To make public housing in prime locations more affordable, inclusive and accessible for Singaporeans, the government recently announced the new Prime Location Public Housing (PLH) model.

More specifically, new and resale prime location flats under the PLH model are subject to the following conditions:

- 10-year Minimum Occupation Period (MOP)

- S$14,000 income ceiling (or S$21,000 for extended or multi-generational family)

- At least one applicant is a Singaporean

- Eligible family nucleus eg. married couples, engaged couples, etc.

- Must not own or have an interest in private property and have not disposed of any in the last 30 months

- No renting out of the whole unit

What’s more, for flats sold through BTO, there will be a reduced quota set aside under the Married Child Priority Scheme. Doing so gives those without parents or children living near the project a higher chance of securing a queue number.

When the flats are sold on the resale market for the first time, the sellers will need to return to the government a percentage of the resale price. This is to recover the subsidies provided.

On the surface, all these measures do make public housing more affordable and accessible. People will be less likely to buy a PLH flat for investment purposes.

However, the knock-on effect is that it makes it harder for owners to upgrade to private property.

(Side note: Singles won’t be able to buy a resale flat in these prime locations as well, limiting their public housing options even more. While they’re restricted to 2-room Flexi flats in non-mature estates for BTO, they were previously not restricted to the flat type and estate when buying a resale flat.)

Your funds will be locked in your flat longer.

A lot of people usually buy a BTO with the goal of earning a profit when they sell it after the five-year MOP. Ideally, in 10 years (around five years of construction plus five years of MOP), they can use the capital gains to upgrade to private property, usually a condo.

But with a PLH flat, the MOP is 10 years. Coupled with the construction duration of around five years, you’ll have to wait for 15 years before you can cash out of your flat to upgrade.

What’s more, prices of HDB flats don’t increase as much as condo prices. With the extra five years of your money being locked in the flat, you would have lost the opportunity to grow your asset faster by investing in a condo five years earlier.

You won’t be able to cash out as much to upgrade when you sell your PLH flat.

For starters, you won’t be able to price your PLH flat as high as other BTOs in other prime locations.

With the S$14,000 income ceiling, the maximum monthly instalment for a resale PLH flat would be S$4,200, as per the 30% Mortgage Servicing Ratio (MSR).

If the buyers take an HDB loan with a 90% loan-to-value ratio and 2.6% interest rate for a 25-year tenure, the maximum financing they can get would be S$925,784 (calculated using CPF’s mortgage calculator). This would mean that the maximum resale price would be S$1,028,648.89. This calculation assumes that the selling price and valuation would be the same.

However, the actual financing amount will be based on whichever is lower, either the price or valuation. Whether the valuation would be higher or lower than S$1 million in 15 years, there’s a limit to how much higher owners can price the flats.

Unless they’re cash-rich, there’s a limited pool of buyers with a S$14,000 household income willing to pay a higher cash-over-valuation (COV).

On top of the lower resale price, there’s the subsidy that you have to return to the government. So the final profit will be even lower, leaving you with less options to upgrade to.

The PLH flats are designed for long-term stay.

Ultimately, the PLH model allows you to own public housing in a prime location to stay for the long term, and not for it to be flipped for profit. After all, the goal is to provide housing that’s affordable, accessible and inclusive.

While the government has stressed that they’ll review the measures and make adjustments along the way, we still expect that the measures implemented will control the demand and price increase of the resale PLH flats. The impact is that owners will get a lower return when they sell to upgrade.

So if you have plans for asset progression, getting a PLH flat may make it harder for you to upgrade to private property.

What are your options if you want to upgrade in future?

Ideally, to maximise your capital gains, the best option would be to go for a BTO in a central location. So those who managed to snag a flat at Telok Blangah Beacon in the May 2021 BTO can potentially earn higher profit to upgrade. Even though the project is located near the Greater Southern Waterfront, it’s not subject to these PLH restrictions.

Given the introduction of the PLH model, the best option would be to go for a BTO in popular estates, such as Queenstown and Bukit Merah. After the MOP, flats here will be in high demand and can fetch a good price.

Alternatively, you might want to go for a resale flat, especially since you can sell it after five years (instead of around 10 years for a BTO). Opt for a flat with a longer remaining lease, and one that’s near an MRT or within 1km of various primary schools to maximise your capital gains. It would also be good to go for one with various amenities nearby.

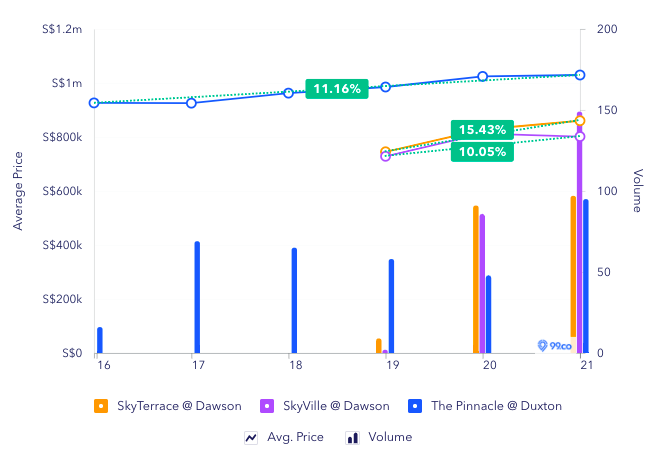

Buying a flat in a prime project such as Pinnacle@Duxton, SkyTerrace@Dawson or SkyVille@Dawson can be an option too. But since the flats in these projects aren’t restricted to the PLH rules, we expect them to be in even higher demand (and priced higher).

Profits aside, the most important thing to consider when you plan to upgrade is your finances. Ensure that you have sufficient savings (cash and CPF) and income to fund your downpayment and mortgage. You shouldn’t overstretch beyond your means. Because at the end of the day, the last thing you want is to forgo the things you enjoy (like the weekly dining out at restaurants and cafes, frequent Grab trips, overseas trips when borders open, etc.) to fund a more expensive home.

Will you buy a PLH flat? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Here’s how much you need to earn to afford a condo [2021 Edition] and 5 fatal mistakes Singaporeans make when upgrading to a condo.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Here’s why you may not want to get the PLH flat if you’re thinking of upgrading in future appeared first on 99.co.