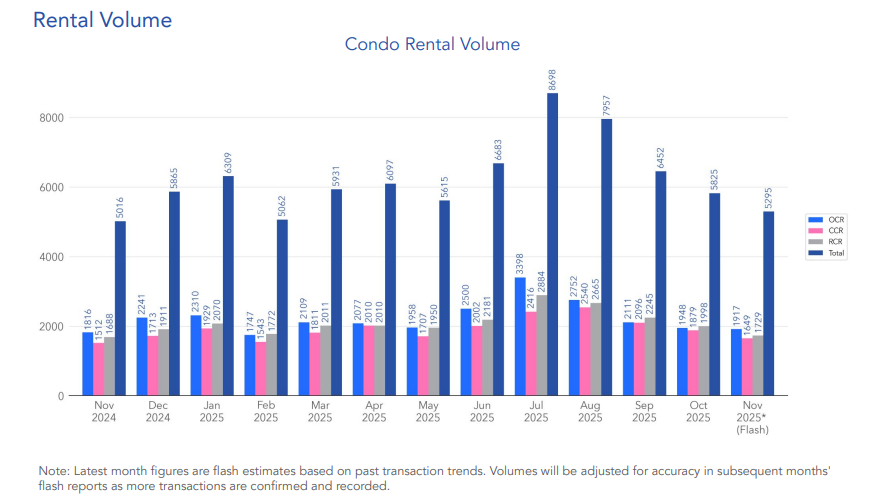

Leasing volumes declined more noticeably. An estimated 5,295 condo units were rented in November, marking a 9.1% month-on-month drop from October’s 5,825 units. Even so, volumes were still 5.6% higher year-on-year, indicating that demand remains healthier than it was a year ago.

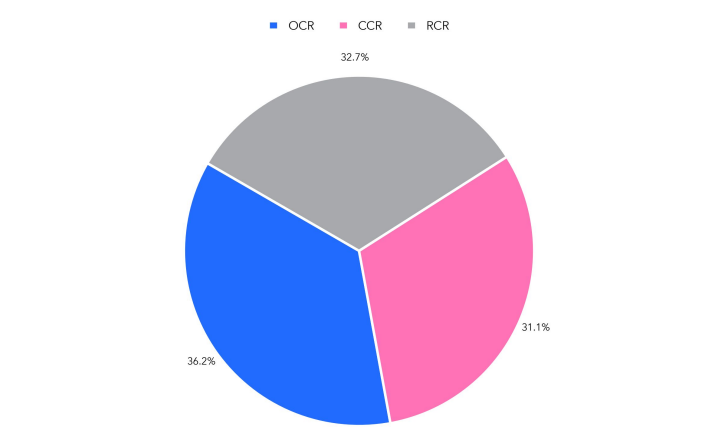

By region, the OCR accounted for 36.2% of total rental volume in November 2025, followed by the RCR at 32.7% and the CCR at 31.1%.

Mr. Luqman highlighted the different dynamics at play across regions, noting that affordability continues to shape tenant behaviour. “Tenant demand remains price-sensitive in higher-rent segments, while affordability-driven demand in suburban locations continues to provide a floor to rents.”

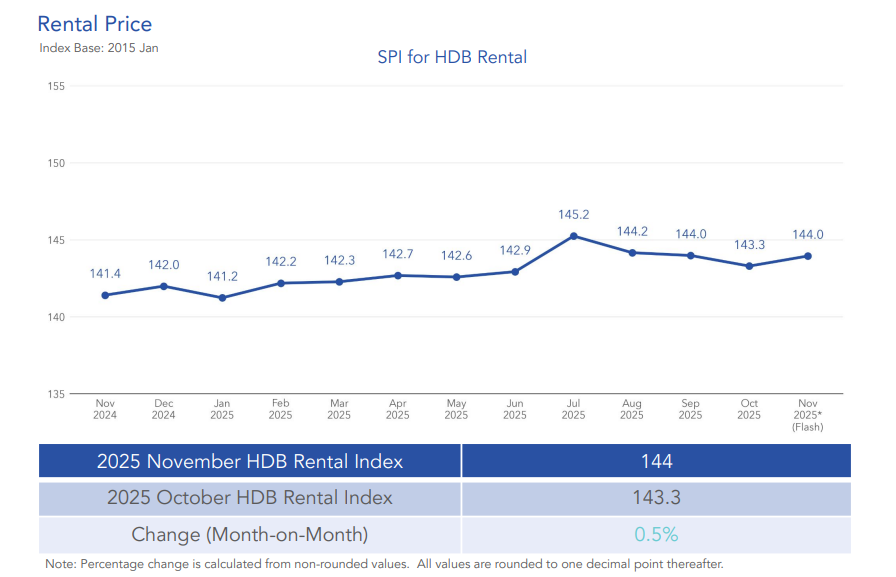

HDB rental prices rebound modestly after three months of decline

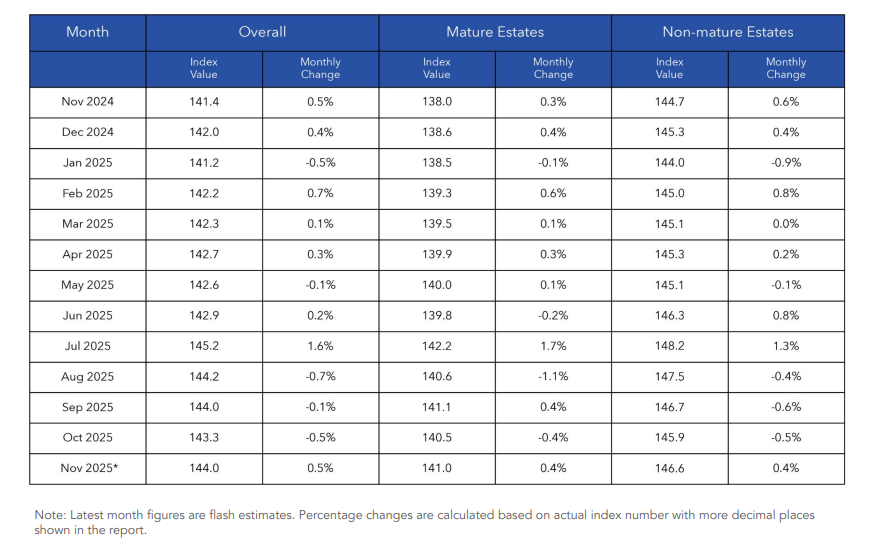

In contrast to the private market, the HDB rental index rose by 0.5% month-on-month in November 2025, reversing three consecutive months of price declines. Rental prices increased evenly across Mature and Non-Mature Estates, both posting 0.4% monthly growth.

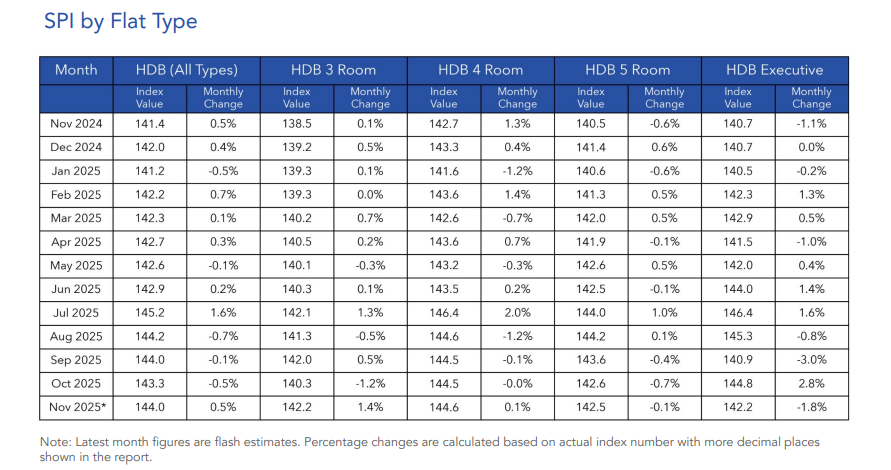

By flat type, smaller units led the recovery. 3-room flats recorded a 1.4% increase, while 4-room rents rose 0.1%. Larger units saw some softness, with 5-room flats slipping 0.1% and Executive flats declining 1.8% month-on-month.

According to Mr. Luqman, the pattern points to sustained demand from budget-conscious renters, including singles, young couples, and foreign workers.

Year-on-year, HDB rental prices were 1.8% higher than in November 2024. Mature Estates saw a 2.2% increase, while Non-Mature Estates recorded 1.3% growth. Across flat types, annual price gains ranged from 1.1% to 2.7%, with 3-room flats once again leading the way.

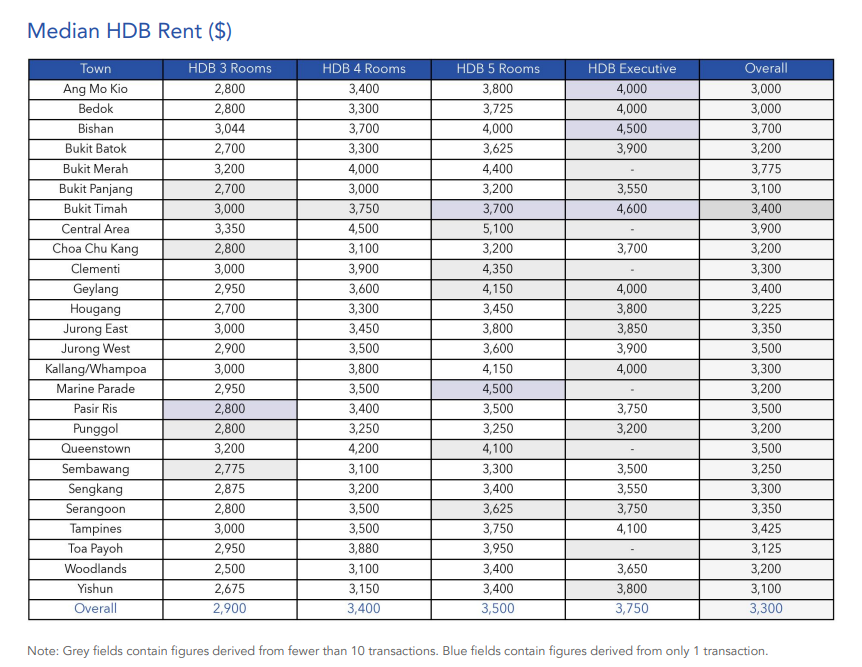

The median HDB rental price in November 2025 is as follows:

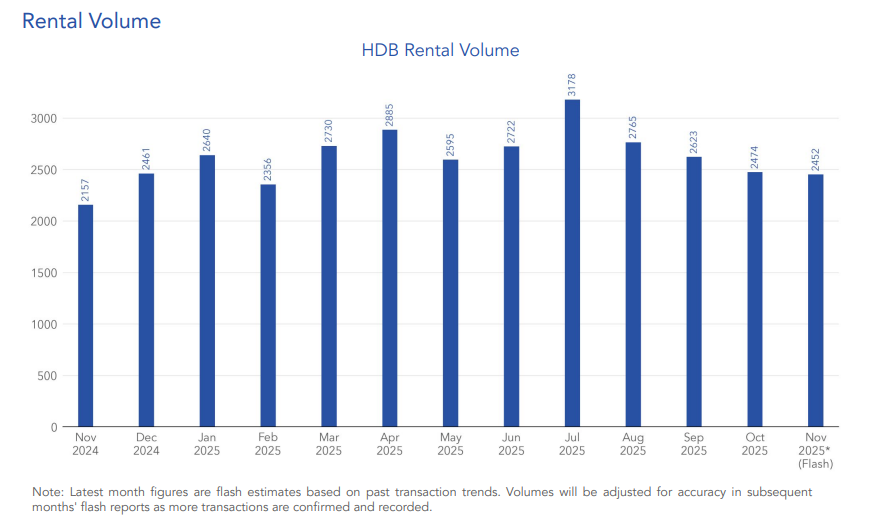

HDB rental activity dipped slightly in November, declining 0.9% month-on-month to an estimated 2,452 flats rented. This was a modest pullback compared to the sharper slowdown seen in the condo segment.

On a year-on-year basis, however, HDB leasing activity remained robust. Volumes were 13.7% higher than in November 2024 and sat 0.2% above the five-year average for the month. This suggests that demand for public rental housing continues to absorb tenants priced out of higher-cost private options.

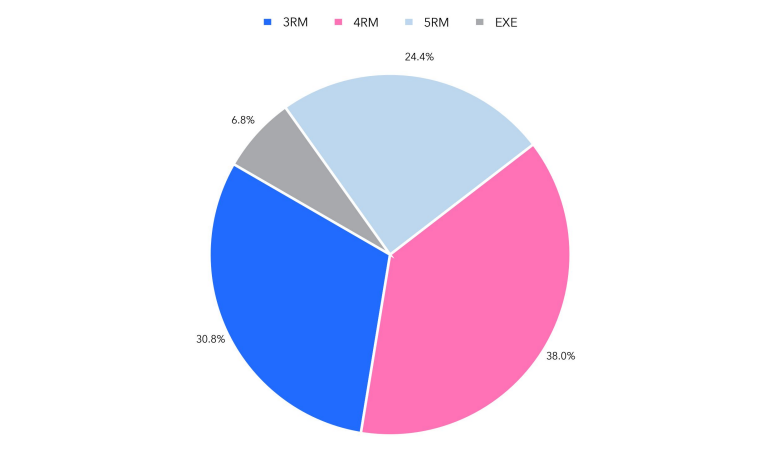

In terms of unit mix, 4-room flats accounted for the largest share at 38%, followed by 3-room flats at 30.8%, 5-room flats at 24.4%, and Executive flats at 6.8%.

A market cooling seasonally, not structurally

Taken together, November’s data reinforces the view that Singapore’s rental market is entering a seasonal year-end lull, rather than heading into a downcycle. Volumes have eased as expected during the holiday period, but prices have remained broadly stable across both private and public housing segments.

Condo rental prices continue to show underlying strength on a year-on-year basis, while HDB rents have stabilised and even rebounded slightly after recent months of softness. Importantly, rental volumes for both markets remain higher than a year ago, signalling that tenant demand has not fallen away.

Looking ahead, activity is likely to stay subdued through the festive period. Mr. Luqman noted that clearer signals on rental momentum should emerge in early 2026, “when hiring patterns, immigration flows, and interest-rate expectations become more defined.”

The post Rental prices remain stable amid declining volumes in November 2025 appeared first on .